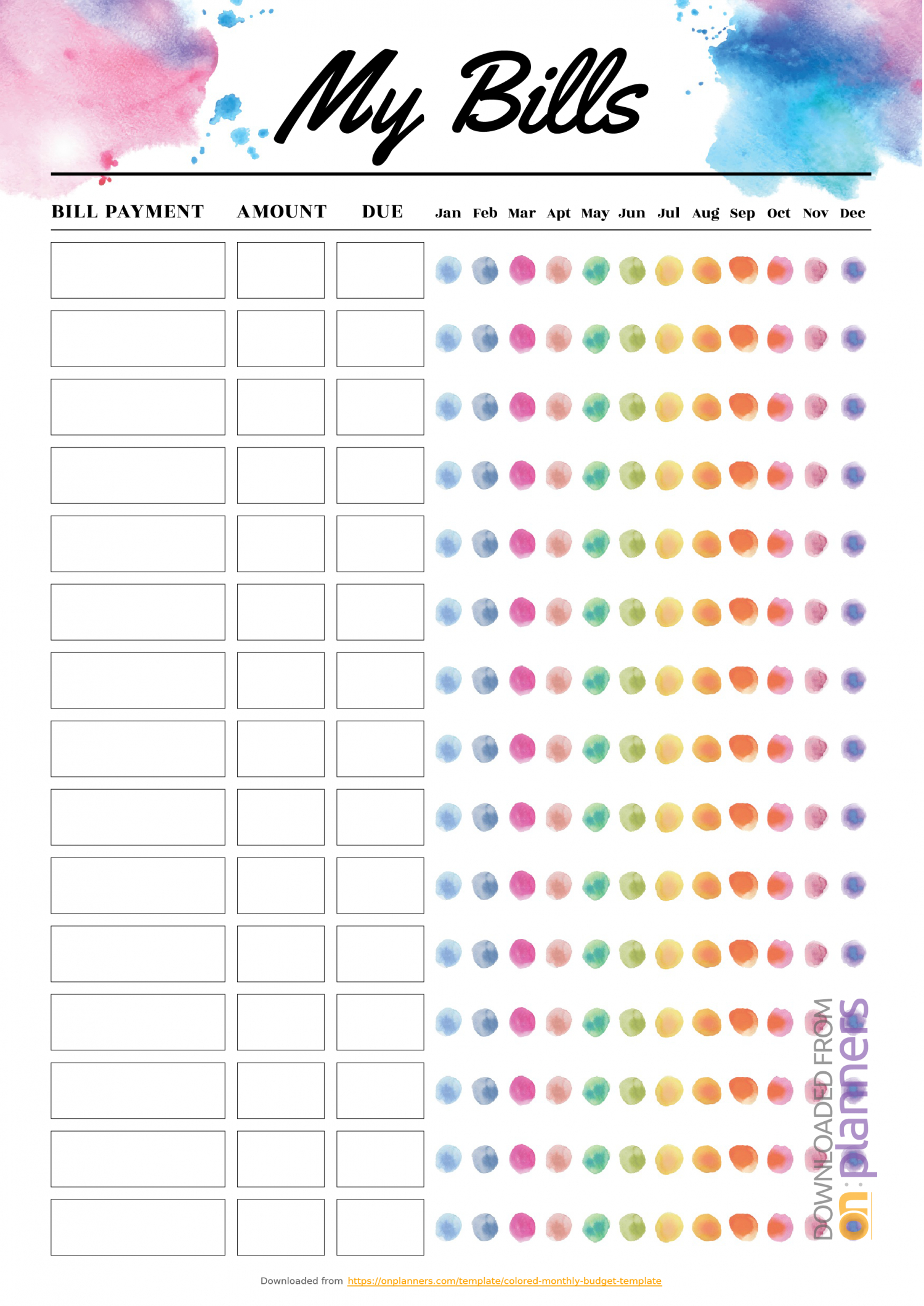

Free Template For Bills Due Monthly Example Calendar Printable

Free Template For Bills Due Monthly Example Calendar Printable

Free Template For Bills Due Monthly Example Calendar Printable – A budget is necessary to control your financials. The most efficient way to organize your spending is with the use of a printable. Budget sheets that are printable can help you stay organized and on the right track.

There are a variety of ways to make a budget. It is possible to use a software application, a program, or even a spreadsheet. A budget template that is printable is recommended if you’re looking for the simplest method to create and track your budget.

Online, you can find numerous budget sheets that can be printed. Budget sheets can be downloaded online either free of charge or for a small cost. Print the page you like and start tracking your spending once you have discovered the.

Budgeting doesn’t have to be complicated. It is possible to manage your finances by putting in a bit of planning and effort.

Why Do You Need To Use Budgets To Help Make Choices?

There are many reasons that households and individuals need to establish budgets. It allows you to keep track of your spending and savings that can allow you to make informed financial decisions. A budget can also assist you to maintain your financial goals and objectives.

Budgeting is simple and can be done using a variety of methods such as pencil and paper, a spreadsheet, or personal finance software. Being truthful about your earnings and expenditures is the most essential aspect of creating the budget. To increase your financial standing be sure to stick to the budget you’ve created.

Related For Budget Sheet Free PDF

How To Use Your Budget

The budget is a crucial tool in managing your finances. Monitoring your spending and income will help you make informed choices about how to allocate your funds. While budgeting may seem daunting but with a little planning and work, it’s feasible to stick to your budget.

Here are some suggestions for ways to make use of a Budget:

- Calculate your expenses and income. To make a budget you should first record your earnings. This will provide you with an accurate picture of where your funds are going.

- The importance of setting realistic goals is. The most realistic goals can be established once you’ve figured out the direction of your money. It is important to consider variable expenses such as gasoline and groceries so you don’t waste money for other things.

- Be on the right track.

Tracking Your Progression

The first step to financial control is to create the budget. To ensure that you’re staying within your budget, you must be able to track your performance. This can be accomplished through a variety of ways.

A budget-tracking app is available. These apps connect to your bank account to track your spending automatically. They can also assist you in setting your budget and monitor your growth in time.

A spreadsheet or pen and paper is a different option to track your performance. This approach requires more manual effort, but it is just as effective as using an application. Simply record your income each month and then compare your spending with the budgeted amount. This will let you discern areas where you can reduce your spending or adjust your spending accordingly.

Budget Sheet Free PDF

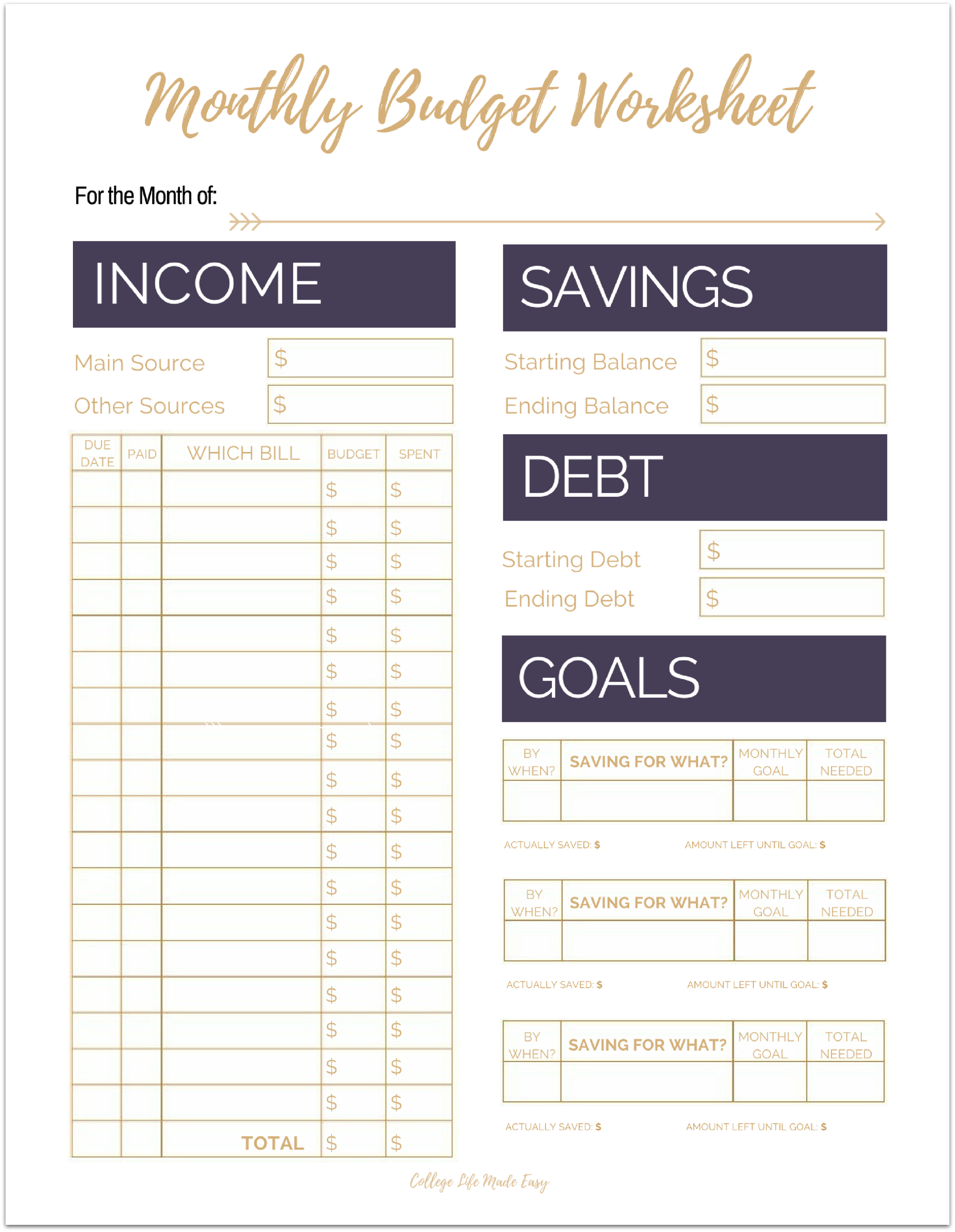

Fix Your Finances ASAP With My Free Simple Monthly Budget Template

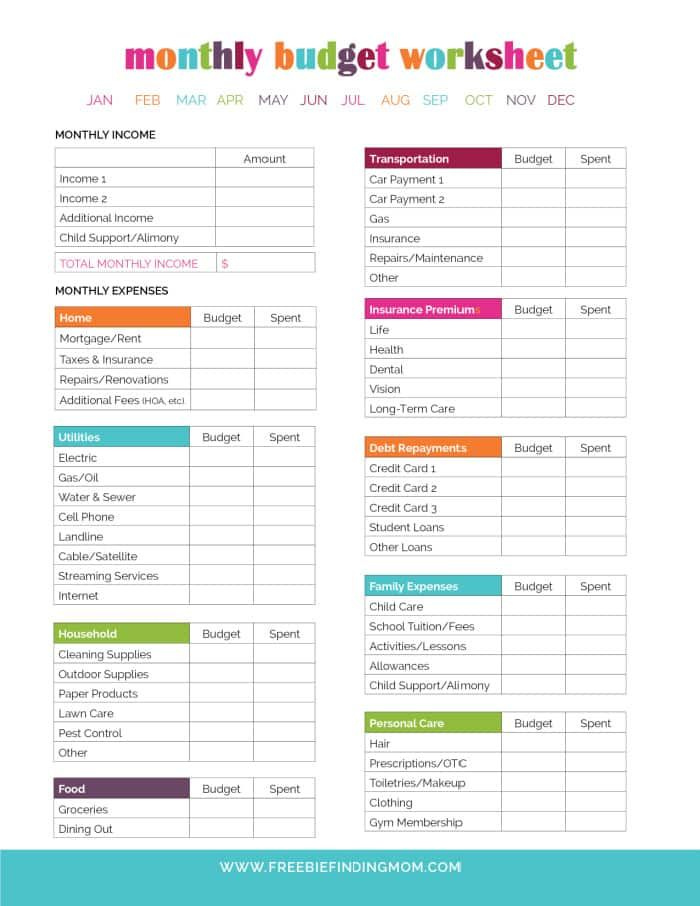

Free Household Budget Worksheet PDF Printable Freebie Finding Mom In

The Benefits Of Budgeting

The process of budgeting can seem like an intimidating task, however it’s a critical element to ensure financial stability. You can track your spending and set aside money to put aside to be used for emergencies. You can then make changes as required.

While it might take time to get used to the process of creating and sticking to a budget, the benefits are worth the effort. A budget can help you pay off debt, save money to fund long-term goals, and prevent financial troubles down the road.

There are many sources that can assist you to make a budget that suits your requirements. Once you get in the habit of making a budget, you’ll be well on your way towards financial success.