Free Budgeting Printables Expense Tracker Budget Goal Setting

Free Budgeting Printables Expense Tracker Budget Goal Setting

Free Budgeting Printables Expense Tracker Budget Goal Setting – A budget is crucial for organizing your finances. A budget template that you can print is the most efficient way for you to stay on track. You can use printable budget sheets to help you keep track of your expenses and stay organized.

There are a variety of ways to make budget. An app, a spreadsheet or software program may all be used to construct the budget. If you are looking for the simplest method of creating and keeping track of your budget using a printable budget worksheet is the perfect option.

There are plenty of budget sheets that can be printed online. They are accessible online for either free or at the cost of a small amount. Print the worksheet you like and begin tracking your expenditure once you’ve found it.

It doesn’t have to be difficult. It takes little effort and some planning to ensure your finances are in order.

Why Should You Use A Budget?

A budget is important due to a number of reasons. It allows you to record your expenditure and save as well as help you make informed financial decisions. A budget can be used to help you keep track of your financial goals.

It’s easy to make a budget. The most important thing to remember when making the budget is being honest about your earnings and expenses. It is important to stick to your budget in order to improve your financial condition.

Related For Budget Sheet Free

How To Use A Budget

Budgets are an important tool to manage your finances. You can keep track of your income and expenses to make informed choices about how to spend your money. It’s not easy to budget, but it can be done by a little planning and effort.

Here are some suggestions to use a budget

- Find out your income and expenses. Rectifying your expenses and income is the initial step to creating budget. This will provide you with an accurate picture of where your money is going.

- Set realistic goals. It is possible to set realistic goals when you know the direction of your money. In order to ensure you don’t go overboard on other goods, make sure to include variable expenses such as gas and food.

- Stay on the right path.

Tracking Your Progression

The process of creating a budget is the initial step in controlling your finances. To make sure you’re adhering to your budget, it is essential to be able to track your performance. There are several methods for doing this.

A budget tracking app is available. These apps connect to your bank account, so you can keep track of your expenditure. These apps can also be used to help you set up a budget, track your progress, and keep you up to date.

You can also monitor your progress with an excel spreadsheet, pen and paper or notepad and pen. Although this method takes more effort, it is similar to an app. Input your expenses and income each month. After that, you can compare the actual amount you spend with the budgeted amount. This allows you to determine the areas in which you can reduce your spending or adjust your spending accordingly.

Budget Sheet Free

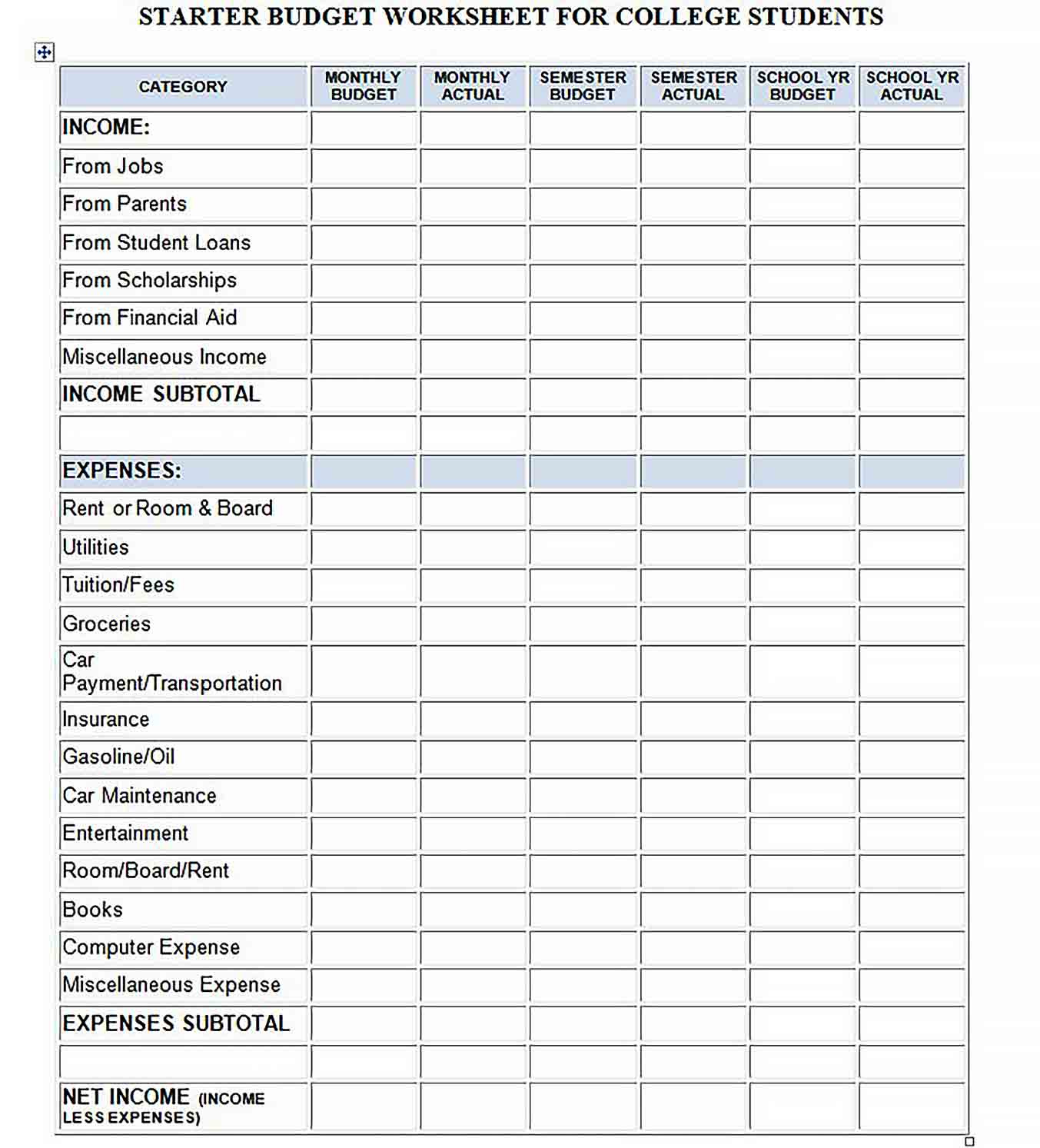

Printable Budget Worksheet Template Culturopedia

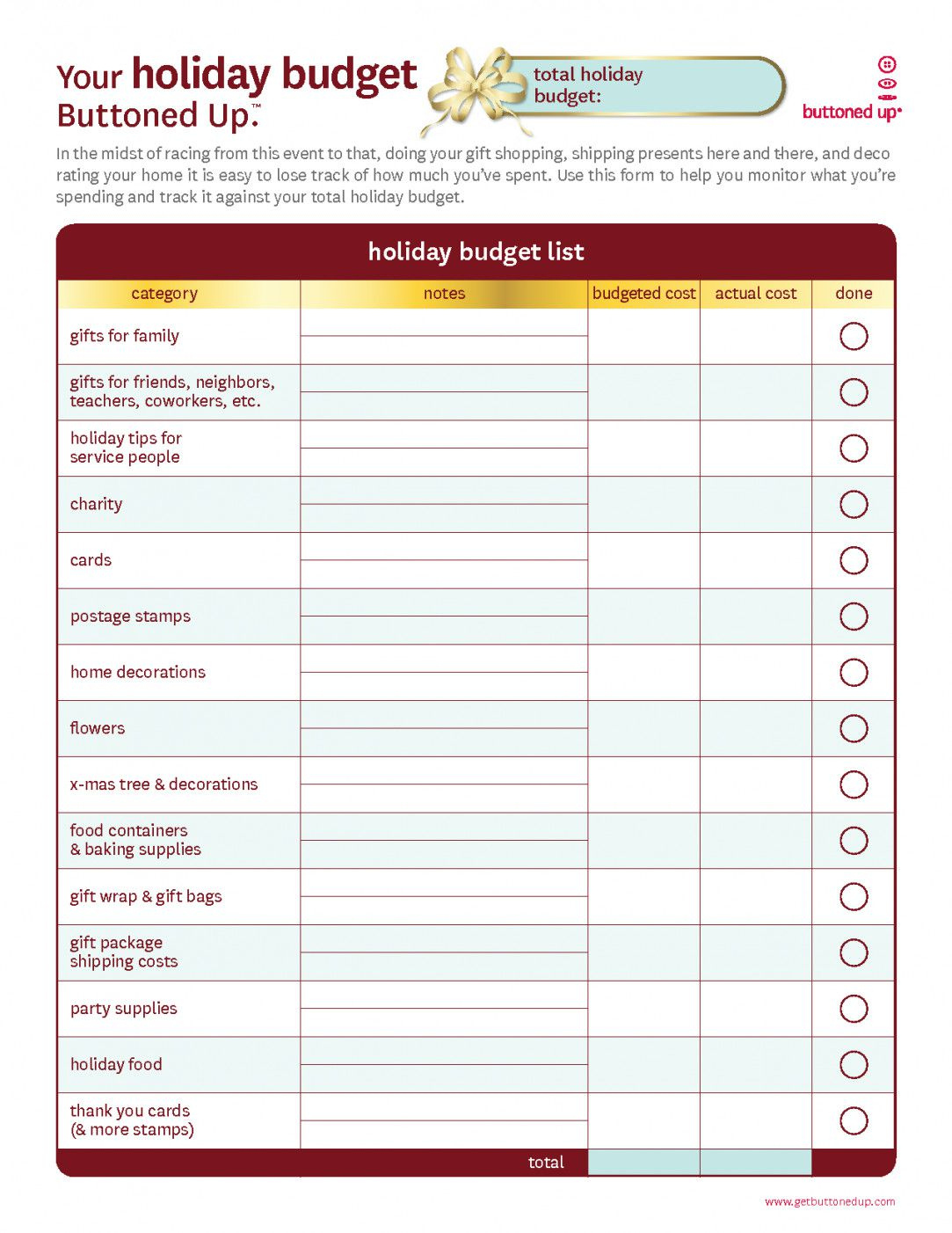

Free Monthly Budget Template Frugal Fanatic Free Printable Home

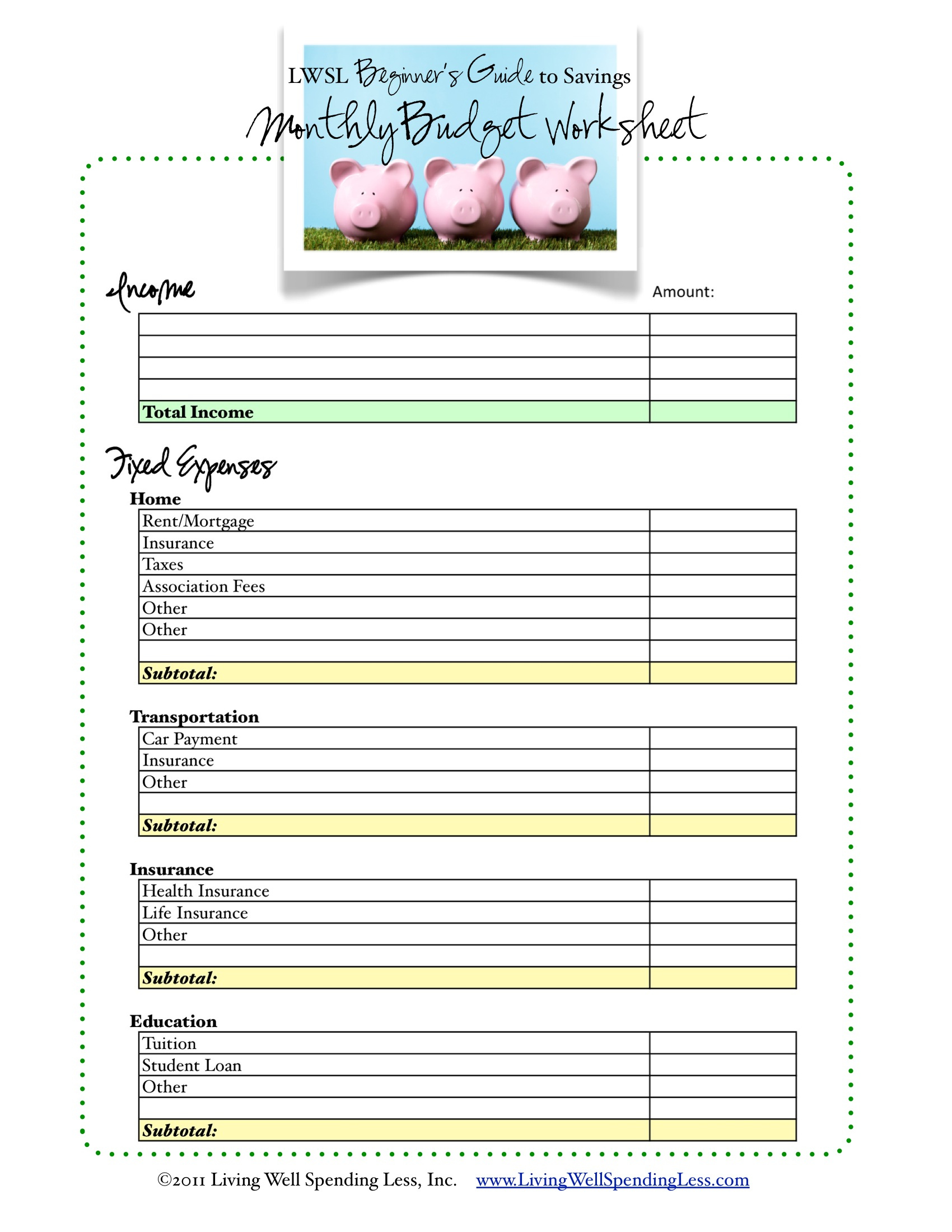

Free Budget Worksheet Living Well Spending Less

The Benefits Of Budgeting

The task of budgeting might seem like a tedious task, but it’s an essential step in ensuring your financial stability. Budgeting lets you monitor your spending, adjust in the event of a need, and put aside funds for emergencies and savings.

While it may take some time to understand how to develop and maintain your budget in a proper manner however, the rewards are worth the effort. A budget can help you to reduce debt, make savings for long term goals, and also avoid financial difficulties later on.

There are a variety of sources to help you come up with a budget that is suitable for your needs. Soon you’ll be able plan your budget efficiently and attain financial success.