Monthly Budget Planner Free Printable Worksheet Savor Savvy

Monthly Budget Planner Free Printable Worksheet Savor Savvy

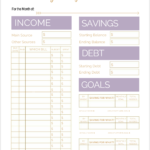

Monthly Budget Planner Free Printable Worksheet Savor Savvy – If you’re looking to have your finances organized, you’ll require to create a budget. The most efficient way to organize your spending is with the use of a printable. Budget sheets that are printable will help you stay organized and on track.

There are numerous options to create an effective budget. There are many ways to set up a budget. You can utilize an app, a software or spreadsheet. However, if you’re looking for the most straightforward method to make and monitor your budget, a printed budget worksheet is the best way to go.

On the internet, you can access many printable budget sheets. Budget sheets can be downloaded online either for free or at a small cost. After you locate the appropriate sheet, you just need to print it and begin tracking your expenditure.

Budgeting shouldn’t be difficult. With just a bit of effort and a little planning it is possible to get your finances in no time.

What Is The Reason You Require A Budget?

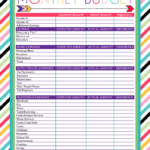

There are a variety of reasons why individuals and households should have the benefit of a budget. A budget helps you track your spending and savings that can aid you in making educated financial choices. A budget can assist you to keep track of your financial objectives.

The process of creating a budget is easy and can be accomplished by using a variety using pencils and paper, spreadsheets, or personal financial software. Being truthful about your earnings and expenses is the most important aspect of establishing an effective budget. You must stick to your budget to improve your financial condition.

Related For Monthly Budget Worksheet Printable

How To Use The Budget

Budgets are an essential instrument for managing your finances. Monitoring your spending and income will allow you to make informed choices about how to allocate your funds. Although it can be overwhelming to budget, with some planning and hard work it’s possible to stick to your budget.

Here are some suggestions for how you can make use of a budget:

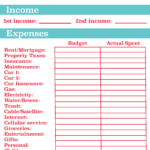

- Make sure you know your income and expenditures. To make a budget you should first record your income. This will provide you with an accurate picture of where your cash is going.

- Set realistic goals. When you are aware of the direction your money is heading and what you are spending it on, you can set realistic goals for savings and spending. It is important to consider other expenses that aren’t fixed, like grocery and gas so that you don’t go over budget on other purchases.

- Keep your eyes on the ball.

Tracking Your Progression

Setting a budget is the first step in getting control of your financial situation. However, once you’ve got an established budget, you must keep track of your progress in order to make sure you are adhering to it. There are a variety of ways to track your progress.

A tool that tracks your expenditure can be used to track your budget. These apps link to your bank account, and keep track of your spending on a regular basis. They can also be used to help you set up a budget, keep track of your progress, and keep you on track.

A spreadsheet or a pen and paper is another way to record your performance. While this will require more effort than an app, it can be just as effective. Enter your monthly earnings and expenses for the month, then compare your actual expenditure to your budgeted amounts. This will help you discover areas that should be cut or modified.

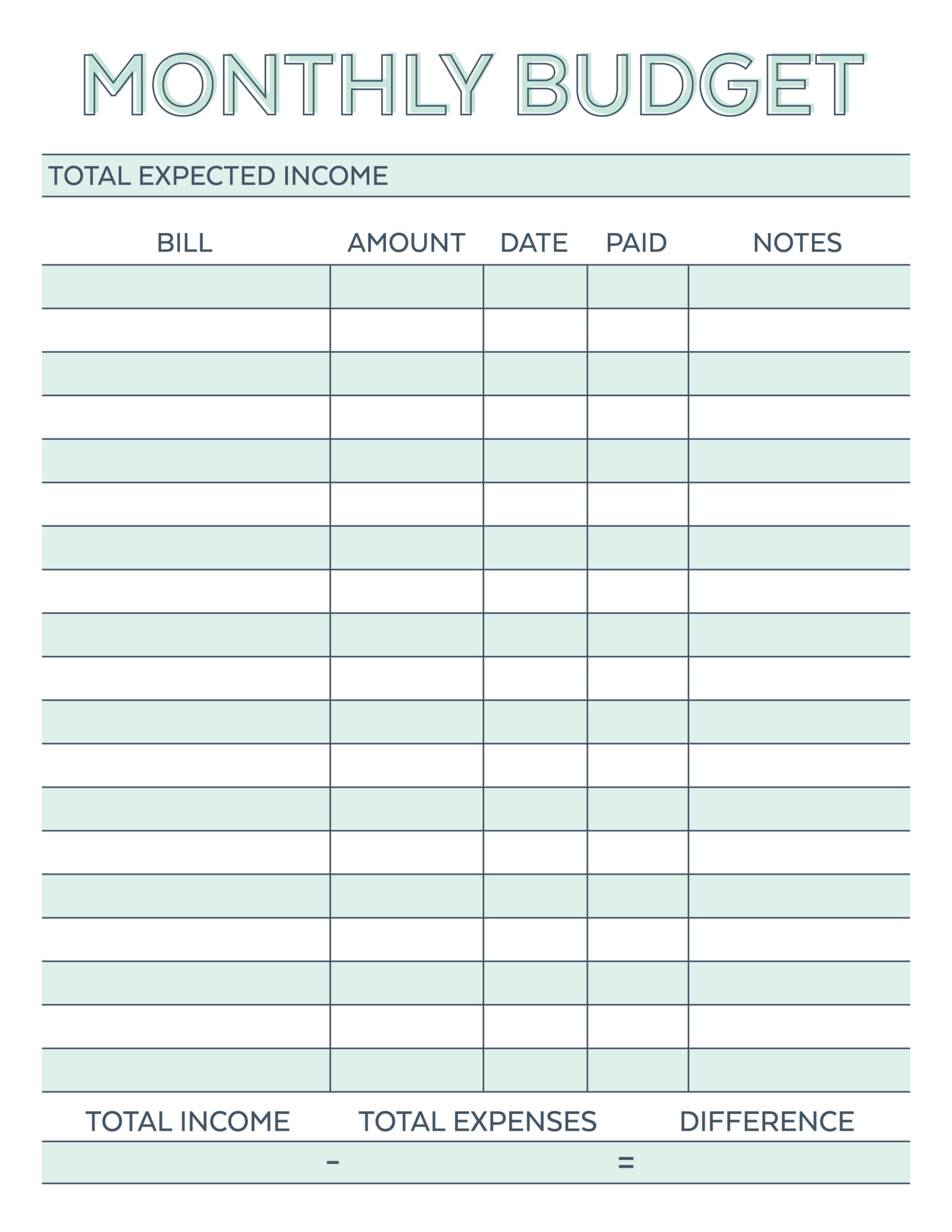

Monthly Budget Worksheet Printable

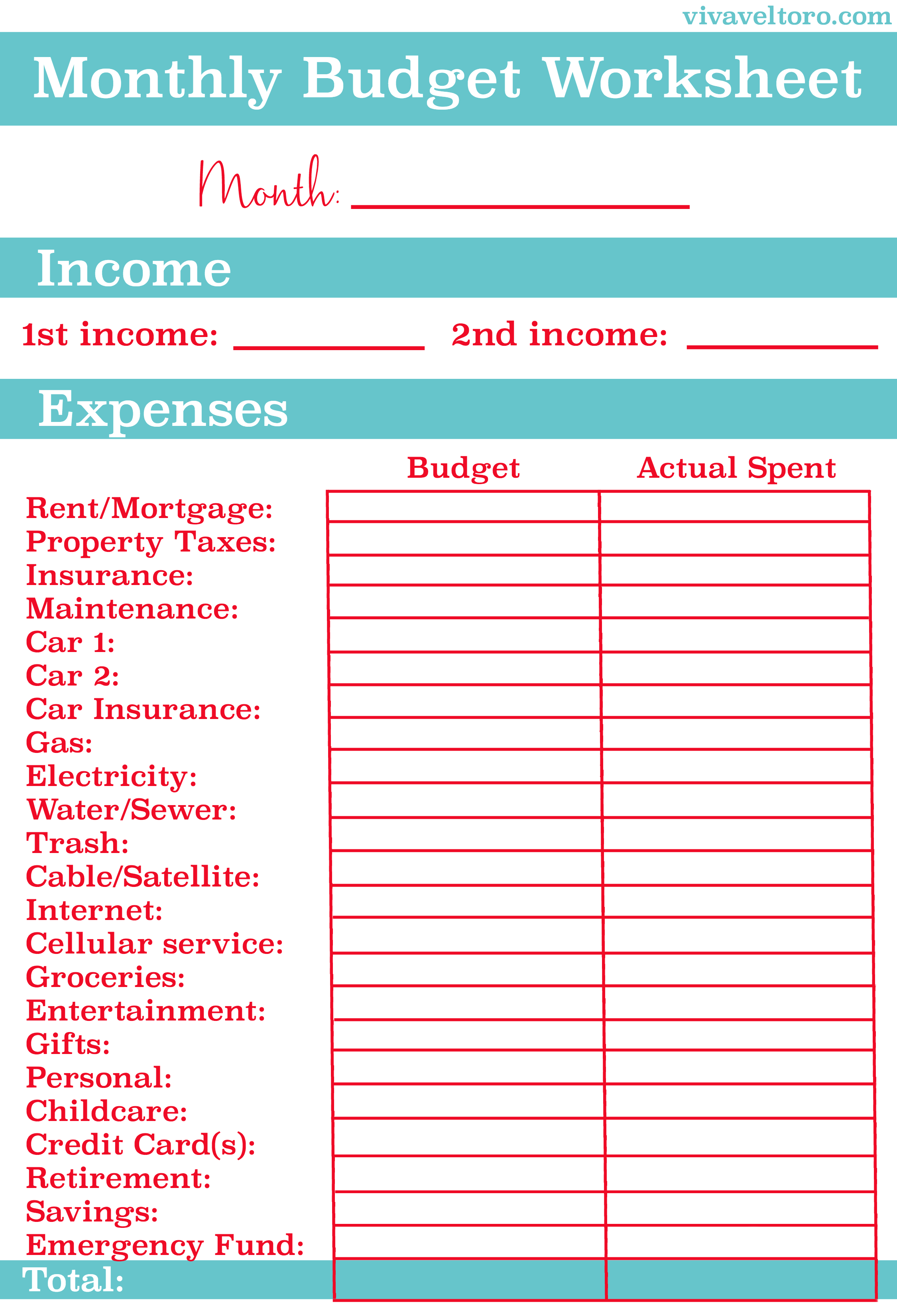

Monthly Budget Worksheet Free Printable Viva Veltoro

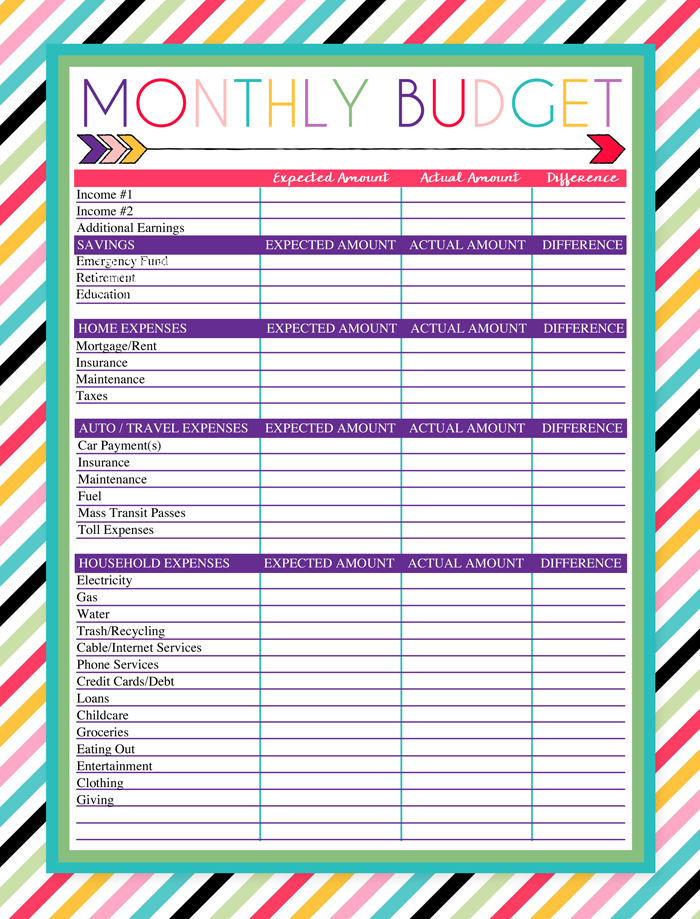

Great Monthly Budget Worksheet Printable Pdf Literacy Worksheets

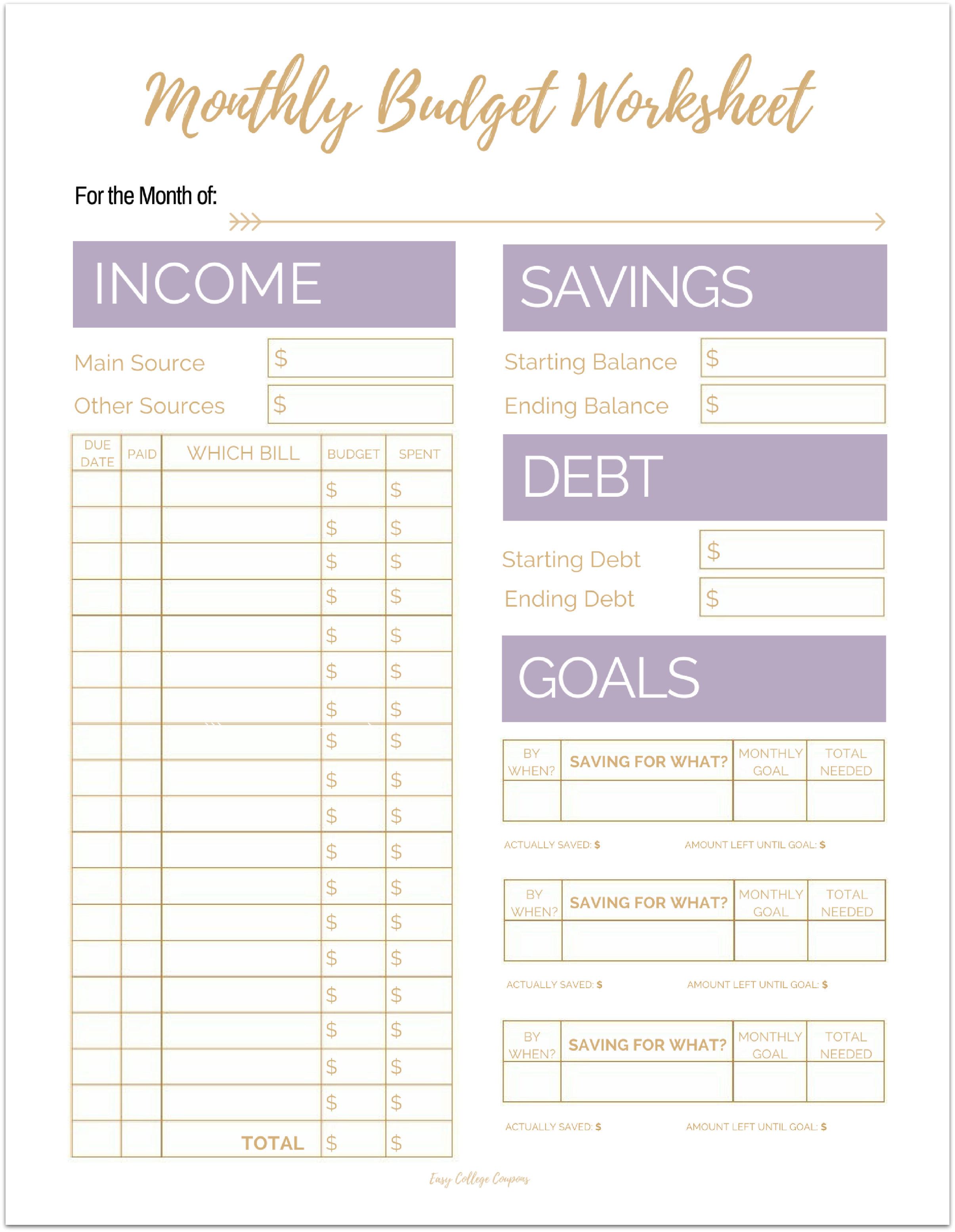

Free Printable Monthly Budget Template

The Benefits Of Budgeting

Although budgeting can seem tedious but it’s an essential step in achieving financial stability. Budgeting lets you monitor your expenditure, make adjustments as needed, and put aside funds for emergencies and savings.

Although it will take time to be comfortable setting up and sticking to budgets, the results are worth the effort. A budget can allow you reduce your debt, make savings to meet long-term goals and help you avoid financial problems at a later date.

If you don’t know where to start, there are lots of resources available to help make a budget. Success in financial planning is achievable once you begin budgeting.