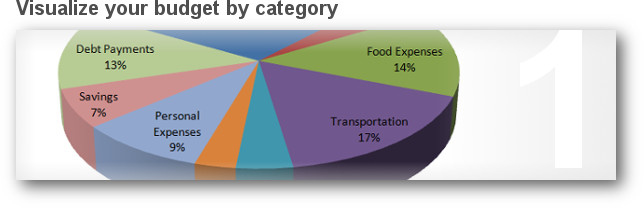

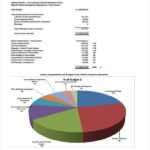

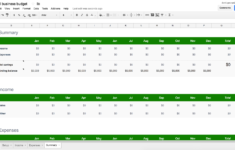

Intelligent Free Excel Budget Calculator Spreadsheet Download

Budget Spreadsheet With Pie Chart Template

Budget Spreadsheet With Pie Chart Template – If you’re trying to keep your finances organized, you need the help of a budget. The most effective way to monitor your budget is to use the use of a printable. Budget worksheets that you can print can help you stay on top of your finances and on track.

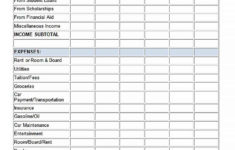

There are a myriad of methods to set up a budget. An app, a spreadsheet or software program can be used to build the budget. A budget template that is printable is the best option if you’re searching for the simplest method to track and create your budget.

You can easily locate budget sheets that can be printed online. You can find them either for free or at an affordable cost. When you have found a template you would like to use, all you need to do is print it and begin tracking your expenditure.

Budgeting shouldn’t be a hassle. With just a little effort and a little planning you can get your finances under control in no time.

What Are The Reasons You Should Have A Budget?

There are several reasons why individuals and households should have budgets. A budget can be utilized to monitor your spending habits and help you save money, which can help with financial decisions. You can utilize a budget to help you keep track of your financial goals.

Making a budget is simple and can be done using various methods using pencils and paper, a spreadsheet, or personal financial software. Being honest about your income and expenses is the most important element of making the budget. You should stick to your budget in order to improve your financial condition.

Related For Budget Spreadsheet With Pie Chart Template

How Do You Use A Budget

Your budget is an essential tool for managing your finances. Tracking your income and spending will enable you to make informed choices on the best way to allocate your funds. While it may be difficult to plan your budget but with a little planning and effort , it’s feasible to stick to your budget.

Here are some suggestions on how to use a budget.

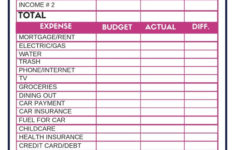

- Find out your income and expenses. In order to create a budget, you must first track your income. This will provide you with an understanding of where your funds are going.

- The importance of setting realistic goals is. It is possible to set reasonable goals for savings and spending once you’ve got an accurate picture of where your money is going. Make sure to factor in the cost of variable items, like food and gas, to ensure that you don’t overspend on other purchases.

- Stay on track.

Be Aware Of Your Development

Making a budget is the initial step in getting control of your finances. Once you’ve set up the budget, it’s crucial to keep track of your progress and ensure that you adhere to the plan. This can be accomplished in many ways.

A tool that tracks your spending can be used to keep track of your budget. These apps connect to your bank account and monitor your expenditure automatically. They can also assist you in setting the budget and track your progress in time.

A pen or spreadsheet, or a piece of paper are another way to keep track of your performance. Although this method requires longer to complete, it’s equally effective as an app. Simply record your income and expenses for each month, and then evaluate your actual expenditure with your budgeted amounts. This will help you see what areas you should cut back or make adjustments.

Budget Spreadsheet With Pie Chart Template

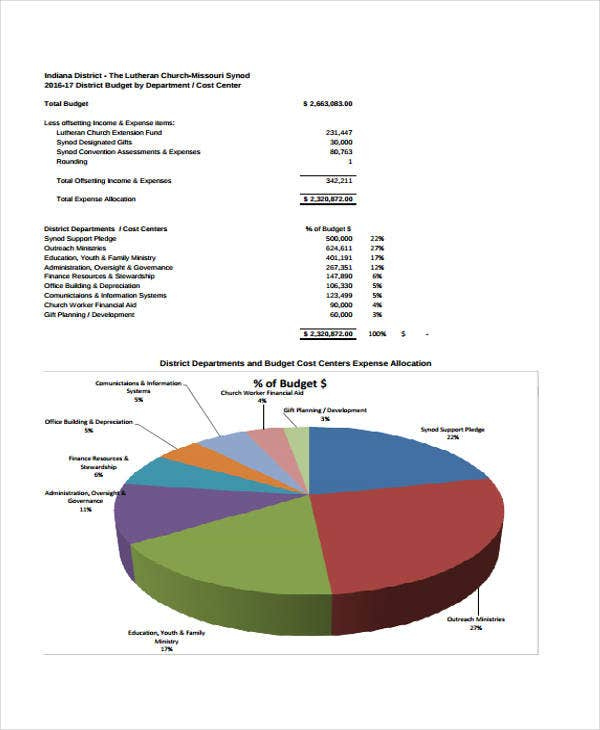

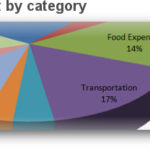

40 Free Chart Templates Free Premium Templates

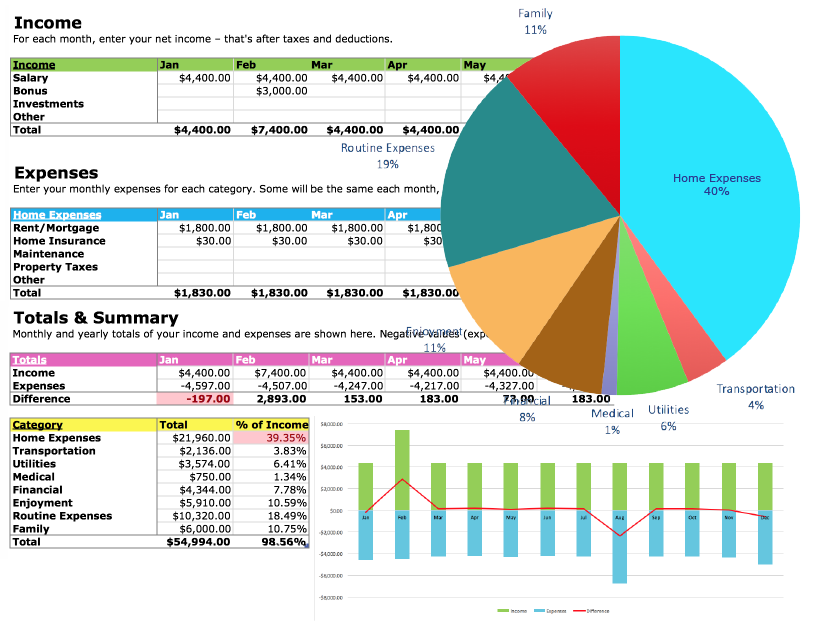

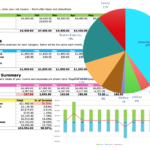

Track Your Money With The Free Budget Spreadsheet 2022 Squawkfox

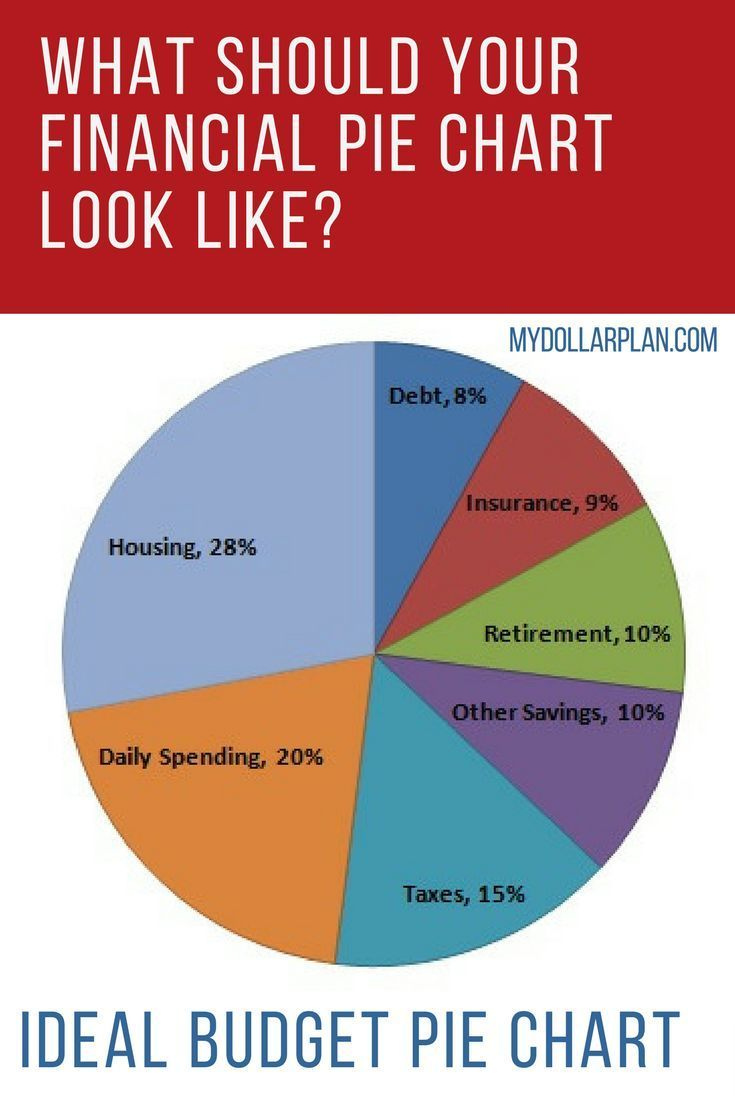

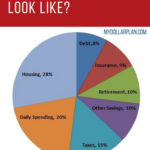

What Should Your Financial Pie Chart Look Like Budgeting Financial

The Benefits Of Budgeting

The task of budgeting might seem like a tedious task, but it’s an essential element to ensure financial stability. Budgeting allows you to track your spending, set aside money for savings or emergency money, and make adjustments according to the need.

While it may take some time to be comfortable making and adhering to a budget, the benefits are worth the effort. A budget can help you pay off debts, save money for long-term goals, and help you avoid financial issues further down the line.

There are numerous sources to help you make a budget that suits your requirements. Financial success is possible when you begin to budget.