Free Google Docs Budget Templates Smartsheet

Free Google Docs Budget Templates Smartsheet

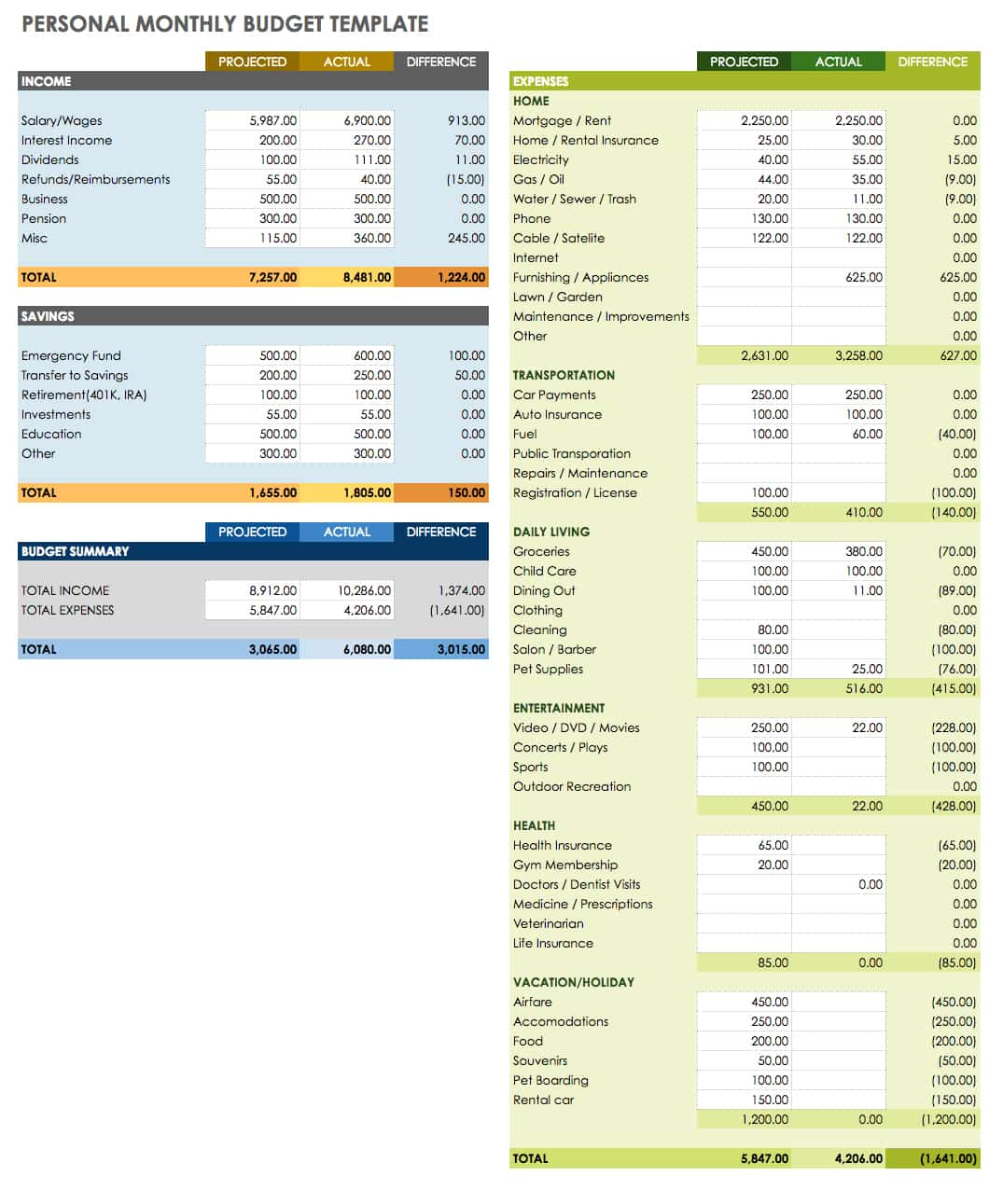

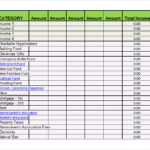

Free Google Docs Budget Templates Smartsheet – A budget is necessary to manage your finances. The printable budget sheets are the best method to stay on track. Printable budget sheets can help you stay on top of your finances and on the right track.

There are a myriad of methods to come up with a budget. A spreadsheet, an app or a software program could all be used to create your budget. A printable budget sheet is best if you are looking for the easiest way to monitor and build your budget.

Printable budget sheets are widely available on the internet. They can be downloaded online either for free or at an affordable cost. You can print the form you like and start tracking your expenditure once you’ve located the.

Budgeting does not have to be difficult. It’s just a matter of some planning to ensure your finances are in order.

Why Should You Use A Budget?

There are many reasons why households and individuals need to have a budget. A budget allows you to keep track of your spending and savings, which can help you make informed financial choices. A budget can also help remain on track with your financial goals and objectives.

A budget can be designed in just a few steps. It is possible to use pencil or a spreadsheet to draw the budget. It is essential to be upfront to yourself about your financial incomes and expenses while creating the budget. Once you have created an budget, you must adhere to it as strictly as you can in order to improve your financial position.

Related For Free Budget Spreadsheet Google Sheets

How To Make The Most Of Your Budget

Your budget is an essential instrument to manage your financial situation. By keeping track of your income and expenses, you will be able to make informed decisions about how you can best utilize your money. It may be difficult to budget, but it’s a task that can be accomplished with some planning and work.

Here are some suggestions on how to use a budget.

- Find out your earnings and expenses. The tracking of your income and expenses is the first step towards making a budget. This will provide you with an understanding of where your funds are going.

- Setting realistic goals is essential. It is possible to set reasonable goals for savings and spending when you have an accurate picture of where your money will go. It is important to consider variables like gas and groceries to ensure you don’t overspend on other expenses.

- Keep your eyes on the right direction.

You Can Track Your Progress

The first step in achieving financial management is to set up an budget. To ensure that you’re staying within your budget, you must track your progress. There are a variety of methods to accomplish this.

The budget tracking app is available. These apps are connected to your bank account so you can monitor your spending. The apps can also be used to help you set up a budget, keep track of your progress, and keep you up to date.

A notebook or pen and piece of paper is another method to track your performance. This method takes more effort to do manually, but it can be just as effective as using an app. Simply record your income and expenses for each month, then compare your actual expenditure to your budgeted amounts. This will let you see the areas where you can cut back or adjust your spending accordingly.

Free Budget Spreadsheet Google Sheets

The Benefits Of Budgeting

Although budgeting may seem like an intimidating task but it is vital to ensure your financial security. It is possible to track your spending and reserve funds to save or for emergency needs. In the future, you’ll be able to make changes as required.

Though it takes time to understand how to develop and maintain your budget in a proper manner it is worth it. A budget can assist you cut down on debt, save money for your long-term goals and also avoid financial difficulties down the line.

There are a myriad of sources that can assist you to come up with a budget that is suitable for your needs. Soon, you’ll be able to make a sound budget and enjoy financial success.