37 Handy Business Budget Templates Excel Google Sheets TemplateLab

37 Handy Business Budget Templates Excel Google Sheets TemplateLab

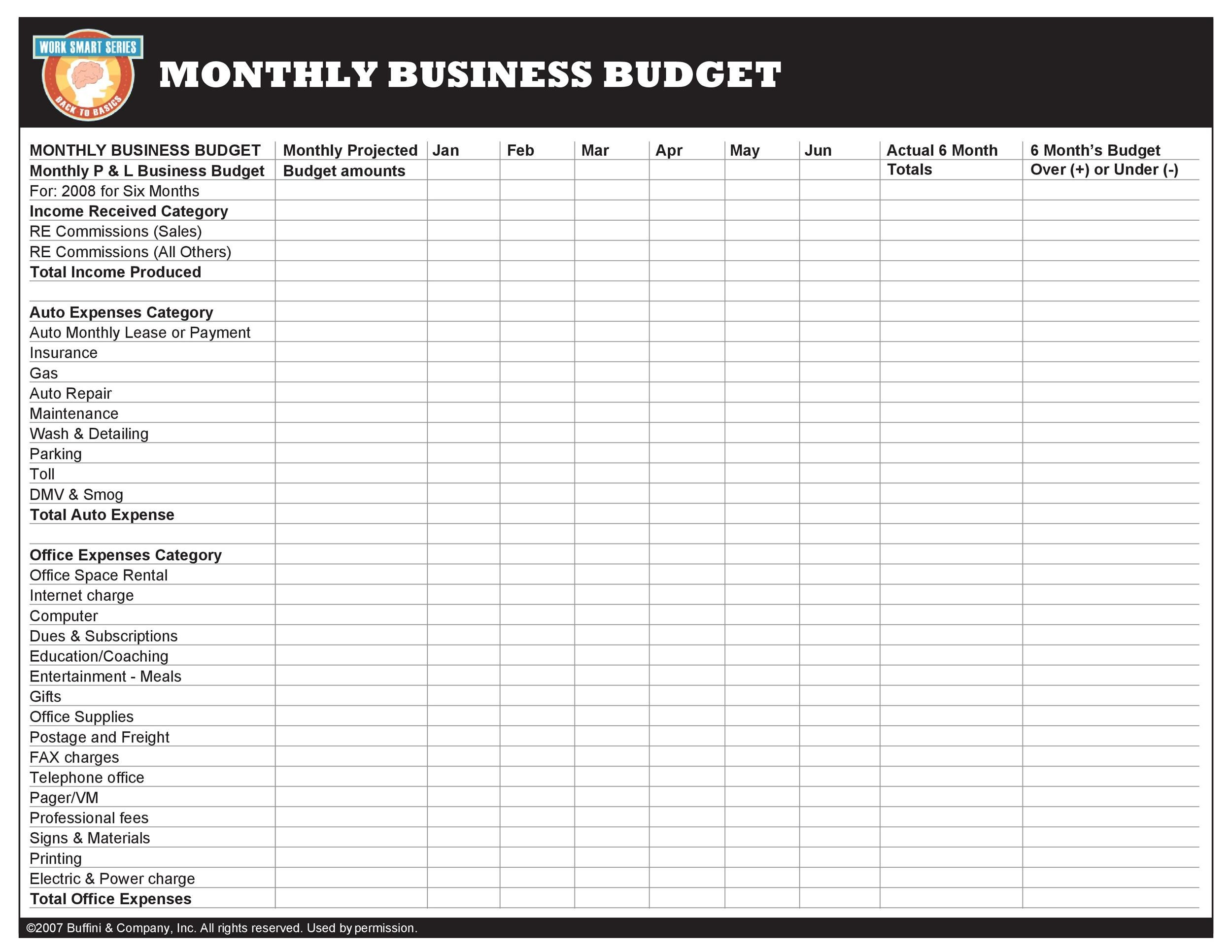

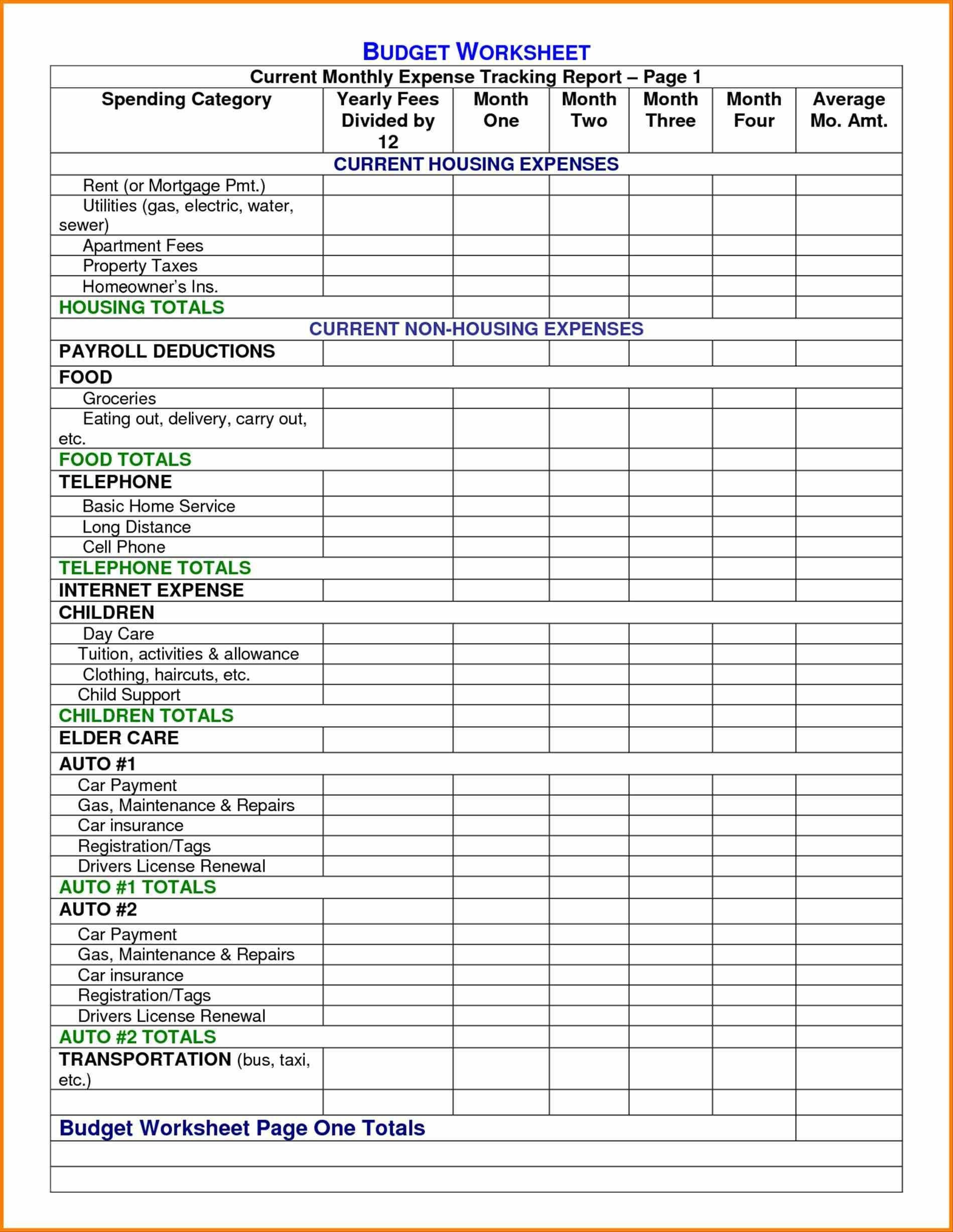

37 Handy Business Budget Templates Excel Google Sheets TemplateLab – If you’re looking to get your finances in order, you’ll need a budget. A printable budget template can help you to stay on track. Printable budget sheets can help you stay in order and on the right track.

There are many options to create a budget. It is possible to use a software program, an app or even a spreadsheet. However, if you’re looking for the easiest way to create and monitor your budget, a budget worksheet is the best option to choose.

You can easily find budget templates online. You can find them for free or for some cost. After you locate the appropriate sheet, simply create it and start tracking your expenses.

It doesn’t have to be difficult. It takes little effort and some planning to get your finances in order.

Why Do You Need An Budget?

A budget is essential due to a number of reasons. It helps you monitor your expenditure and savings and can assist you in making informed financial decisions. A budget can also help you remain on track with your financial goals and targets.

It’s simple to come up with budgets. The most important aspect to consider when making an effective budget is to be honest about the amount of money you earn and what you spend. You must stick to your budget in order to enhance your financial position.

Related For Free Budget Spreadsheet For Small Business

How To Utilize A Budget

Budgets are a vital instrument to control your finances. Indicating your earnings and expenses will allow you to make informed decisions on how best to allocate your funds. Although budgeting can seem overwhelming, with some planning and effort , it’s possible to adhere to your budget.

Here are some suggestions on how to utilize a budget.

- Find out your income and expenses. In order to create a budget, you should first record your earnings. This will let you determine where your money is spending.

- Create realistic goals. Once you have a clear picture of where your money is going then you can establish realistic goals in terms of saving and spending. It is important to consider the cost of variable items like gasoline and food so that you don’t overspend for other things.

- Keep your eyes on the right direction.

Tracking Your Progress

The first step toward financial control is to make the budget. To ensure you’re sticking to your budget, you need to track your improvements. There are numerous ways to do this.

A budget tracking app is available. These apps can be linked to your bank account so you can keep track of your spending. They also help you set your budget and keep track of your performance over time.

You could also track your progress by using pen, a spreadsheet, paper or notepad and pen. While this requires more manual work than an app, it can still be as effective. Input your expenses and income every month. Then , compare your actual spending with your budgeted amount. This will allow you to find areas that must be cut or altered.

Free Budget Spreadsheet For Small Business

Small Business Budget Templates Db excel

The Benefits Of Budgeting

The process of budgeting can seem like an intimidating task, however it’s a vital step to ensure your financial stability. A budget lets you track your spending, set aside funds for savings as well as emergency money, and make adjustments whenever needed.

While it might take time to become comfortable with setting up and sticking to budgets, the results are worth the effort. A budget can allow you lower your the amount of debt you have, and save for your long-term goals and prevent financial issues at a later date.

If you’re unsure of where to begin, there’s plenty of resources available to help you create a budget that works for you. You’ll soon be able manage your finances effectively and have financial success.