Free Budget Spreadsheet Intended For Budget Planning Spreadsheet

Free Budget Spreadsheet Intended For Budget Planning Spreadsheet

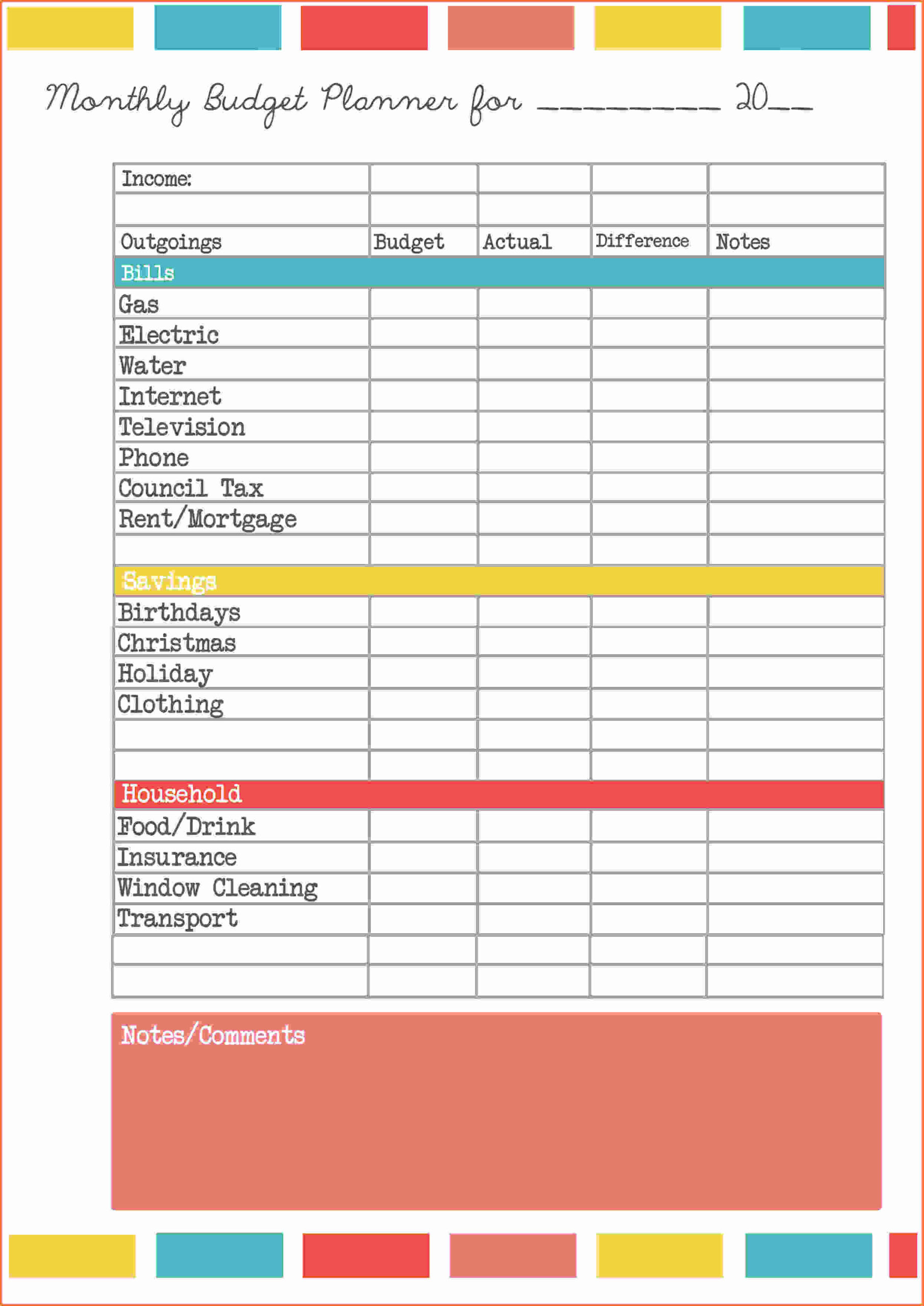

Free Budget Spreadsheet Intended For Budget Planning Spreadsheet – A budget is necessary if you are to organize your financial affairs. The most efficient way to organize your budget is with an easy-to-print. The printable budget sheets can assist you in keeping track of your expenses.

There are many choices for creating your budget. You can make use of a software program, an app or even an Excel spreadsheet. If you’re looking for the simplest method of creating and keeping track of your budget using a printable budget worksheet is your ideal alternative.

There are plenty of budget sheets that can be printed on the internet. Budget sheets are available online free of charge or for the cost of a small amount. After you locate the appropriate sheet, simply print it and begin tracking your expenses.

Budgeting doesn’t need to be a hassle. With a little effort and some preparation you can have your finances within a matter of minutes.

What Is The Reason You Require An Budget?

Budgets are important due to a number of reasons. Budgets can be used to monitor your spending and save money, which can aid you in making financial choices. A budget can help you keep track of your financial goals.

Creating a budget is relatively easy to do with a variety of ways such as pencil and paper, a spreadsheet or personal financial software. Being truthful about your earnings and expenditures is the most essential aspect of establishing an effective budget. You should adhere to your budget in order to improve your financial situation.

Related For Free Budget Spreadsheet Excel

How To Make Use Of A Budget

Your budget is an essential instrument to manage your financial situation. Monitoring your spending and income can help you make educated decisions on how best to allocate your funds. It’s not easy to budget, but it’s a task that can be accomplished with some planning and effort.

Here are some helpful tips for budgeting:

- Make sure you know your expenses and income. The tracking of your income and expenses is the first step in formulating a budget. This will enable you to know where your money is going.

- It is essential to set realistic goals. Once you have a clear picture of what your budget is and what you are spending it on, you can set realistic goals for savings and spending. You should factor in the cost of variable items like gasoline and groceries to ensure you don’t overspend for other things.

- Keep your eyes on the right direction.

Monitor Your Progression

The first step toward financial control is to create an budget. When you’ve created a budget, you need be able to monitor your progress to make sure you are adhering to it. There are many ways to do this.

The budget tracking app is available. The apps are linked to your bank account to keep track of your spending and link to your bank account. They allow you to create a budget and track your progress over time.

Another way to track your progress is to use an excel spreadsheet or pen and paper. While this requires more work than apps, it can nevertheless be equally efficient. Enter your income and expenses each month. Then compare your actual spending with your budgeted amount. This will help you see where you need to reduce or adjust your spending.

Free Budget Spreadsheet Excel

Free Download Household Budget Spreadsheet Db excel

The Benefits Of Budgeting

Although it can be a bit tedious however, it’s an essential step in achieving financial stability. Budgeting allows you to monitor your spending, set aside money for savings and emergency money, and make adjustments whenever needed.

While it may take some time to become comfortable with making and adhering to budgets, the results are well worth the effort. A budget can assist you reduce your debt, save money to meet long-term goals and also avoid financial difficulties down the line.

If you’re not sure where to begin, there’s a wealth of resources available to help you create the perfect budget for you. Once you’ve gotten into the habit of spending money, you’ll soon be on the road towards financial success.