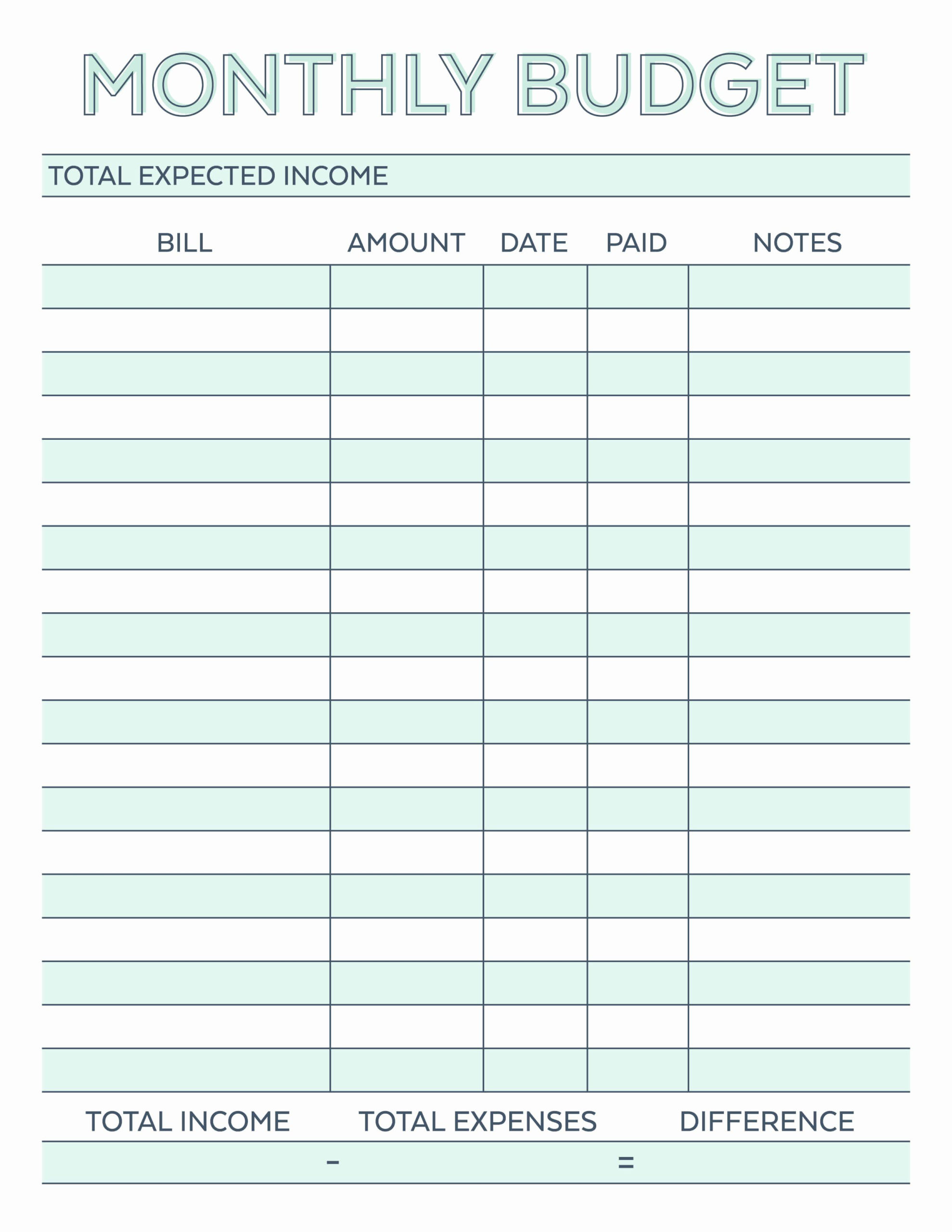

Condo Budget Template New Monthly Bud Planner Free Printable Bud

Condo Budget Template New Monthly Bud Planner Free Printable Bud

Condo Budget Template New Monthly Bud Planner Free Printable Bud – If you’re looking to put your finances organized, you’ll need an budget. The printable budget template can help you to monitor your spending. Budget sheets that are printable can help you stay in order and on track.

There are a variety of options available for creating an effective budget. There are many ways to create your budget. It is possible to use an app, program or a spreadsheet. If you’re searching for the easiest method to create and track your budget and track your expenses, then a printable budget worksheet is the ideal option.

On the internet, you can access several budget worksheets that are printable. The budget sheets can be downloaded online either free of charge or for only a small fee. You can print the form you like, and then begin to track your expenses after you have located it.

It doesn’t have to be a hassle. It is possible to manage your finances with just a bit of planning effort.

What Are The Benefits Of Using A Budget In Order To Make Choices?

A budget is essential for many reasons. It helps you monitor your expenditure and savings that can aid you in making informed financial decisions. A budget can also help maintain your financial goals as well as objectives.

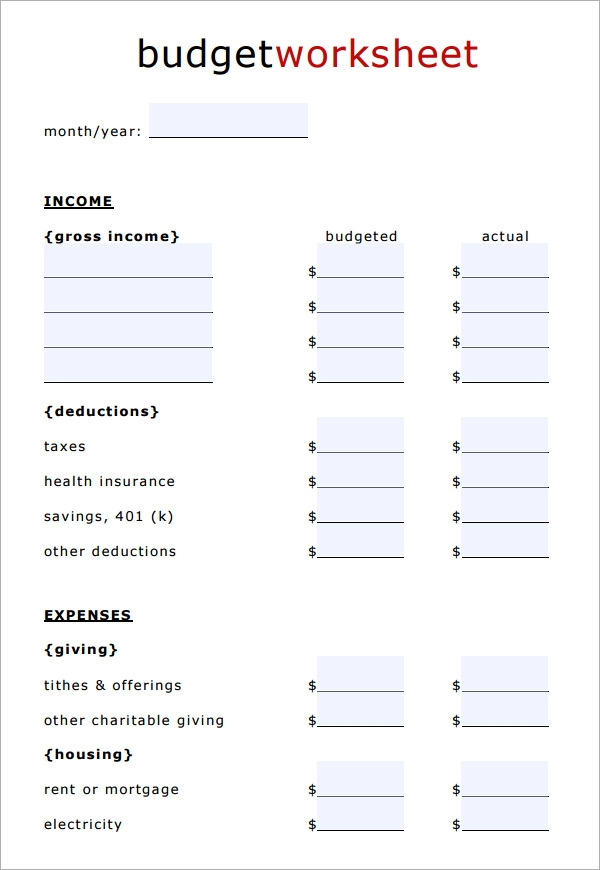

Budgets can be made by following a few easy steps. You can utilize an excel spreadsheet or pencil to draw it. Be honest about your income and expenses is the most crucial element of making the budget. It is important to stick to your budget in order to improve your financial situation.

Related For Blank Household Budget Sheet Printable

How To Utilize A Budget

A budget is an essential tool to manage your finances. The ability to track your income and expenditure will enable you to make informed choices about how to spend your money. It’s not always easy to plan your budget, however it can be accomplished by a little planning and effort.

Here are some ideas on how to utilize a Budget:

- Calculate your income and expenses. In order to create a budget, you must first track your income. This will provide you with an accurate picture of where your cash is going.

- Set reasonable goals. It is possible to set reasonable goals for savings and spending after you have an accurate picture of where your money is going. Consider variables like gas and food items so that you don’t waste money for other things.

- Keep on track.

Monitoring Your Progression

Setting a budget is the first step towards gaining financial control. To ensure you’re sticking to the budget you set, keep track of your progress. There are a variety of methods to accomplish this.

You can make use of an app to track your budget. The apps are linked with your bank account to keep track of your spending and link to your bank account. The apps let you make a budget and keep track of your progress over period of.

A notebook or pen and piece of paper are another option to track your development. Although this method takes longer to complete, it’s similar to an app. Simply record your income and expenses for each month, then compare your actual expenditure to your budgeted amounts. This will help you discern areas where you can reduce your spending or make adjustments.

Blank Household Budget Sheet Printable

FREE 10 Household Budget Samples In Google Docs Google Sheets

The Benefits Of Budgeting

Although it might appear like an overwhelming task but it’s essential to your financial stability. It is possible to track your spending and set aside money to save and to use for emergencies. Then, you can make any necessary adjustments.

While it might take time to become comfortable with creating and sticking to budgets, the results are worth the effort. Budgets can be used to reduce debt, set aside funds for goals that are long-term and avoid future financial difficulties.

If you’re not sure where to begin, there’s a wealth of resources that can help you develop your budget that is right for you. Financial success is possible when you start planning your budget.