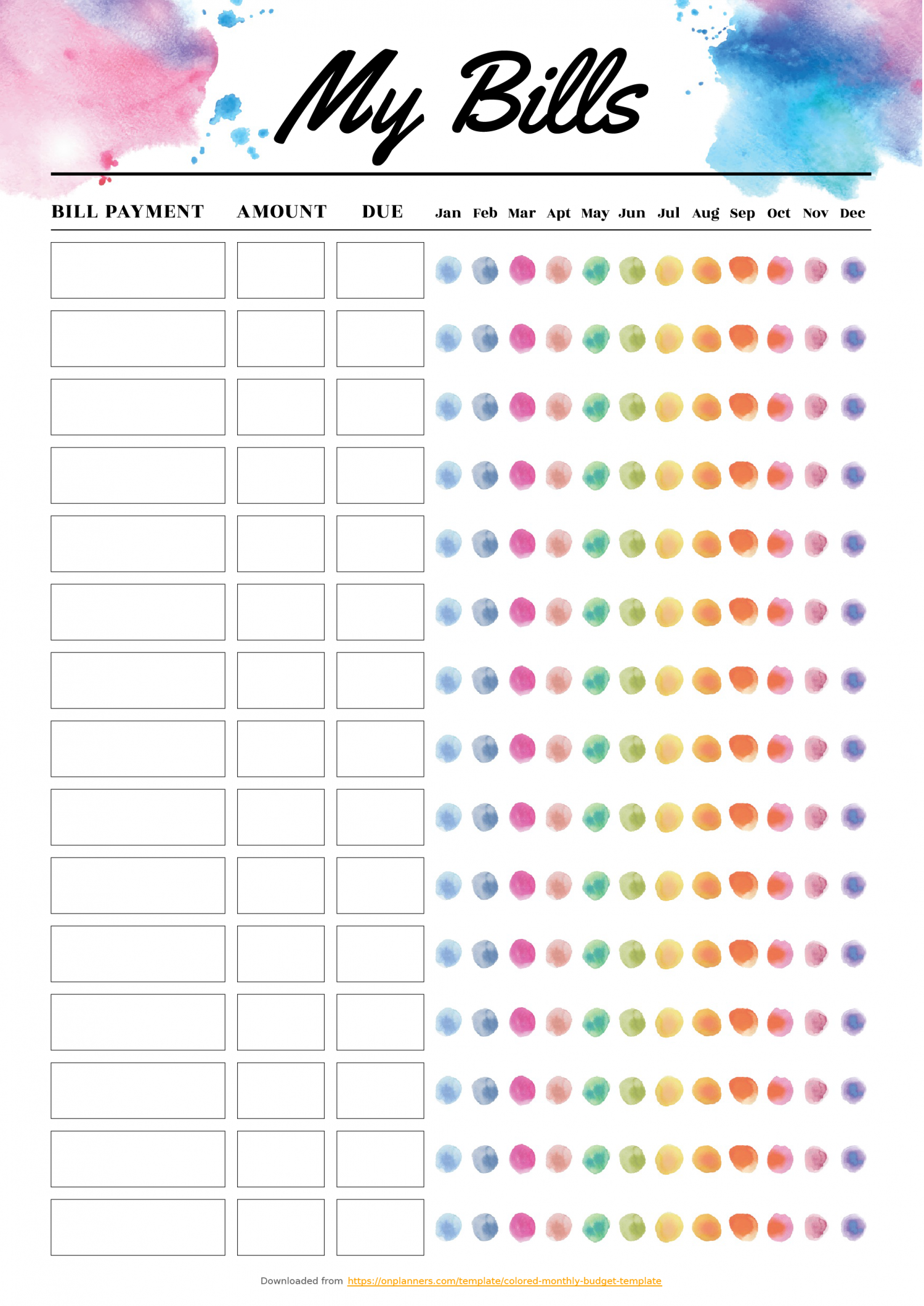

Free Printable Colored Monthly Budget Template PDF Download

Free Printable Colored Monthly Budget Template PDF Download

Free Printable Colored Monthly Budget Template PDF Download – You need a budget for managing your finances. A printable budget template is the most effective way for you to stay on track. The printable budget sheets can keep you organized.

There are many different ways to set up budget. There are many different ways to create a budget. You can use an app, program or a spreadsheet. A budget worksheet that you can print is best if you are looking for the simplest method to create and track your budget.

On the web, you can download many printable budget sheets. These budget sheets are available online without cost or at a small cost. You can print the sheet you like, and then begin to track your expenditure once you’ve located it.

It doesn’t have to be difficult. With a little effort and some preparation it is possible to get your finances under control in no time.

Why Do You Need A Budget?

A budget is important due to a number of reasons. It helps you monitor your expenditure and savings that can aid you to make educated financial choices. You can utilize a budget to help you monitor your financial objectives.

Budgeting is simple and can be completed by using a variety such as pencil and paper, spreadsheets, or personal finance software. Being truthful about your earnings and expenses is the most crucial aspect of creating an effective budget. To improve your financial position, you should stick to the budget that you’ve established.

Related For Free Monthly Budget Template Editable

How Do You Use The Budget

Your budget is an essential tool in managing your finances. Through tracking your earnings and expenses, you are able to make educated decisions on how you can best utilize your money. While budgeting may seem daunting but with a little planning and work, it’s possible to stay within your budget.

Here are some suggestions for using a budget:

- Calculate your expenses and income. Monitoring your expenses and income is the initial step to formulating budget. This will help you to determine where your money is going.

- Set realistic goals. The most realistic goals can be established once you’ve figured out where your money is going. Be sure to include variables like gas and groceries to ensure you don’t waste money on other things.

- Stay on track.

You Can Track Your Progression

The first step to financial control is to make a budget. Once you have established the budget, it’s vital to track your progress and make sure you stick to it. There are many ways to do this.

The budget tracking app is available. These apps connect to your bank account so you can monitor your expenditure. The apps let you set up a budget and monitor your progress over duration of.

You can also keep track of your progress by using the spreadsheet, pen and paper or a notepad. Although this approach requires more effort, it’s similar to an application. Simply record your expenses and income for each month and then check your actual spending to your budgeted amounts. This will help you determine the areas in which you can cut back or make adjustments.

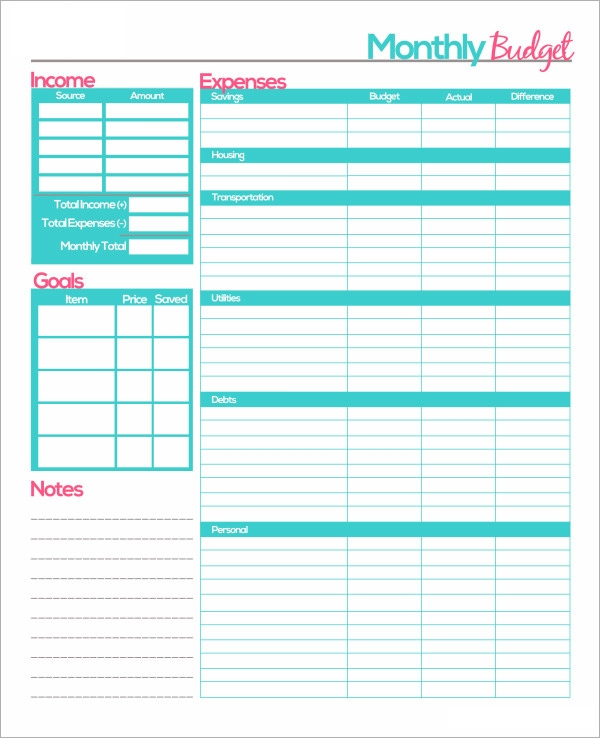

Free Monthly Budget Template Editable

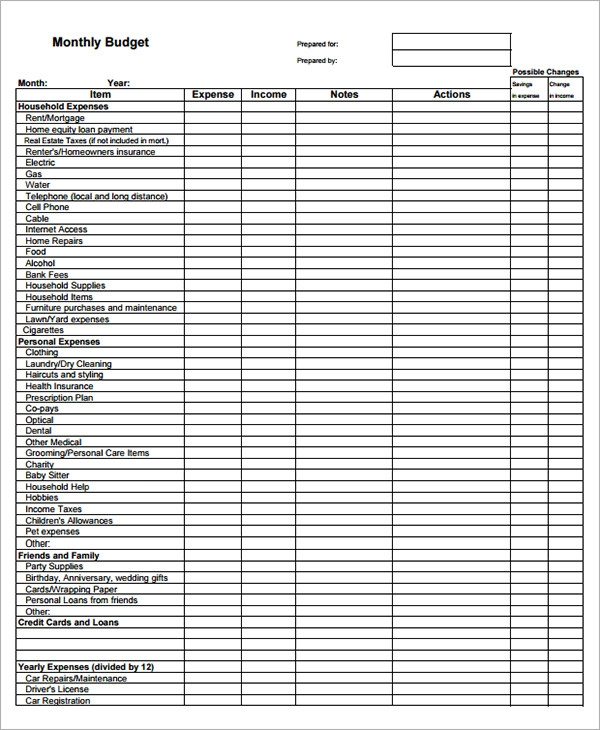

FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets

FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets

The Benefits Of Budgeting

Although budgeting can seem tedious, it is an essential step to financial stability. Budgeting allows you to manage your spending, put aside money for savings and emergency funds, and make adjustments as needed.

Although it can take some time to understand how to create and stick to your budget in a proper manner, the rewards are well worth it. A budget can assist you lower your debt, save money to fund long-term goals, and prevent financial issues later on.

There are a myriad of resources to help you create a budget that meets your requirements. Once you get in the habit of making a budget, you’ll be well on your way towards financial success.