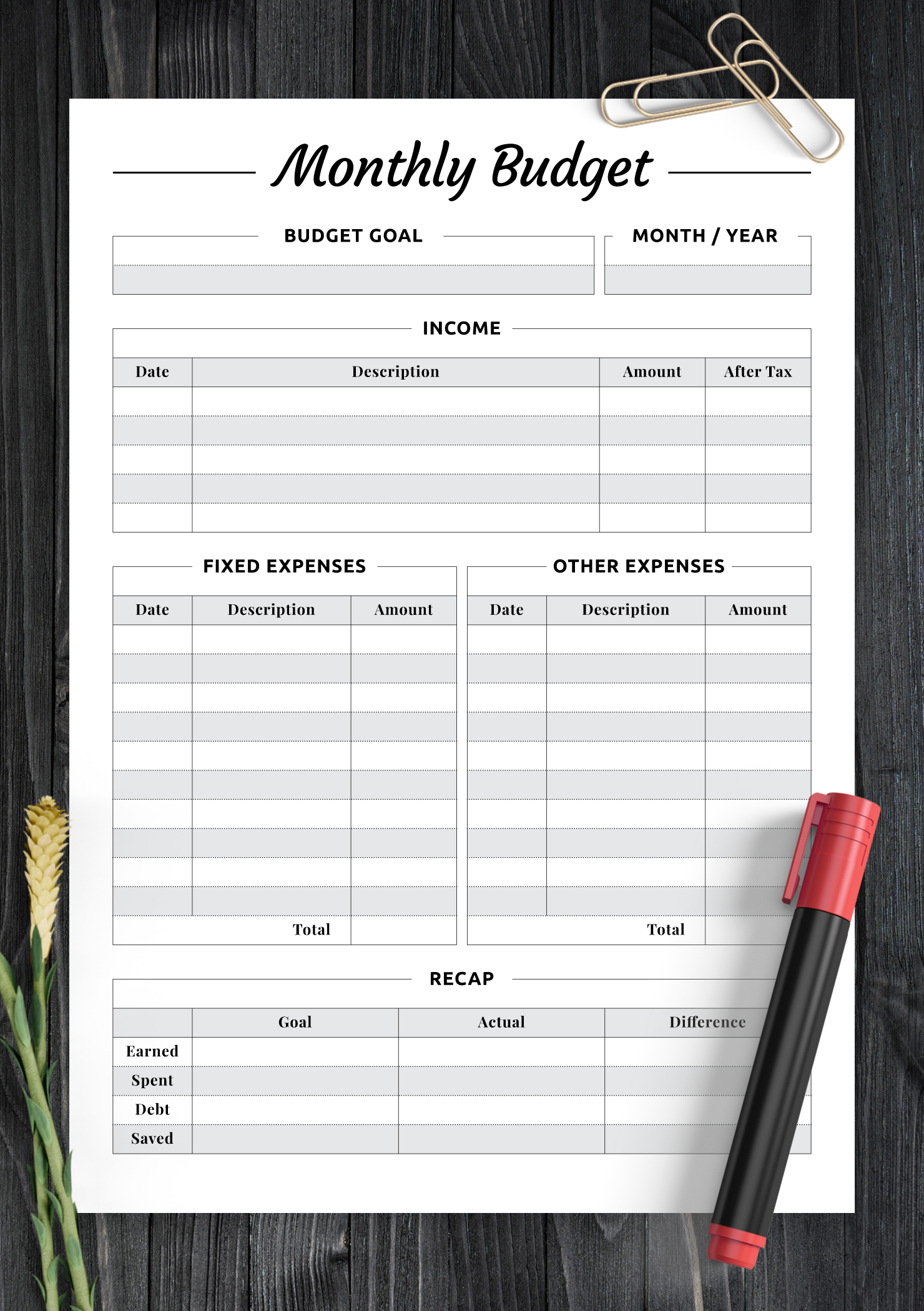

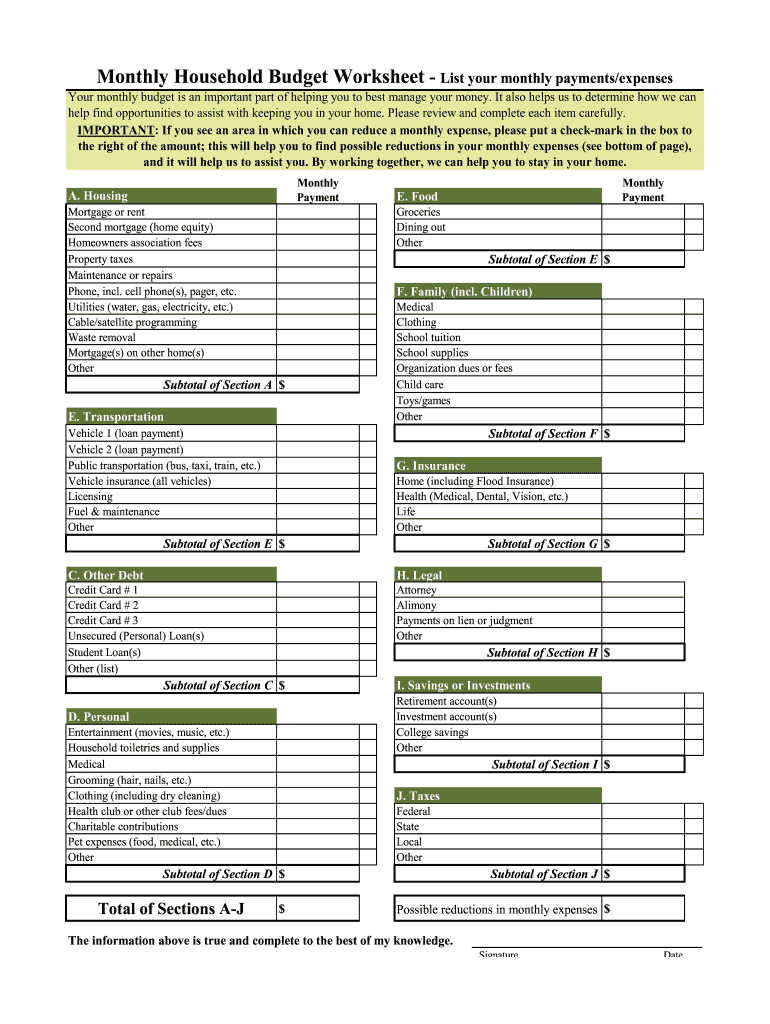

Download Printable Monthly Budget With Recap Section PDF

Download Printable Monthly Budget With Recap Section PDF

Download Printable Monthly Budget With Recap Section PDF – If you want to get your finances in order, you need an budget. A printable budget sheet is the best method to stay on track. Printing budget sheets to help keep track of your expenses and stay organized.

There are many different ways to create budget. There are many ways to make your budget. You can use an app, software or spreadsheet. A budget template that is printable is the best option if you’re searching for the easiest way to keep track of and develop your budget.

You can easily find budget worksheets that are printable on the internet. They are available online without cost or at an affordable cost. You can print the form you like, and then begin to track your expenses after you have found it.

It doesn’t have to be difficult. With a little effort and some preparation you can have your finances in no time.

Why Should You Use A Budget?

There are several reasons why households and individuals should have budgets. It allows you to record your expenditure and save and can assist you to make better financial decisions. A budget can assist you to remain on track with your financial objectives.

Budgets can be made in a few easy steps. You can make use of pencil or a spreadsheet to create it. It is important to be honest about your earnings and expenses when you create budget. You should adhere to your budget in order to increase your financial standing.

Related For Free Editable Monthly Budget Worksheet PDF Editable

[show-list showpost=5 category=”budget-sheets-free-printable” sort=sort]

How To Utilize A Budget

Your budget is an important tool to control your finances. By tracking your income and expenses, you will be able to make informed choices about the best way to use your money. While it may be difficult to plan your budget however, with a bit of planning and work, it’s possible to adhere to your budget.

These are some ways to make use of a budget.

- Make sure you know your expenses and income. Tracking your income and expenses is the initial step to creating budget. This will let you see where your money is spending.

- Setting realistic goals is essential. The most realistic goals can be established once you understand the direction of your money. In order to ensure you don’t go overboard on other purchases, be sure you add in variable expenses such as gas and food.

- Keep your eyes on the right direction.

You Can Track Your Performance

The first step in achieving financial control is to establish the budget. Once you have established your budget, it’s essential to monitor your progress and make sure that you adhere to the plan. There are many ways to do this.

An app that keeps track of your expenditure can be used to manage your budget. These apps link to your bank account and track your spending on a regular basis. The apps let you make a budget and keep track of your progress over the period of.

Another method of keeping track of your progress is with either a spreadsheet or pen with paper. This requires more manual effort, but it’s just as efficient as using an app. Simply record your income each month and compare your expenditure to your budgeted amount. This will allow you to determine where you need to reduce or adjust your spending.

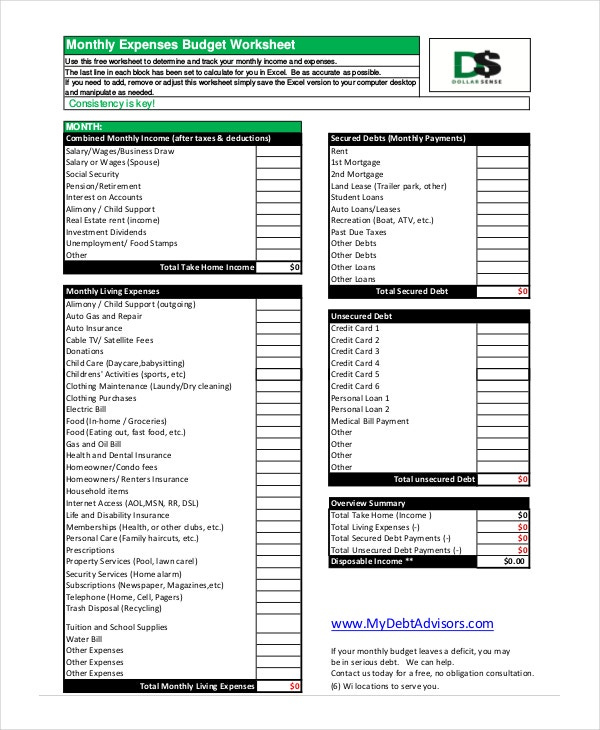

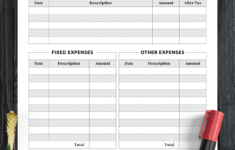

Free Editable Monthly Budget Worksheet PDF Editable

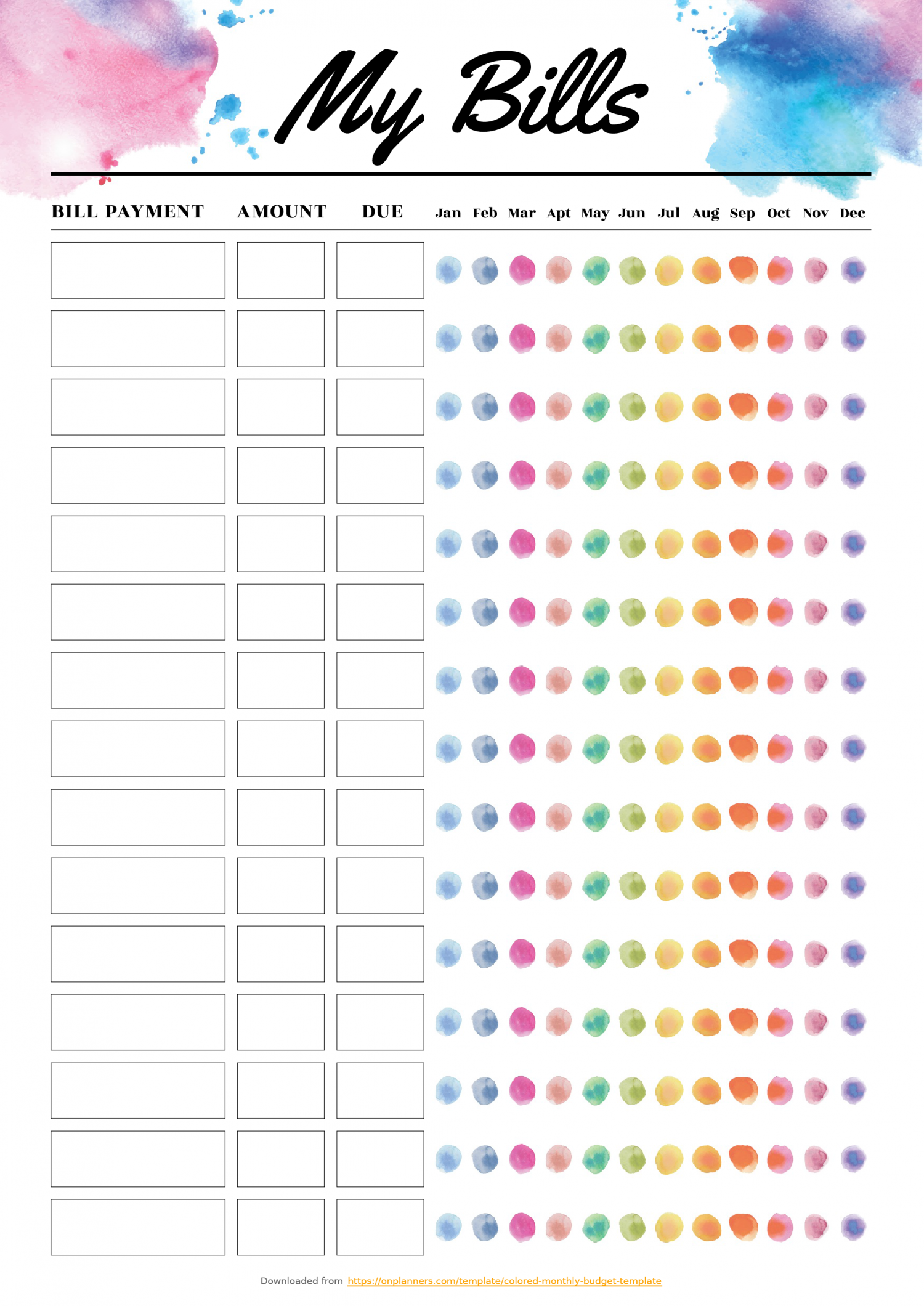

Free Printable Colored Monthly Budget Template PDF Download

Household Budget Worksheet Pdf Fill Online Printable Fillable

The Benefits Of Budgeting

The process of budgeting can seem like an overwhelming job, but it’s an essential element to ensure financial stability. You can track your spending and save money to save and for emergency purposes. You can then make any necessary adjustments.

Though it takes time to to establish and follow your budget correctly it is worth it. A budget can assist you in paying off debts, make savings to fund long-term goals, and avoid financial problems further down the line.

If you’re not sure where to start There are plenty of resources to help you prepare your budget. Once you’ve got into the habit of budgeting, you’ll be on your way to financial success.

Leave a Reply