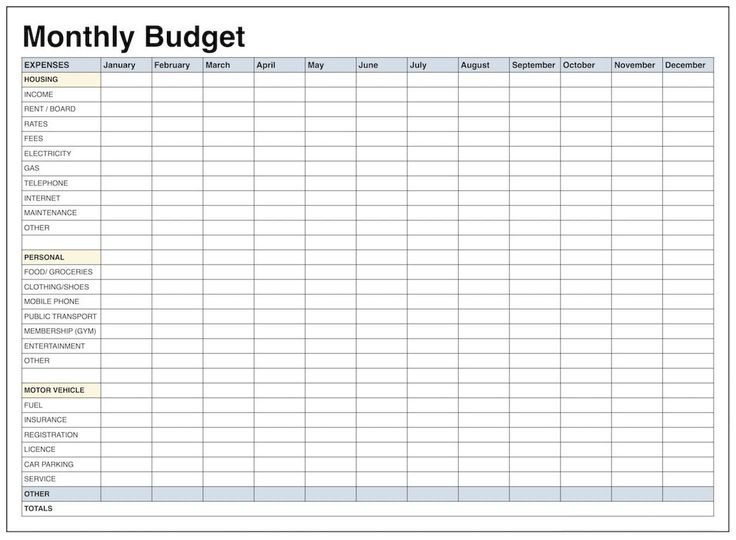

Family Monthly Budget Worksheet Budget Spreadsheet Template

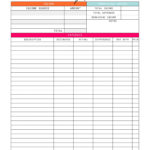

Budget Spreadsheet Free Blank

Budget Spreadsheet Free Blank – A budget is necessary to manage your finances. A template for your budget is the most efficient way for you to stay on track. Budget sheets that are printable can help you stay organized.

There are a myriad of methods to set up a budget. You can utilize a computer application, a program, or even an Excel spreadsheet. A budget worksheet that you can print is recommended if you’re looking for the simplest method to create and track your budget.

Budget templates are widely available online. The budget sheets are available online for free or for an affordable cost. Once you find a sheet that you like, all you need to do is print it and begin tracking your expenditure.

Budgeting doesn’t have to be a hassle. With a little effort and some planning, you can get your finances under control in no time.

Why Should You Use The Budget To Make Decisions?

There are a variety of reasons why households and individuals need to establish a budget. A budget can be used to track your spending and reduce expenses, which will help with financial decisions. A budget can be used to stay on top of your financial objectives.

It’s easy to make a budget. Being transparent about your income and expenditures is the most essential element of making your budget. Once you’ve come up with the budget, follow it as strictly as you can to improve your financial situation.

Related For Budget Spreadsheet Free Blank

How To Utilize A Budget

Budgets are an important tool to manage your finances. By keeping track of your income and expenditures, you can make informed decisions about how to best use your money. Budgeting can be difficult, but with a little planning and work, it can be easy to stick to a budget.

Here are some suggestions on how to utilize a budget.

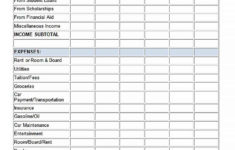

- Make sure you know your expenses and income. In order to create a budget, you first need to track your income. This will provide you with a clear picture of where your money is going.

- The importance of setting realistic goals is. You can establish reasonable goals for savings and spending when you have an idea of how much money you’re spending. Make sure to factor in other expenses that aren’t fixed, like gasoline and food, so that you don’t overspend on other expenses.

- Stay on track.

You Can Track Your Development

The first step to financial control is to establish your own budget. Once you’ve set up a budget, it is vital to track your progress and make sure that you adhere to it. There are many ways to do this.

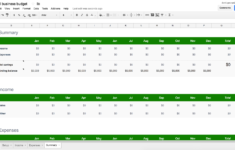

An app that keeps track of your spending can help you track your budget. These apps can be linked with your bank account to track your spending and automatically connect to your bank account. The apps let you make a budget and keep track of your progress over period of.

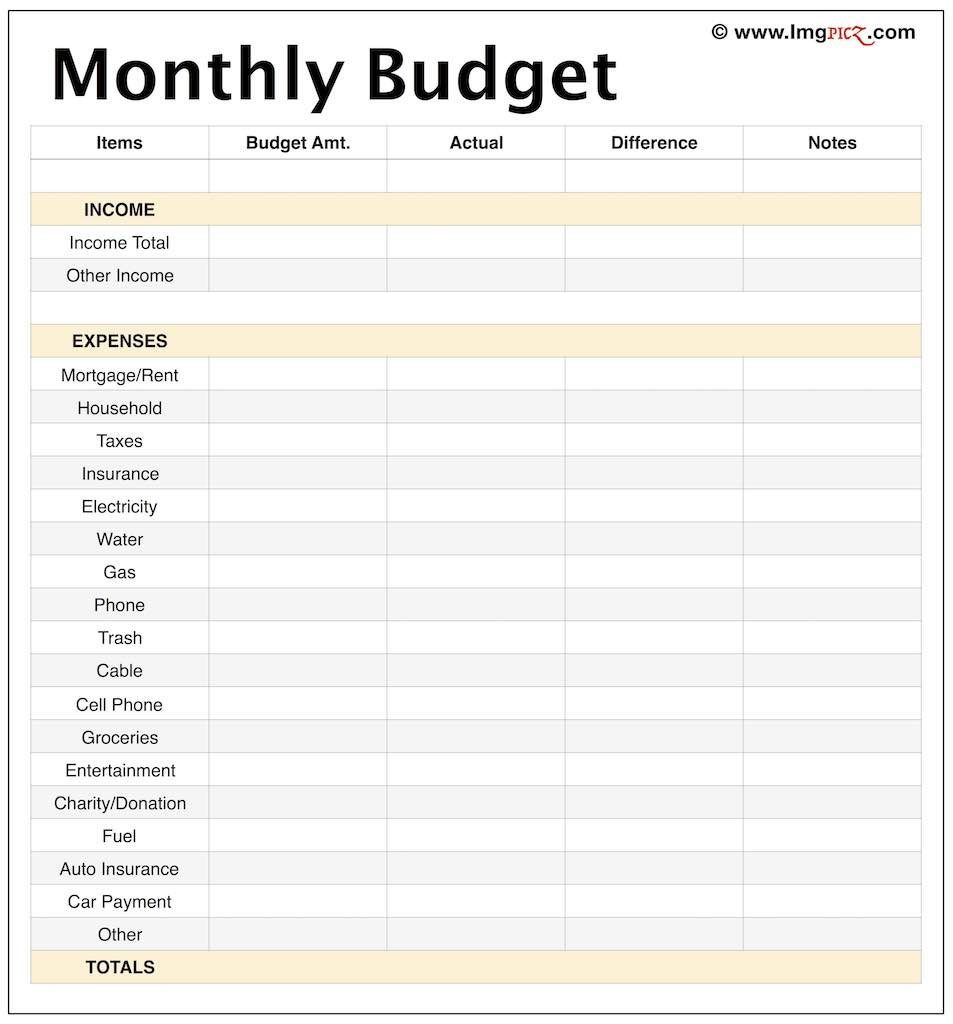

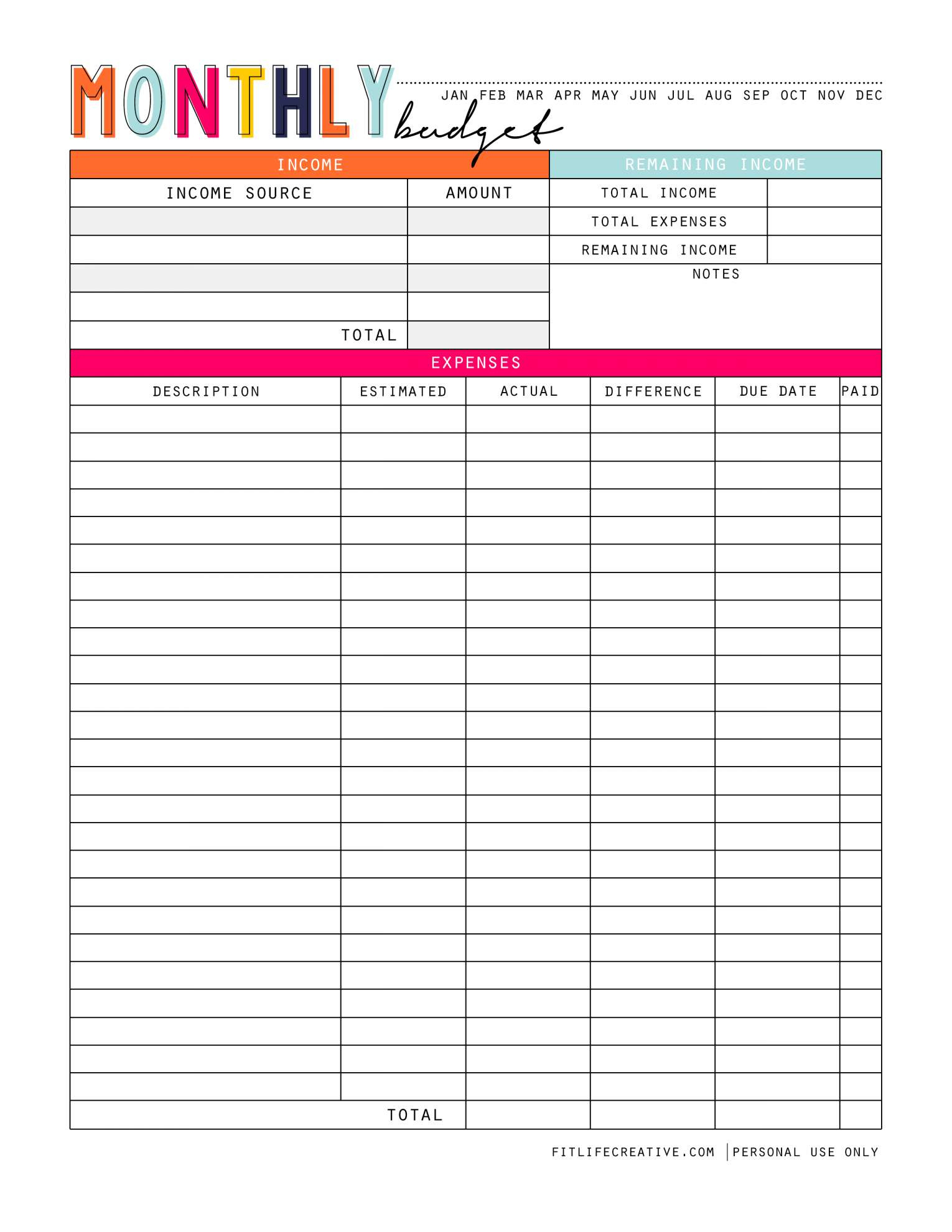

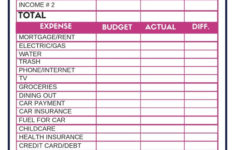

Another method of tracking your progress is using an excel spreadsheet or pen and paper. Although this takes more manual work than an app, it could nevertheless be equally effective. Enter your earnings and expenses for the month, then compare the actual expenses to the budgeted amount. This will help you see what areas you should reduce or adjust your spending.

Budget Spreadsheet Free Blank

Blank Budget Spreadsheet Regarding Free Printable Budget Worksheet

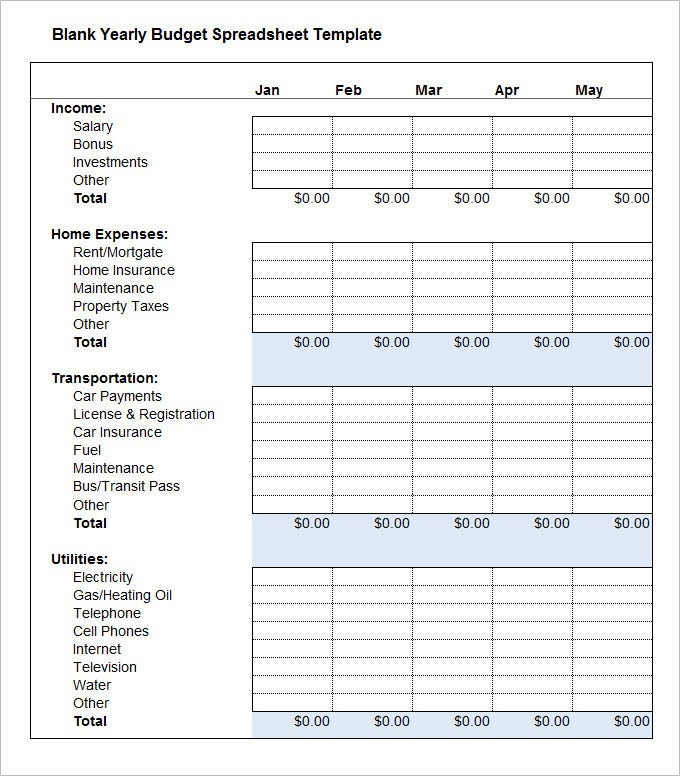

5 Yearly Budget Templates Word Excel PDF Free Premium Templates

Weekly Budget Worksheet Pdf Db excel

The Benefits Of Budgeting

It may appear to be an overwhelming task, but it is a crucial element to ensure financial stability. You can keep track of your expenses and reserve money to put aside to use for emergencies. After that, you are able to make changes as required.

Although it can take time to adjust to creating and sticking to budgets, the rewards are worth the effort. A budget can allow you lower your the amount of debt you have, and save for your long-term goals and help you avoid financial problems in the future.

There are a variety of resources to help you prepare a budget that fits your requirements. Once you’ve gotten into the habit of budgeting, you’ll be on the road to financial success.