Free Budgeting Printables Expense Tracker Budget Goal Setting

Budget Sheet Free

Budget Sheet Free – A budget is necessary when you want to manage your financial affairs. A budget template that you can print is the best way for you to keep track. Printing budget sheets to help remain on track and organized.

There are many methods to create a budget. A spreadsheet, an app or software program can be used to build a budget. The printable budget sheets are best if you are looking for the easiest method to keep track of and develop your budget.

It is easy to find budget templates on the internet. You can find them at no cost or for a small fee. You can print the sheet you like and start tracking your expenses after you have discovered it.

Budgeting doesn’t have to be difficult. With a little effort and some planning, you can get your finances within a matter of minutes.

What Is The Reason To Use A Budget?

There are a variety of reasons why households and individuals should be able to have budgets. A budget can be utilized to track your spending and help you save money, which can help with financial decisions. A budget can also help remain on track with your financial goals and targets.

A budget can be created in a few easy steps. You can make use of pencil or a spreadsheet to make it. Being honest about your income and expenses is the most crucial element of making a budget. After you’ve created the budget, follow it as close as you can to enhance your financial situation.

Related For Budget Sheet Free

How To Make Use Of The Budget

Budgets are an important tool for managing your finances. You can keep track of your income and expenses so that you can make informed choices about how to spend your money. It may be difficult to budget, but it is able to be accomplished with a little planning and work.

Here are some tips on ways to make use of a Budget:

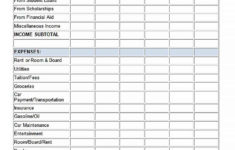

- Make a list of your income and expenses. Rectifying your expenses and income is the first step in making your budget. This will help you get a clear picture about the amount of money you have.

- You should set reasonable goals. Once you’ve figured out where your money is going, you can set realistic goals for saving and spending. Make sure to factor in other expenses that aren’t fixed, like grocery and gas so that you don’t go over budget on other purchases.

- Keep on track.

Monitor Your Progression

The first step in achieving financial control is to make the budget. To ensure you’re sticking to your budget, you need to keep track of your performance. There are numerous methods to accomplish this.

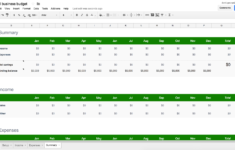

A tool that tracks your spending can help you track your budget. These apps can be linked to your bank account, and keep track of your expenditure automatically. They allow you to establish a budget, and then track your progress over time.

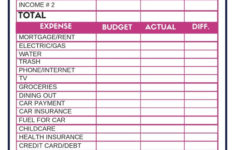

Another method of keeping track of your progress is using a spreadsheet or pen and paper. While this requires longer to complete, it’s just as efficient as an application. Input your expenses and income every month. Then , compare your actual expenses to your budgeted amount. This will help you determine areas that require to be cut or altered.

Budget Sheet Free

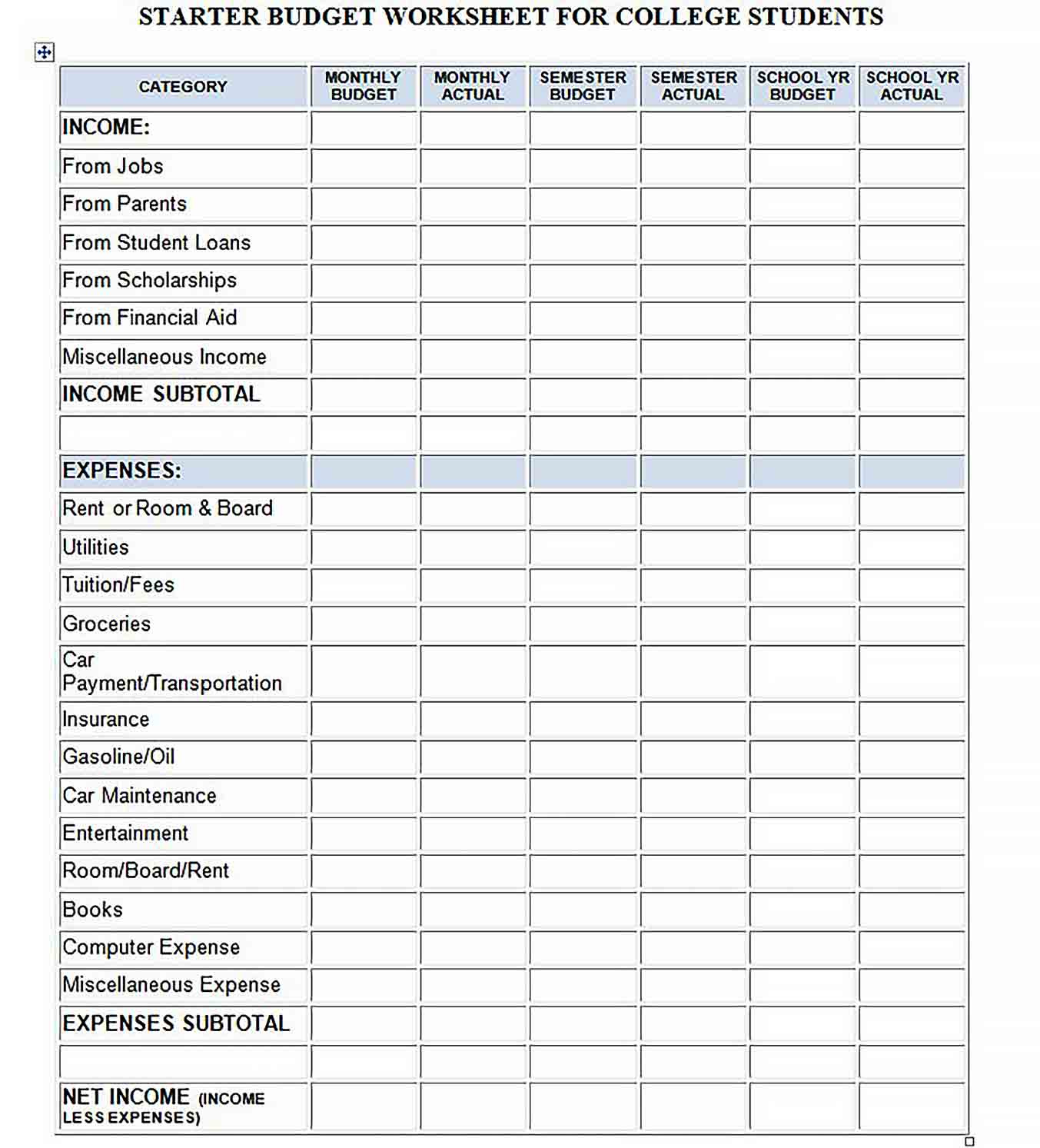

Printable Budget Worksheet Template Culturopedia

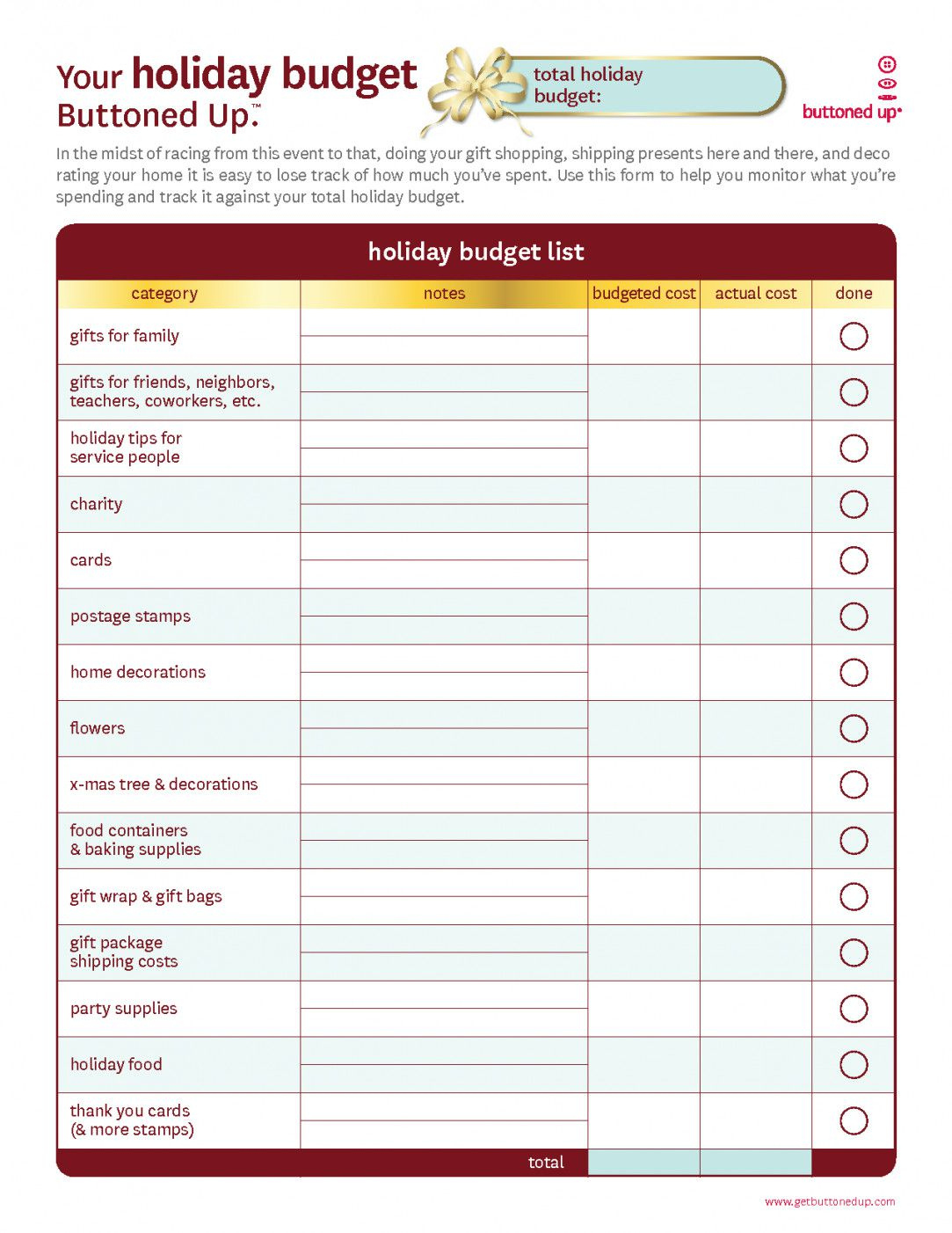

Free Monthly Budget Template Frugal Fanatic Free Printable Home

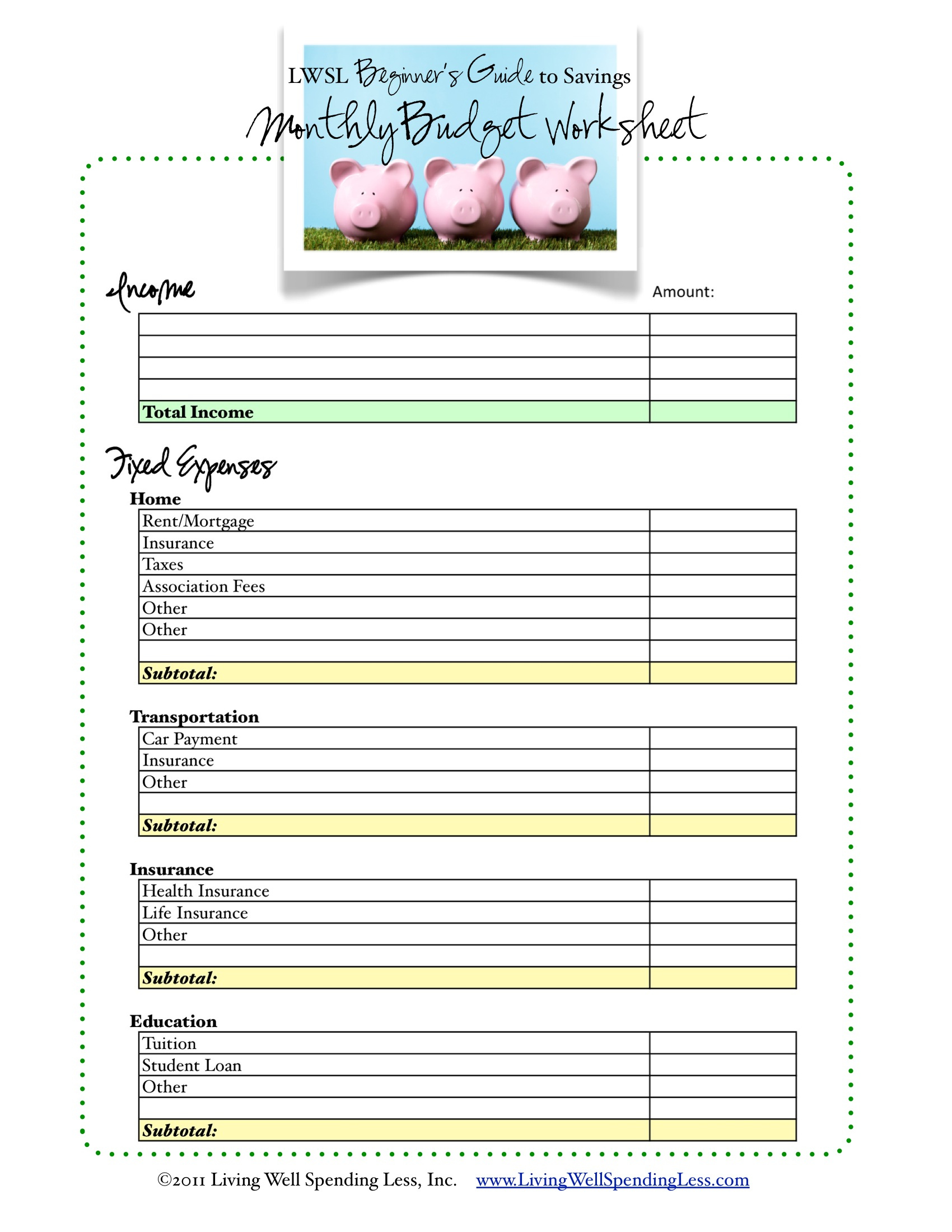

Free Budget Worksheet Living Well Spending Less

The Benefits Of Budgeting

It may appear to be an overwhelming task, but it’s a critical aspect to ensuring financial stability. You can monitor your spending and reserve money to put aside to be used for emergencies. You can then adjust your spending as needed.

Although it will take time to get used to making and adhering to a budget, the benefits are worth the effort. A budget will help you pay off debts, save money for your long-term goals and prevent financial troubles further down the line.

If you’re unsure of where to start there are plenty of resources to help you create your budget. Once you’ve established the habit of budgeting, you’ll be on your way towards financial success.