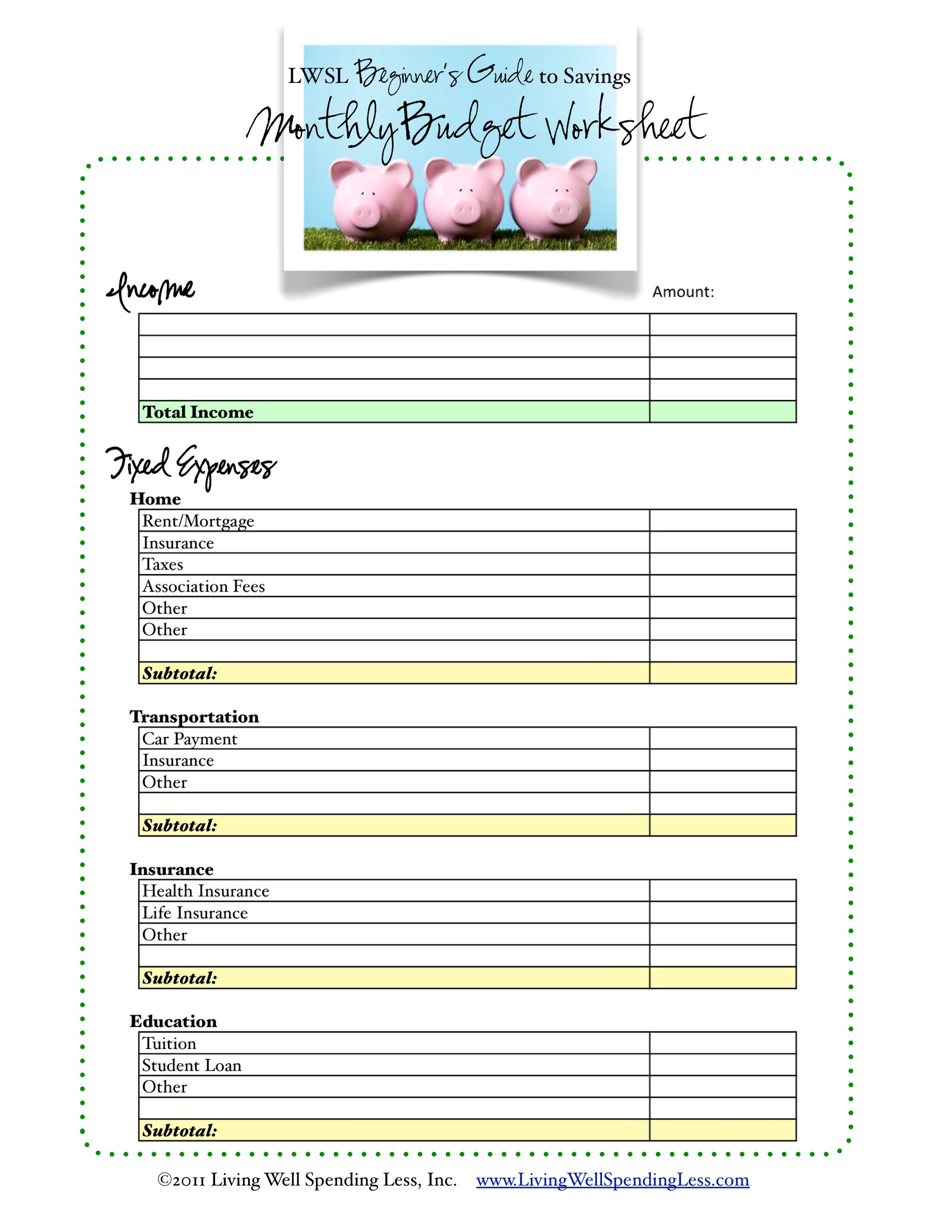

Free Budget Worksheet Living Well Spending Less

Free Budget Worksheet Living Well Spending Less

Free Budget Worksheet Living Well Spending Less – It is essential to have a budget in order to control your financials. A budget worksheet that you can print is the best way to keep in the loop. Printing budget sheets to stay on track and organized.

There are many options for creating your budget. A spreadsheet, an app or software program may be used to build the budget. If you’re searching for the simplest way to make and keep track of your budget and track your expenses, then a printable budget worksheet is your best choice.

Budget templates are widely available on the internet. These budget sheets are available online free of charge or for the cost of a small amount. Once you’ve found the perfect sheet, simply make it available and begin keeping track of your expenses.

Budgeting doesn’t have to be complicated. It requires only a little effort and some planning to get your finances in order.

What Is The Reason You Require A Budget?

A budget is essential because of a variety of reasons. A budget allows you to track your spending and savings that can aid you to make informed financial choices. A budget will also help you maintain your financial goals and objectives.

Making a budget is simple and can be done by using a variety using pencils and paper, a spreadsheet or personal finance software. Being honest about your income and expenses is the most crucial aspect of establishing an effective budget. It is important to stick to your budget to improve your financial condition.

Related For Budget Worksheet

How Do You Use A Budget

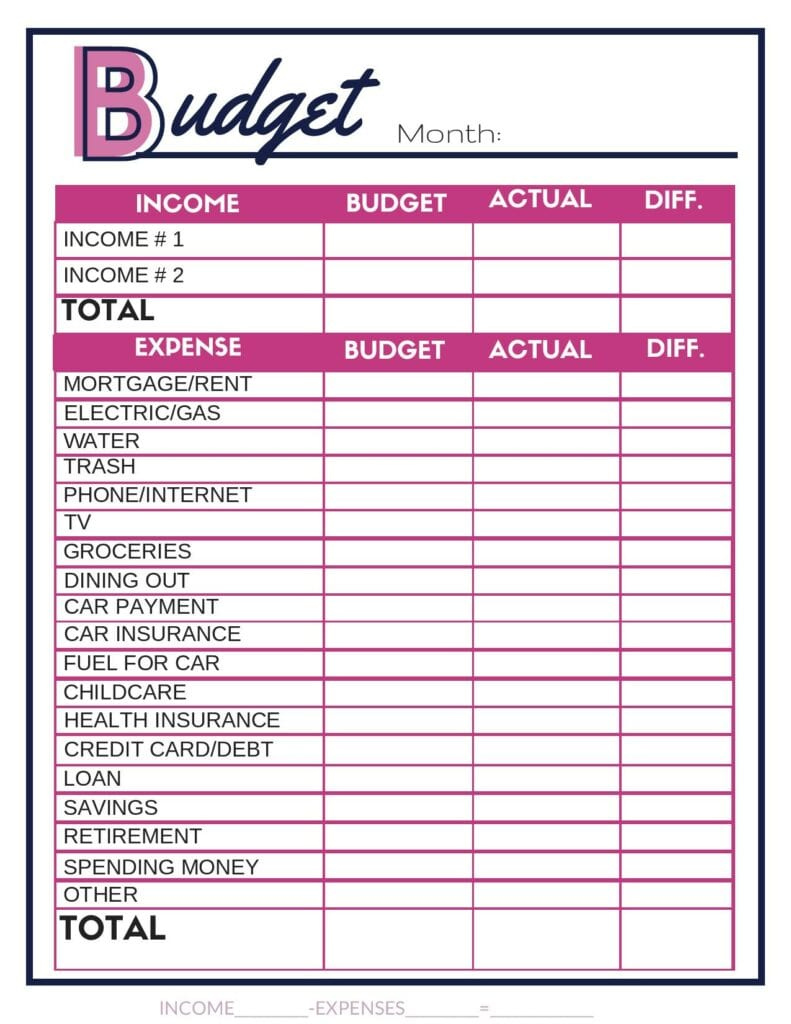

A budget is an essential instrument for managing your finances. You can monitor your income and expenses in order to make well-informed decisions about how you allocate your funds. It’s not easy to plan your budget, however it can be accomplished by a little planning and effort.

Here are some tips for using a budget:

- Calculate your expenses and income. Monitoring your expenses and income is the first step in making your budget. This will give you a clear picture of where your funds are going.

- Create realistic goals. Once you have a clear picture of the direction your money is heading You can set achievable goals to save and spend. To ensure that you don’t spend too much on other things, be sure you add in variable expenses like groceries and gas.

- Stay on the right track.

Monitor Your Progression

A budget is the first step towards gaining control of your financial situation. To ensure that you’re staying within your budget, you need to track your improvement. There are a variety of ways to do this.

A budget tracking application is available. These apps can be linked to your bank account, and keep track of your spending in real-time. The apps can also be used to create a budget, track your progress and keep you up to date.

Another way to track your progress is to use either a spreadsheet or pen with paper. While this requires more effort, it’s similar to an application. Enter your income and expenses for each month, and then evaluate your actual expenditure to the budgeted amount. This will let you know where you need to reduce or adjust your spending.

Budget Worksheet

Free Budget Worksheets Single Moms Income

The Benefits Of Budgeting

While it may appear to be something that is difficult but it’s essential to your financial stability. Budgeting allows you to monitor your expenditure, make adjustments whenever necessary, and save money for unexpected expenses and savings.

Although it will take time to get used to making and adhering to an established budget, the advantages are worth the effort. A budget can assist you to reduce the amount of debt you have, and save for your long-term goals and also avoid financial difficulties at a later date.

There are a variety of sources to help you make a budget that suits your requirements. Once you’ve gotten into the habit of making a budget, you’ll be well on your way towards financial success.