FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets

FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets

FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets – It is vital to have a budget if you are to organize your financial affairs. A budget template is the most effective way to stay on your finances on track. Budget templates can help you stay on top of your finances and on the right track.

There are numerous ways to create a budget. It is possible to use a software program, an app, or even spreadsheets. If you are looking for the most efficient way to make and keep track of your budget with a worksheet, then a budget worksheet is your ideal choice.

You can easily locate printable budget sheets online. You can download them at no cost or for some cost. Print the worksheet you like and start tracking your expenditure once you’ve discovered the.

Budgeting doesn’t have to be a hassle. With a little effort and some preparation, you can get your finances within a matter of minutes.

Why Should You Use A Budget?

A budget is essential because of a variety of reasons. The budget is a way to track your spending and reduce expenses, which will aid you in making financial choices. A budget can aid you to stay on track with your financial objectives.

It is easy to create your own budget. The most important aspect to consider when creating an effective budget is to be truthful about your income and expenses. You should stick to your budget in order to enhance your financial position.

Related For Free Editable Monthly Budget Worksheet PDF Editable

How To Utilize A Budget

Budgets are an important tool for managing your finances. You can keep track of your income and expenses in order to make well-informed choices about how to allocate your funds. It can be a daunting task to budget but with a little planning and work it is possible for you to stick to a budget.

Here are some ideas on how to make use of a budget.

- Calculate your expenses and income. In order to create a budget, you must first track your income. This will help you to see where your money is spending.

- It is essential to set reasonable goals. You can establish realistic goals for savings and spending once you have an understanding of how much money you’re spending. To avoid spending too much on other purchases, be sure you include any variable costs like food and gas.

- Keep your eyes on the ball.

Be Aware Of Your Progress

Setting a budget is the first step in getting control of your finances. However, once you’ve got set up a budget, it is important to track your progress to ensure that you are sticking to it. There are a variety of methods for doing this.

You can make use of an app to track your budget. These apps can be linked to your bank account and monitor your spending automatically. They also help you set up a budget and track your progress over time.

A spreadsheet or pen and piece of paper is another method to track your progress. This approach requires more manual effort, but it’s as effective as using an app. Simply record your income each month and then compare your expenditure to your budgeted amount. This will allow you to determine where you may need to reduce or adjust your spending.

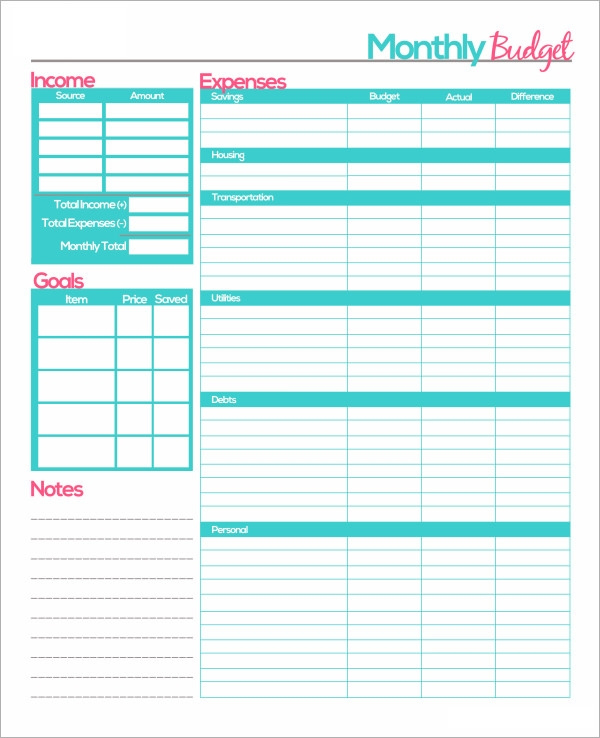

Free Editable Monthly Budget Worksheet PDF Editable

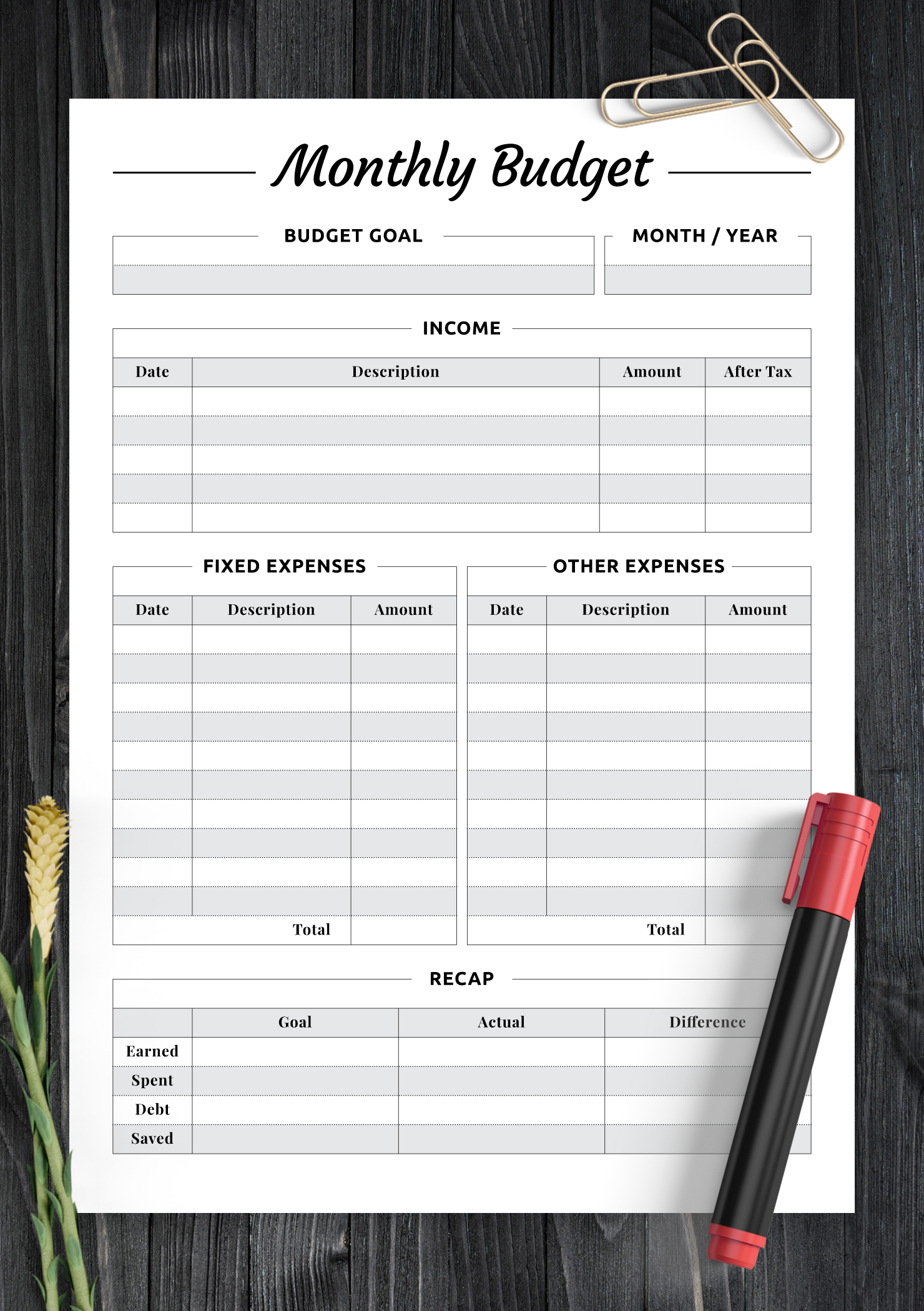

Download Printable Monthly Budget With Recap Section PDF

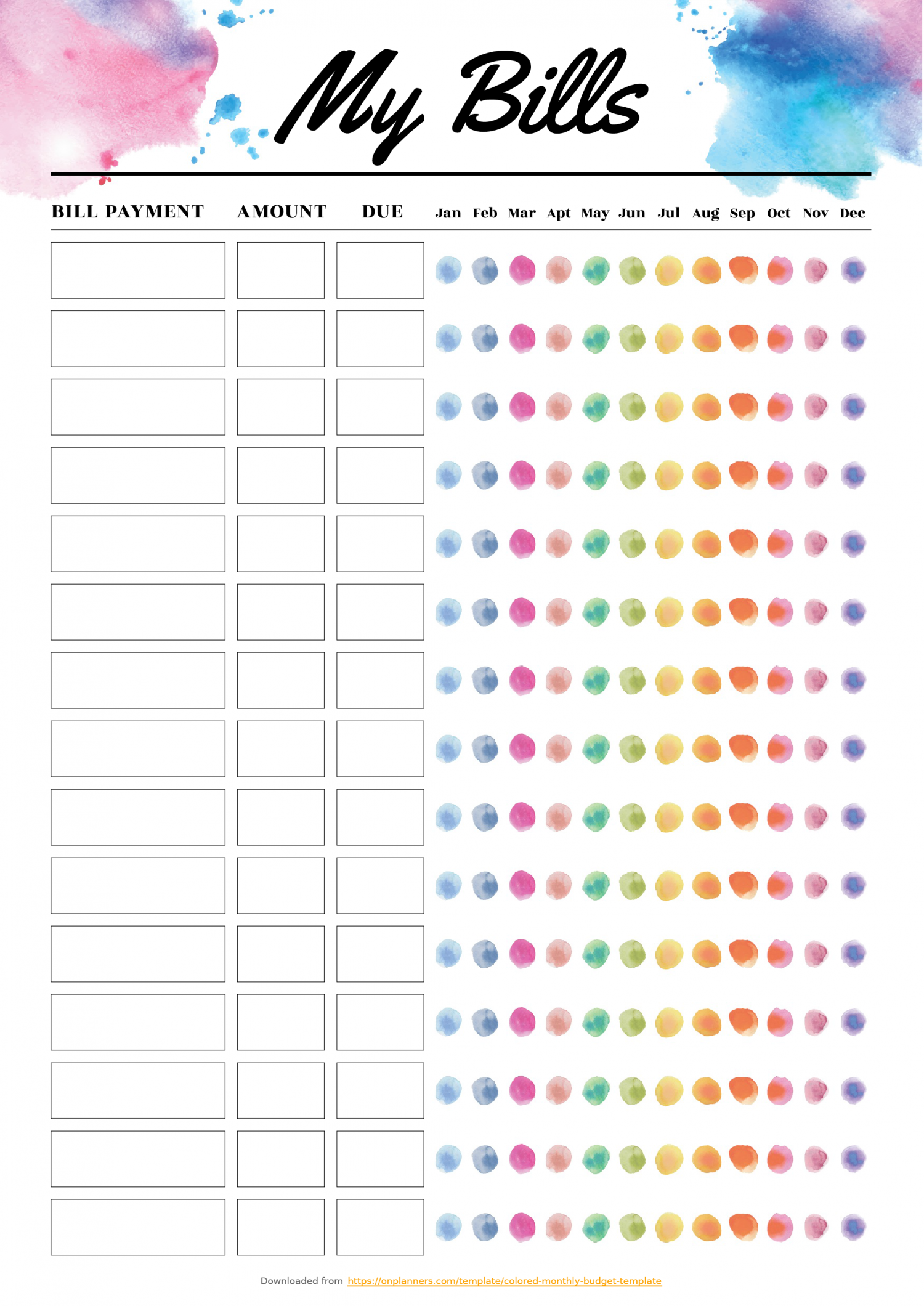

Free Printable Colored Monthly Budget Template PDF Download

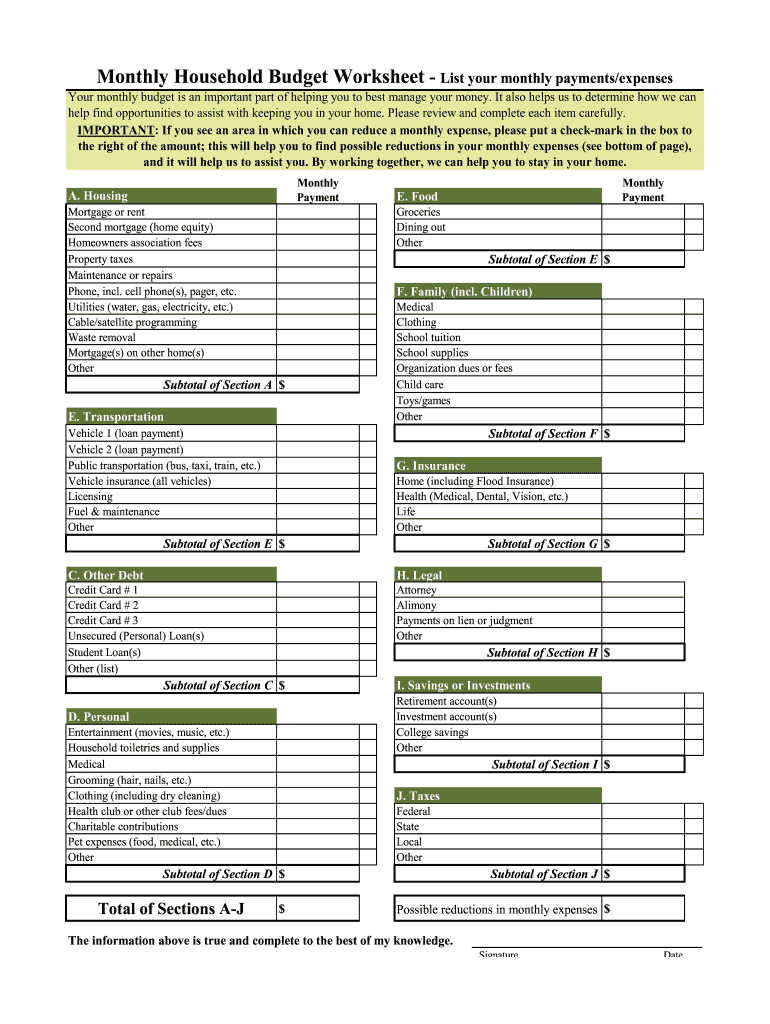

Household Budget Worksheet Pdf Fill Online Printable Fillable

The Benefits Of Budgeting

While it may appear to be an overwhelming task however, it is crucial to ensure your financial security. Budgeting allows you to monitor your spending, set aside funds for savings as well as emergency money, and make adjustments whenever needed.

Though it takes time to to make and adhere to your budget in a proper manner but the benefits are worth it. A budget can assist you in paying off your debts, set aside funds to fund long-term goals, and prevent financial troubles in the future.

If you don’t know where to start There are plenty of resources available to help prepare the perfect budget. Financial success is possible after you begin to budget.