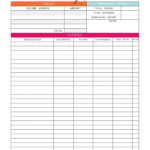

Weekly Budget Worksheet Pdf Db excel

Weekly Budget Worksheet Pdf Db Excel

Weekly Budget Worksheet Pdf Db Excel – If you want to have your finances organized, you need the help of a budget. The printable budget sheets are the most effective way to stay on track. Printable budget sheets will help you stay organized and on the right track.

There are many methods to make a budget. There are many methods to come up with budget. You can make use of an app, spreadsheet, or even a program. A budget template that is printable is ideal if you’re looking for the easiest way to monitor and build your budget.

Online, you can find several budget worksheets that are printable. They are available on a free basis or for a small fee. Once you’ve found the perfect sheet, you can simply make it available and begin keeping track of your expenditure.

Budgeting shouldn’t be difficult. It takes little effort and some planning to get your finances in order.

Why Would You Want To Make Use Of A Budget In Order To Make Decisions?

A budget is crucial due to a number of reasons. Budgets can be used to keep track of your spending and save money, which can aid you in making financial choices. You can utilize a budget to keep track of your financial objectives.

Budgets can be made in just a few steps. You can use an excel spreadsheet or pencil to create the budget. It is essential to be transparent to yourself about your financial incomes and expenses when creating budget. Once you’ve come up with an budget, you must adhere to it as closely as possible to enhance your financial situation.

Related For Budget Spreadsheet Printable

How To Make Use Of A Budget

A budget is a vital tool to manage your finances. Through tracking your earnings and expenses, you will be able to make informed choices about the best way to use your money. It can be a daunting task to budget but with a little planning and effort it is possible to stick to a budget.

Here are some helpful tips to make use of a budget:

- Make sure you know your income and expenditures. To create a budget, you should first record your income. This will provide you with the exact location of your money is going.

- Realistic goals are important. Realistic goals can be set once you’ve figured out where your money is going. In order to ensure you don’t go overboard on other items, be sure to include variable expenses like gas and groceries.

- Stay on track.

Monitoring Your Progress

A budget is the first step to controlling your finances. Once you’ve established a budget, you need to track your progress to ensure you’re adhering to the plan. There are many methods to accomplish this.

A budget tracking application is available. These apps can be linked to your bank account, so you can track your spending. The apps can also be used to establish a budget, track your progress, and keep you on track.

Another method of keeping track of your progress is with either a spreadsheet or pen with paper. While this is more work than an app, it can nevertheless be equally efficient. Input your expenses and income each month. After that, you can compare the amount you actually spend to your budgeted amount. This will help you identify areas that need to be reduced or changed.

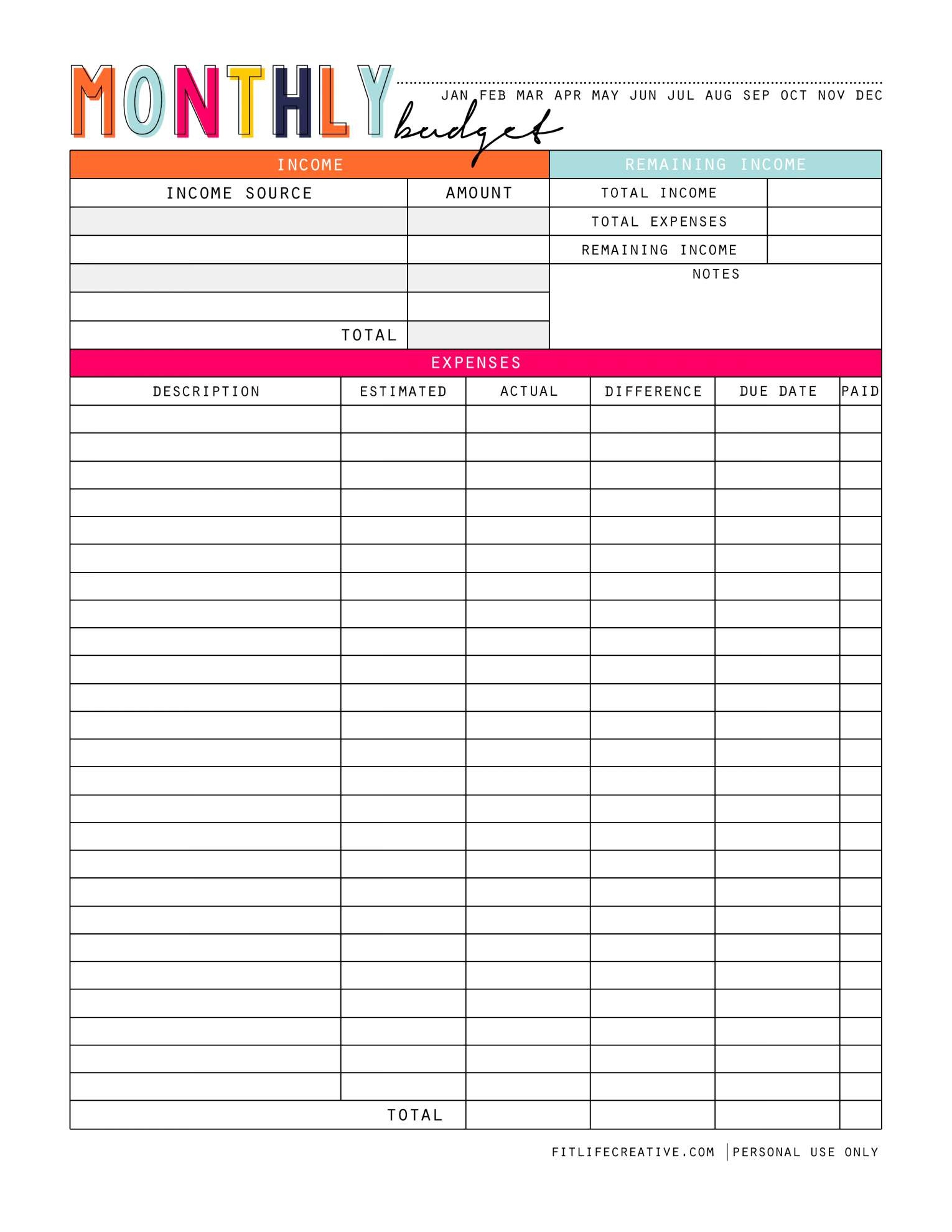

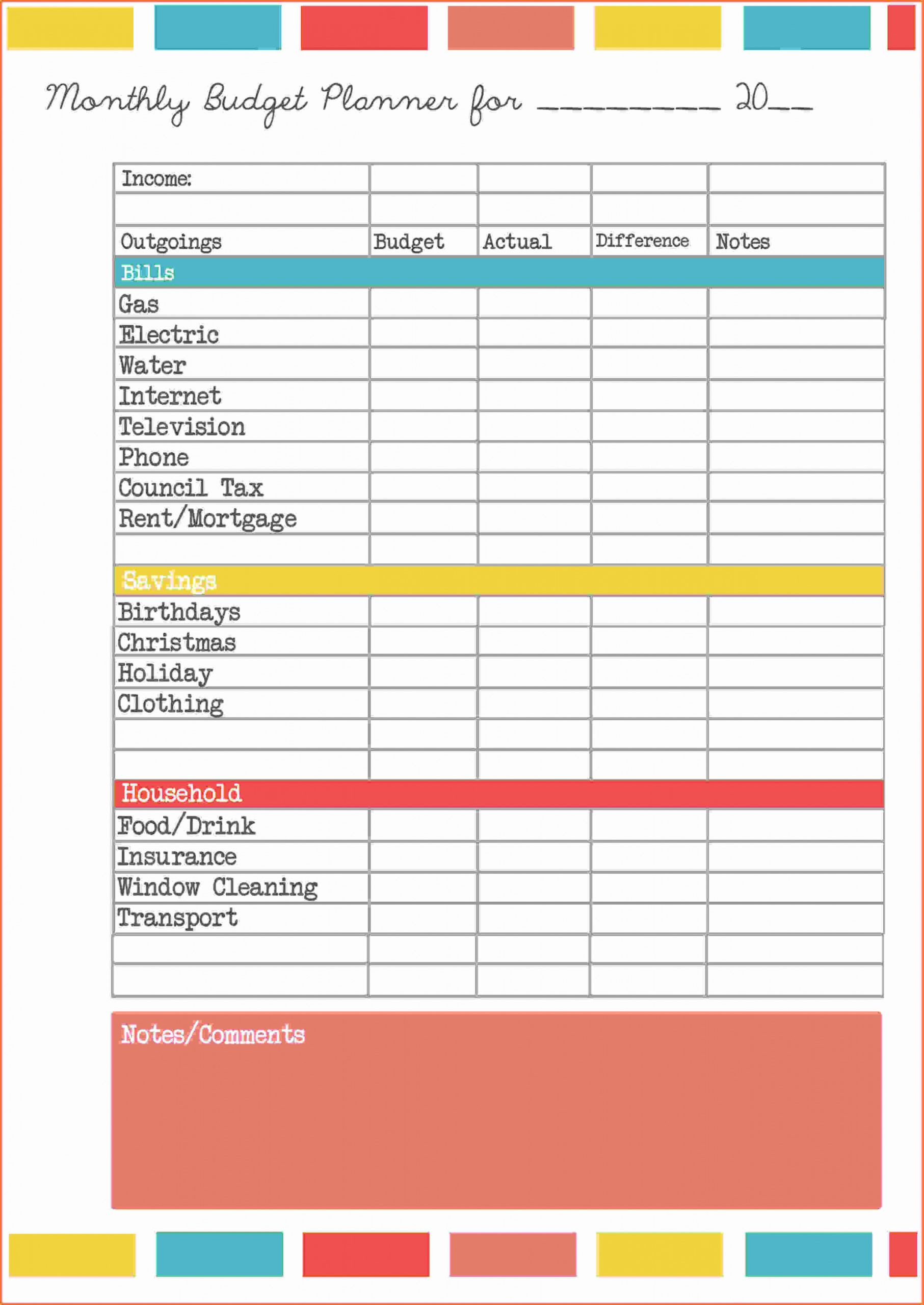

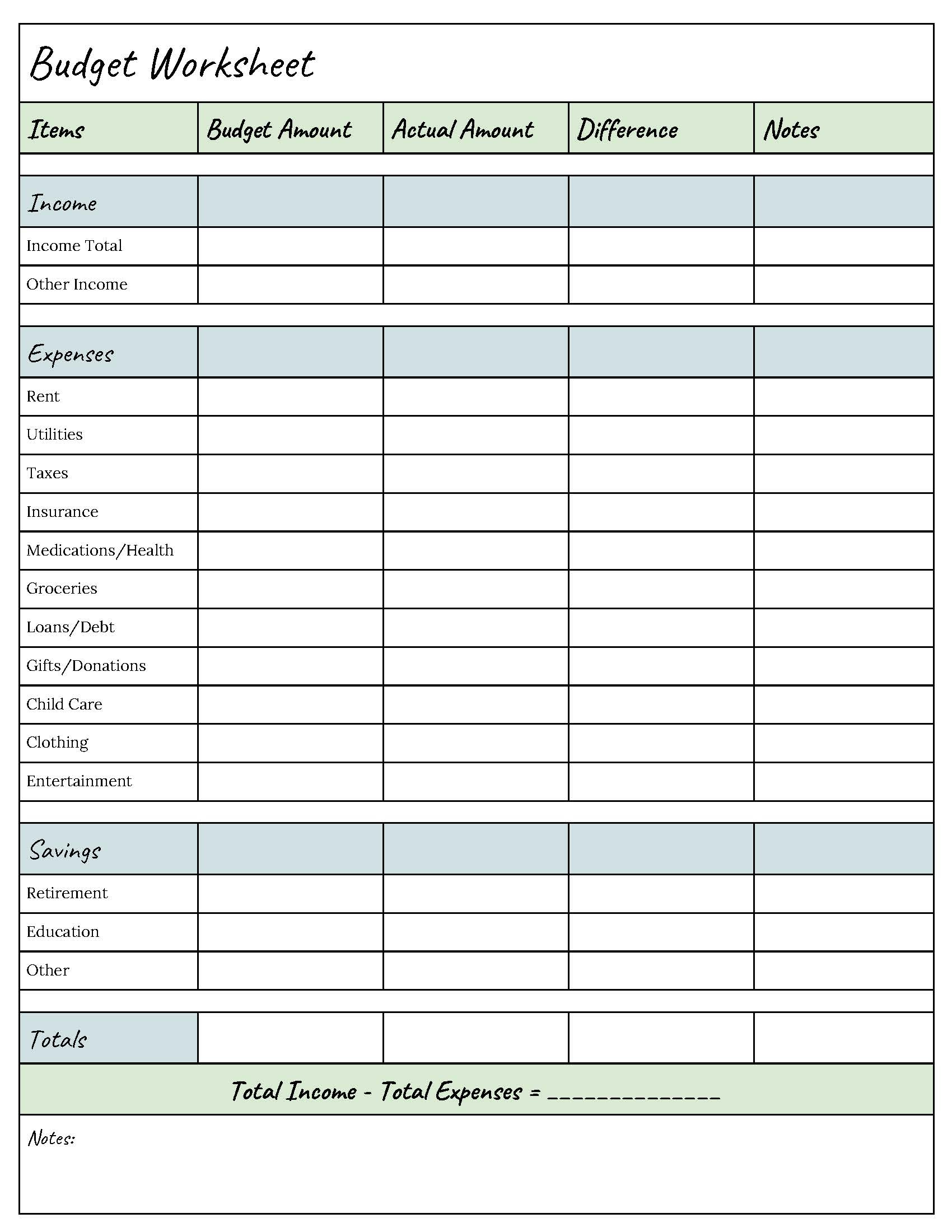

Budget Spreadsheet Printable

Printable Family Budget Free Spreadsheet Excel Basic Home Monthly

Free Simple Budget Spreadsheet PrinterFriendly

The Benefits Of Budgeting

The task of budgeting might seem like an overwhelming job, but it’s a vital step in ensuring your financial stability. You can keep track of your expenses and reserve money to put aside for emergency purposes. Then, you can make any necessary adjustments.

Though it takes time to master the art of develop and maintain an effective budget, the rewards are well worth it. A budget can assist you lower your credit card debt, set aside money for your long-term goals and avoid financial troubles down the line.

There are a myriad of resources to help you prepare a budget that fits your needs. Financial success is possible after you start budgeting.