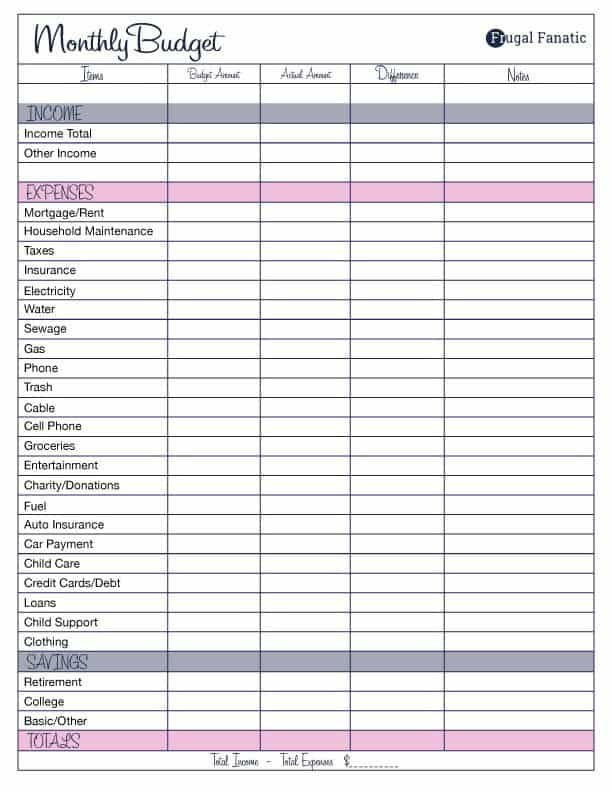

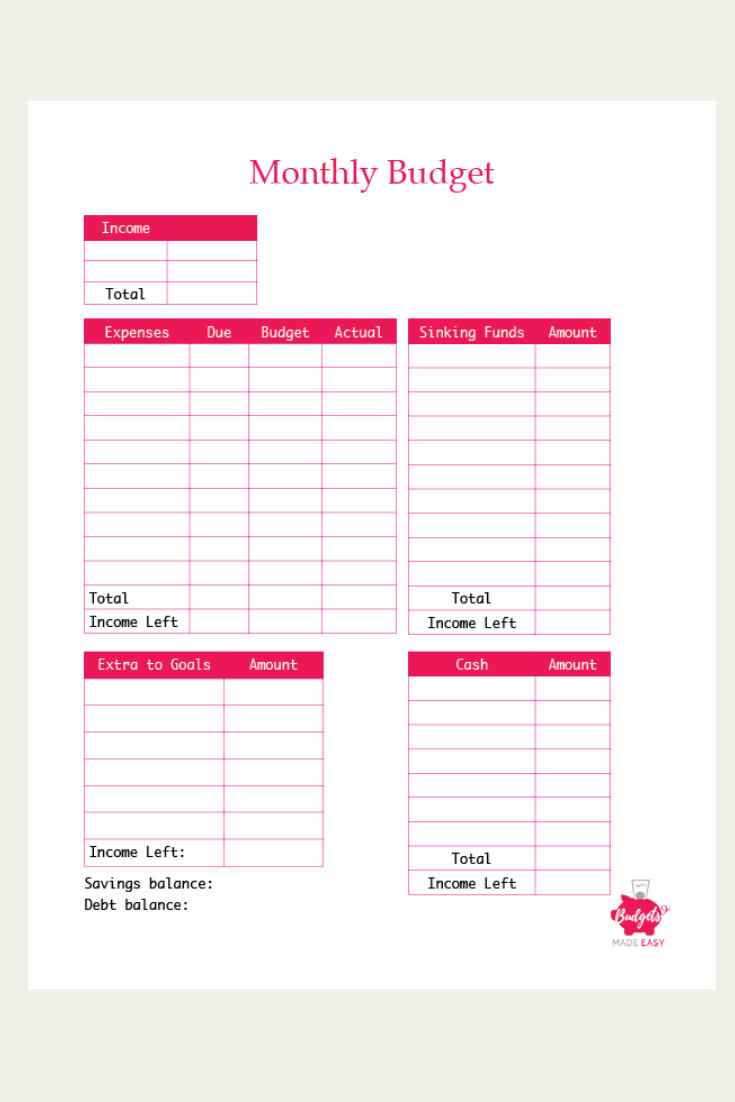

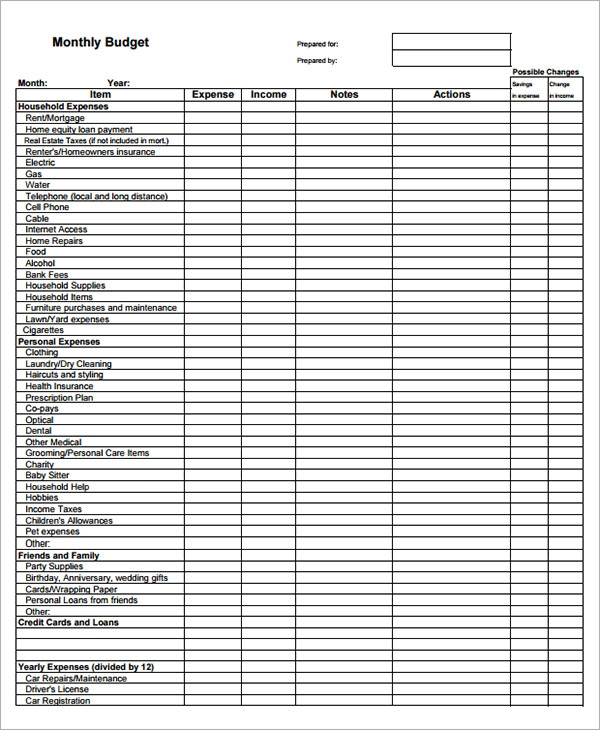

17 Brilliant And FREE Monthly Budget Template Printable You Need To Grab

Free Monthly Budget Templates Printable

Free Monthly Budget Templates Printable – If you’re looking to get your finances organized, you’ll need to create a budget. The best method to monitor your spending is with the use of a printable. Printing budget sheets to help you keep track of your spending and organize.

There are numerous ways to come up with a budget. There are many different ways to create a budget. You can make use of an app, a spreadsheet, or even a program. A budget worksheet that you can print is recommended if you’re looking for the easiest method to create and track your budget.

You can easily find budget templates on the internet. They are available online free of charge or for only a small fee. Once you’ve found the perfect sheet, you just need to create it and start tracking your spending.

It doesn’t have to be a hassle. It takes little effort and some planning to put your finances in order.

Why Do You Need To Use A Budget To Help You Make Choices?

A budget is crucial due to a number of reasons. A budget lets you keep track of your spending and savings, which can help you make better financial decisions. A budget can help you to keep track of your financial goals.

The process of creating a budget is easy to do with a variety of ways, including pencil and paper, a spreadsheet, or personal financial software. Being truthful about your earnings and expenses is the most crucial aspect of creating your budget. You should stick to your budget in order to improve your financial condition.

Related For Free Monthly Budget Templates Printable

How Do You Use The Budget

Your budget is an important tool to control your finances. You can track your income and expenses so that you can make informed decisions regarding how you spend your money. It can be a daunting task to budget, but with a little planning and work it is possible to adhere to a budget.

Here are some ideas on how you can make use of a budget:

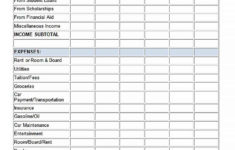

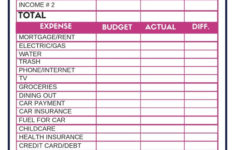

- Make a list of your income and expenses. The first step in creating a budget is to track your earnings and expenses. This will let you see where your money is spending.

- Create realistic goals. Once you have a clear picture of the direction your money is heading and what you are spending it on, you can set achievable goals in terms of saving and spending. Make sure to factor in variables like grocery and gas so that you don’t go over budget on other purchases.

- Keep on the right track.

Monitor Your Performance

Setting a budget is the first step in getting control of your finances. But once you have a budget, you need to track your progress to ensure that you are sticking to the plan. This can be accomplished through a variety of ways.

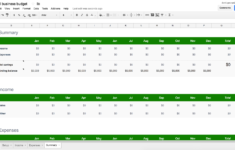

A budget tracking application is available. These apps link to your bank account, and keep track of your spending in real-time. The apps let you set up a budget and monitor your progress over period of.

You can also track your progress with pen, a spreadsheet, paper or notepad and pen. While this is more effort than an app, it could still be efficient. Simply input your income each month and compare your expenses to the budgeted amount. This will help you identify areas where you can reduce your spending or make adjustments.

Free Monthly Budget Templates Printable

The Most Effective Free Monthly Budget Templates That Will Help You

Printable Monthly Budget Template A Cultivated Nest

FREE 23 Sample Monthly Budget Templates In Google Docs Google Sheets

The Benefits Of Budgeting

Although budgeting may seem like an overwhelming task but it is vital for your financial stability. Budgeting allows you to monitor your spending, make adjustments as needed, and save money for unexpected expenses and savings.

While it may take some time to become comfortable with the process of creating and sticking to budgets, the rewards are worth the effort. A budget can help you pay off debt, save money for the long term, and even avoid financial difficulties further down the line.

If you’re unsure of where to start, there are lots of resources that will help you prepare a budget. Once you’ve got into the habit of planning your budget, you’ll be on the road towards financial success.