30 Budget Templates Budget Worksheets Excel PDF TemplateLab

30 Budget Templates Budget Worksheets Excel PDF TemplateLab

30 Budget Templates Budget Worksheets Excel PDF TemplateLab – You require a budget to control your financials. The best method to monitor your budget is with the help of a printable. Budget sheets that are printable can help you stay organized and on the right track.

There are many methods to create a budget. There are many methods to come up with your budget. You can utilize an app, a spreadsheet or program. If you’re looking for the most efficient method of creating and tracking your budget, then a printable budget worksheet is the most effective choice.

Online, you can find numerous budget sheets that can be printed. They can be downloaded online for download for no cost or at the cost of a small amount. You can print the sheet you like and start tracking your expenses after you have discovered the.

Budgeting doesn’t need to be difficult. It takes little effort and some planning to ensure your finances are in order.

What Are The Reasons You Should Have An Budget?

There are numerous reasons why individuals and households should consider a budget. A budget allows you to track your spending and savings as well as assist you in making educated financial choices. A budget can aid you to remain on track with your financial objectives.

A budget can be created with just a few simple steps. You can make use of an excel spreadsheet or pencil to draft the budget. Being honest about your income and expenses is the most important aspect of creating a budget. You should stick to your budget in order to improve your financial condition.

Related For Budget Sheet Template

How Do You Use A Budget

A budget is a vital tool to manage your finances. Indicating your earnings and expenses will enable you to make informed decisions on how best to spend your money. It can be a daunting task to budget but with a little planning and effort it’s not difficult to stick to a budget.

There are a few ways to use your budget.

- Calculate your expenses and income. Tracking your income and expenses is the first step to formulating your budget. This will help you to determine where your money is spending.

- Set realistic goals. Once you have a clear picture of the direction your money is heading and what you are spending it on, you can set achievable goals for savings and spending. In order to ensure you don’t go overboard on other things, be sure to account for variable costs like groceries and gas.

- Stay on the right track.

You Can Monitor Your Performance

The first step in achieving financial control is to make an budget. However, once you’ve got a budget, you need keep track of your progress in order to ensure you’re adhering to it. There are many ways to do this.

You can use an app for budget tracking. These apps can be linked to your bank account to track your expenditure automatically. They can also be used to set up an expense plan, track your progress and keep you updated.

A pen or spreadsheet, or a piece of paper is another option to track your progress. While this requires more manual work than the use of an app, it can still be effective. Simply record your income every month, and then compare your expenses to the budgeted amount. This allows you to identify areas where you can reduce your spending or make adjustments.

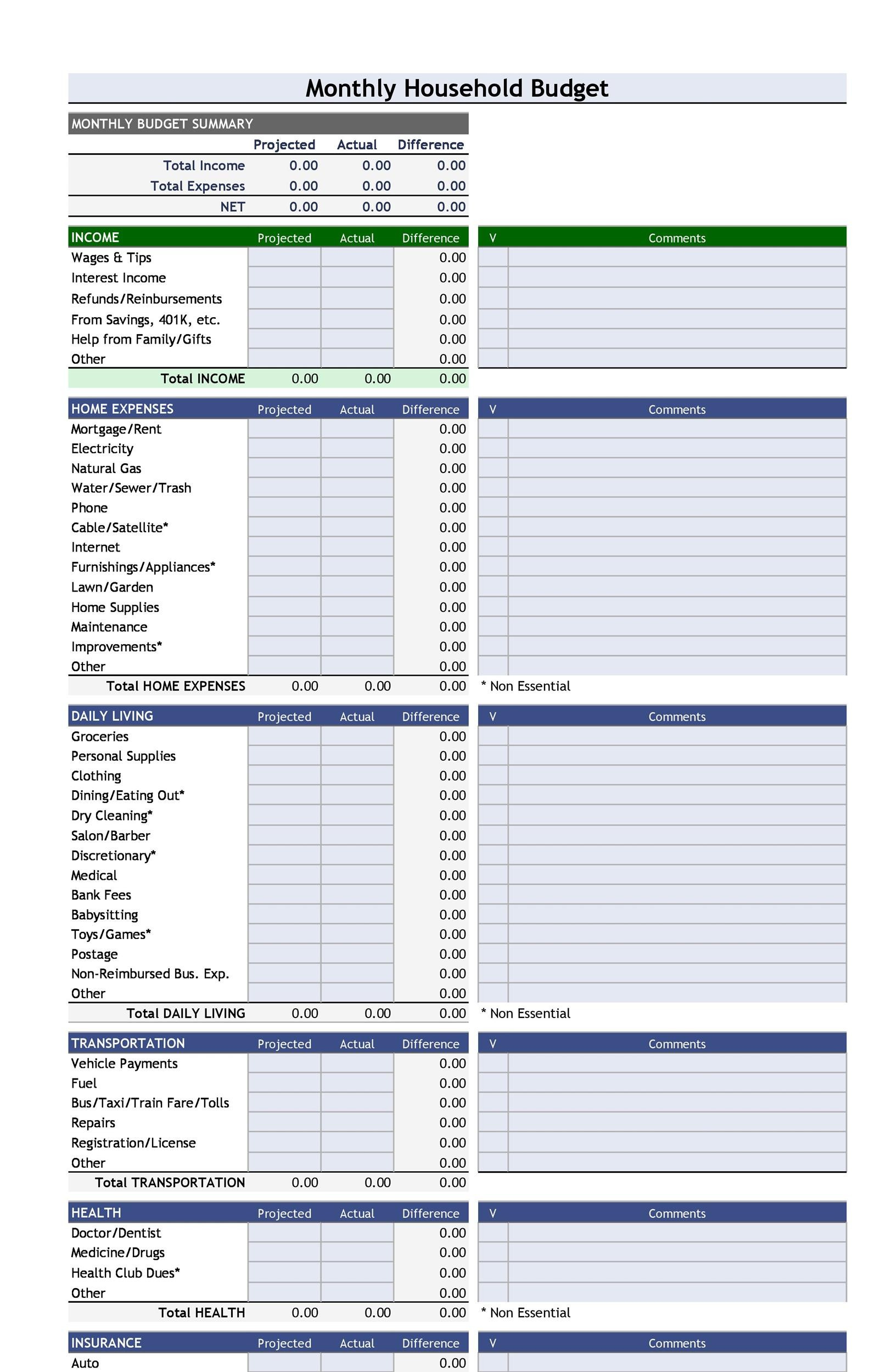

Budget Sheet Template

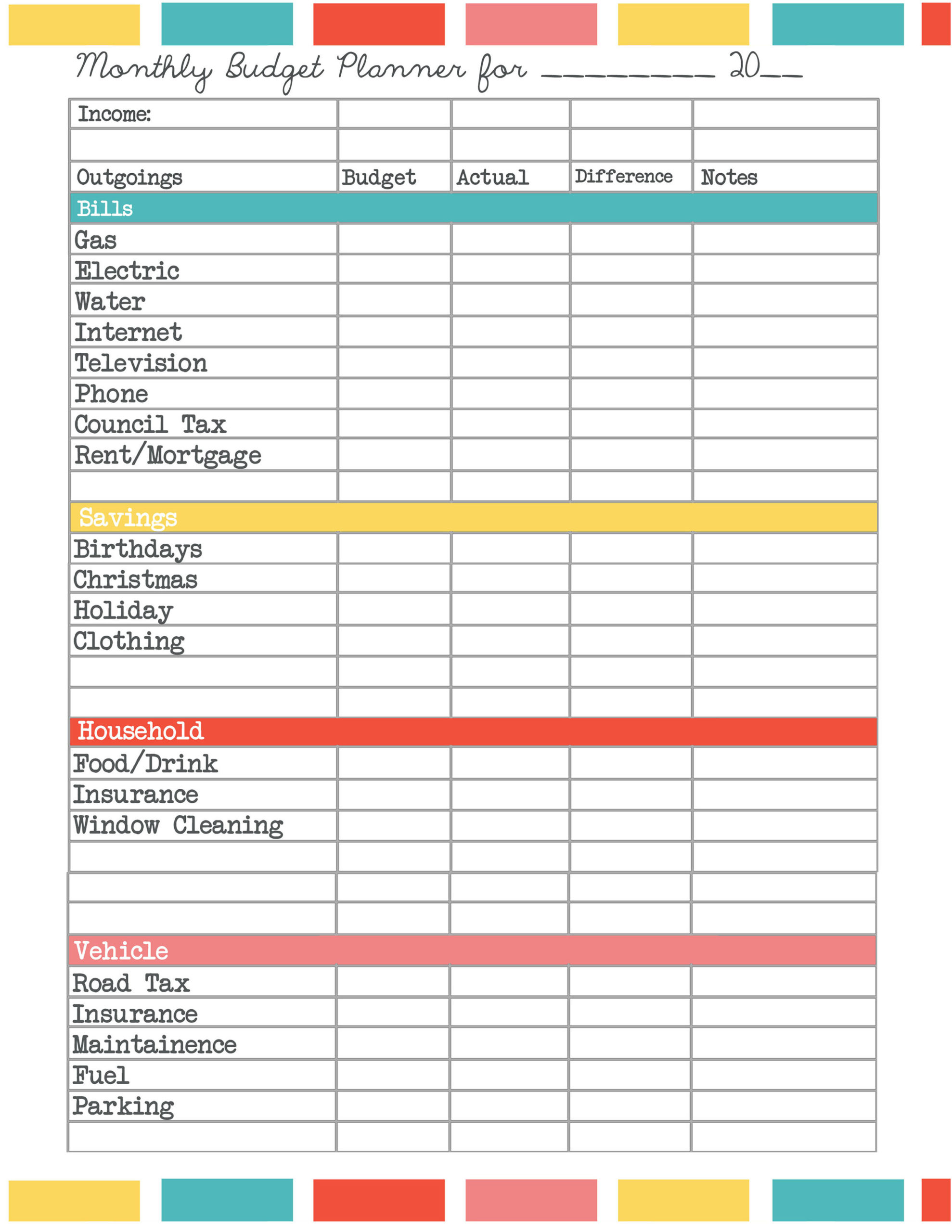

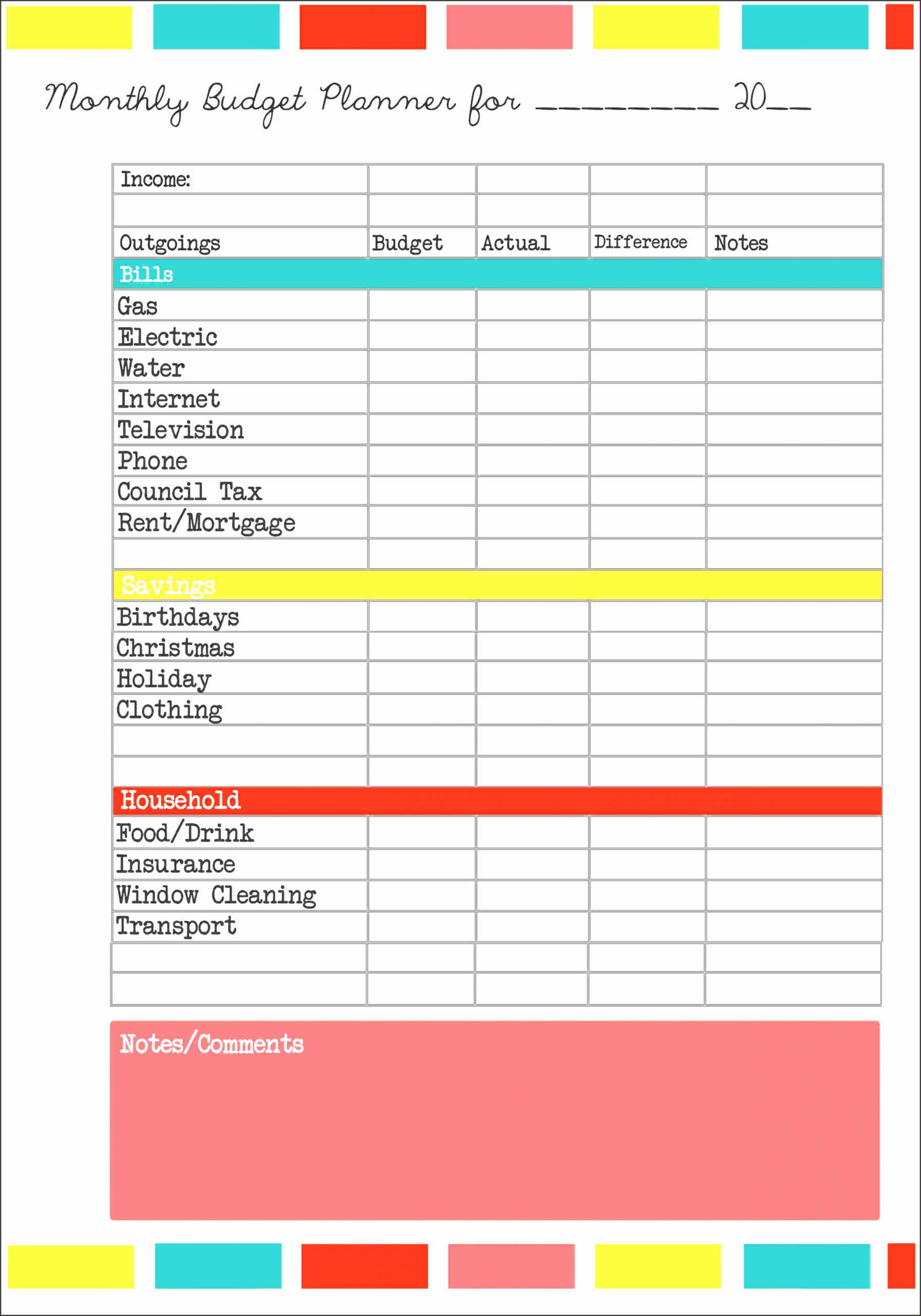

Sample Family Budget Spreadsheet Pertaining To Sample Household Budget

8 Daily Budget Spread Sheet Template SampleTemplatess SampleTemplatess

The Benefits Of Budgeting

The task of budgeting might seem like an overwhelming job, but it is a crucial element to ensure financial stability. Budgeting allows you to keep track of your expenses, set aside funds for savings and emergency money, and make adjustments according to the need.

While it might take time to become comfortable with making and adhering to an established budget, the advantages are worth the effort. Budgets can be used to pay off debts, put aside money for long-term goals and avoid future financial difficulties.

There are many resources to help you come up with a budget that is suitable for your needs. Once you’ve established the habit of budgeting, you’ll be on your way to financial success.