Budget Template For Young Adults 5 Things Nobody Told You About Budget

Free Editable Budget Template

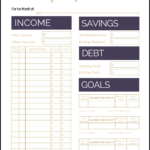

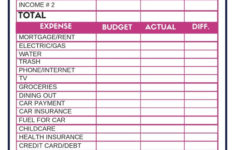

Free Editable Budget Template – If you’re looking to get your finances organized, you’ll need the help of a budget. A budget worksheet that you can print is the best way to keep the track. The printable budget sheets can assist you in keeping track of your expenses.

There are numerous ways to create a budget. An app, a spreadsheet or software program may all be used to create your budget. However, if you’re looking for the most simple method of creating and monitor your budget, a printed budget sheet is the option to choose.

Budget sheets for printables are readily available online. They can be downloaded for free or at only a small fee. Print the worksheet you like and begin tracking your spending once you have found the.

Budgeting shouldn’t be difficult. With just a bit of effort and a bit of planning you can have your finances in no time.

Why Use A Budget?

Budgets are important for many reasons. A budget can help you keep track of your spending and savings and can assist you to make informed financial decisions. You can utilize a budget to keep track of your financial objectives.

Creating a budget is relatively simple and can be completed using various methods such as pencil and paper, a spreadsheet, or personal financial software. It is important to be open with yourself regarding your incomes and expenses while creating budget. To improve your financial position adhere to the budget you’ve set.

Related For Free Editable Budget Template

How To Make Use Of The Budget

Budgets are an important tool to manage your finances. Tracking your income and spending will help you make informed choices about how to spend your money. Budgeting can be daunting however, with a bit of planning and effort it is possible for you to stick to a budget.

Here are some tips on how you can make use of a budget:

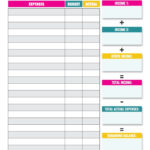

- Calculate your income and expenses. To make a budget you should first record your income. This will enable you to see clearly where your money is.

- The importance of setting realistic goals is. The most realistic goals can be established when you know the direction of your money. You should factor in the cost of variable items like gasoline and groceries to ensure you don’t have to spend a lot on other things.

- Keep on track.

You Can Track Your Development

The first step towards financial control is to establish an budget. To make sure you’re adhering to your budget, you must keep track of your improvement. There are many ways to track your progress.

An app that keeps track of your expenditure can be used to monitor your budget. These apps can be connected to your bank account so that you can track your spending and automatically connect to your bank account. They can also be used to help you set up an expense plan, track your progress, and keep you up to date.

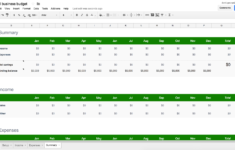

Another method of tracking your progress is to use an excel spreadsheet or pen and paper. This method takes some manual work, but it is just as efficient as using an app. Record your expenses and your income every month. Then compare the amount you actually spend to your budgeted amount. This will allow you to see where you may need to reduce or adjust your spending.

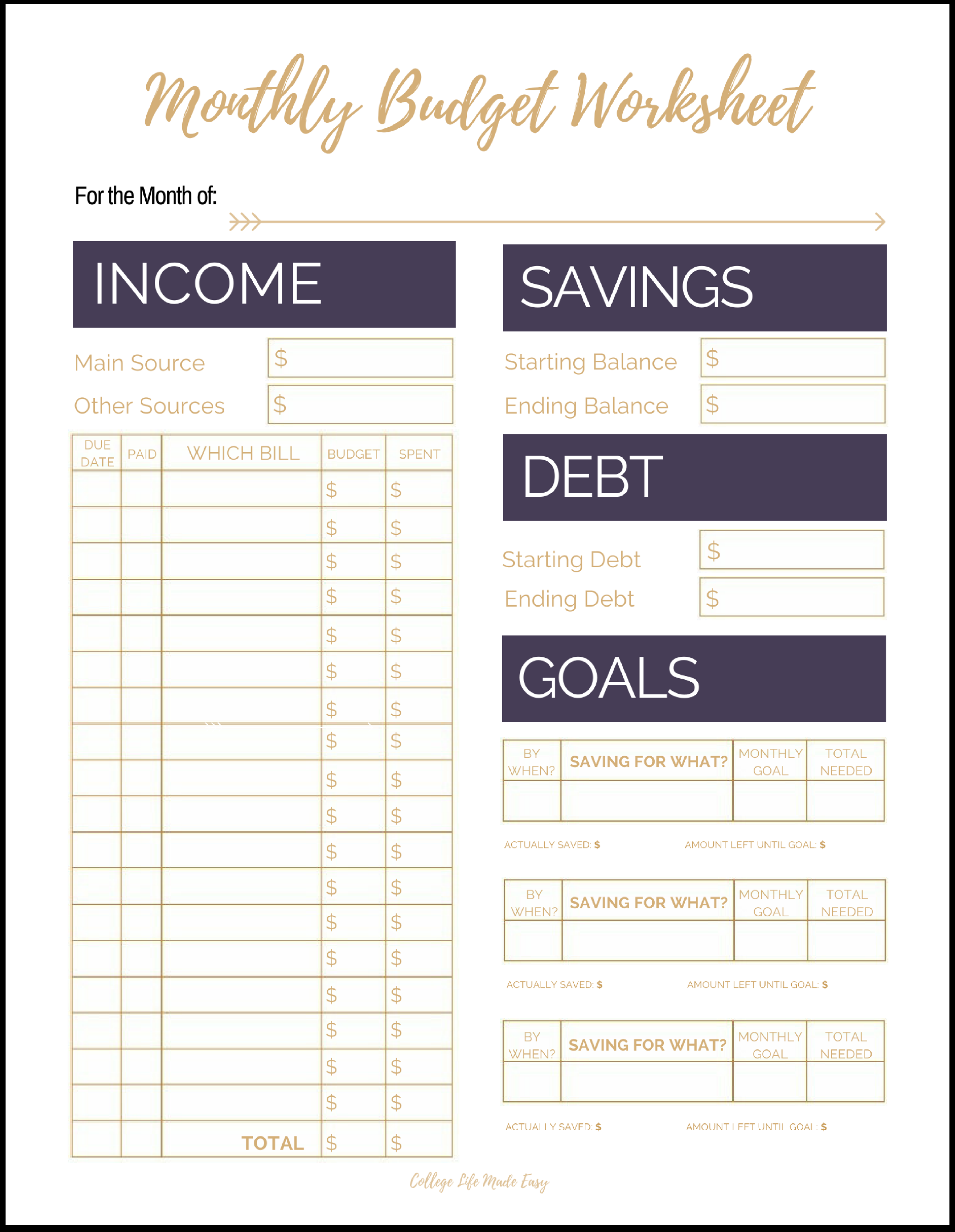

Free Editable Budget Template

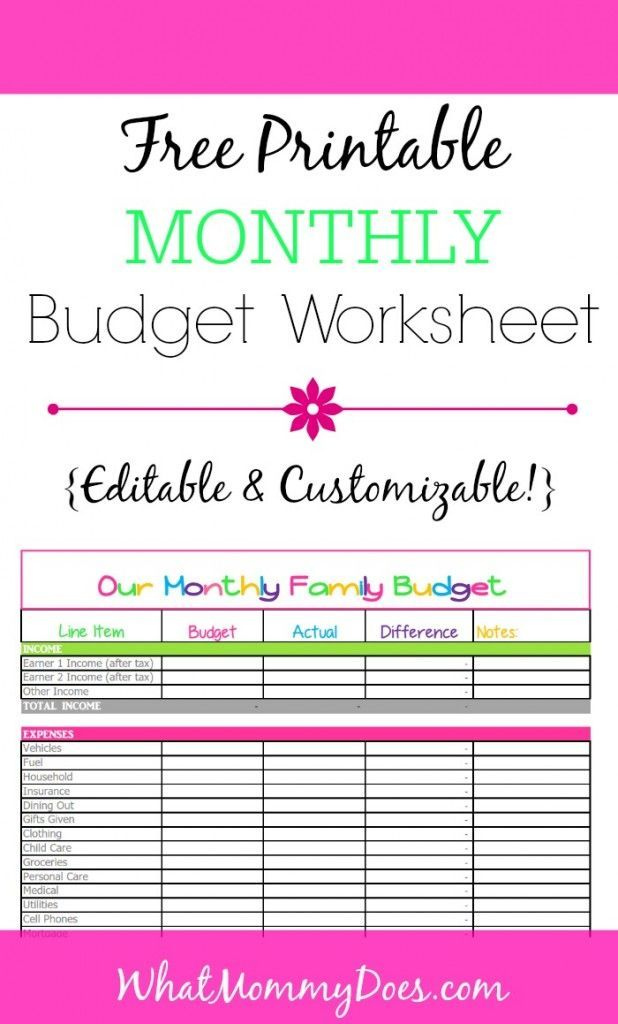

Free Monthly Budget Template Cute Design In Excel Monthly Budget

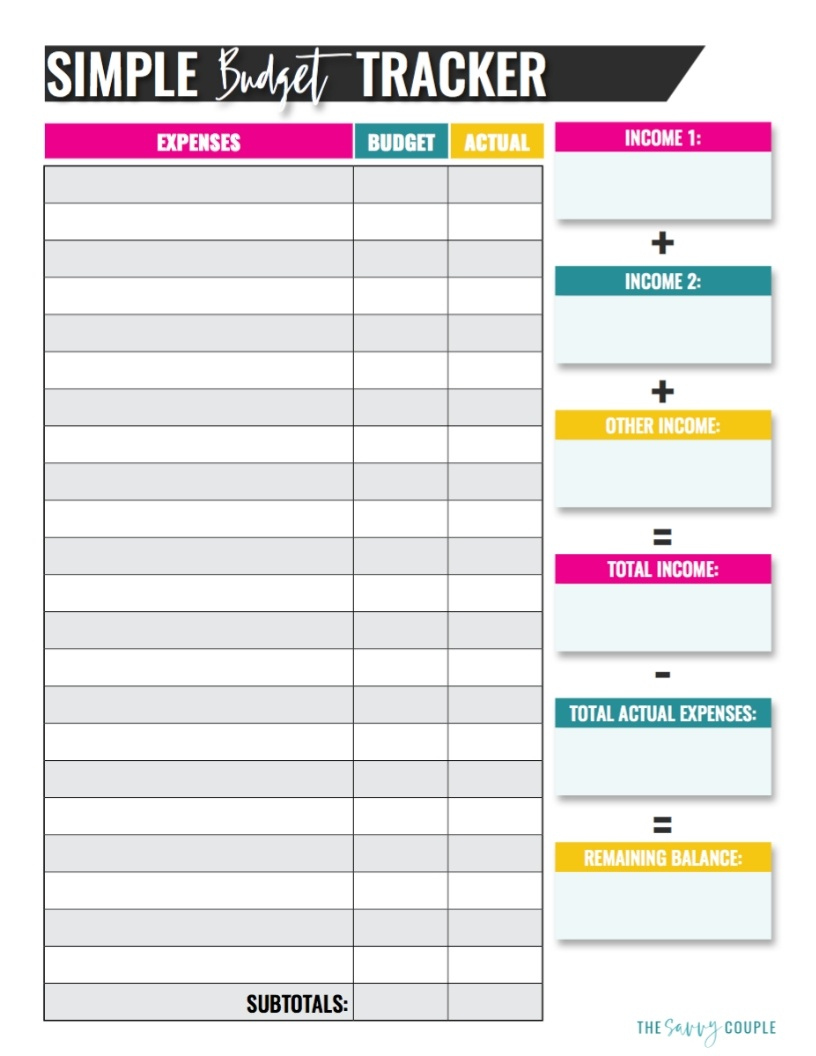

Free Budget Templates In Excel For Any Use Household Budget Template

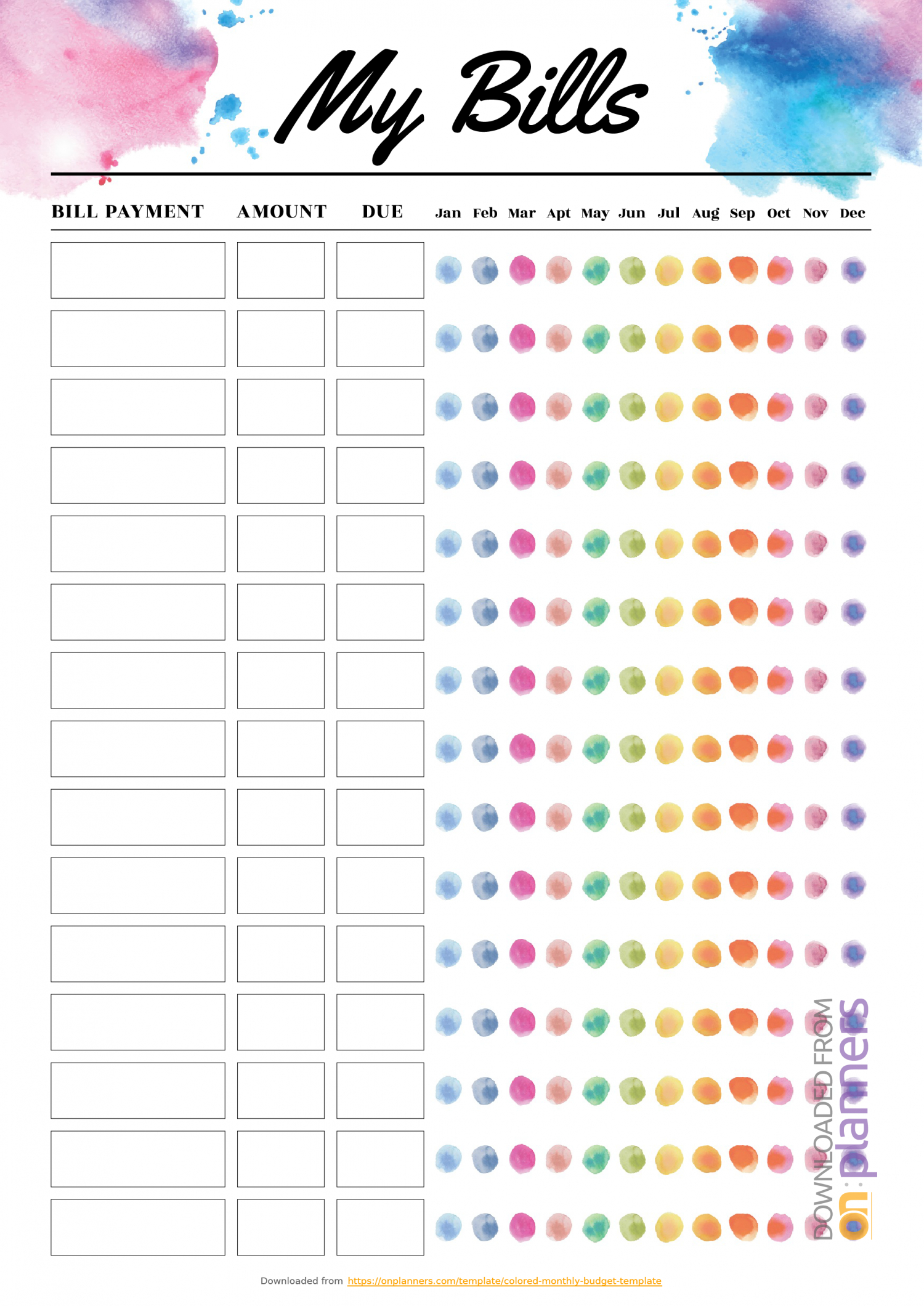

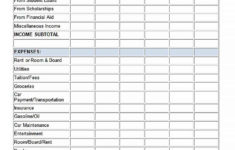

Free Template For Bills Due Monthly Example Calendar Printable

The Benefits Of Budgeting

Although it can be a bit tedious but it’s an essential step to financial stability. Budgeting allows you to manage your spending, put aside money for savings or emergency funds, and make adjustments as needed.

Although it can take time to become comfortable with creating and sticking to a budget, the benefits are worth the effort. A budget can help you cut down on debt, save money for your long-term goals and prevent financial issues at a later date.

If you’re unsure where to begin, there are plenty of resources to help you create the perfect budget for you. Once you’ve established the habit of spending money, you’ll soon be on the road towards financial success.