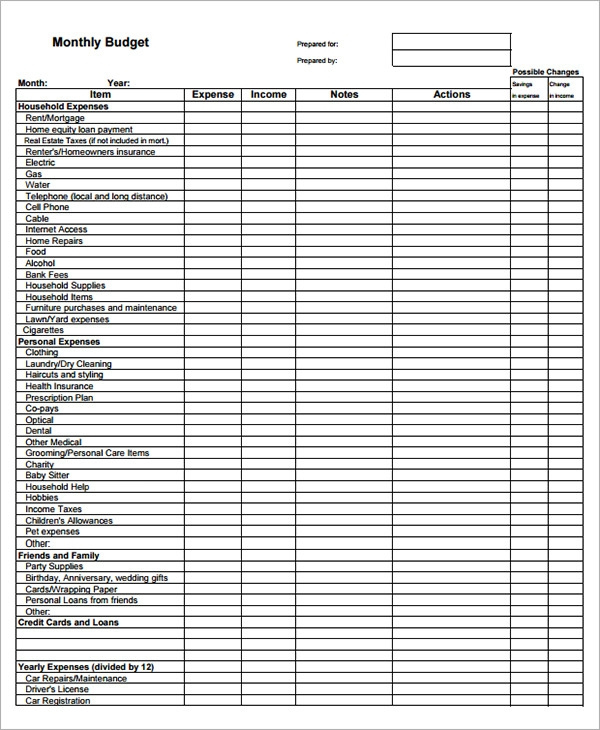

FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets

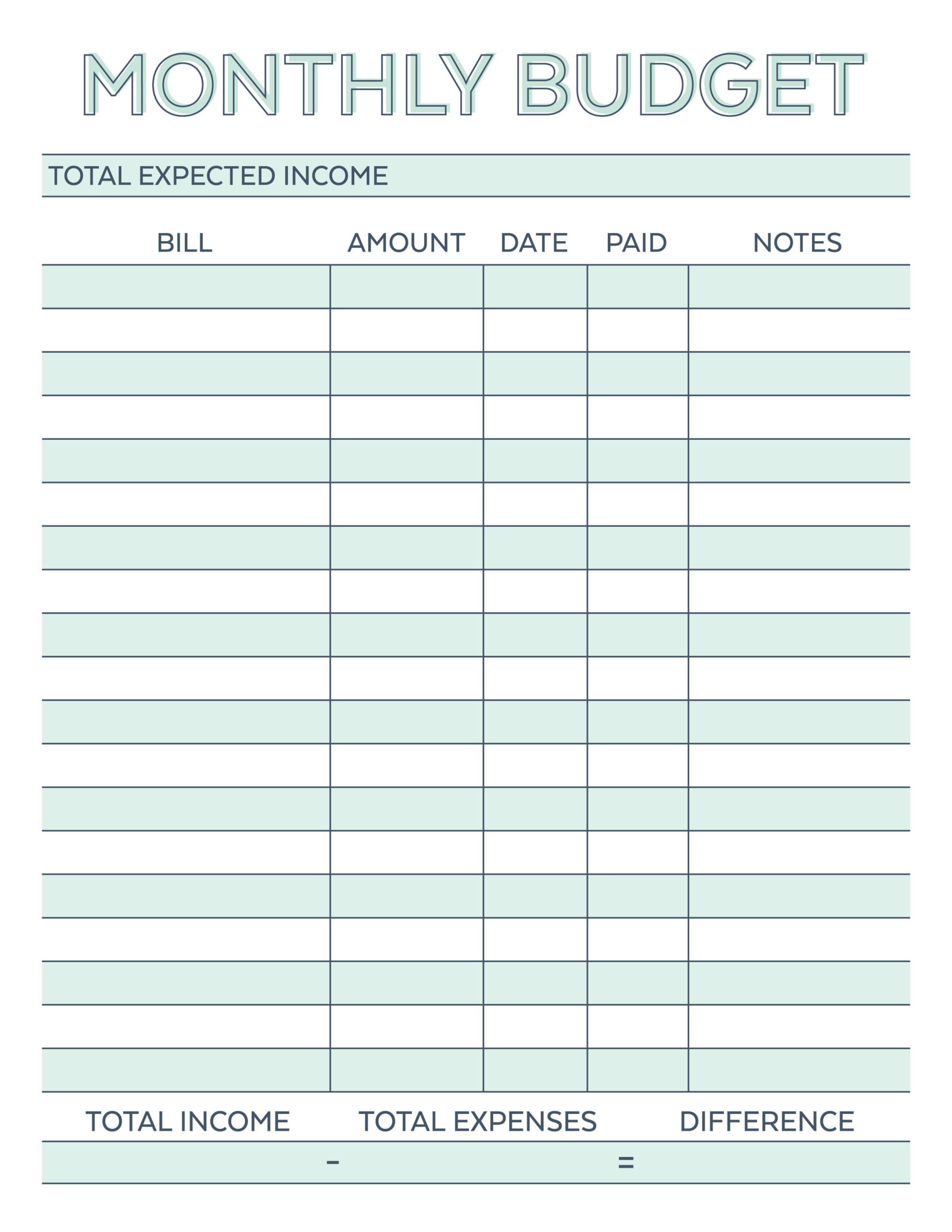

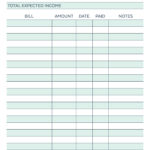

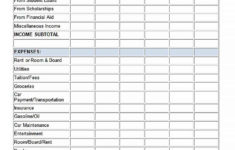

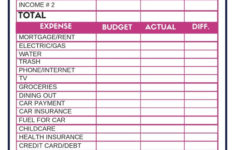

Free Monthly Budgeting Worksheet

Free Monthly Budgeting Worksheet – A budget is essential when you want to manage your financial affairs. The best method to keep track of your budget is to use the use of a printable. You can use printable budget sheets to help remain on track and organized.

There are numerous options for creating a budget. A spreadsheet, an app or software program can all be used to create your budget. But if you want the most efficient method to design and track your budget, then a printable budget sheet is the most effective option.

Printable budget sheets are widely available online. They can be downloaded free of charge or for an affordable cost. Once you find the right sheet, simply print it out and begin to track your spending.

It doesn’t have to be difficult. It’s just a matter of some planning to get your finances in order.

Why Should You Use A Budget?

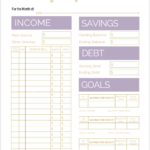

There are many reasons that households and individuals need to establish budgets. A budget can help you keep track of your savings and spending, which can help guide you to make educated financial decisions. You can use a budget to help you maintain a track of your financial objectives.

A budget can be created by following a few easy steps. You can use pencil or a spreadsheet to draft it. Being honest about your income and expenses is the most crucial aspect of establishing an effective budget. In order to improve your financial situation it is important to stick to the budget that you’ve established.

Related For Free Monthly Budgeting Worksheet

How To Use Your Budget

Budgets are a vital tool to manage your finances. Indicating your earnings and expenses will allow you to make informed decisions on how best to spend your money. Although budgeting can seem overwhelming but with a little planning and effort it is possible to adhere to your budget.

Here are some tips on ways to make use of a Budget:

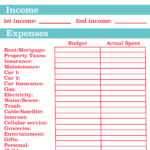

- Find out your earnings and expenses. To establish a budget, you must first track your income. This will provide you with a clear picture of where your funds are going.

- Setting realistic goals is essential. You can set realistic goals for saving and spending when you have an understanding of how much money you’re spending. So that you don’t overspend on other items, be sure to include variable expenses like food and gas.

- Stay on track.

You Can Monitor Your Performance

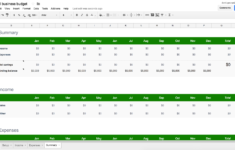

The process of setting a budget is the initial step in gaining financial control. Once you’ve created the budget, it’s vital to track your progress and make sure you adhere to the plan. This can be done in many ways.

You can make use of an app for budget tracking. These apps can be linked to your bank account to keep track of your spending and link to your bank account. They can also be used to create a budget, track your progress and keep you informed.

Another way to track your progress is using the spreadsheet, or pen and paper. Although this method requires more effort, it’s just as efficient as an application. Simply record your income every month, and then compare your expenditure to your budgeted amount. This will let you determine the areas in which you can cut down or adjust your spending accordingly.

Free Monthly Budgeting Worksheet

Monthly Budget Planner Free Printable Budget Worksheet

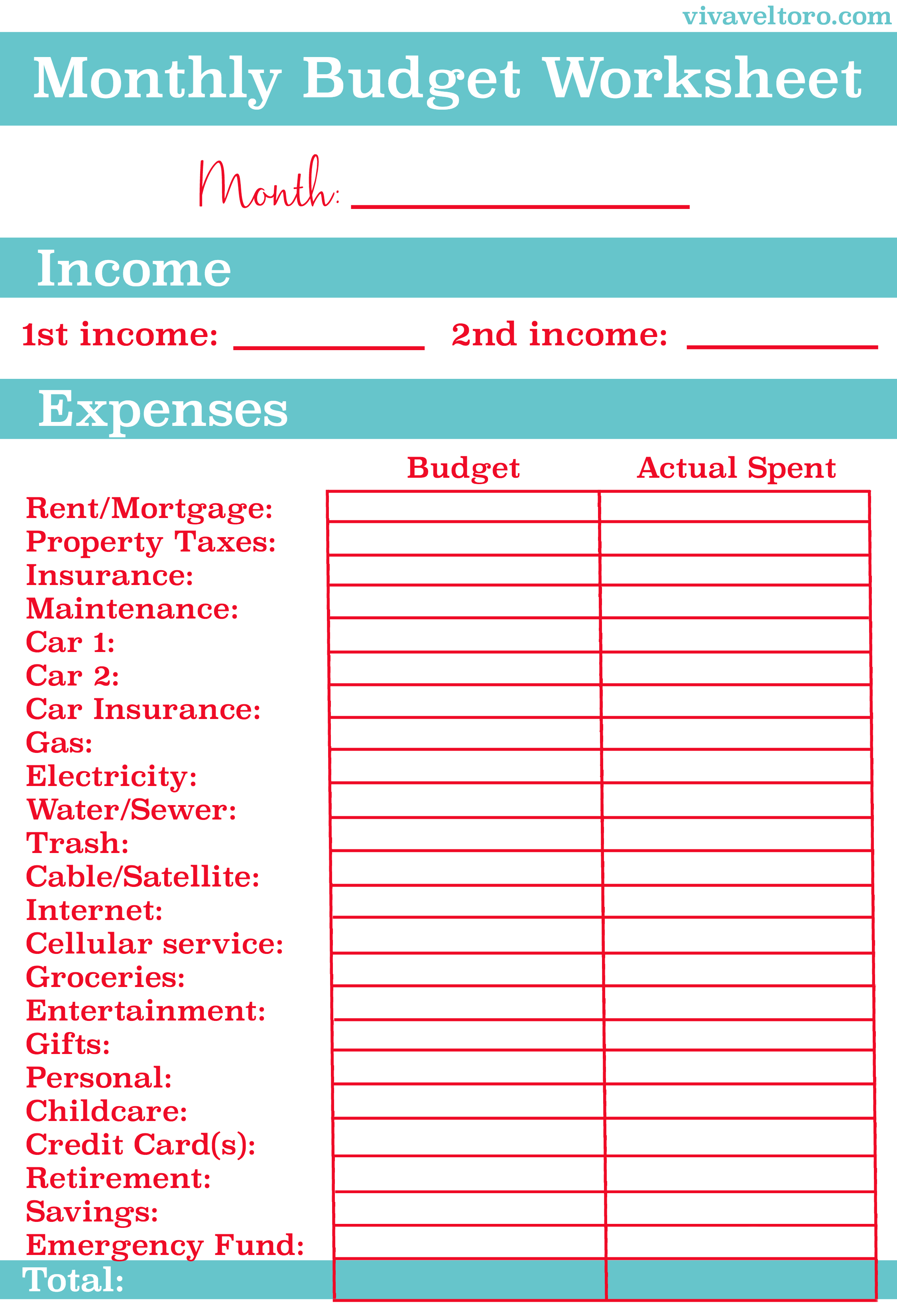

Monthly Budget Worksheet Free Printable Viva Veltoro

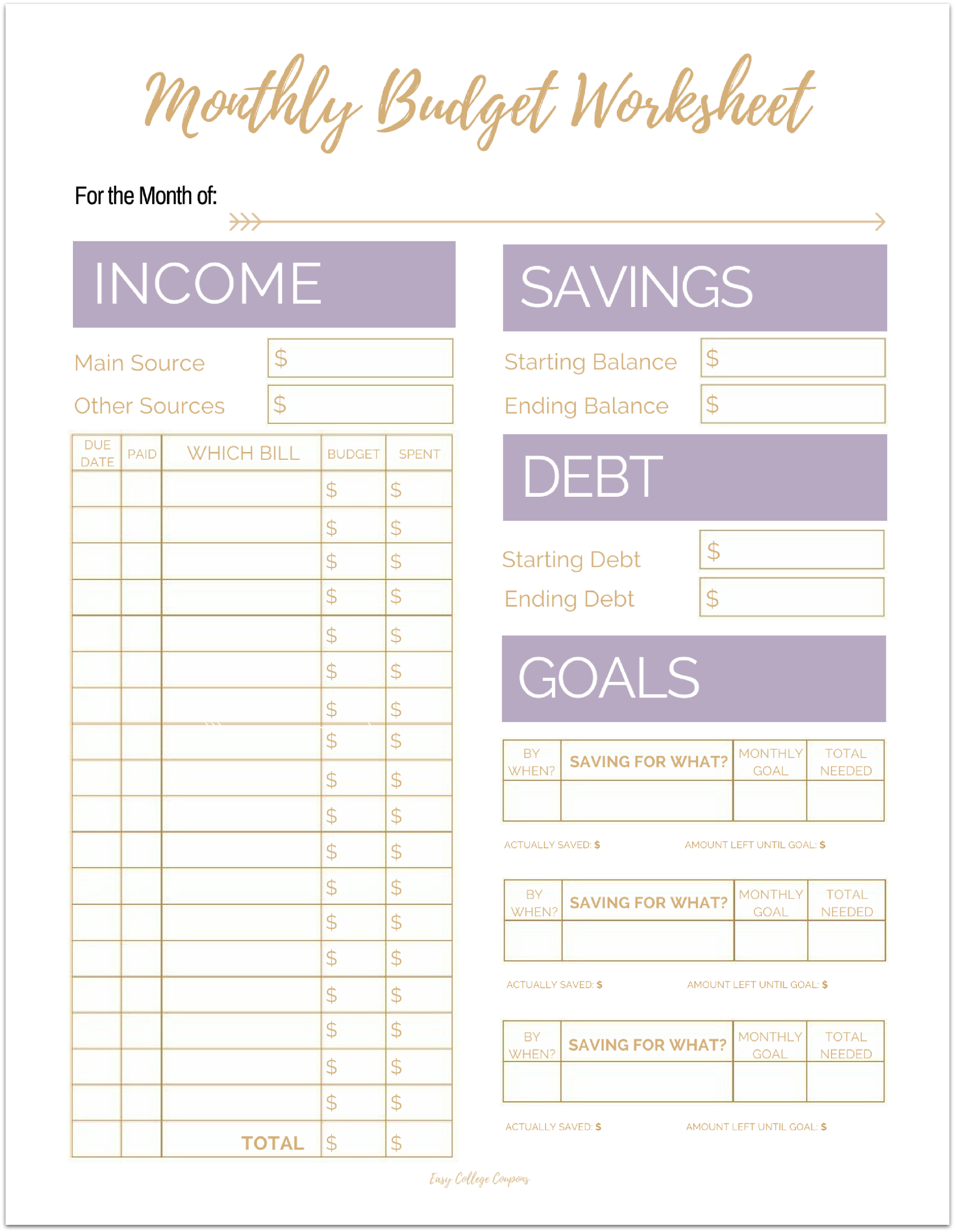

Free Printable Monthly Budget Template

The Benefits Of Budgeting

The process of budgeting can seem like an overwhelming job, but it’s an essential element to ensure financial stability. Budgeting allows you to monitor your spending, adjust in the event of a need, and save money for unexpected expenses and savings.

Although it can take some time to master the art of create and stick to your budget in a proper manner it is worth the effort. A budget can help you to reduce credit card debt, set aside money to fund long-term goals, and help you avoid financial problems down the line.

There are a myriad of sources that can assist you to create a budget that meets your needs. Once you’ve gotten into the habit of budgeting, you’ll be on the road towards financial success.