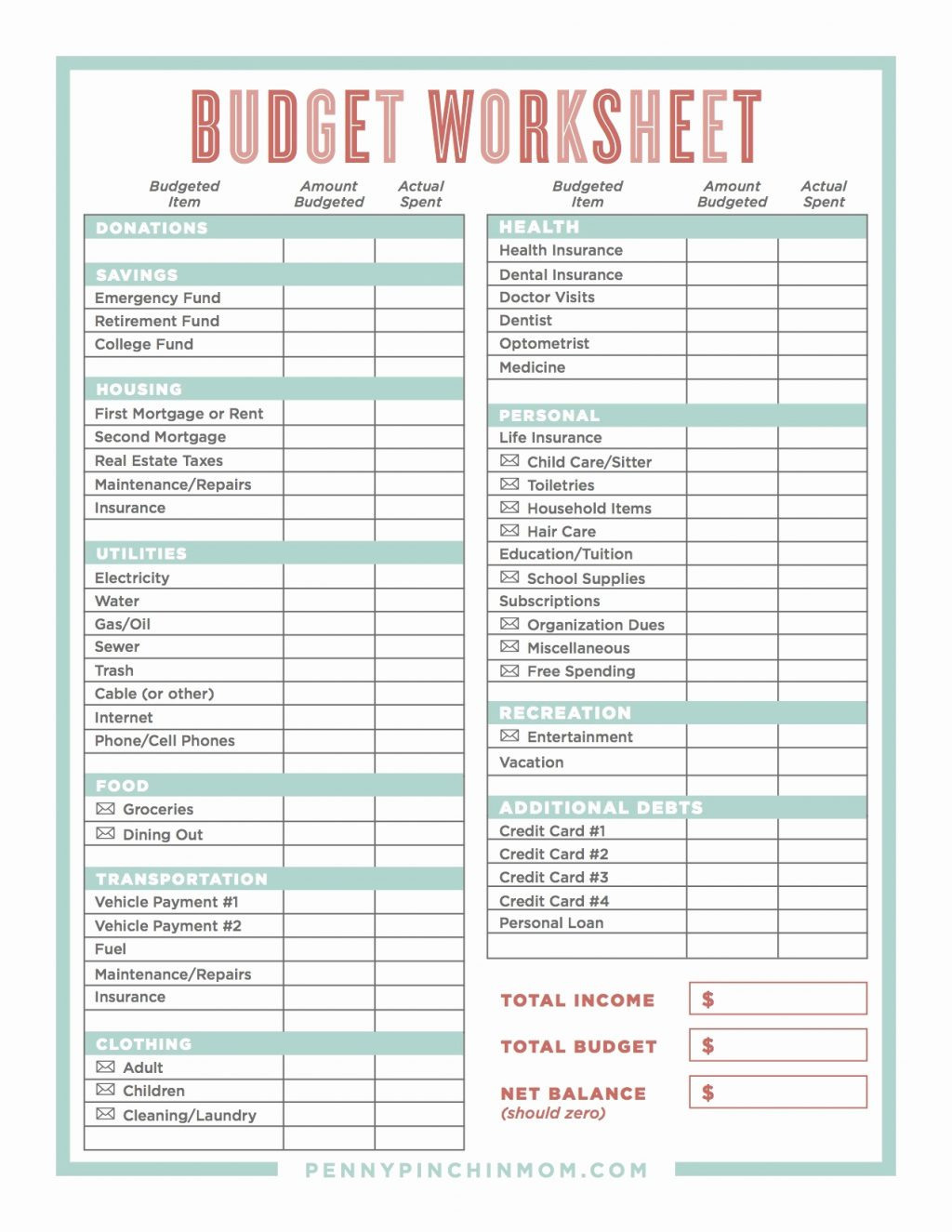

Printable Budget Worksheet Pdf Db excel

Printable Budget Worksheet Pdf Db Excel

Printable Budget Worksheet Pdf Db Excel – You require a budget for managing your finances. A budget worksheet that you can print is the best way to keep your finances on track. Printing budget sheets to remain on track and organized.

There are a variety of options available to create an effective budget. You can use a software program, an app or even a spreadsheet. But if you want the easiest way to create and keep track of your budget, a budget sheet is the way to go.

Printable budget sheets are widely accessible on the internet. The budget sheets are available online for free or at an affordable cost. When you have found the correct document, you simply create it and start tracking your expenses.

Budgeting doesn’t have to be complicated. It’s just a matter of some planning to get your finances in order.

What Is The Reason To Use A Budget?

A budget is essential for many reasons. It allows you to keep track of your spending and savings and can assist you to make informed financial decisions. A budget can also assist you to remain on track with your financial goals and goals.

It is easy to create budgets. The most important thing to remember when making an effective budget is to be truthful about your income and expenses. After you’ve created a budget, stick to it as strictly as you can in order to improve your financial situation.

Related For Free Budget Spreadsheet PDF

How To Make The Most Of Your Budget

Your budget is an important tool in managing your financial situation. It allows you to track your earnings and expenses in order to make educated decisions regarding how you spend your money. Budgeting can be daunting however, with a bit of planning and work it is possible to adhere to a budget.

Here are some helpful tips to make use of a budget:

- Find out your income and expenses. To establish a budget, you first need to track your income. This will enable you to understand where your money spending.

- Set realistic goals. The most realistic goals can be established after you have a clear understanding of the direction of your money. Make sure to factor in variable expenses, such as grocery and gas so that you don’t end up spending too much on other items.

- Be on track.

You Can Track Your Development

Setting a budget is the first step in gaining financial control. Once you’ve established an established budget, you must be able to monitor your progress to ensure that you are adhering to it. There are many methods to accomplish this.

A program that monitors your spending can be used to keep track of your budget. These apps are linked to your bank account to track your spending on a regular basis. They also help you set the budget and track your development in time.

Another way to track your progress is using an excel spreadsheet or pen and paper. Although this method requires longer to complete, it’s similar to an application. Simply enter your income and expenses for each month, then compare your actual expenditure with your budgeted amounts. This will allow you to determine where you may need to reduce or adjust your spending.

Free Budget Spreadsheet PDF

The Benefits Of Budgeting

Although budgeting can seem tedious yet it’s the first step towards financial stability. It is possible to track your spending and reserve money to put aside for emergency needs. You can then adjust your spending as needed.

Though it takes time to master the art of make and adhere to your budget correctly, the rewards are well worth it. Budgets can be used to reduce debt, set aside money for long-term goals and avoid future financial issues.

There are numerous resources to help you create a budget that meets your needs. Success in financial planning is achievable once you begin to budget.