Free Budget Spreadsheet Intended For Budget Planning Spreadsheet

Free Budget Spreadsheet Intended For Budget Planning Spreadsheet

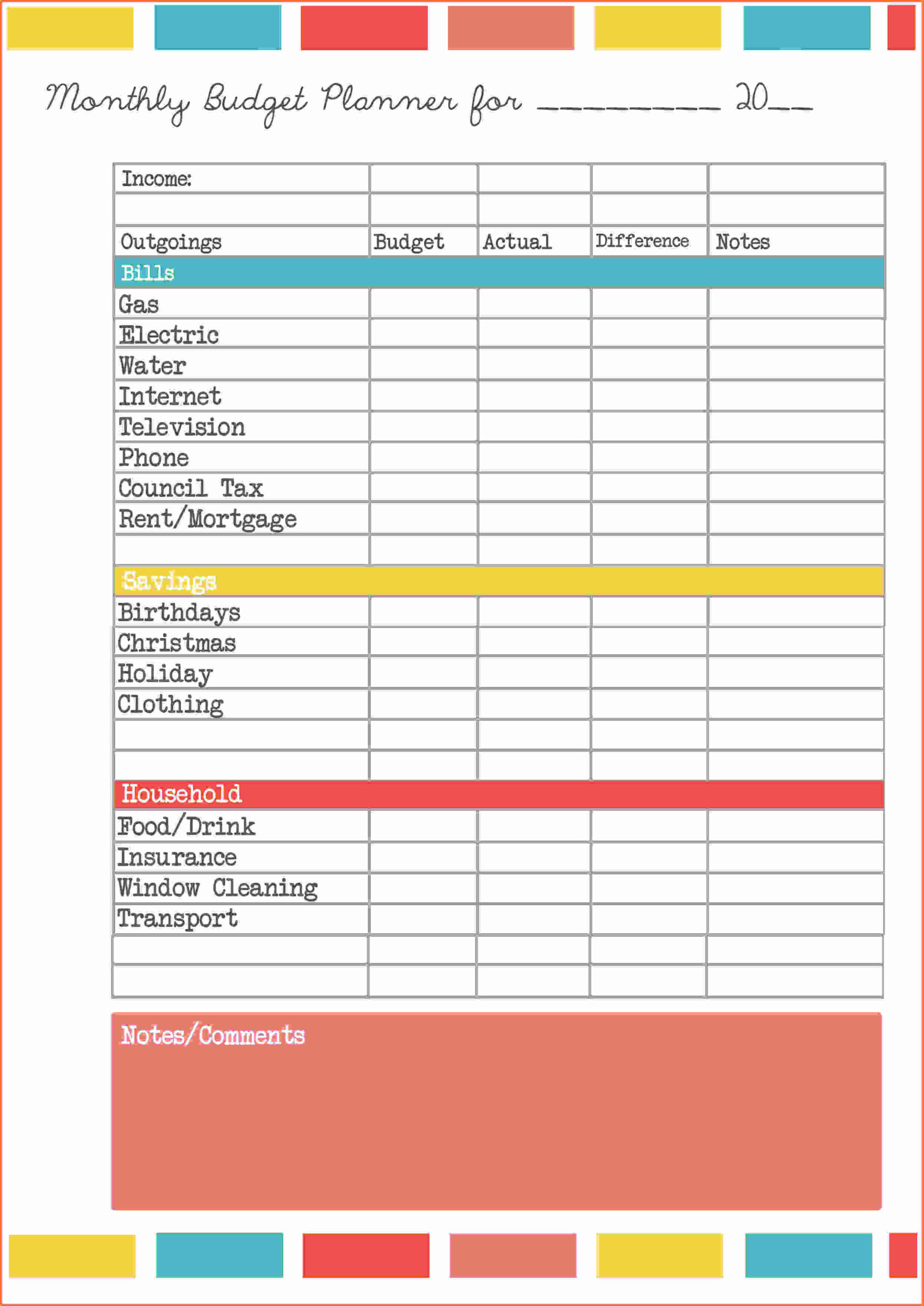

Free Budget Spreadsheet Intended For Budget Planning Spreadsheet – You require a budget to keep track of your finances. A printable budget template is the best way for you to keep track. Budget worksheets that you can print can help you stay organized and on the right track.

There are numerous options to create an effective budget. There are many different ways to come up with a budget. It is possible to use an app, a spreadsheet or program. A printable budget sheet is ideal if you’re looking for the easiest way to track and create your budget.

On the web, you can download numerous budget sheets that can be printed. They can be found either for free or at a small fee. Once you find a sheet that you like, all you need to do is print it and start tracking your spending.

It doesn’t have to be a hassle. With just a little effort and some planning you can have your finances in no time.

Why Use A Budget?

A budget is crucial due to a number of reasons. The budget is a way to track your spending and make savings, which could aid in making financial decisions. It is possible to use a budget to help you stay on top of your financial goals.

It’s simple to come up with your own budget. It is vital to be upfront with yourself regarding your incomes and expenses when you create the budget. Once you’ve made an budget, you must adhere to it as strictly as you can to improve your financial situation.

Related For Free Budget Spreadsheet Template To Download

How To Make The Most Of Your Budget

Your budget is an essential tool in managing your financial situation. When you track your income and expenditures, you’ll be able to make educated decisions on how you can best utilize your money. It can seem difficult to plan your budget, however it can be accomplished with a bit of planning and work.

These are some ways to use a budget.

- Make a list of your income and expenses. Monitoring your expenses and income is the first step to creating your budget. This will give you the exact location of your funds are going.

- Set realistic goals. Once you have a clear picture of the exact location of your money and what you are spending it on, you can set realistic goals in terms of saving and spending. You should factor in variables like gas and food so that you don’t waste money on other items.

- Keep your eyes on the right direction.

Tracking Your Development

The process of setting a budget is the first step towards attaining financial control. When you’ve created a budget, you need keep track of your progress in order to ensure you’re adhering to the plan. There are numerous ways to track your progress.

A program that monitors your spending can be used to keep track of your budget. The apps are linked with your bank account to track your spending and automatically connect to your bank account. The apps can also be used to set up budgets, monitor your progress, and keep you informed.

You could also track your progress with an excel spreadsheet, pen and paper, or pen and note. This method requires more manual work, however it can be just as efficient as using an app. Enter your income and expenses for each month and then check the actual expenses to the budgeted amount. This will allow you to determine areas that require to be cut or adjusted.

Free Budget Spreadsheet Template To Download

The Benefits Of Budgeting

Although it can be a bit tedious yet it’s an essential step in achieving financial stability. It allows you to keep track of your spending, adjust when necessary, and even set aside money for emergencies and savings.

Although it takes some time to understand how to make and adhere to your budget correctly however, the rewards are worth the effort. Budgets can be utilized to pay off debts, to set aside funds for goals that are long-term or to avoid financial difficulties.

There are a myriad of sources to help you come up with a budget that is suitable for your requirements. Once you’ve gotten into the habit of spending money, you’ll soon be on the road towards financial success.