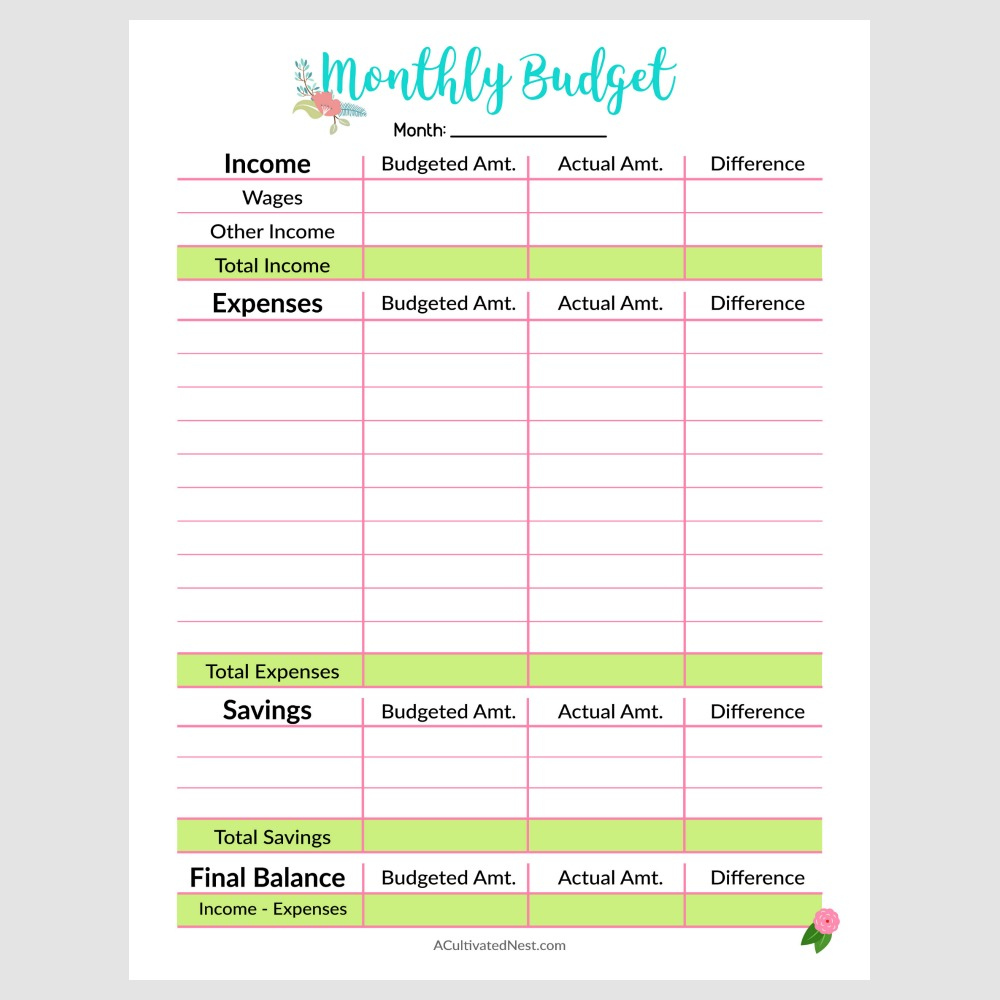

Printable Monthly Budget Template A Cultivated Nest

Printable Monthly Budget Template A Cultivated Nest

Printable Monthly Budget Template A Cultivated Nest – A budget is necessary to control your financials. The printable budget sheets are the best way to keep the track. Printing budget sheets to help you stay on track and organized.

There are many methods to set up budget. A spreadsheet, an app or software program may all be used to construct your budget. If you are looking for the most simple method of creating and tracking your budget, then a printable budget worksheet is your most effective solution.

Printable budget sheets are widely accessible online. These budget sheets can be downloaded online either without cost or at the cost of a small amount. When you have found a template that you like, all you need to do is print it out and begin tracking your expenditure.

Budgeting doesn’t have have to be a hassle. You can budget your money with just a bit of planning effort.

Why Use A Budget?

There are a number of reasons why households and individuals should consider budgets. It allows you to track your spending and saving, which can help you make informed financial choices. A budget can also assist you to remain on track with your financial goals and objectives.

Budgets can be made in a few easy steps. You can use the spreadsheet or pencil to create the budget. The most crucial aspect of making the budget is being honest with yourself regarding your expenses and income. To increase your financial standing, you should stick to the budget you’ve created.

Related For Monthly Budget Template

How To Utilize A Budget

Your budget is an essential tool to control your finances. You can keep track of your income and expenses so that you can make informed decisions about how you spend your money. While it may be difficult to plan your budget With a little planning and work, it’s feasible to stick to your budget.

Here are some tips for budgeting:

- Find out your income and expenses. In order to create a budget, you should first record your earnings. This will help you to know where your money is going.

- It is important to set realistic goals. Once you know where your money is going then you can establish achievable goals in terms of saving and spending. To avoid spending too much on other items, be sure to include variable expenses like gas and groceries.

- Stay on track.

Monitoring Your Performance

The process of setting a budget is the initial step in getting control of your finances. Once you have established an budget, it’s vital to track your progress and ensure that you stick to it. There are a variety of ways to track your progress.

An app that keeps track of your spending can be used to monitor your budget. The apps are connected with your bank account to monitor your spending, and also automatically connect to your bank account. These apps can be used to set up budgets, monitor your progress, and keep you informed.

You could also track your progress using a spreadsheet, pen and paper or notepad and pen. This method requires some manual work, but it can be just as effective as using an app. Input your expenses and income every month. Then , compare your actual spending with your budgeted amount. This will allow you to find areas that must be cut or modified.

Monthly Budget Template

The Benefits Of Budgeting

Although it might appear like something that is difficult however, it is crucial to your financial stability. Budgeting allows you to keep track of your expenses, set aside money for savings and emergency money, and make adjustments when needed.

While it may take some time to master the art of develop and maintain a budget properly but the benefits are worth the effort. Budgets can be used to pay off debts, put aside money to meet long-term goals, or avoid future financial troubles.

There are a variety of sources that can assist you to come up with a budget that is suitable for your needs. You’ll soon be able plan your budget efficiently and attain financial success.