Pin On Teens

Pin On Teens

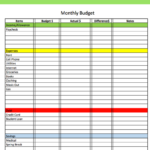

Pin On Teens – It is essential to have a budget in order for managing your finances. A printable budget sheet is the best way to keep track. A budget worksheet that you can print out will help you stay organized.

There are many different ways to make a budget. There are a variety of ways to come up with your budget. You can use an app, software or spreadsheet. If you are looking for the simplest method to create and track your budget, then a printable budget worksheet is the ideal alternative.

Online, you will find various budget sheets for printing. They can be downloaded on the internet for free or at a minimal cost. Once you find the right sheet, you just need to print it out and begin to track your spending.

Budgeting doesn’t have have to be a hassle. It’s a matter of a few minutes and some planning to ensure your finances are in order.

What Is The Reason To Use A Budget?

There are several reasons why households and individuals should use a budget. A budget helps you track your savings and expenditure that can aid you to make informed financial choices. It is possible to use a budget to keep track of your financial objectives.

Budgeting is simple and can be done by using a variety using pencils and paper, a spreadsheet or personal financial software. Being truthful about your earnings and expenditures is the most essential aspect of establishing the budget. Once you have created an budget, you must adhere to it as close as you can to improve your financial situation.

Related For Budgeting Worksheets For Teens

How Do You Use The Budget

Your budget is an important tool in managing your financial situation. You can track your income and expenses to make informed decisions on how to allocate your funds. Budgeting can be difficult However, with some planning and effort, it can be easy for you to stick to a budget.

Here are some suggestions to make use of a budget:

- Make sure you know your expenses and income. The tracking of your income and expenses is the initial step to creating your budget. This will give you an understanding of where your cash is going.

- Set realistic goals. Set realistic goals once you’ve figured out the direction of your money. Be sure to include variables like gas and groceries to ensure you don’t waste money on other things.

- Keep your eyes on the right direction.

You Can Monitor Your Development

The process of creating a budget is the first step in getting control of your finances. Once you have established an budget, it’s important to monitor your progress and ensure that you stick to it. There are a variety of ways to track your progress.

You can utilize budget tracking apps. These apps can be linked to your bank account in order to monitor your spending and then automatically connect to your bank account. These apps can also be used to create an expense plan, track your progress, and keep you updated.

Another method of tracking your progress is with an excel spreadsheet or pen and paper. Although this method requires more effort, it is exactly the same as using an app. Enter your expenses and income for each month and then check the actual expenses to your budgeted amounts. This will help you identify areas that need to be cut or changed.

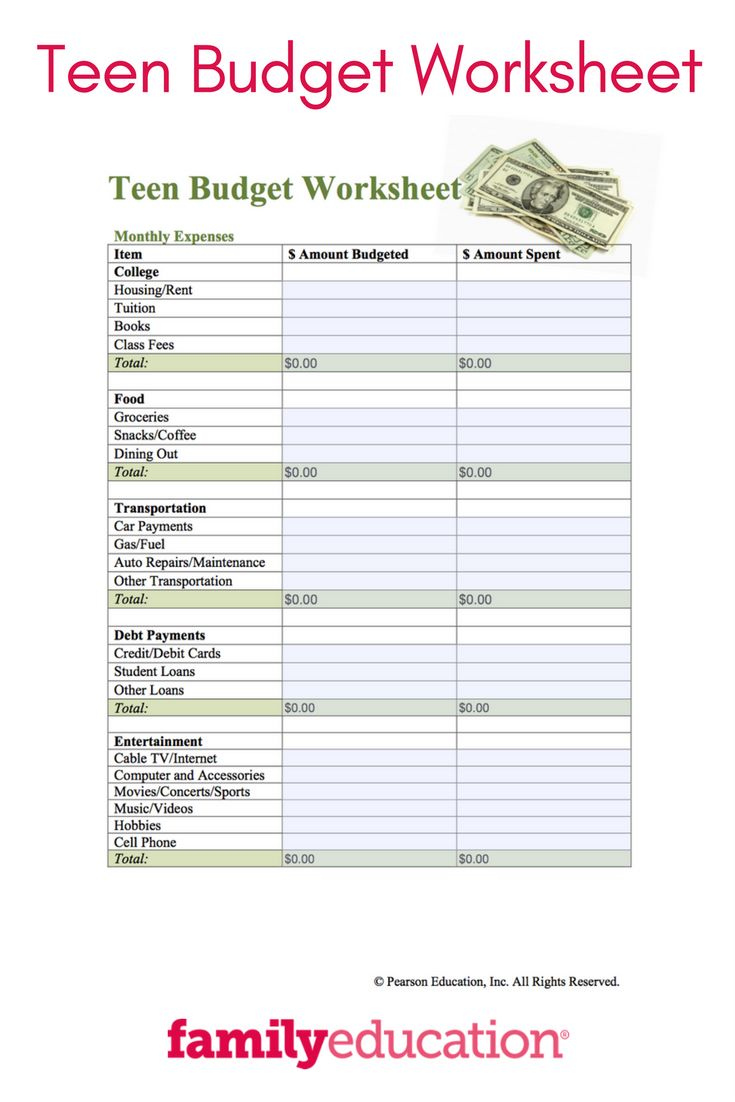

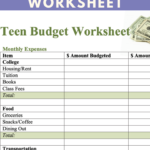

Budgeting Worksheets For Teens

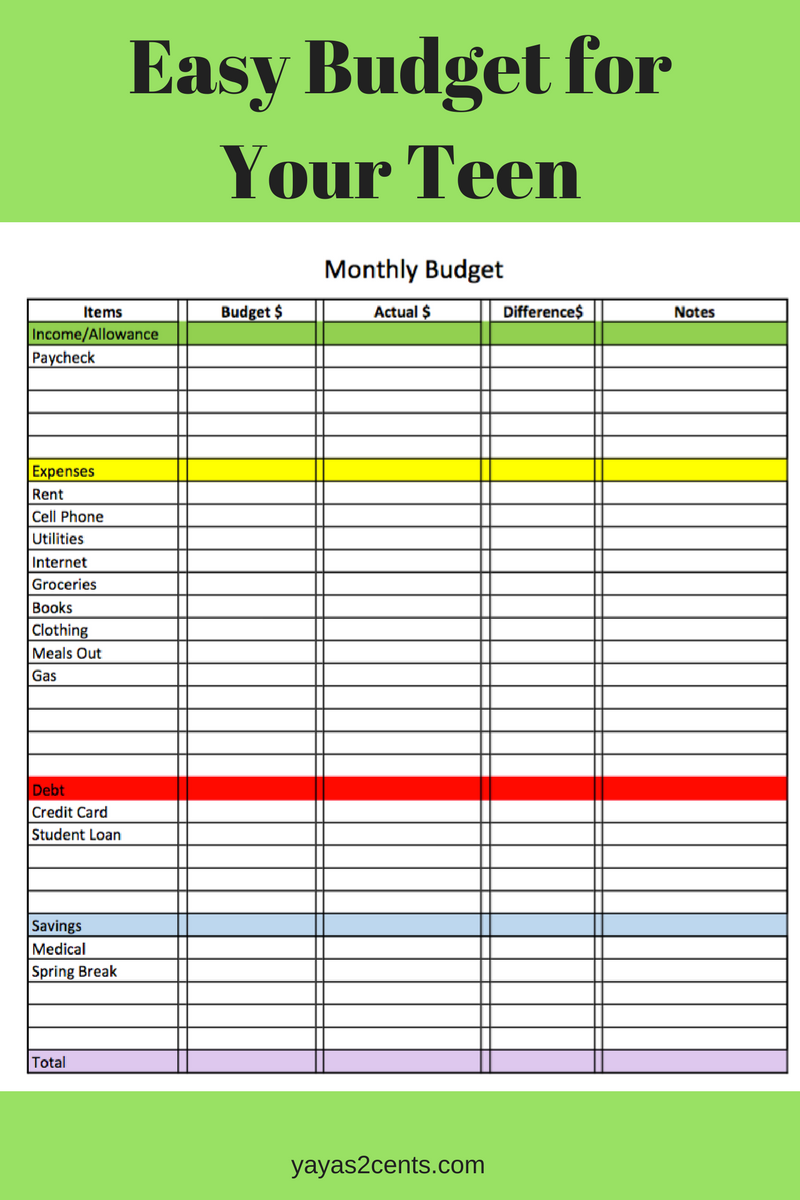

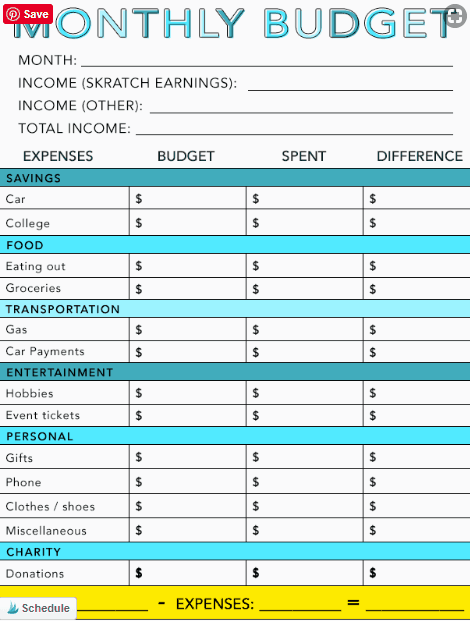

Pin On Teens And Money

10 Free Teen Budget Worksheets To Start Your Teenager Budgeting

Teen Budget Worksheet Printable

The Benefits Of Budgeting

The process of budgeting can seem like an overwhelming job, but it’s a vital element to ensure financial stability. A budget allows you to monitor your spending, set aside funds for savings as well as emergency funds, and make adjustments when needed.

Although it can take some time to to make and adhere to an effective budget but the benefits are worth the effort. A budget can allow you lower your credit card debt, set aside money for long term goals, and prevent financial issues down the line.

If you’re not sure where to begin, there’s plenty of resources to help you create a budget that works for you. Financial success is possible once you start budgeting.