2021 Budget Binder Printables Budget Binder Printables Budget Binder

Budget Planner Printable

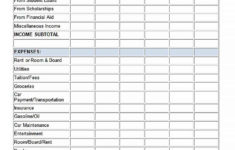

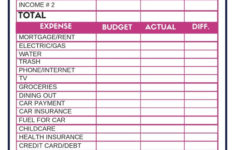

Budget Planner Printable – If you’re looking to have your finances organized, you’ll need an budget. The most efficient way to keep track of your budget is to use a printable. It is possible to print budget worksheets to help you keep track of your spending and organize.

There are a variety of options available for creating an effective budget. You can make use of a software program, an app or even spreadsheets. A budget worksheet that you can print is best if you are looking for the easiest way to track and create your budget.

You can easily find budget sheets that can be printed online. They are available online for download for no cost or at a minimal cost. Once you’ve found a sheet you like, all you need to do is print it out and begin tracking your expenditure.

Budgeting doesn’t have to be a hassle. You can budget your money with just a bit of planning effort.

Why Do You Need A Budget?

There are a variety of reasons why households and individuals must have budgets. A budget lets you record your expenditure and save that can allow you to make informed financial decisions. You can use a budget to help you stay on top of your financial goals.

The process of creating a budget is simple and can be completed by using a variety such as pencil and paper, a spreadsheet, or personal finance software. The most important thing to remember when creating an effective budget is to be honest with yourself regarding your income and expenses. After you’ve created your budget, adhere to it as tightly as you can to enhance your financial position.

Related For Budget Planner Printable

How To Use A Budget

A budget is a vital tool to manage your finances. You can keep track of your income and expenses in order to make well-informed choices about how to spend your money. It can seem difficult to plan your budget, however it can be accomplished with some planning and effort.

There are a few ways to make use of a budget.

- Determine your expenses and income. To make a budget you must first track your income. This will provide you with an accurate picture of where your cash is going.

- Set realistic goals. Once you’ve figured out the direction your money is heading and what you are spending it on, you can set achievable goals for saving and spending. Consider the cost of variable items like gasoline and food so that you don’t waste money on other things.

- Keep your eyes on the right direction.

You Can Track Your Progress

The process of setting a budget is the first step to gaining financial control. But once you have a budget, you need keep track of your progress in order to ensure that you are adhering to the plan. There are several methods to accomplish this.

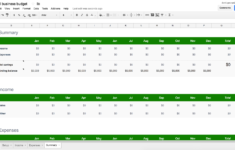

A budget-tracking app is available. These apps connect to your bank account and track your spending on a regular basis. They allow you to create a budget and track your progress over the time.

A spreadsheet or a pen and paper is another method to track your development. This method takes more manual work, however it is just as efficient as using an application. Record your expenses and your income every month. After that, you can compare your actual expenses to your budgeted amount. This will help you see where you need to reduce or adjust your spending.

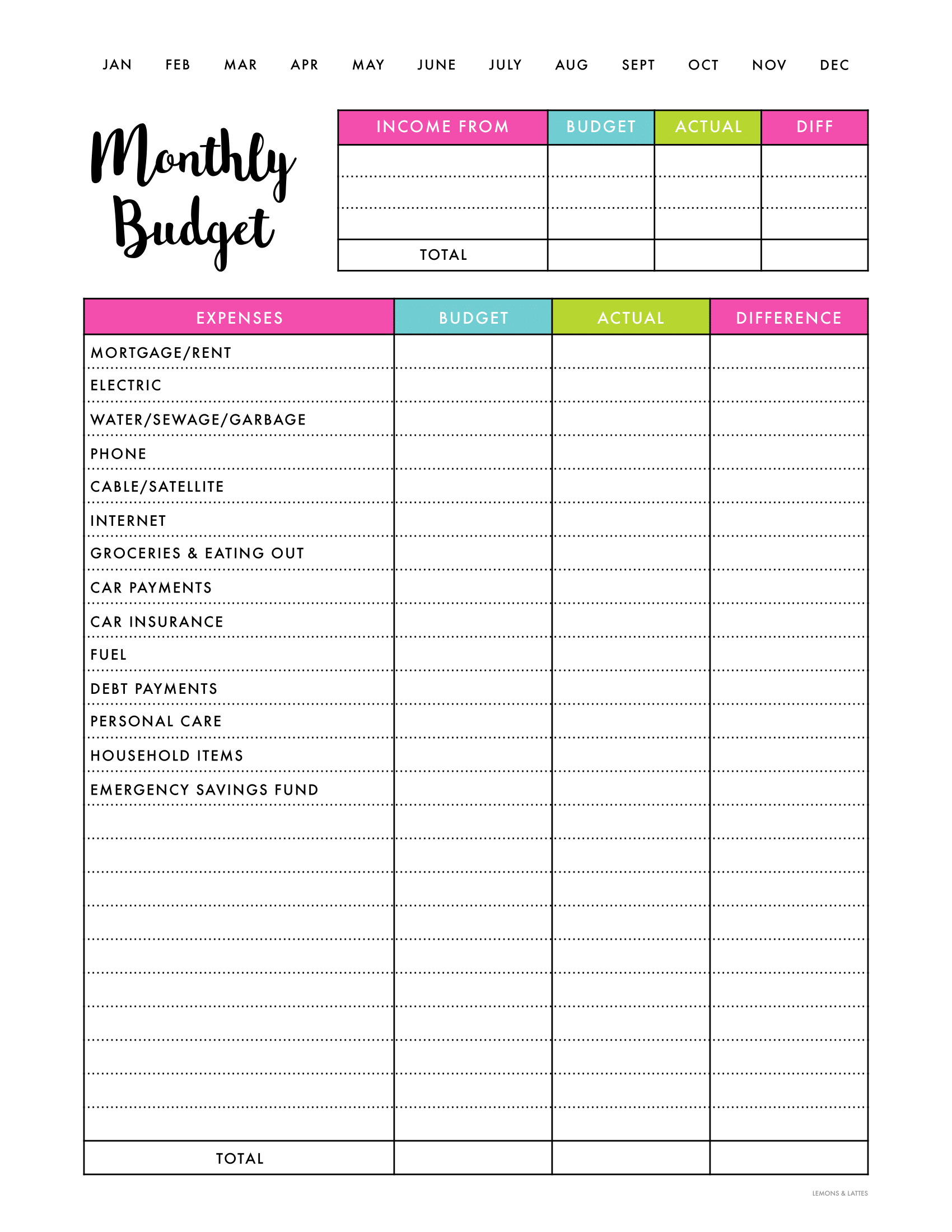

Budget Planner Printable

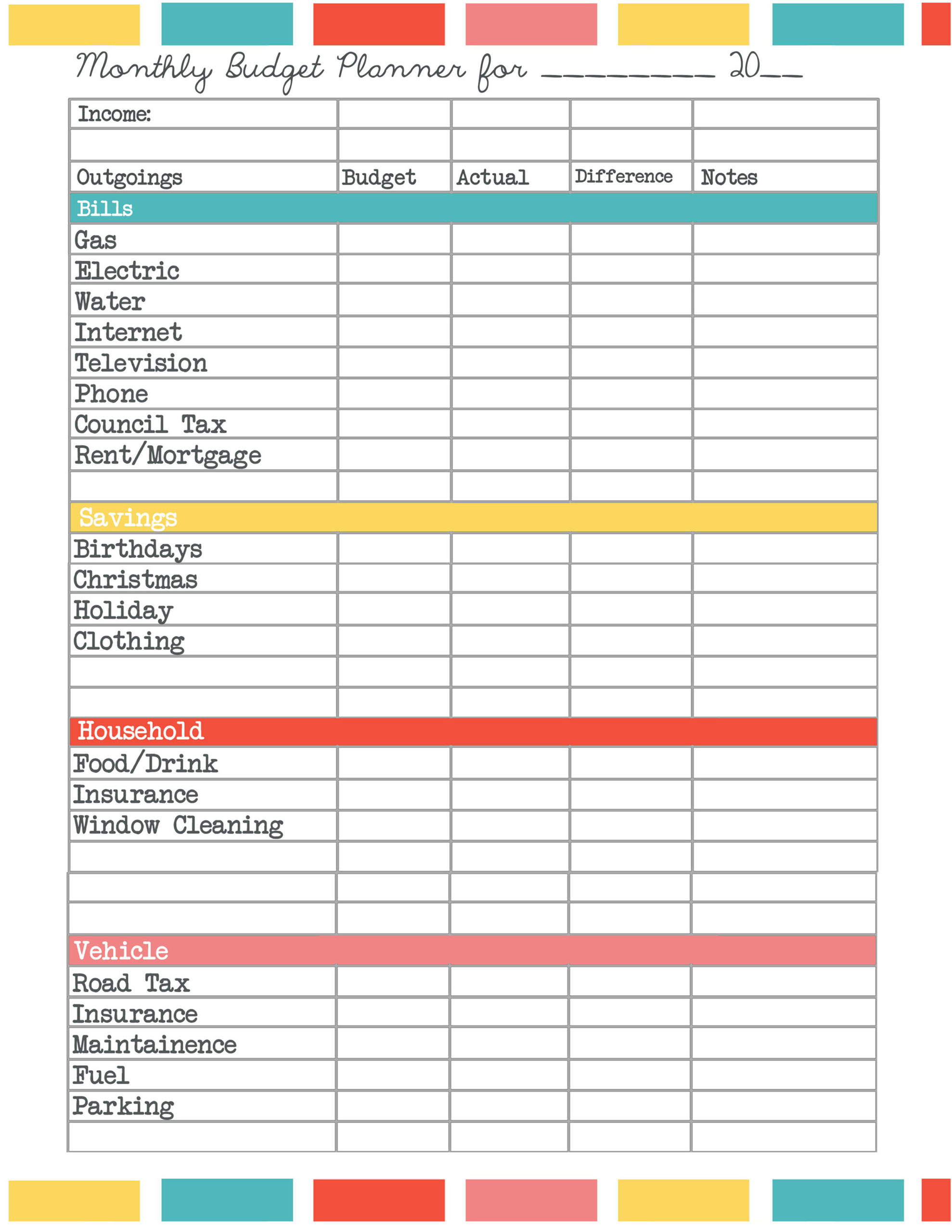

Printable Budget Planner Uk Planner Template Free

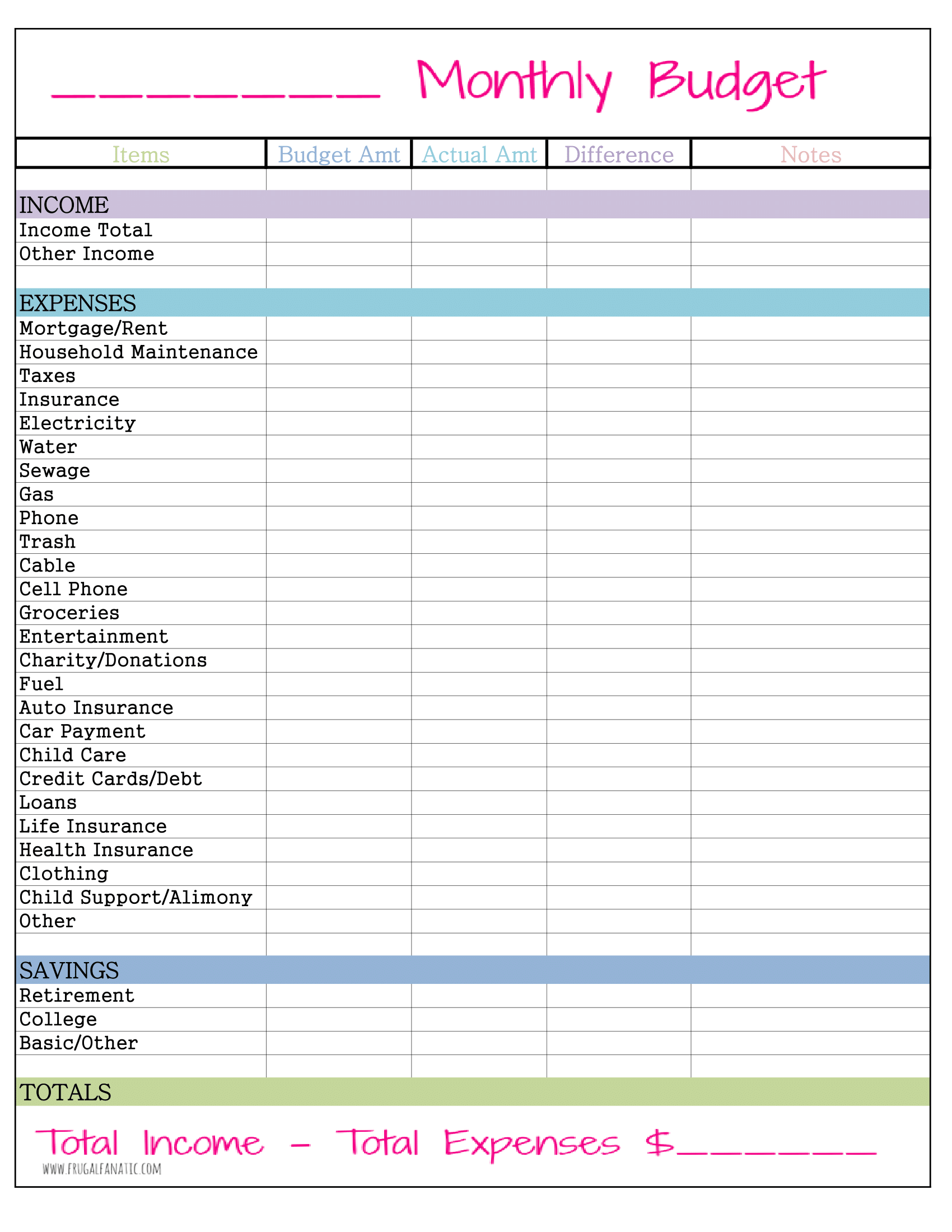

Budget Planner With Mini Bills Tracker Free Printable

Monthly Budget Planner Form Download FREE Template

The Benefits Of Budgeting

Budgeting may seem like an intimidating task, however it’s an essential aspect to ensuring financial stability. It allows you to keep track of your spending, adjust whenever necessary, and reserve money for emergency situations and savings.

Although it takes some time to understand how to create and stick to a budget properly however, the rewards are worth it. A budget can help you lower your the amount of debt you have, and save for long term goals, and help you avoid financial problems in the future.

If you’re not sure where to begin, there are plenty of resources available to help you create your budget that is right for you. Financial success is possible when you begin to budget.