Sample Budget Spreadsheet Excelxo

Sample Budget Spreadsheet Excelxo

Sample Budget Spreadsheet Excelxo – A budget is crucial if you are to organize your financial affairs. The best way to organize your budget is with a printable. It is possible to print budget worksheets to help you stay on track and organized.

There are a myriad of methods to come up with a budget. You can utilize a computer program, an app, or even using a spreadsheet. However, if you’re looking for the most straightforward method to make and keep track of your budget, a printed budget worksheet is the best most effective option.

Online, you can find numerous budget sheets that can be printed. They are available online free of charge or for an affordable cost. Once you find a sheet that you would like to use, all you need to do is print it out and begin tracking your expenditure.

It doesn’t have to be difficult. With just a bit of work and some preparation it is possible to get your finances within a matter of minutes.

Why Do You Need An Budget?

A budget is essential because of a variety of reasons. A budget can help you track your spending and saving that can allow you to make better financial decisions. You can utilize a budget to help you keep track of your financial objectives.

The process of creating a budget can be accomplished in just a few steps. It is possible to use a spreadsheet or pencil to draw the budget. The most crucial aspect of creating your budget is to be truthful about the amount of money you earn and what you spend. To increase your financial standing, you should stick to the budget that you’ve established.

Related For Budget Spreadsheet Example

How To Make Use Of A Budget

A budget is a vital tool for managing your finances. By keeping track of your income and expenditures, you’ll be able to make informed decisions about the best ways to spend your money. It can be a daunting task to budget, but with a little planning and effort it’s possible for you to stick to a budget.

There are a few ways to make use of a budget.

- Find out your income and expenses. To make a budget you need to first keep track of your income. This will give you an understanding of where your money is going.

- The importance of setting realistic goals is. Realistic goals can be set once you’ve figured out the direction of your money. So that you don’t overspend on other things, be sure you include any variable costs like groceries and gas.

- Be on the right track.

Tracking Your Progression

The process of creating a budget is the first step towards taking control of your financial situation. Once you have established an budget, it’s crucial to keep track of your progress and make sure that you adhere to the plan. This can be done in many ways.

The budget tracking app is available. The apps are connected with your bank account to monitor your spending and then automatically link to your bank account. They can also assist you in setting your budget and monitor your growth in time.

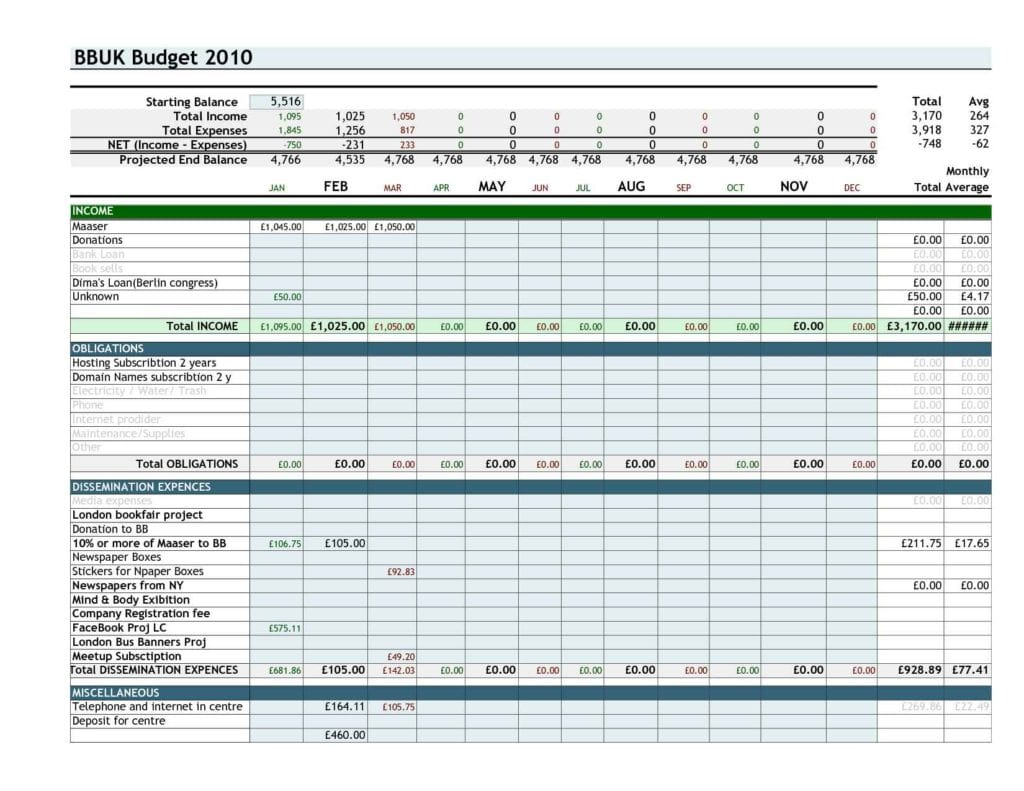

Another method of tracking your progress is to use an excel spreadsheet or pen and paper. While this requires more manual work than apps, it can nevertheless be equally efficient. Simply record your earnings and expenses for the month and then check the actual expenses to your budgeted amounts. This will help you determine areas that require to be reduced or altered.

Budget Spreadsheet Example

The Benefits Of Budgeting

Although it can be a bit tedious, it is an essential step to financial stability. A budget allows you to track your spending, set aside money for savings or emergency funds, and then make adjustments as needed.

While it may take some time to be comfortable the process of creating and sticking to an established budget, the advantages are well worth the effort. A budget can assist you in paying off debts, save money to fund long-term goals, and avoid financial problems further down the line.

If you’re not sure where you should start, there are plenty of resources that can aid you in creating a budget that works for you. You’ll soon be able plan your budget efficiently and attain financial success.