Free Budget Worksheets Single Moms Income

Free Budget Worksheets Single Moms Income

Free Budget Worksheets Single Moms Income – A budget is necessary in order to keep track of your finances. A budget template is the most effective way to stay on track. A budget worksheet that you can print out will aid you in staying organized.

There are many choices for creating your budget. It is possible to use a software program, an app or even a spreadsheet. But if you’re looking to find the most straightforward method to make and monitor your budget, then a printable budget worksheet is the best way to go.

There are plenty of budget sheets that can be printed on the internet. They are available on a free basis or for an affordable cost. You can print the sheet you like and begin tracking your expenditure once you’ve discovered it.

Budgeting doesn’t need to be a hassle. You can manage your finances with a little planning and effort.

Why Would You Want To Make Use Of Budgets To Help Make Decisions?

There are a number of reasons why individuals and households should consider budgets. A budget allows you to track your savings and spending, which can help guide you in making educated financial choices. You can use a budget to help you keep track of your financial goals.

Creating a budget is relatively simple and can be completed using a variety of methods that include pencil and paper, a spreadsheet or personal financial software. It is important to be transparent about your earnings and expenses when creating budget. To enhance your financial position, you should stick to the budget you’ve established.

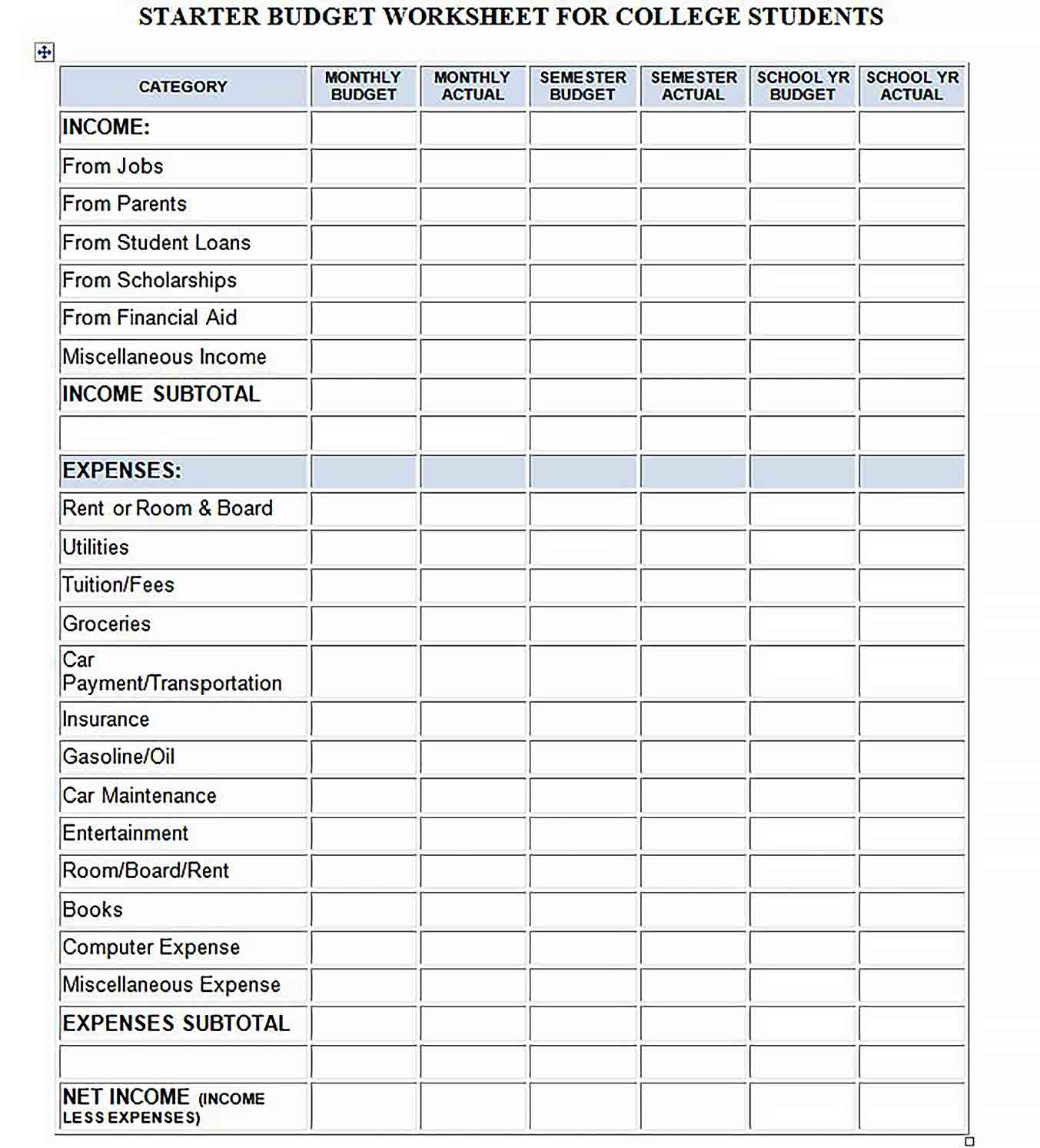

Related For Budget Sheets Free

How To Make Use Of A Budget

Your budget is an essential tool in managing your financial situation. Tracking your income and spending will allow you to make informed choices about how to allocate your funds. It can be a daunting task to budget, but with a little planning and work, it can be easy to stick to a budget.

These are some ideas for ways to make use of a Budget:

- Find out your earnings and expenses. The tracking of your income and expenses is the first step to setting up budget. This will help you to know where your money is spending.

- The importance of setting realistic goals is. The most realistic goals can be established once you’ve figured out where your money is going. You should factor in variable expenses such as gasoline and groceries so you don’t spend too much for other things.

- Stay on track.

You Can Track Your Progress

A budget is the first step to attaining financial control. Once you’ve created your budget, it’s crucial to keep track of your progress and make sure that you stick to the plan. This can be accomplished by a variety of methods.

You can use budget tracking apps. The apps are linked to your bank account in order to monitor your spending, and also automatically link to your bank account. The apps can also be used to set up budgets, monitor your progress, and keep you informed.

A spreadsheet or a pen and paper is a different way to keep track of your progress. This requires more effort to do manually, but it can be just as effective as using an app. Simply enter your income and expenses for each month, and then compare your actual expenditure to the budgeted amount. This will help you identify areas where you can cut back or make adjustments.

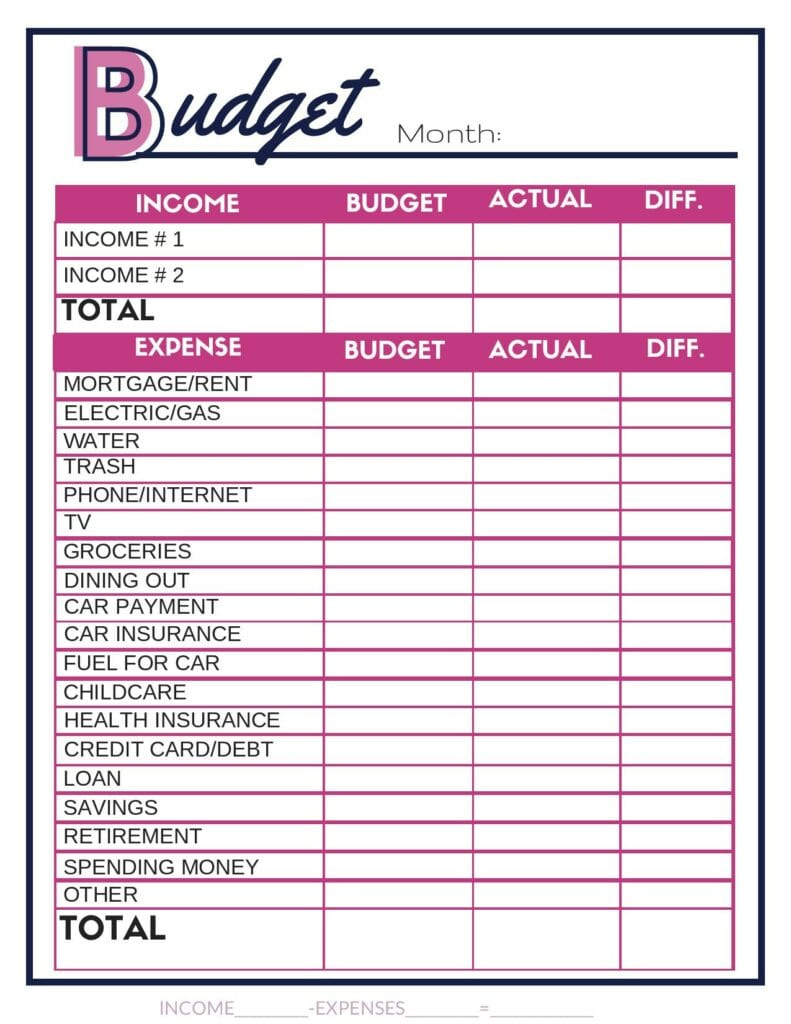

Budget Sheets Free

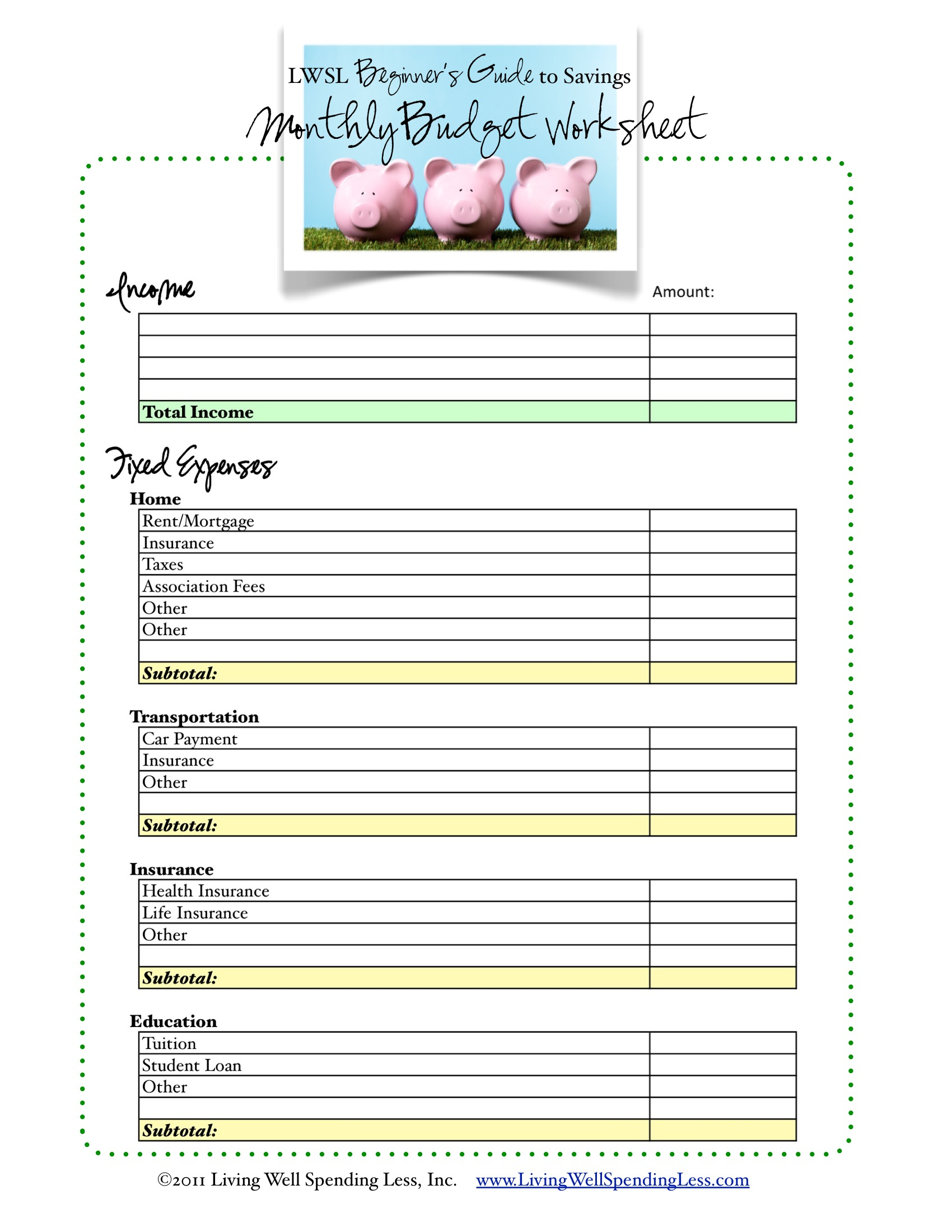

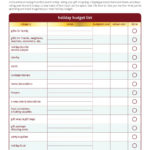

Free Budget Worksheet Living Well Spending Less

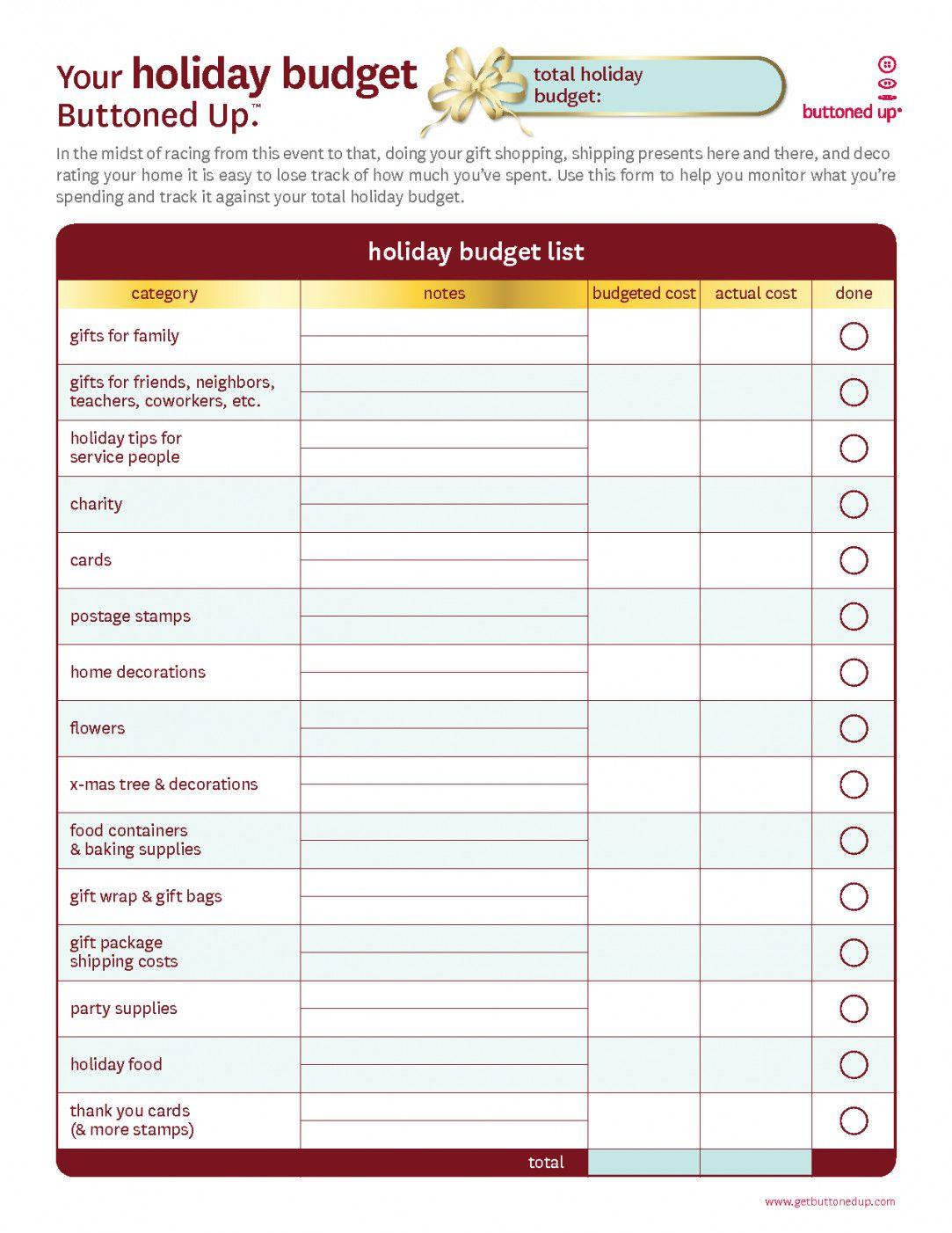

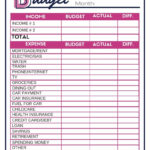

Free Monthly Budget Template Frugal Fanatic Free Printable Home

Printable Budget Worksheet Template Culturopedia

The Benefits Of Budgeting

While it may appear to be an overwhelming task but it’s essential to your financial stability. Budgeting lets you monitor your spending, make adjustments whenever necessary, and reserve money for emergency situations and savings.

Although it takes some time to learn how to establish and follow your budget correctly however, the rewards are worth it. Budgets can be utilized to pay off debts, set aside money to meet long-term goals, or avoid future financial problems.

If you’re unsure where to begin, there’s a wealth of resources available to help you create an effective budget for you. Financial success is possible when you start budgeting.