Monthly Budget Planner Excel Free Download Example Of Spreadshee

Monthly Budget Planner Excel Free Download Example Of Spreadshee

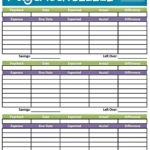

Monthly Budget Planner Excel Free Download Example Of Spreadshee – You need a budget to manage your finances. A budget template that you can print can help you to keep track. Printable budget sheets can help you stay in order and on the right track.

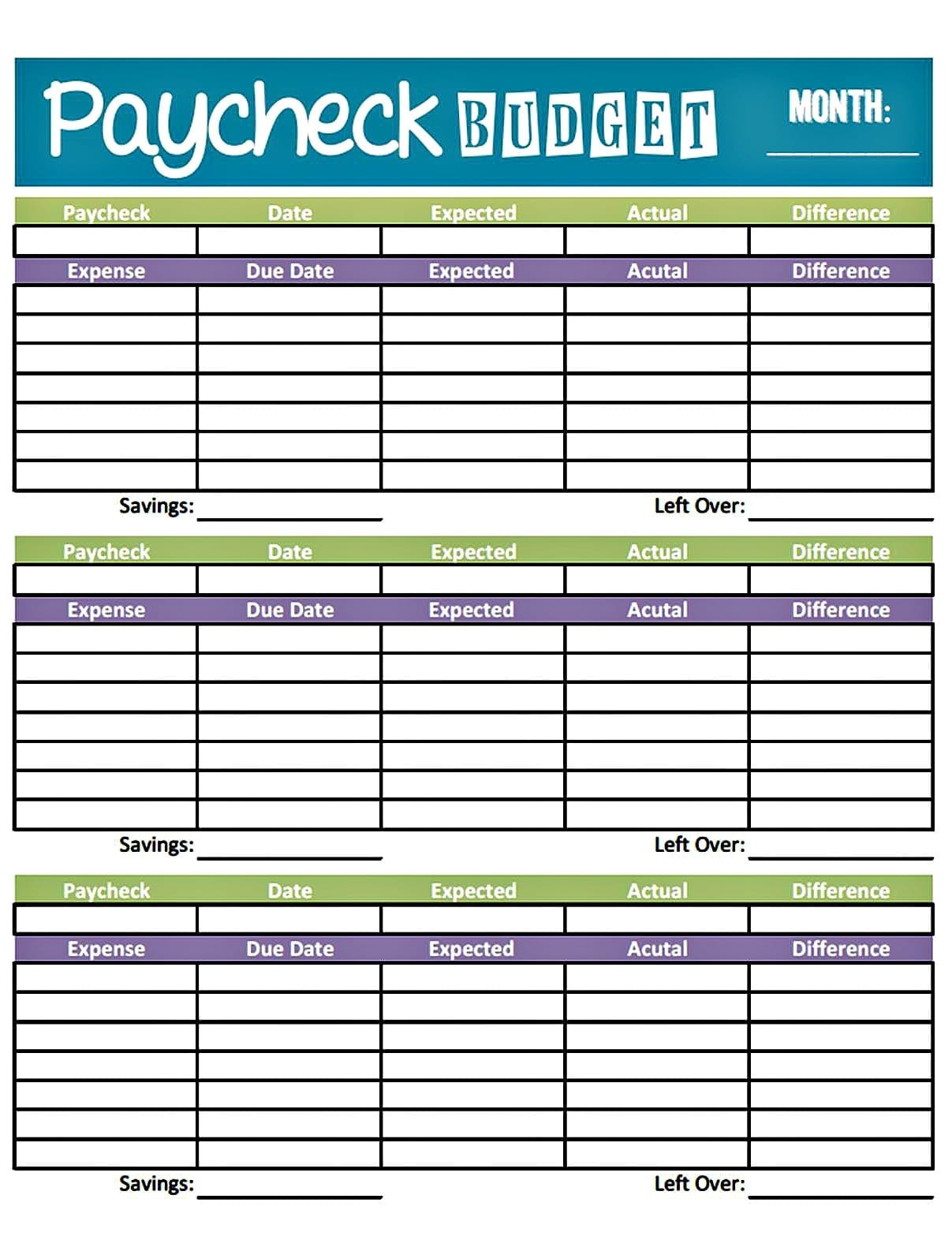

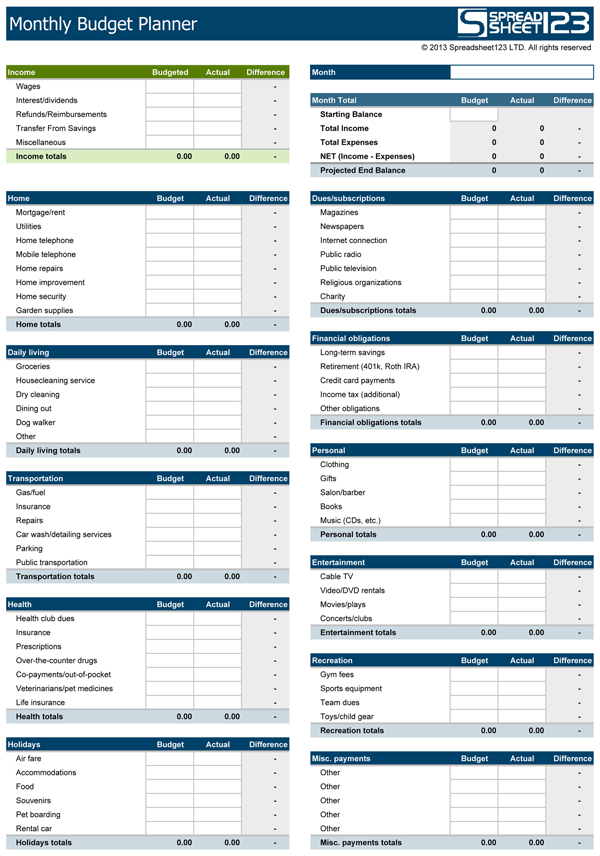

There are a myriad of methods to set up budget. There are many different ways to come up with an effective budget. It is possible to use an app, spreadsheet, or even a program. A printable budget sheet is the best option if you’re searching for the easiest way to keep track of and develop your budget.

Budget sheets for printables are readily available online. Budget sheets are available online without cost or at an affordable cost. Once you find the right sheet, you just need to print it out and begin to track your spending.

It doesn’t have to be complicated. It’s just a matter of some planning to put your finances in order.

What Is The Reason You Require A Budget?

A budget is essential for a variety of reasons. It allows you to keep track of your spending and savings as well as help you make better financial decisions. A budget can aid you remain on track with your financial objectives.

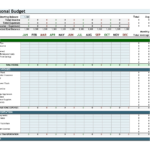

Budgets can be made in just a few steps. It is possible to use pencil or a spreadsheet to draw it. The most important part of making your budget is to be honest with yourself about the amount of money you earn and what you spend. After you’ve created your budget, adhere to it as strictly as you can to improve your financial position.

Related For Monthly Budget Worksheet Excel Free Download

How Do You Make Use Of Your Budget

Budgets are a crucial tool for managing your finances. It allows you to track your earnings and expenses in order to make well-informed decisions about how you allocate your funds. Although it can be overwhelming to budget however, with a bit of planning and work, it’s feasible to stick to your budget.

Here are some ideas to make use of a budget:

- Determine your expenses and income. Rectifying your expenses and income is the first step in setting up budget. This will help you gain a better understanding of where your money is.

- You should set reasonable goals. Set achievable goals for savings and spending after you have an idea of where your money will go. Make sure to factor in other expenses that aren’t fixed, like food and gas, to ensure that you don’t end up spending too much on other things.

- Keep your eyes on the right direction.

You Can Track Your Performance

The first step towards financial control is to make the budget. After you’ve established the budget, it’s essential to monitor your progress and make sure you stick to the plan. There are a variety of ways to do this.

An app that tracks your spending can help you manage your budget. These apps can be linked to your bank account, and keep track of your spending in real-time. They also aid you in setting your budget and monitor your growth over time.

Another method to monitor your progress is with either a spreadsheet or pen with paper. Although this takes more manual effort than apps, it can still be effective. Record your expenses and your income each month. Then compare the actual amount you spend with the budgeted amount. This will help you discern areas where you can cut back or make adjustments.

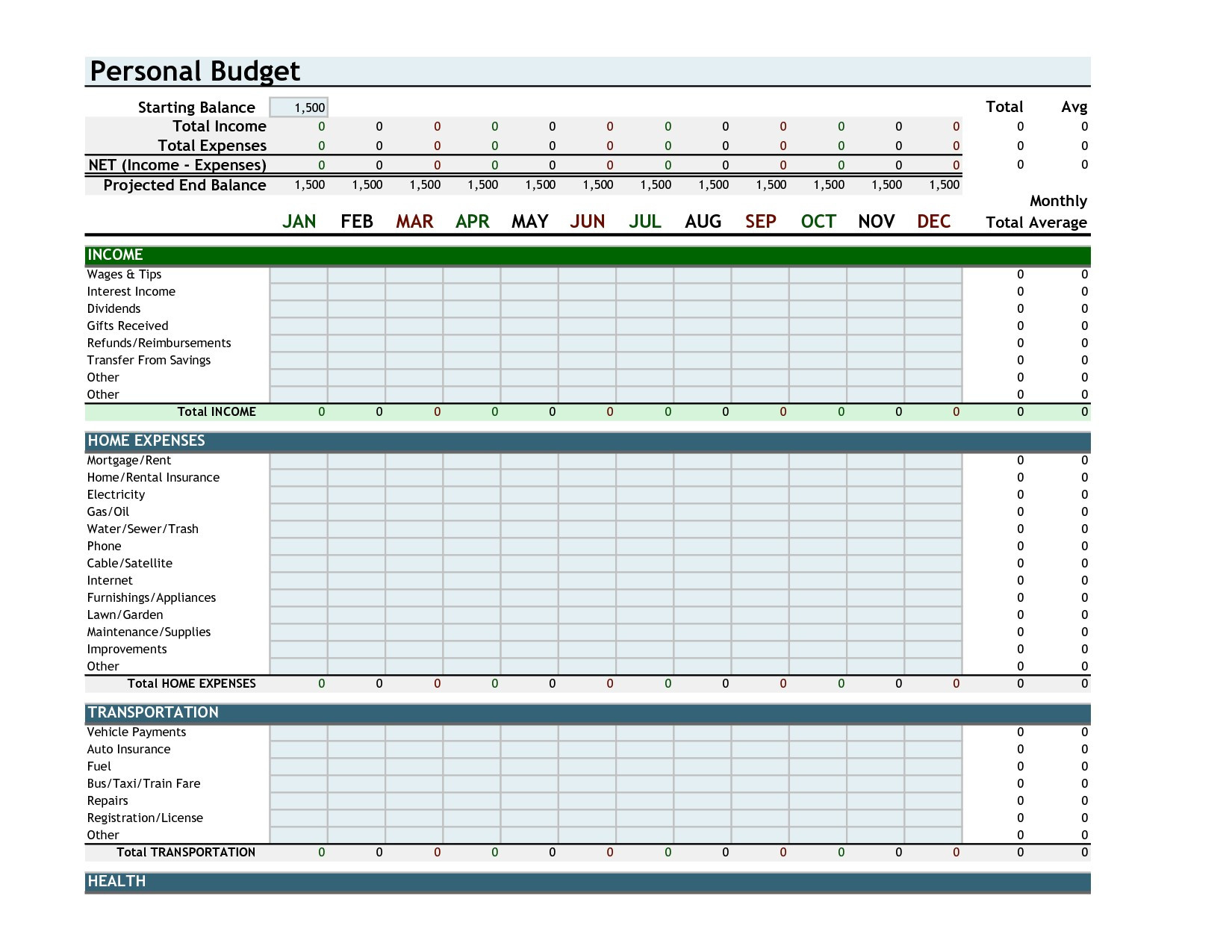

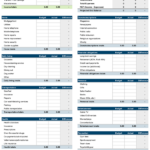

Monthly Budget Worksheet Excel Free Download

Monthly Home Budget Spreadsheet Easy Worksheet Excel Free Download

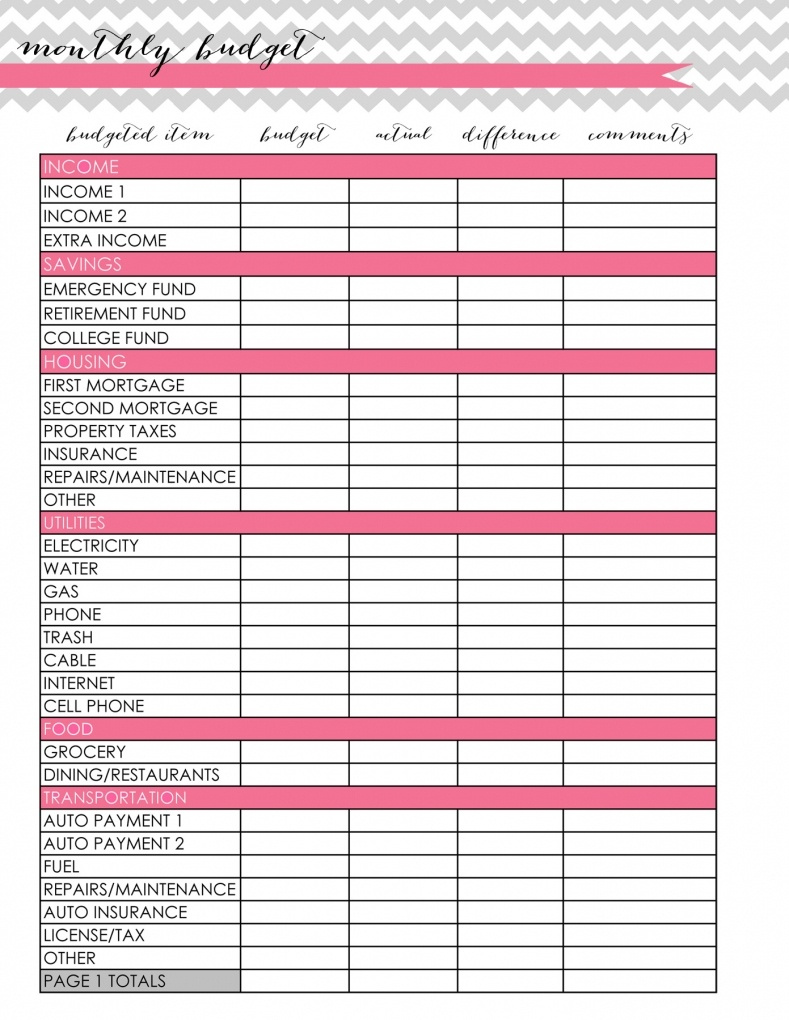

Monthly Budget Form Fillable Excelxo

Download A Free Monthly Budget Spreadsheet For Excel

The Benefits Of Budgeting

Although it can be a bit tedious, it is an essential step to financial stability. You can track your spending and put aside money to put aside for emergency purposes. You can then make any necessary adjustments.

It can take time for you to feel comfortable with creating and following a budget. But the advantages are worth it. A budget will help you pay off your debts, set aside funds to fund long-term goals, and even avoid financial difficulties down the road.

There are numerous resources that can help you prepare a budget that fits your needs. Once you’ve got into the habit of planning your budget, you’ll be on your way towards financial success.