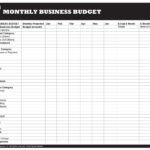

Small Business Budget Spreadsheet Pertaining To Business Expense

Small Business Budget Spreadsheet Pertaining To Business Expense

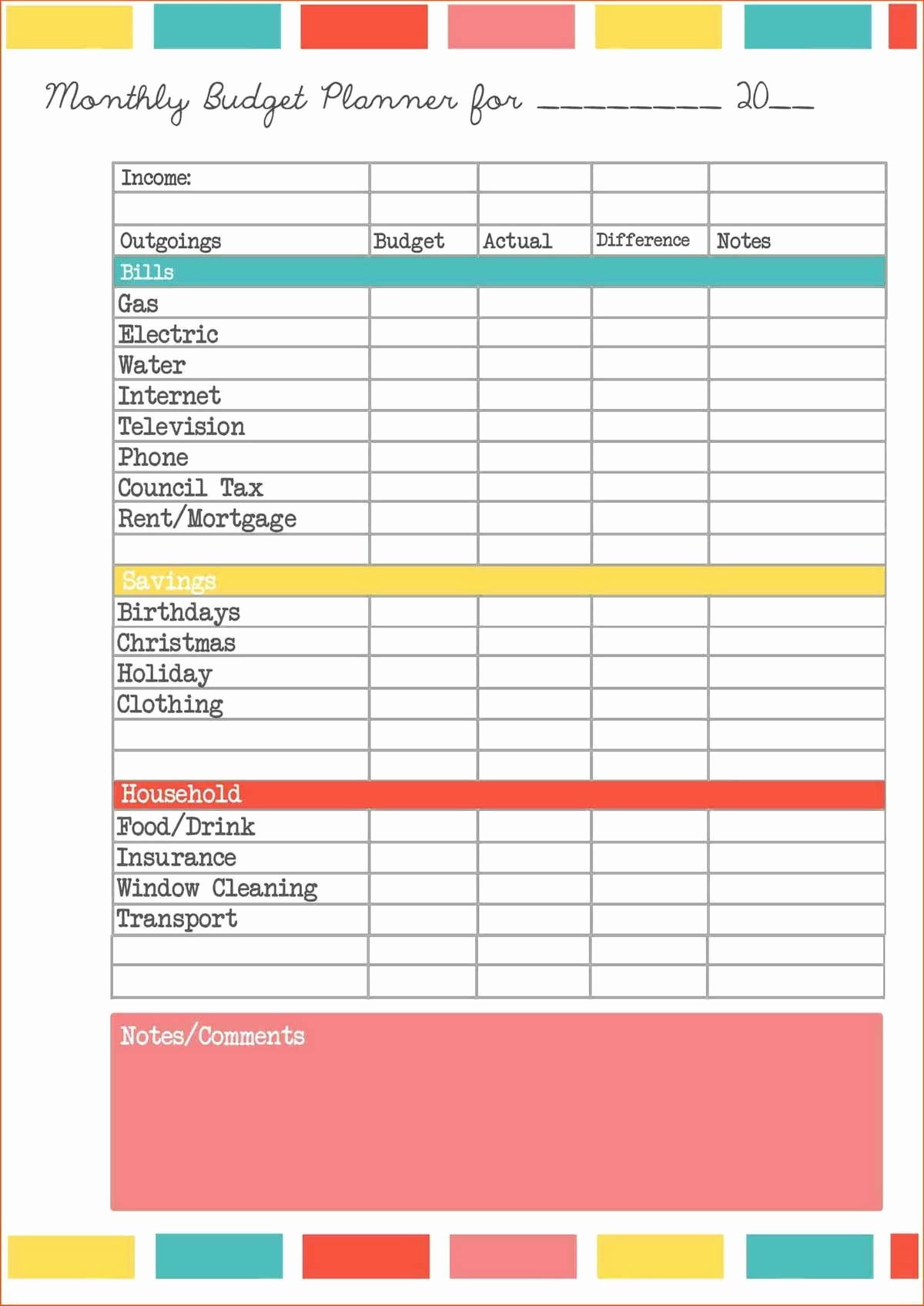

Small Business Budget Spreadsheet Pertaining To Business Expense – A budget is crucial for organizing your financial affairs. A budget worksheet that you can print is the most effective way to stay on in the loop. Budget sheets that are printable can keep you organized.

There are many ways to create a budget. There are a variety of ways to create budget. You can utilize an app, spreadsheet or program. If you are looking for the most efficient way to make and keep track of your budget with a worksheet, then a budget worksheet is your perfect choice.

Printable budget sheets are widely accessible on the internet. They can be downloaded free of charge or for only a small fee. When you have found the correct sheet, simply print it out and begin to track your spending.

Budgeting shouldn’t be difficult. It’s a matter of a few minutes and some planning to ensure your finances are in order.

Why Do You Need To Use The Budget To Make Decisions?

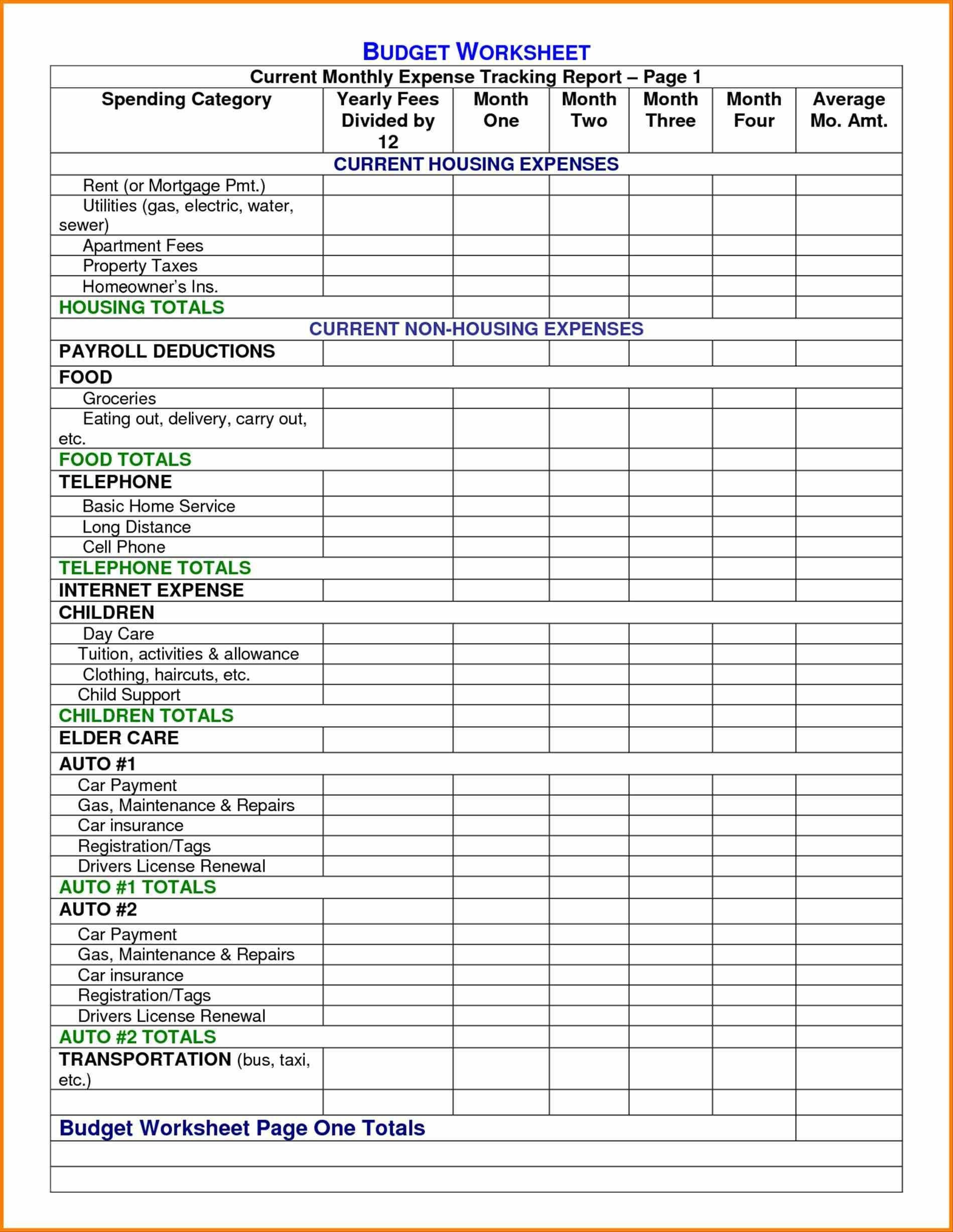

There are many reasons why households and individuals should be able to have a budget. A budget can be used to track your spending and reduce expenses, which will aid you in making financial choices. You can utilize a budget to keep track of your financial objectives.

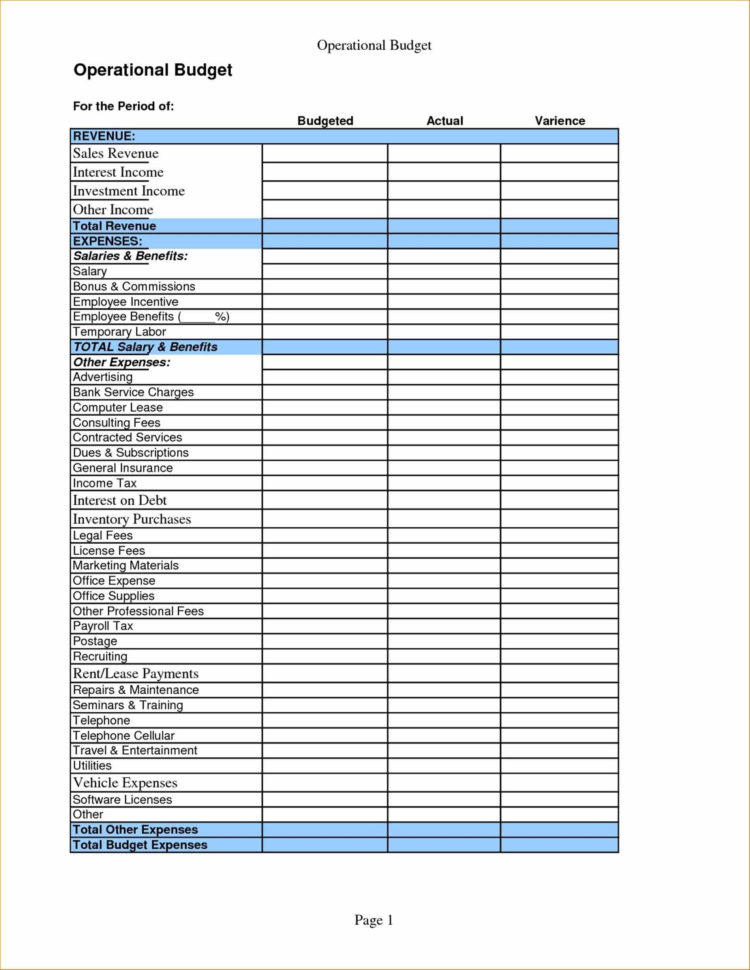

Budgets can be made in a few easy steps. It is possible to use the spreadsheet or pencil to draw it. The most important aspect to consider when creating your budget is to be honest with yourself regarding your earnings and expenses. Once you’ve come up with your budget, adhere to it as close as you can in order to improve your financial position.

Related For Free Budget Spreadsheet For Small Business

How To Make Use Of A Budget

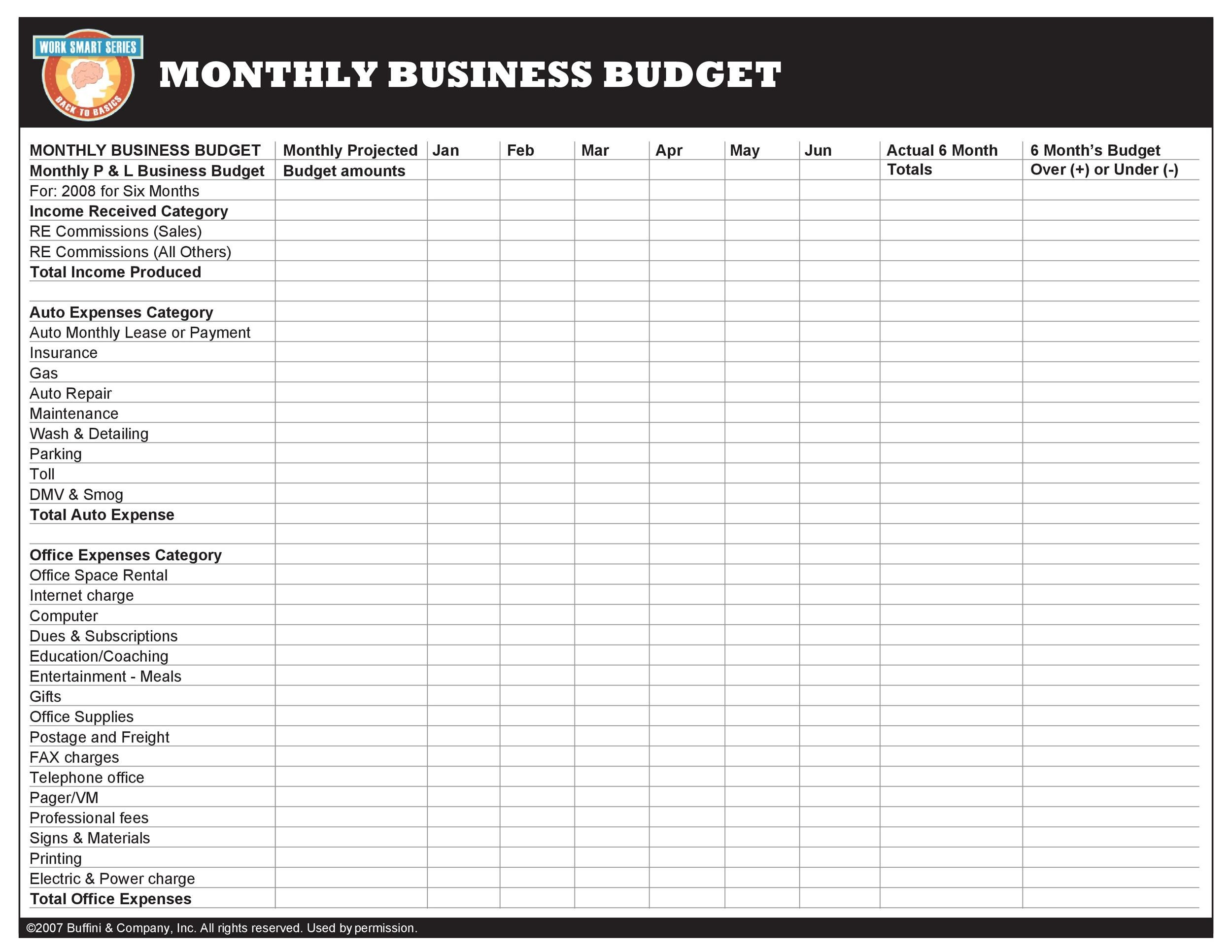

Your budget is an important tool in managing your financial situation. By keeping track of your income and expenses, you will be able to make educated decisions on how to best use your money. It’s not easy to plan your budget, however it can be accomplished with a bit of planning and work.

Here are some suggestions for ways to make use of a Budget:

- Find out your earnings and expenses. The first step to create a budget is to track your earnings and expenses. This will enable you to gain a better understanding of where your money is.

- It is important to set realistic goals. You can set realistic goals for saving and spending once you have an understanding of where your money is going. In order to ensure you don’t go overboard on other purchases, be sure you include any variable costs such as gas and food.

- Keep on the right track.

Monitoring Your Performance

The first step toward financial control is to make the budget. To ensure you’re sticking to your budget, it is essential to keep track of your performance. There are many ways to track your progress.

It is possible to use a budget tracking app. These apps are connected to your bank account so you can monitor your expenditure. These apps allow you to establish a budget, and then track your progress over the period of time.

Another method of keeping track of your progress is to use the spreadsheet, or pen and paper. Although this method requires longer to complete, it’s equally effective as an app. Input your expenses and income every month. After that, you can compare the amount you actually spend to the budgeted amount. This will let you see the areas where you can cut down or adjust your spending accordingly.

Free Budget Spreadsheet For Small Business

Small Business Budget Template Excel Free New Excel Pany Bud In Small

37 Handy Business Budget Templates Excel Google Sheets TemplateLab

Small Business Budget Templates Db excel

The Benefits Of Budgeting

Although it might appear like something that is difficult but it’s essential to ensure your financial security. A budget will allow you to monitor your spending, set aside money for savings and emergency money, and make adjustments as needed.

Although it will take time to become comfortable with making and adhering to a budget, the benefits are worth the effort. A budget can assist you in paying off debts, save money for the long term, and even avoid financial difficulties in the future.

There are numerous sources to help you make a budget that suits your requirements. Financial success is possible after you begin budgeting.