The Single Best Budget For Google Sheets You ll Ever Use EndThrive

Budget Sheet Template Google Sheets

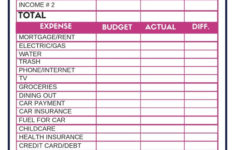

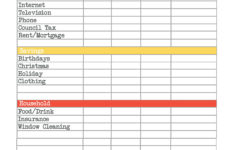

Budget Sheet Template Google Sheets – A budget is necessary if you are to organize your finances. The printable budget sheets are the best method to stay on the track. It is possible to use printable budget sheets to help stay on track and organized.

There are a variety of ways to make a budget. An app, a spreadsheet or software program can all be used to create your budget. However, if you’re looking for the easiest way to create and keep track of your budget, a printable budget worksheet is the best option to choose.

Online, you will find various budget sheets for printing. You can find them on a free basis or for the cost of a small amount. Once you’ve found the perfect sheet, you just need to print it and begin tracking your spending.

Budgeting shouldn’t be difficult. You can handle your finances by putting in a bit of planning and effort.

Why Use A Budget?

There are a number of reasons why households and individuals should have budgets. A budget lets you monitor your spending and save as well as help you make better financial decisions. A budget can be used to monitor your financial objectives.

A budget can be designed in a few easy steps. You can make use of the spreadsheet or pencil to draw it. The most important part of making an effective budget is to be honest about your earnings and expenses. In order to improve your financial situation adhere to the budget you’ve established.

Related For Budget Sheet Template Google Sheets

How Do You Use The Budget

Budgets are a vital tool for managing your finances. You can monitor your income and expenses in order to make well-informed choices about how to spend your money. While it may be difficult to plan your budget, with some planning and effort it is possible to adhere to your budget.

Here are some tips on how to use a Budget:

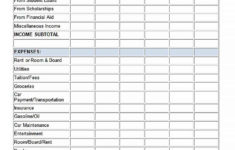

- Find out your income and expenses. Rectifying your expenses and income is the first step in creating budget. This will allow you to know where your money is spending.

- Set realistic goals. You can set achievable goals for savings and spending once you have an idea of the direction your money is heading. So that you don’t overspend on other purchases, be sure you add in variable expenses like gas and groceries.

- Be on track.

You Can Monitor Your Progress

The process of creating a budget is the first step towards getting control of your finances. To ensure that you’re staying within your budget, you must keep track of your improvement. This can be done by a variety of methods.

You can use an app for budget tracking. The apps are connected to your bank account so that you can keep track of your spending and link to your bank account. The apps let you create a budget and track your progress over the time.

A spreadsheet or pen and piece of paper are another method to track your performance. While this requires more manual effort than the use of an app, it can still be as effective. Enter your monthly earnings and expenses for the month and then check your actual spending to your budgeted amounts. This will allow you to determine areas that require to be cut or adjusted.

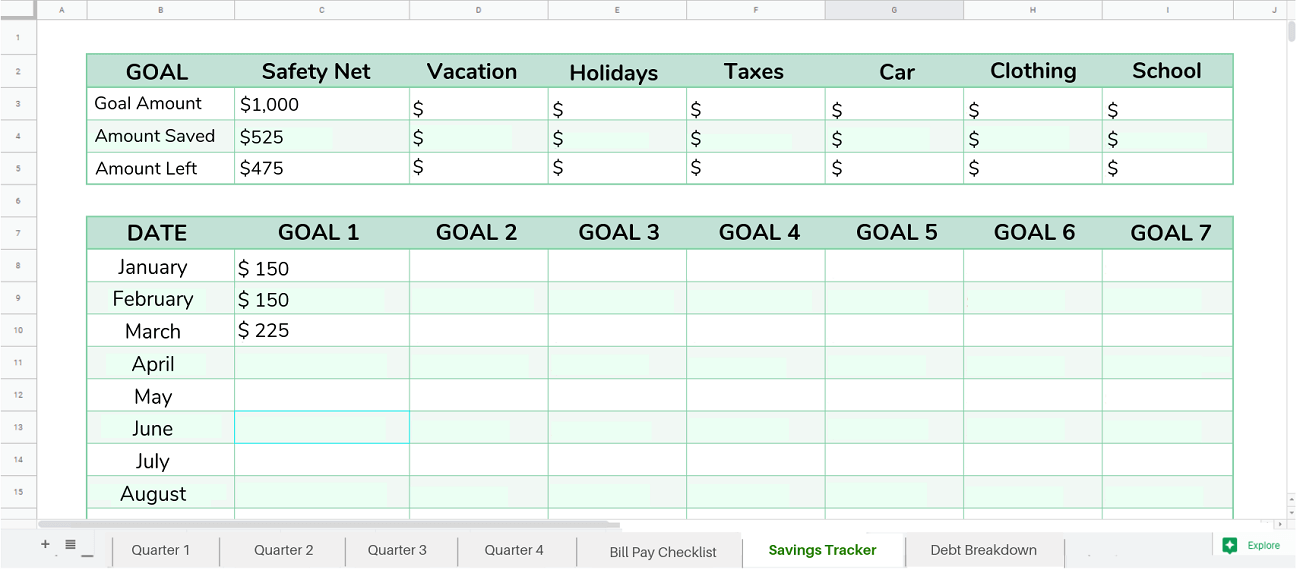

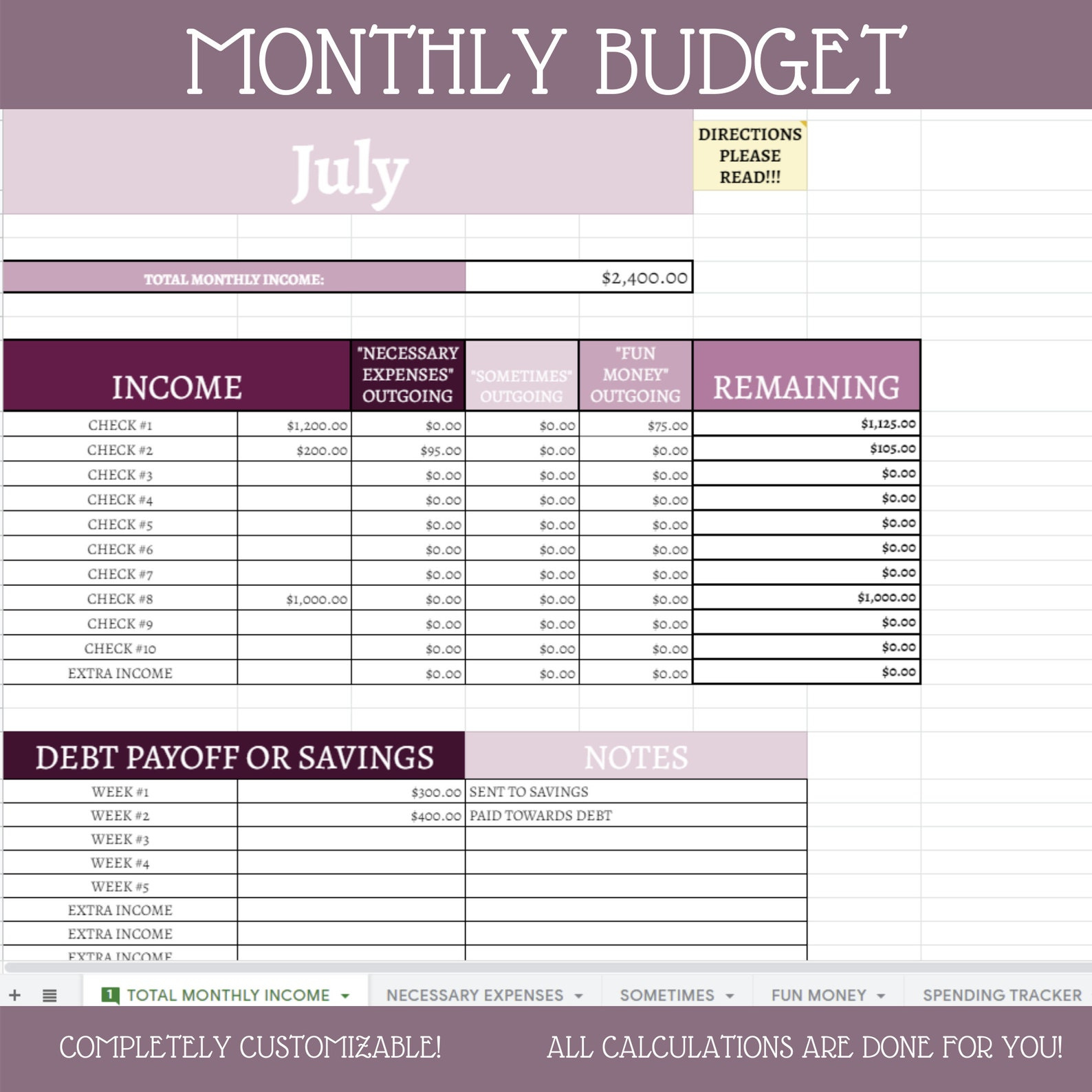

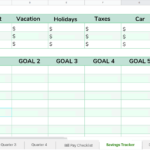

Budget Sheet Template Google Sheets

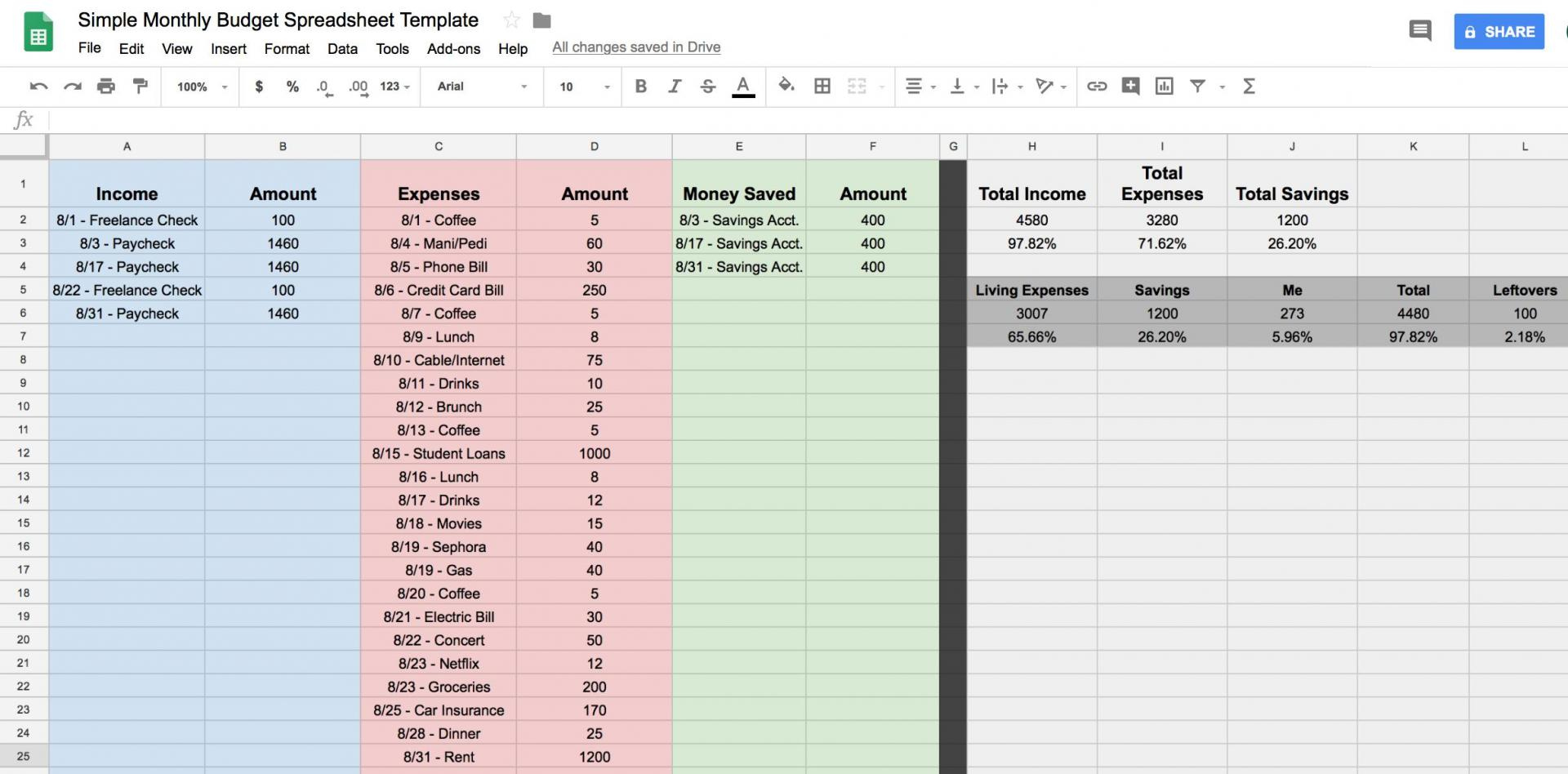

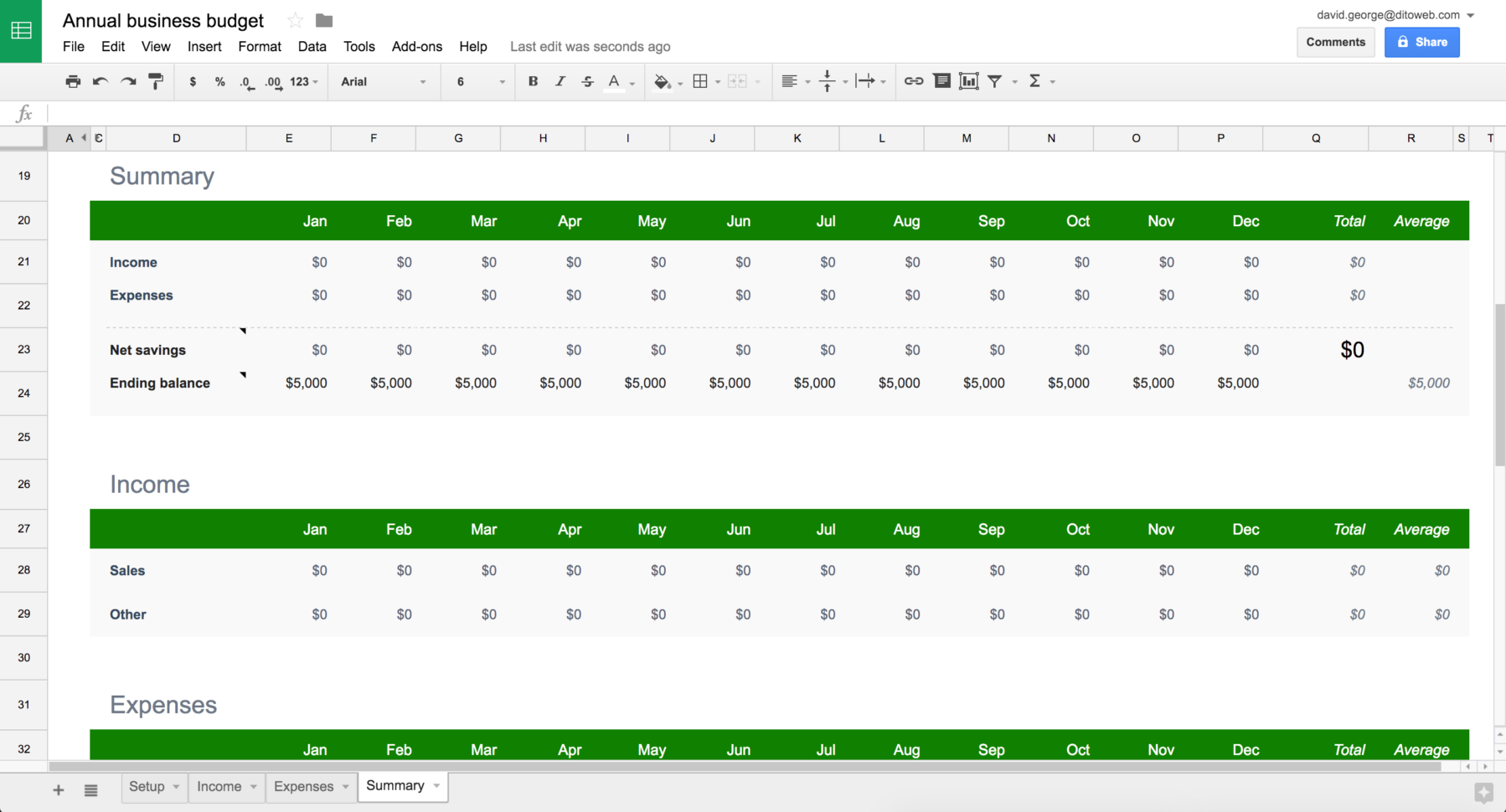

How To Create A Budget Spreadsheet In Google Sheets

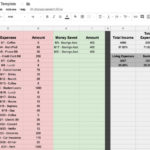

Monthly Budget Spreadsheet Google Sheets Instant Download Etsy

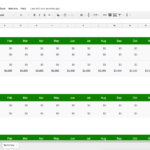

Free Google Budget Spreadsheet Throughout New Professionallydesigned

The Benefits Of Budgeting

While it may be difficult to budget however, it’s an essential step to financial stability. You can keep track of your expenses and put aside funds to save or for emergency purposes. Then, you can make adjustments as necessary.

While it may take some time to be comfortable setting up and sticking to an established budget, the advantages are well worth the effort. A budget can help you cut down on credit card debt, set aside money to fund long-term goals, and prevent financial issues in the future.

If you’re unsure of where to begin, there are plenty of resources that can aid you in creating the perfect budget for you. You’ll soon be able make a sound budget and enjoy financial success.