Free Budget Worksheet Living Well Spending Less

Free Budget Worksheet Living Well Spending Less

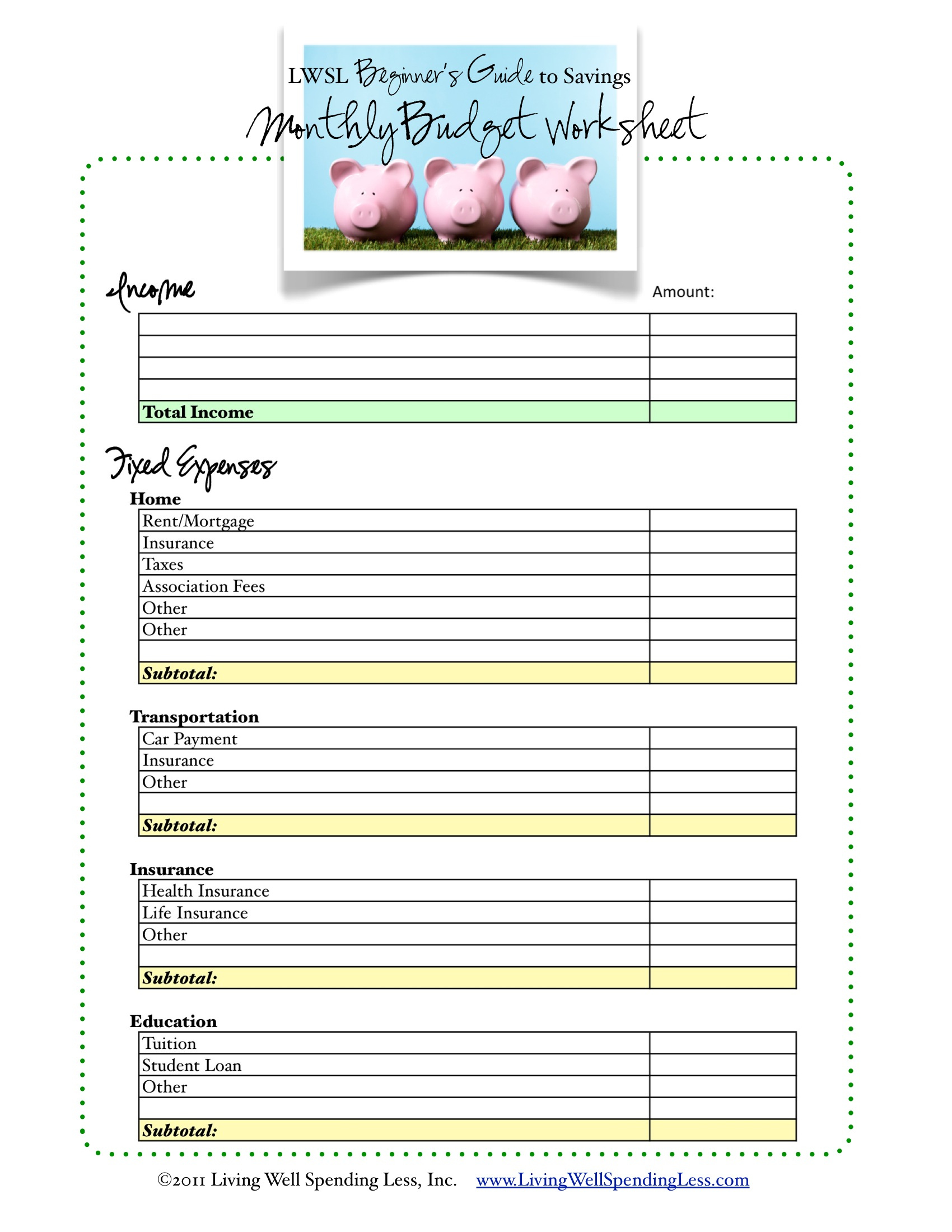

Free Budget Worksheet Living Well Spending Less – A budget is necessary to manage your finances. A budget worksheet that you can print is the best method to stay on in the loop. Budget sheets that are printable can aid you in staying organized.

There are a variety of options available to create a budget. A spreadsheet, an app or a software program could all be used to construct an budget. But if you want the easiest way to create and track your budget, a budget worksheet is the best most effective option.

Budget worksheets for printing are readily available on the internet. They are available online for free or for only a small fee. You can print the form you like and begin tracking your expenses once you’ve discovered the.

It doesn’t have to be difficult. With just a bit of effort and some planning, you can get your finances within a matter of minutes.

Why Use A Budget?

There are several reasons why individuals and households should consider a budget. It allows you to track your spending and saving that can allow you to make informed financial choices. You can use a budget to help you keep track of your financial objectives.

A budget can be created in just a few steps. You can utilize pencil or a spreadsheet to draft it. Being truthful about your earnings and expenses is the most important element of making your budget. It is important to stick to your budget in order to improve your financial condition.

Related For Budget Sheet

How To Make Use Of The Budget

A budget is a vital instrument for managing your finances. It allows you to track your earnings and expenses so that you can make informed decisions about how you allocate your funds. It can be a daunting task to budget however, with a bit of planning and work it is possible to stick to a budget.

These are some ways to make use of a budget.

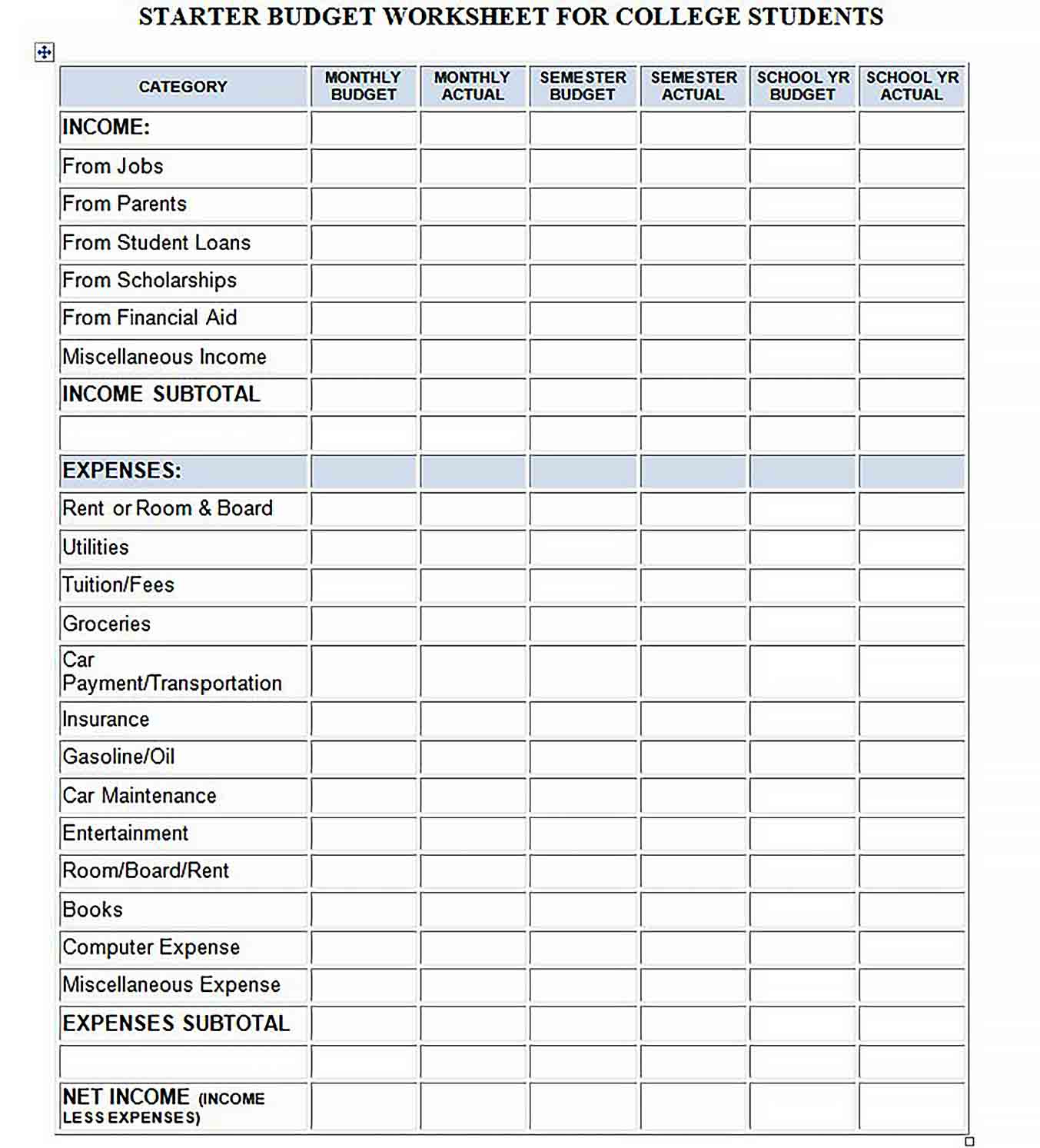

- Determine your income and expenses. The first step in creating your budget is keeping track of your expenses and income. This will give you an understanding of where your cash is going.

- It is important to set reasonable goals. It is possible to set realistic goals when you know where your money is going. Be sure to include variables like gas and groceries so you don’t have to spend a lot for other things.

- Stay on the right path.

Tracking Your Development

The process of creating a budget is the initial step in controlling your finances. Once you’ve set up your budget, it’s crucial to keep track of your progress and make sure you stick to the plan. There are a variety of methods for doing this.

An app that tracks your spending can help you monitor your budget. These apps connect to your bank account and track your expenditure automatically. They allow you to make a budget and keep track of your progress over the period of time.

You could also track your progress with an excel spreadsheet, pen and paper, or pen and note. This approach requires more manual effort, but it can be just as effective as using an application. Simply record your expenditures and income each month, and then evaluate your actual spending to your budgeted amounts. This will let you know the areas where you can cut back or make adjustments.

Budget Sheet

Printable Budget Worksheet Template Culturopedia

The Benefits Of Budgeting

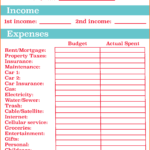

Budgeting may seem like an overwhelming job, but it is a crucial aspect to ensuring financial stability. You can keep track of your expenses and put aside funds to save to use for emergencies. After that, you are able to make changes as required.

While it might take time to become comfortable with setting up and sticking to budgets, the results are worth the effort. Budgets can be utilized to pay off debts, to set aside funds for goals that are long-term, or avoid future financial issues.

There are numerous resources to help you create a budget that meets your needs. Success in financial planning is achievable once you start budgeting.