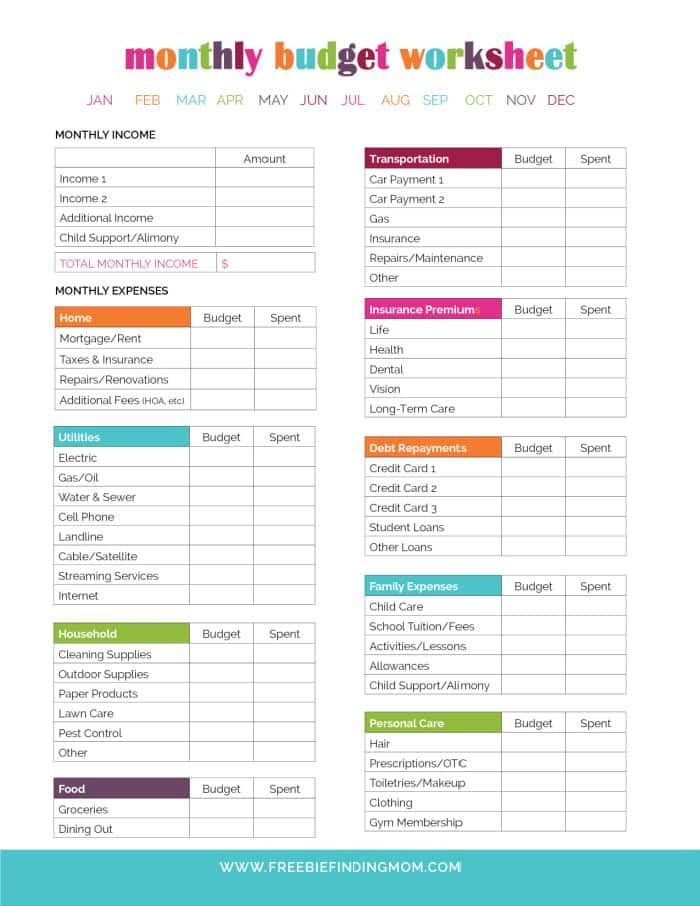

Free Household Budget Worksheet PDF Printable Freebie Finding Mom In

Free Household Budget Worksheet PDF Printable Freebie Finding Mom In

Free Household Budget Worksheet PDF Printable Freebie Finding Mom In – A budget is essential when you want to manage your financial affairs. The best way to monitor your budget is to use the use of a printable. A budget worksheet that you can print out will assist you in keeping track of your expenses.

There are a variety of ways to set up budget. There are many different ways to set up budget. You can utilize an app, software or spreadsheet. But if you want the most straightforward method to make and keep track of your budget, a printed budget sheet is the most effective option.

Online, you can find numerous budget sheets that can be printed. These budget sheets can be downloaded for free or for a small cost. Once you’ve found a sheet that you find appealing, all you have to do is print it out and begin tracking your expenditure.

Budgeting shouldn’t be difficult. It takes little effort and some planning to get your finances in order.

What Are The Benefits Of A Budget?

A budget is essential because of a variety of reasons. A budget lets you monitor your spending and save, which can help you make informed financial choices. A budget will also help you remain on track with your financial goals and targets.

It is easy to create an effective budget. Be honest about your income and expenditures is the most essential part of creating a budget. Once you have created your budget, adhere to it as closely as possible in order to improve your financial position.

Related For Budgeting Worksheets Free Printable PDF

How To Utilize The Budget

Your budget is an essential tool to control your financial situation. Through tracking your earnings and expenses, you are able to make educated decisions on the best way to use your money. It’s not always easy to plan your budget, however it can be accomplished by a little planning and work.

These are some ways to use your budget.

- Calculate your expenses and income. In order to create a budget, you first need to track your earnings. This will give you an accurate picture of where your cash is going.

- Setting realistic goals is essential. Set realistic goals once you’ve figured out the direction of your money. Be sure to include variable expenses such as gasoline and food items so that you don’t have to spend a lot for other things.

- Keep your eyes on the right direction.

Tracking Your Performance

Setting a budget is the first step towards gaining financial control. Once you have established your budget, it’s essential to monitor your progress and ensure that you adhere to it. There are many methods to accomplish this.

You can make use of a budget tracking app. The apps are linked to your bank account so that you can keep track of your spending and connect to your bank account. The apps let you make a budget and keep track of your progress over the period of time.

A notebook or pen and piece of paper are another way to record your progression. While this requires more manual work than an app, it could be just as effective. Simply enter your income for every month, and then compare your spending with the budgeted amount. This will help you identify areas where you can cut down or make adjustments.

Budgeting Worksheets Free Printable PDF

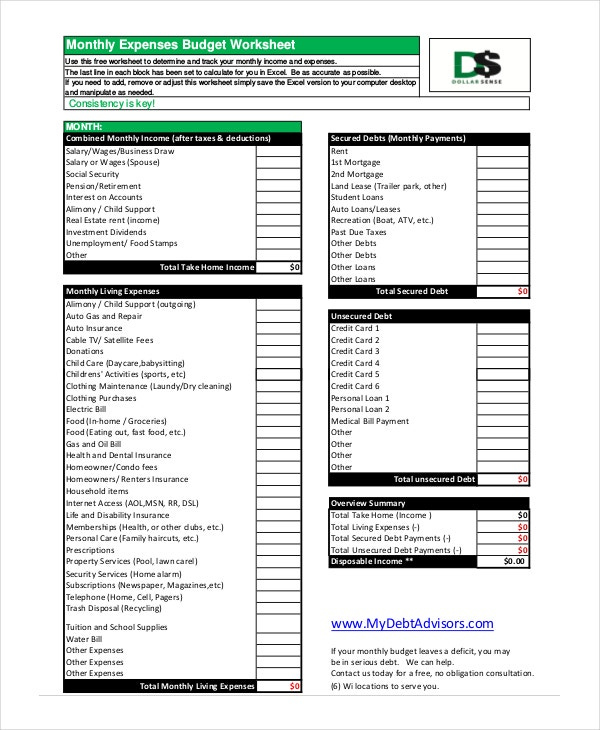

Printable Budget Worksheet 22 Free Word Excel PDF Documents

The Benefits Of Budgeting

Although budgeting may seem like something that is difficult, it is essential to your financial stability. A budget will allow you to keep track of your expenses, set aside money for savings or emergency funds, and adjust when needed.

It may take some time to get familiar with creating and adhering to an established budget. However, the advantages are worth it. A budget can allow you reduce your the amount of debt you have, and save to meet long-term goals and help you avoid financial problems in the future.

There are a variety of sources that can assist you to create a budget that meets your requirements. Financial success is possible when you begin budgeting.