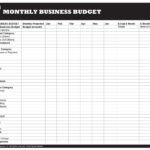

Small Business Budget Spreadsheet Pertaining To Business Expense

Free Budget Spreadsheet For Small Business

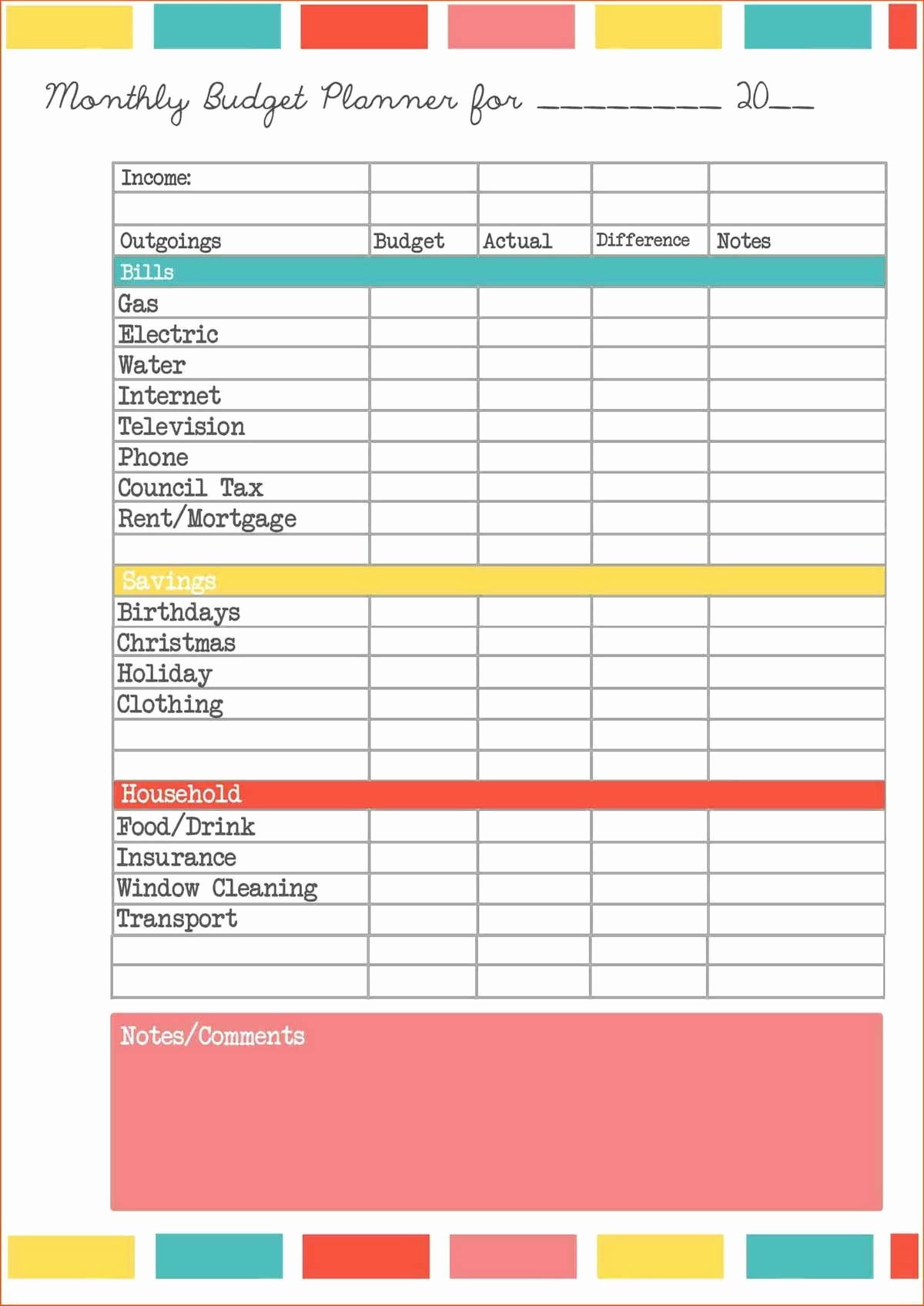

Free Budget Spreadsheet For Small Business – You need a budget to control your financials. A template for your budget is the best way for you to track your finances. Budget worksheets that you can print can help you stay organized and on track.

There are numerous ways to create budget. You can make use of a software program, an app or even an Excel spreadsheet. However, if you’re looking for the most simple method of creating and track your budget, then a printable budget worksheet is the best option to choose.

Printable budget sheets are widely available on the internet. These budget sheets are available online free of charge or for an affordable cost. You can print the sheet you like and start tracking your expenditure once you’ve located the.

Budgeting doesn’t need to be a hassle. It takes little effort and some planning to put your finances in order.

What Are The Benefits Of Using A Budget To Help You Make Choices?

Budgets are important for a variety of reasons. The budget is a way to track your spending and reduce expenses, which will aid you in making financial choices. A budget can be used to help you keep track of your financial objectives.

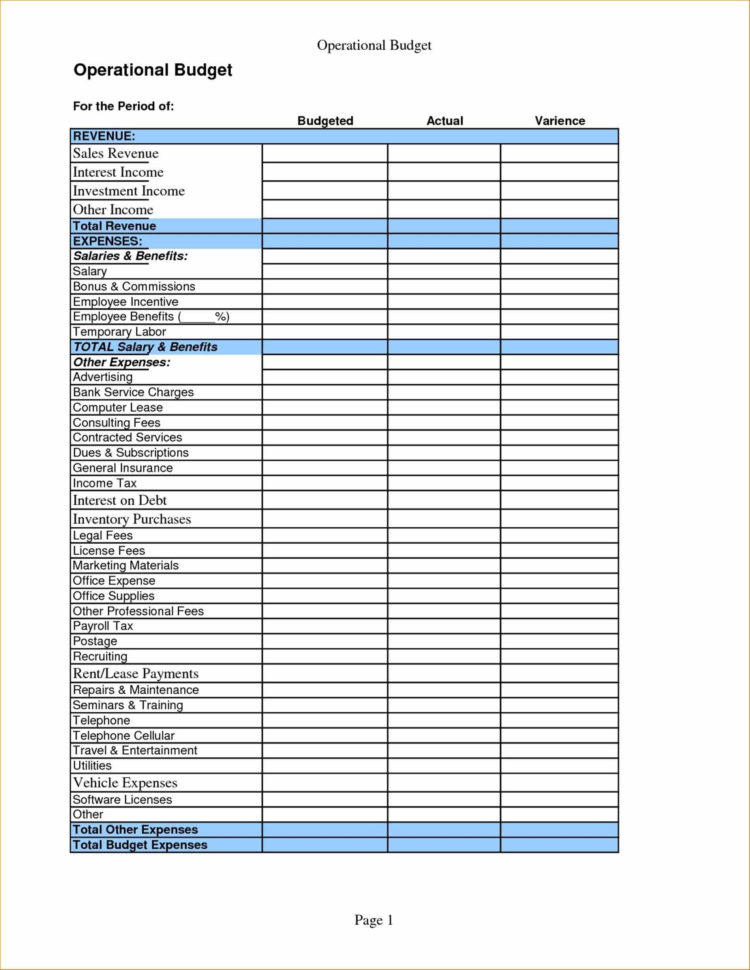

The process of creating a budget can be accomplished in just a few steps. You can use an excel spreadsheet or pencil to draw the budget. Being truthful about your earnings and expenses is the primary aspect of creating the budget. You must stick to your budget in order to increase your financial standing.

Related For Free Budget Spreadsheet For Small Business

How To Make The Most Of Your Budget

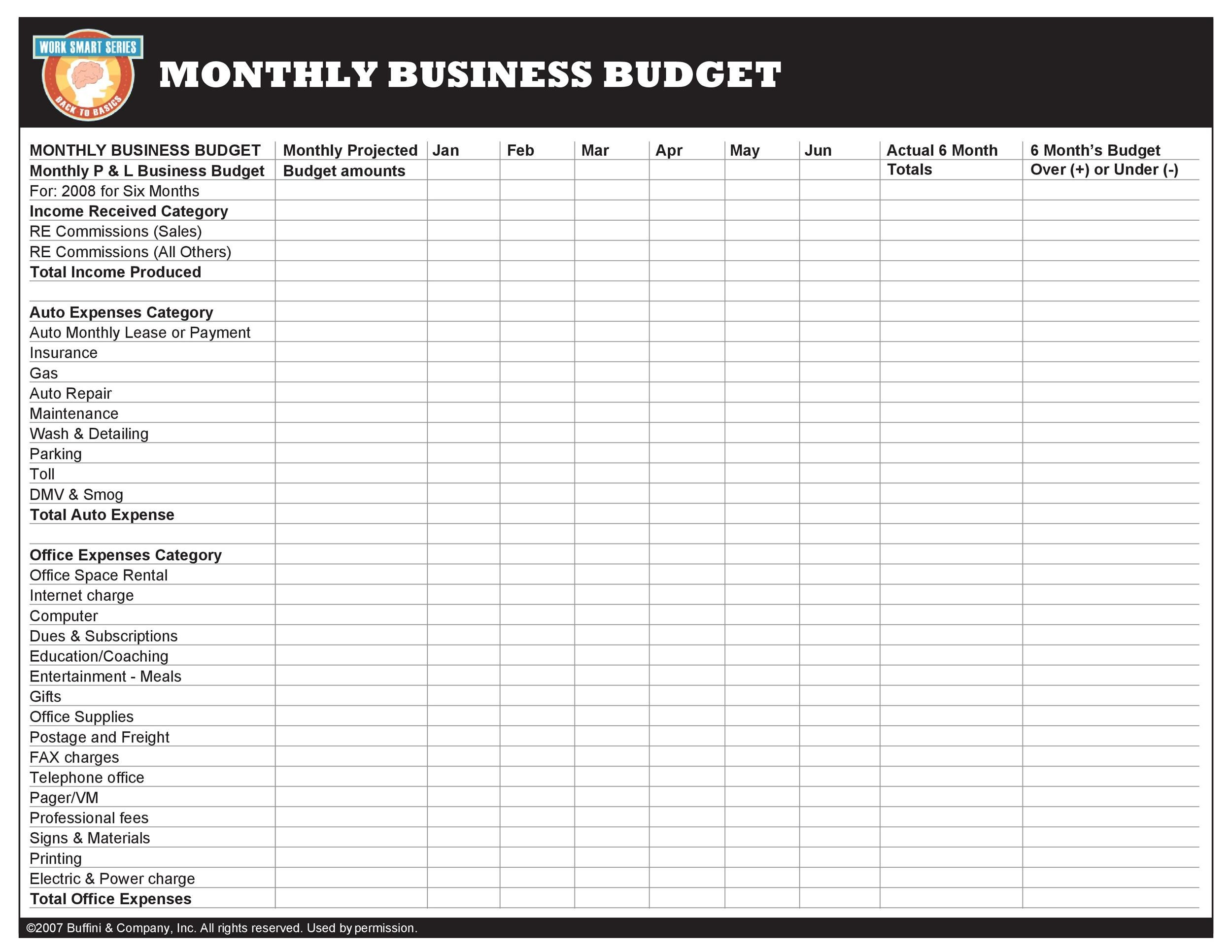

Budgets are a vital tool to manage your finances. Tracking your income and spending can help you make educated choices about how to allocate your funds. While budgeting may seem daunting but with a little planning and effort it is possible to stay within your budget.

Here are some ideas to use a budget

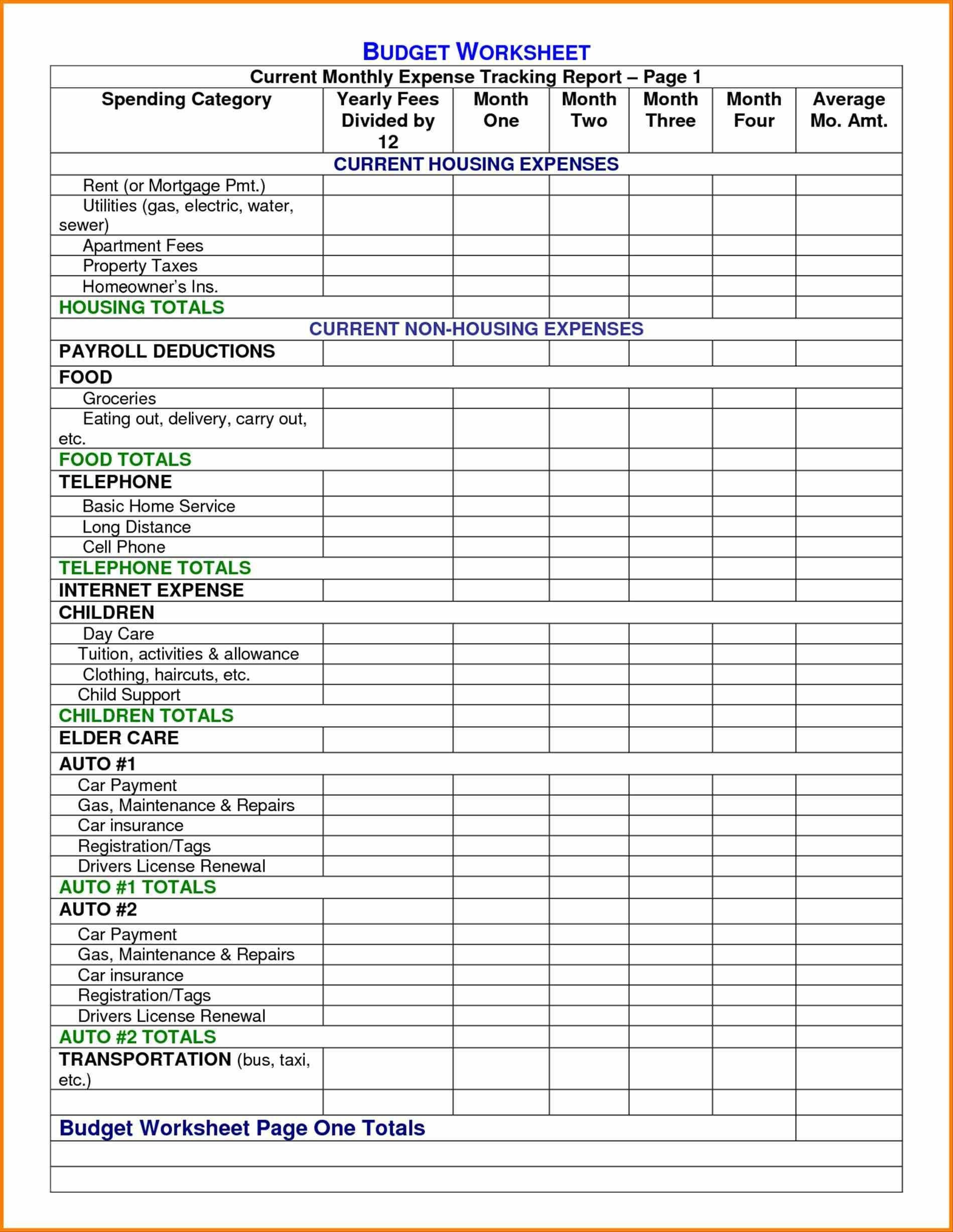

- Calculate your expenses and income. The first step in creating a budget is to track your earnings and expenses. This will enable you to see where your money is going.

- It is important to set realistic goals. Realistic goals can be set after you have a clear understanding of where your money is going. To ensure that you don’t spend too much on other purchases, be sure to account for variable costs like gas and groceries.

- Keep your eyes on the right direction.

You Can Track Your Development

A budget is the first step towards controlling your finances. But once you have an established budget, you must to track your progress to ensure that you are adhering to it. This can be accomplished through a variety of ways.

An app that keeps track of your expenditure can be used to manage your budget. These apps connect to your bank account so you can monitor your spending. The apps let you establish a budget, and then track your progress over period of.

Another way to track your progress is by using either a spreadsheet or pen with paper. This method requires some manual work, but it can be just as effective as using an app. Enter your monthly earnings and expenses for the month, then compare your actual spending to your budgeted amounts. This will help you see where you may need to cut back or make adjustments.

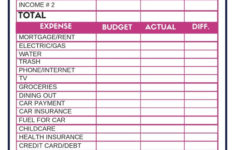

Free Budget Spreadsheet For Small Business

Small Business Budget Template Excel Free New Excel Pany Bud In Small

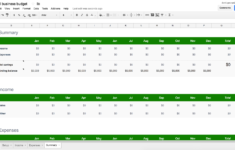

37 Handy Business Budget Templates Excel Google Sheets TemplateLab

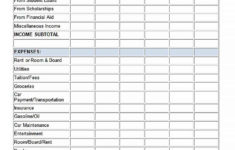

Small Business Budget Templates Db excel

The Benefits Of Budgeting

While budgeting may seem a chore yet it’s an essential step to financial stability. It is possible to track your spending and reserve money to save and for emergency needs. Then, you can make adjustments as necessary.

Although it takes some time to to develop and maintain an effective budget however, the rewards are worth it. A budget can allow you lower your debt, save money to meet long-term goals and avoid financial troubles at a later date.

If you’re not sure where to start, there are lots of resources that can help you prepare your budget. Financial success is possible when you start planning your budget.