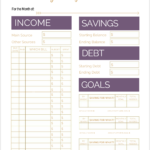

Download Printable Simple Budget Template PDF

Download Printable Simple Budget Template PDF

Download Printable Simple Budget Template PDF – If you want to have your finances in order, you’ll need a budget. A template for your budget can help you to stay on track. Budget sheets that are printable can keep you organized.

There are many methods to come up with budget. A spreadsheet, an app or software program can be used to build your budget. However, if you’re looking for the most straightforward method to make and keep track of your budget, a printed budget worksheet is the best way to go.

Budget templates are widely accessible online. They are accessible on the internet for free or a small charge. If you come across a page that you like, all you need to do is print it and start tracking your spending.

Budgeting does not have to be difficult. It is possible to manage your finances with just a little planning and effort.

What Are The Reasons You Should Have An Budget?

There are several reasons why individuals and households should consider a budget. A budget can help you record your expenditure and save, which can help you make better financial decisions. A budget can also assist you to keep track of your financial goals and targets.

Budgets can be made in just a few steps. You can make use of the spreadsheet or pencil to create the budget. Being truthful about your earnings and expenditures is the most essential aspect of establishing the budget. To enhance your financial position, you should stick to the budget that you have established.

Related For Budget Sheet Template Free

How To Utilize A Budget

A budget is a vital tool for managing your finances. You can monitor your income and expenses to make informed choices about how to allocate your funds. It’s not easy to budget, but it’s a task that can be done by a little planning and work.

Here are some helpful tips for budgeting:

- Determine your income and expenses. To create a budget, you need to first keep track of your income. This will help you to understand where your money going.

- Set realistic goals. Set reasonable goals for savings and spending once you’ve got a clear picture of the direction your money is heading. Be sure to include the cost of variable items like gasoline and food items so that you don’t have to spend a lot for other things.

- Keep on the right track.

You Can Track Your Performance

Making a budget is the first step towards gaining control of your finances. After you’ve established an budget, it’s essential to monitor your progress and ensure that you adhere to the plan. There are numerous ways to do this.

The budget tracking app is available. These apps can be connected with your bank account to monitor your spending and then automatically connect to your bank account. These apps can be used to help you set up a budget, track your progress and keep you informed.

Another method of keeping track of your progress is to use either a spreadsheet or pen with paper. This requires more manual work, however it’s just as efficient as using an application. Enter your monthly earnings and expenses for the month, and then compare your actual expenditure to the budgeted amount. This will enable you to determine areas that require to be reduced or modified.

Budget Sheet Template Free

The Benefits Of Budgeting

While it may be difficult to budget yet it’s an essential step to financial stability. A budget allows you to keep track of your expenses, set aside funds for savings and emergency funds, and adjust when needed.

It may take some time for you to feel confident in creating and following your budget. But, the rewards are worth it. Budgets can be utilized to reduce debt, set aside funds for goals that are long-term or even avoid financial problems.

There are numerous sources to help you prepare a budget that fits your requirements. Financial success is possible once you begin budgeting.