Blank Monthly Budget Template SampleTemplatess SampleTemplatess

Blank Monthly Budget Template SampleTemplatess SampleTemplatess

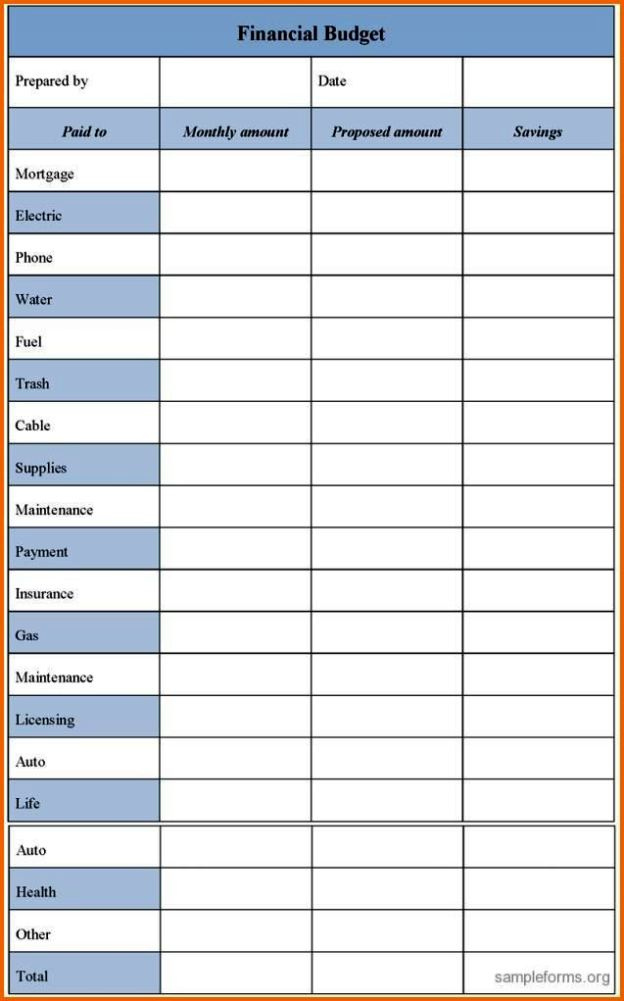

Blank Monthly Budget Template SampleTemplatess SampleTemplatess – A budget is necessary to keep track of your finances. The most efficient way to keep track of your budget is to use the help of a printable. A budget worksheet that you can print out will aid you in staying organized.

There are many ways to make budget. There are many different ways to make budget. You can use an app, a program or a spreadsheet. A printable budget sheet is the best option if you’re searching for the simplest method to track and create your budget.

On the web, you can download various budget sheets for printing. They are available for free or for a small fee. Once you find the right sheet, you just need to print it out and begin to track your expenses.

Budgeting doesn’t have to be a hassle. It’s a matter of a few minutes and some planning to get your finances in order.

Why Would You Want To Make Use Of A Budget In Order To Make Choices?

A budget is important for a variety of reasons. It allows you to keep track of your spending and savings and can assist you to make informed financial decisions. A budget can assist you to stay on track with your financial goals.

It’s simple to come up with an effective budget. Be honest about your income and expenses is the primary aspect of establishing a budget. Once you have created an budget, you must adhere to it as strictly as you can to enhance your financial situation.

Related For Free Printable Budget Forms Blank

How To Utilize A Budget

Your budget is an essential tool for managing your financial situation. You can track your income and expenses in order to make educated decisions regarding how you allocate your funds. Although budgeting can seem overwhelming but with a little planning and effort , it’s possible to adhere to your budget.

Here are some tips on ways to make use of a Budget:

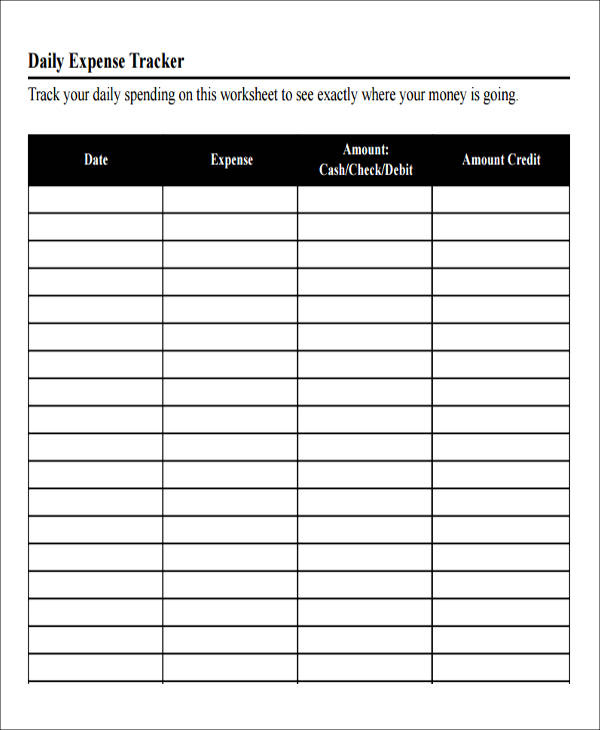

- Determine your expenses and income. The first step to create your budget is keeping track of your earnings and expenses. This will give you the exact location of your funds are going.

- The importance of setting realistic goals is. Set realistic goals once you’ve figured out where your money is going. Make sure to factor in the cost of variable items, like gasoline and food, so that you don’t overspend on other things.

- Stay on track.

Tracking Your Progress

The first step to financial control is to make the budget. In order to ensure that you’re sticking to your budget, it is essential to be able to track your improvements. There are a variety of ways to track your progress.

You can make use of budget tracking apps. The apps are linked to your bank account in order to monitor your spending, and also automatically link to your bank account. These apps can also be used to create a budget, keep track of your progress and keep you up to date.

You can also track your progress with a spreadsheet, pen and paper or notepad. While this requires more effort than apps, it can still be efficient. Simply enter your expenses and income for each month and then check your actual expenditure to your budgeted amounts. This will allow you to identify areas that need to be cut or changed.

Free Printable Budget Forms Blank

FREE 33 Budget Forms In PDF MS Word Excel

FREE 33 Budget Forms In PDF MS Word Excel

The Benefits Of Budgeting

Although budgeting can seem tedious yet it’s vital to financial stability. It allows you to keep track of your spending, make adjustments whenever necessary, and reserve money for emergency situations and savings.

It may take some time for you to become comfortable with the process of creating and implementing your budget. However, the benefits are well worth the effort. A budget can assist you in paying off debts, make savings for long-term goals, and prevent financial troubles in the future.

There are a myriad of sources that can assist you to prepare a budget that fits your needs. You’ll soon be able make a sound budget and enjoy financial success.