The Most Effective Free Monthly Budget Templates That Will Help You

The Most Effective Free Monthly Budget Templates That Will Help You

The Most Effective Free Monthly Budget Templates That Will Help You – A budget is essential for organizing your financial affairs. The most efficient way to keep track of your spending is with the use of a printable. Budget templates can help you stay on top of your finances and on the right track.

There are many methods to set up budget. You can make use of a software program, an app or even using a spreadsheet. A budget worksheet that you can print is the best option if you’re searching for the simplest method to monitor and build your budget.

Budget sheets for printables are readily accessible online. They are available online for download for no cost or a small charge. Once you find the right sheet, you just need to print it and begin tracking your expenditure.

Budgeting does not have to be a hassle. You can handle your finances with just a bit of planning effort.

Why Should You Use The Budget To Make Decisions?

A budget is essential for many reasons. A budget lets you track your spending and saving as well as help you make informed financial decisions. A budget can aid you to stay on track with your financial goals.

The process of creating a budget can be accomplished in a few easy steps. You can make use of an excel spreadsheet or pencil to draft it. It is crucial to be upfront about your earnings and expenses when you create the budget. It is important to stick to your budget in order to improve your financial condition.

Related For Free Monthly Budget Templates Printable

How To Utilize A Budget

Your budget is an important instrument to manage your finances. By keeping track of your income and expenses, you will be able to make informed decisions about the best ways to spend your money. While budgeting may seem daunting With a little planning and effort , it’s possible to stick to your budget.

Here are some helpful tips to make use of a budget:

- Calculate your income and expenses. Tracking your income and expenses is the first step towards formulating a budget. This will allow you to determine where your money is spending.

- Realistic goals are important. Once you have a clear picture of what your budget is, you can set achievable goals for saving and spending. In order to ensure you don’t go overboard on other goods, make sure you include any variable costs like gas and groceries.

- Be on the right track.

Monitoring Your Performance

The first step to financial control is to establish the budget. But once you have an established budget, you must to track your progress to ensure you’re sticking to it. There are a variety of methods for doing this.

A budget tracking app is available. The apps are connected with your bank account to keep track of your spending and link to your bank account. They also aid you in setting up a budget and track your progress in time.

A pen or spreadsheet, or a piece of paper are another way to keep track of your progress. This approach requires more manual effort, but it’s as effective as using an application. Simply record your income and expenses for each month, then compare your actual expenditure with your budgeted amounts. This will let you know where you may need to reduce or adjust your spending.

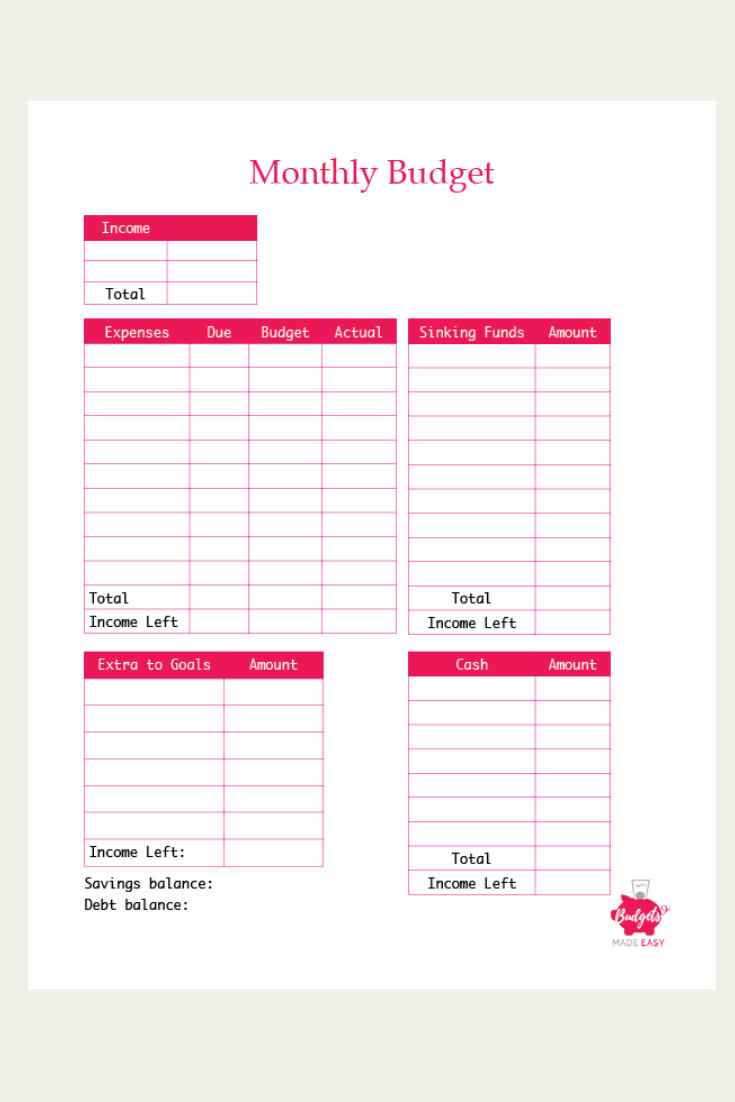

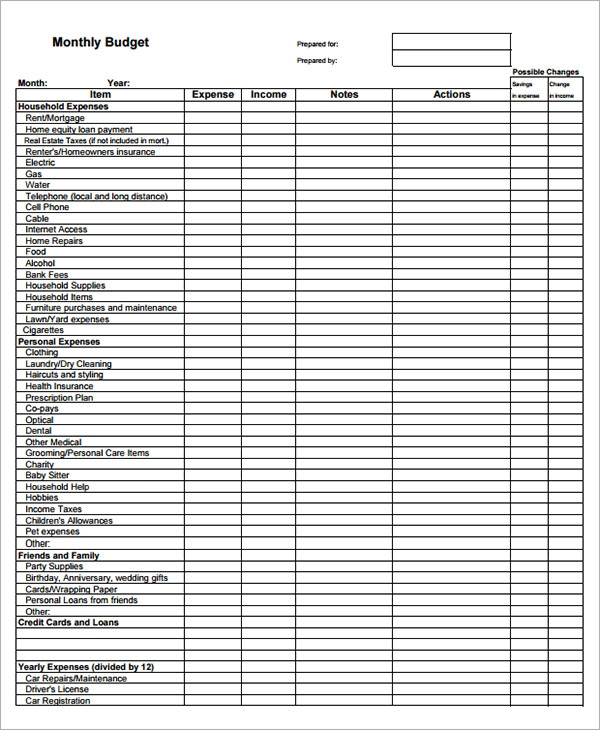

Free Monthly Budget Templates Printable

Printable Monthly Budget Template A Cultivated Nest

FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets

The Benefits Of Budgeting

While it may be difficult to budget yet it’s an essential step in achieving financial stability. A budget allows you to manage your spending, put aside money for savings or emergency money, and make adjustments when needed.

It may take some time before you are comfortable with creating and following a budget. But the advantages are well worth the effort. A budget will help you pay off your debts, set aside funds for long-term goals, and prevent financial troubles further down the line.

If you’re unsure of where to start, there are plenty of resources to aid you in creating an effective budget for you. Success in financial planning is achievable once you begin to budget.