Printable Bi Weekly Budget Templates At Allbusinesstemplates

Printable Bi Weekly Budget Templates At Allbusinesstemplates

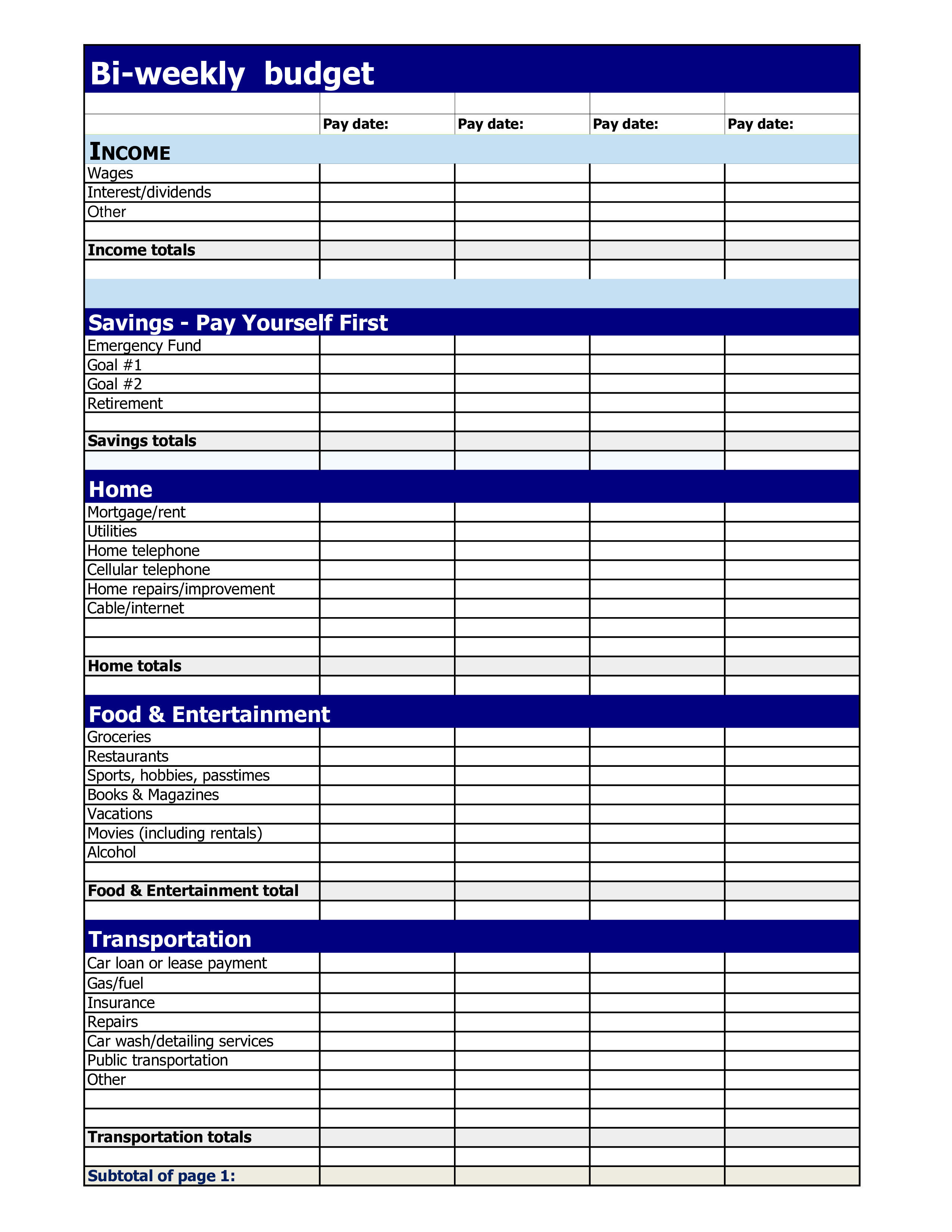

Printable Bi Weekly Budget Templates At Allbusinesstemplates – You require a budget to keep track of your finances. The printable budget template is the most efficient way for you to keep track. Budget sheets that are printable can help you stay organized.

There are numerous ways to come up with a budget. An app, a spreadsheet or software program can be used to build your budget. If you’re looking for the most efficient way to make and keep track of your budget using a printable budget worksheet is the best option.

You can easily locate budget worksheets that are printable online. They can be downloaded on the internet for free or a small charge. If you come across a page that you find appealing, all you have to do is print it out and start keeping track of your spending.

Budgeting doesn’t need to be difficult. With just a bit of effort and a little planning, you can get your finances under control within a matter of minutes.

What Is The Reason You Require The Budget?

A budget is crucial because of a variety of reasons. A budget helps you track your expenditure and savings and can assist you in making informed financial decisions. You can utilize a budget to keep track of your financial goals.

It’s easy to make your own budget. It is essential to be transparent to yourself about your financial incomes and expenses when making a budget. To increase your financial standing it is important to stick to the budget that you’ve set.

Related For Free Printable Budget Forms

How Do You Use Your Budget

Your budget is an important tool for managing your finances. You can keep track of your income and expenses to make informed decisions about how you allocate your funds. It can seem difficult to budget, but it’s a task that can be accomplished with a little planning and effort.

Here are some tips on how to use a Budget:

- Find out your income and expenses. The first step in establishing the budget is to record your expenses and income. This will give you an accurate picture of where your funds are going.

- Realistic goals are important. Once you know the exact location of your money You can set achievable goals for saving and spending. To avoid spending too much on other purchases, be sure you include any variable costs such as gas and food.

- Stay on track.

You Can Monitor Your Performance

The process of creating a budget is the first step towards controlling your financial situation. When you’ve created an established budget, you must keep track of your progress in order to make sure you are adhering to the plan. There are a variety of ways to do this.

A budget tracking app is available. These apps can be linked to your bank account so you can track your spending. These apps allow you to set up a budget and monitor your progress over the period of.

A pen or spreadsheet, or a paper is another method to track your progression. Although this approach requires more effort, it is similar to an application. Enter your income and expenses each month. After that, you can compare the amount you actually spend to the budgeted amount. This allows you to see the areas where you can reduce your spending or adjust your spending accordingly.

Free Printable Budget Forms

FREE 33 Budget Forms In PDF MS Word Excel

The Benefits Of Budgeting

While it may be difficult to budget, it is an essential step in achieving financial stability. It allows you to keep track of your spending, adjust in the event of a need, and set aside money for emergencies and savings.

Although it will take time to be comfortable setting up and sticking to a budget, the benefits are worth the effort. A budget can help you pay off debt, save money for your long-term goals and even avoid financial difficulties in the future.

If you’re unsure of where to start, there are lots of resources that will help you to create an effective budget. Soon you’ll be able plan your budget efficiently and attain financial success.