Monthly Home Budget Spreadsheet Easy Worksheet Excel Free Download

Monthly Home Budget Spreadsheet Easy Worksheet Excel Free Download

Monthly Home Budget Spreadsheet Easy Worksheet Excel Free Download – If you’re trying to have your finances in order, then you must have to create a budget. A budget template that you can print is the most efficient way for you to track your finances. Budget templates will help you stay organized and on track.

There are numerous ways to create a budget. An app, a spreadsheet or software program can be utilized to make an budget. If you are looking for the most simple method to create and track your budget, then a printable budget worksheet is your ideal alternative.

Online, you will find many printable budget sheets. They can be downloaded for free or at an affordable cost. Once you find the right document, you simply print it and begin tracking your expenditure.

Budgeting shouldn’t be difficult. You can budget your money with just a little planning and effort.

What Is The Reason You Require An Budget?

A budget is essential due to a number of reasons. Budgets can be used to monitor your spending habits and reduce expenses, which will assist in financial decisions. A budget will also help you remain on track with your financial goals as well as objectives.

A budget can be created in just a few steps. You can utilize pencil or a spreadsheet to create the budget. It is essential to be open about your earnings and expenses when you create the budget. Once you’ve come up with a budget, stick to it as strictly as you can in order to improve your financial position.

Related For Monthly Budget Worksheet Excel Free Download

How To Make The Most Of Your Budget

A budget is an essential tool to manage your finances. By tracking your income and expenditures, you can make informed decisions about the best ways to spend your money. Although budgeting can seem overwhelming however, with a bit of planning and effort it is possible to adhere to your budget.

Here are some tips on how to use a Budget:

- Make sure you know your income and expenditures. The first step of creating a budget is to track your income and expenses. This will provide you with an accurate picture of where your funds are going.

- Set realistic goals. It is possible to set realistic goals for saving and spending once you have a clear picture of the direction your money is heading. You should be sure to account for variable expenses, such as grocery and gas so that you don’t end up spending too much on other items.

- Keep on track.

Monitoring Your Progress

A budget is the first step in taking control of your financial situation. Once you’ve created a budget, it is crucial to keep track of your progress and make sure that you stick to it. This can be accomplished by a variety of methods.

It is possible to use an app for budget tracking. The apps are linked to your bank account so that you can monitor your spending, and also automatically link to your bank account. They also help you set your budget and monitor your progress in time.

You could also track your progress by using an excel spreadsheet, pen and paper or notepad and pen. Although this approach requires longer to complete, it’s equally effective as an application. Input your expenses and income each month. After that, you can compare the actual amount you spend with the budgeted amount. This will enable you to discover areas that should be reduced or altered.

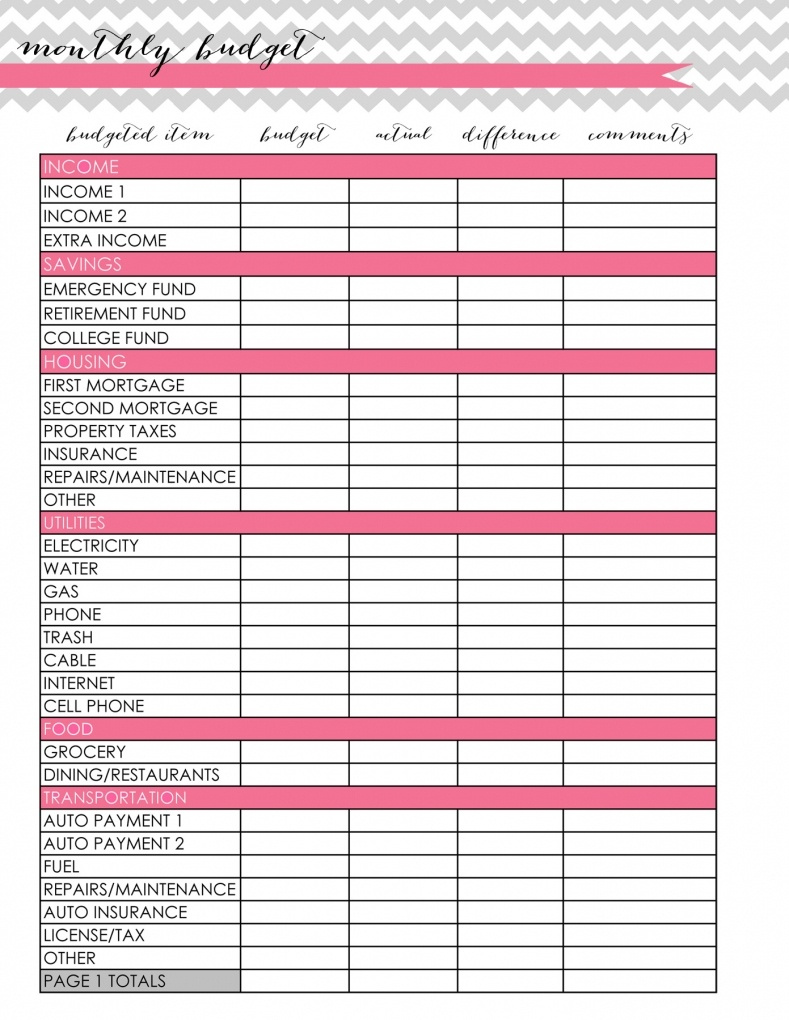

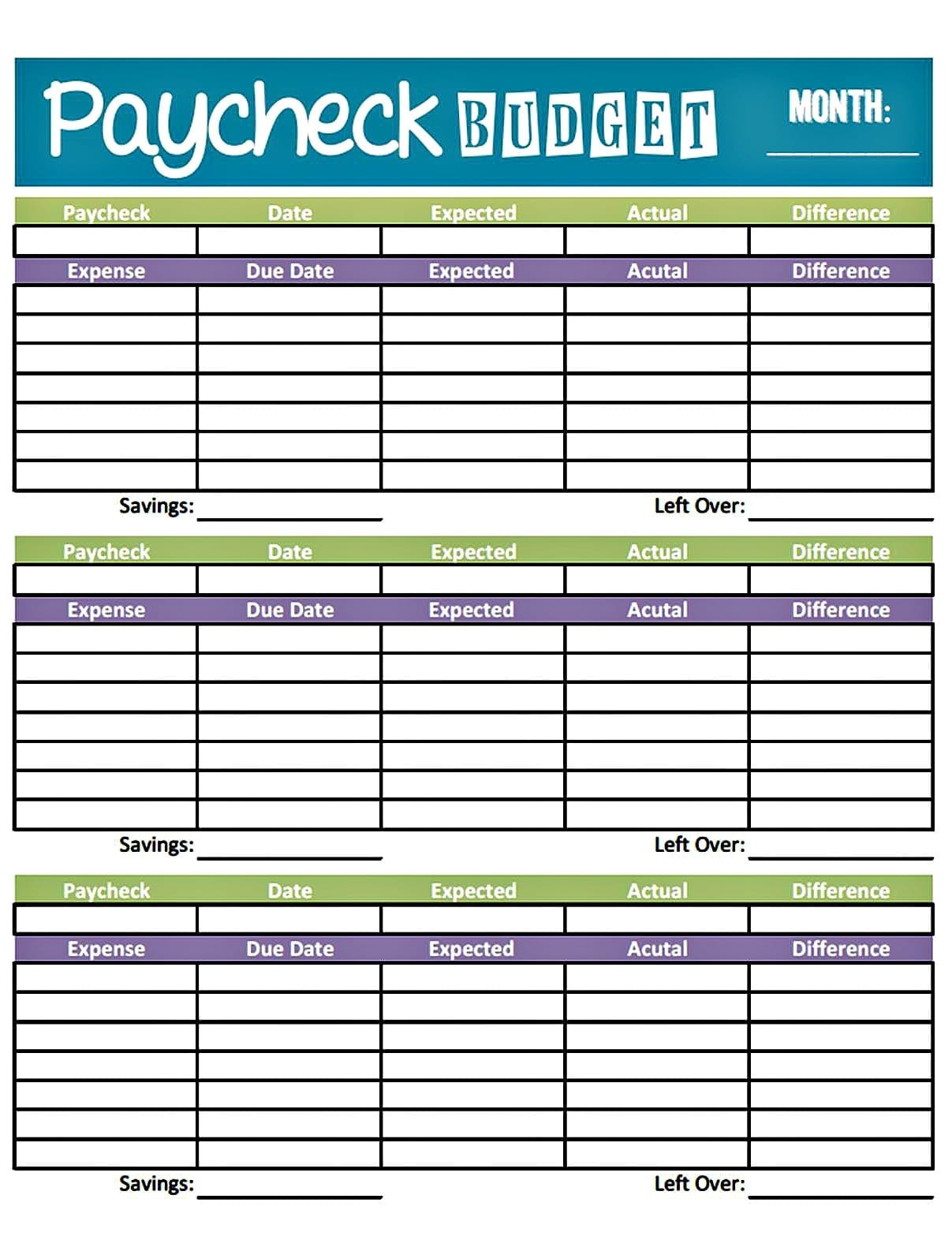

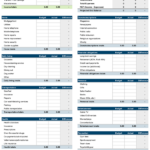

Monthly Budget Worksheet Excel Free Download

Monthly Budget Form Fillable Excelxo

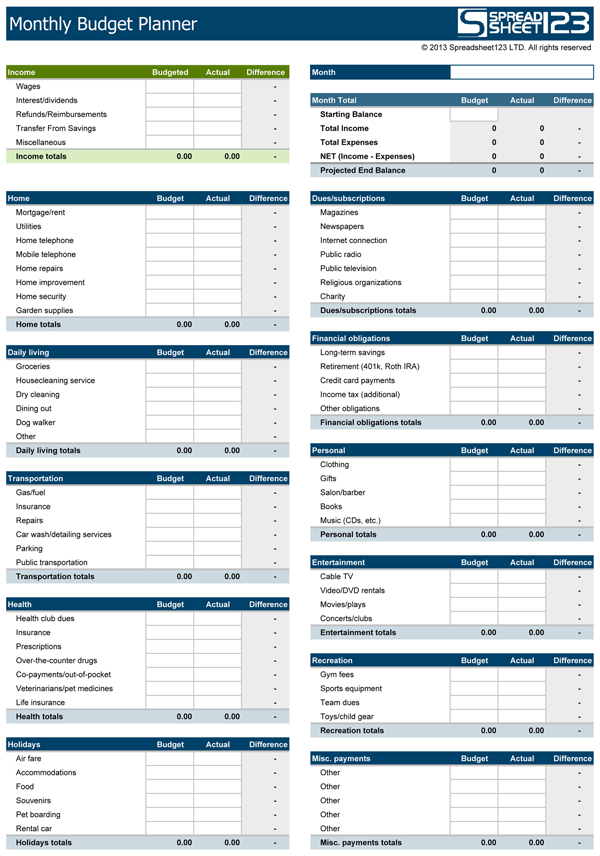

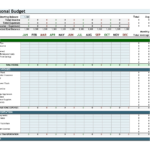

Download A Free Monthly Budget Spreadsheet For Excel

The Benefits Of Budgeting

Although budgeting can seem tedious, it is the first step towards financial stability. You can track your spending and reserve funds to save for emergency needs. Then, you can make changes as required.

Although it takes some time to understand how to develop and maintain your budget correctly however, the rewards are worth it. A budget can help you to pay off debts, make savings for the long term, and prevent financial troubles further down the line.

If you’re not sure where to begin, there’s plenty of resources to help you develop your budget that is right for you. You’ll soon be able budget effectively and achieve financial success.