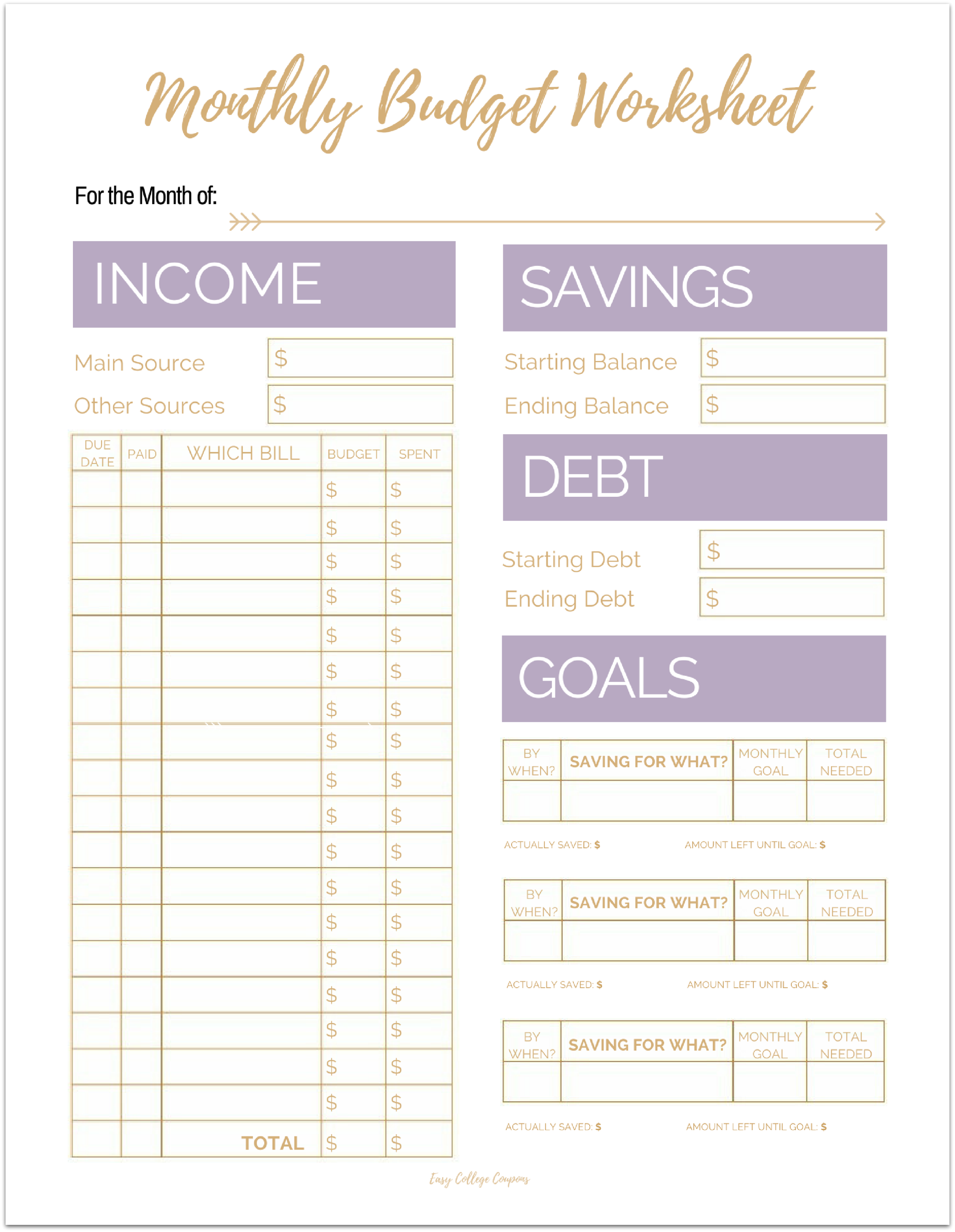

Free Printable Monthly Budget Template

Free Printable Monthly Budget Template

Free Printable Monthly Budget Template – A budget is necessary to keep track of your finances. A template for your budget can help you to track your finances. You can use printable budget sheets to help you stay on track and organized.

There are numerous ways to come up with budget. There are many methods to come up with budget. You can make use of an app, a software or spreadsheet. If you’re searching for the simplest method of creating and tracking your budget, then a printable budget worksheet is the best solution.

You can easily locate budget sheets that can be printed online. These budget sheets can be downloaded without cost or at an affordable cost. If you come across a page you would like to use, all you need to do is print it out and begin tracking your expenditure.

Budgeting shouldn’t be a hassle. You can manage your finances with just a bit of planning effort.

What Is The Reason You Require The Budget?

A budget is important for a variety of reasons. A budget lets you keep track of your spending and savings as well as help you make informed financial decisions. A budget can assist you to keep track of your financial objectives.

Budgets can be made in just a few steps. You can use a spreadsheet or pencil to make the budget. It is crucial to be honest with yourself about your incomes and expenses when making budget. To increase your financial standing, you should stick to the budget you’ve created.

Related For Monthly Budget Worksheet Free

How Do You Use A Budget

The budget is a crucial tool to control your financial situation. By keeping track of your income and expenses, you will be able to make informed decisions about how to best use your money. It’s not always easy to budget, but it is able to be done with some planning and work.

There are a few ways to use a budget.

- Find out your income and expenses. To make a budget you must first track your income. This will give you an understanding of where your funds are going.

- Set realistic goals. It is possible to set realistic goals once you understand where your money is going. You should be sure to account for the cost of variable items, like grocery and gas so that you don’t overspend on other items.

- Be on track.

Monitor Your Progress

Setting a budget is the first step to controlling your finances. Once you have established a budget, it is essential to monitor your progress and ensure that you stick to it. This can be accomplished in many ways.

It is possible to use an app to track your budget. These apps can be linked to your bank account, so you can keep track of your expenditure. They can also be used to help you set up a budget, track your progress and keep you informed.

Another method of tracking your progress is to use either a spreadsheet or pen with paper. While this requires longer to complete, it’s exactly the same as using an app. Input your expenses and income each month. After that, you can compare your actual expenses to your budgeted amount. This will enable you to determine areas that require to be reduced or modified.

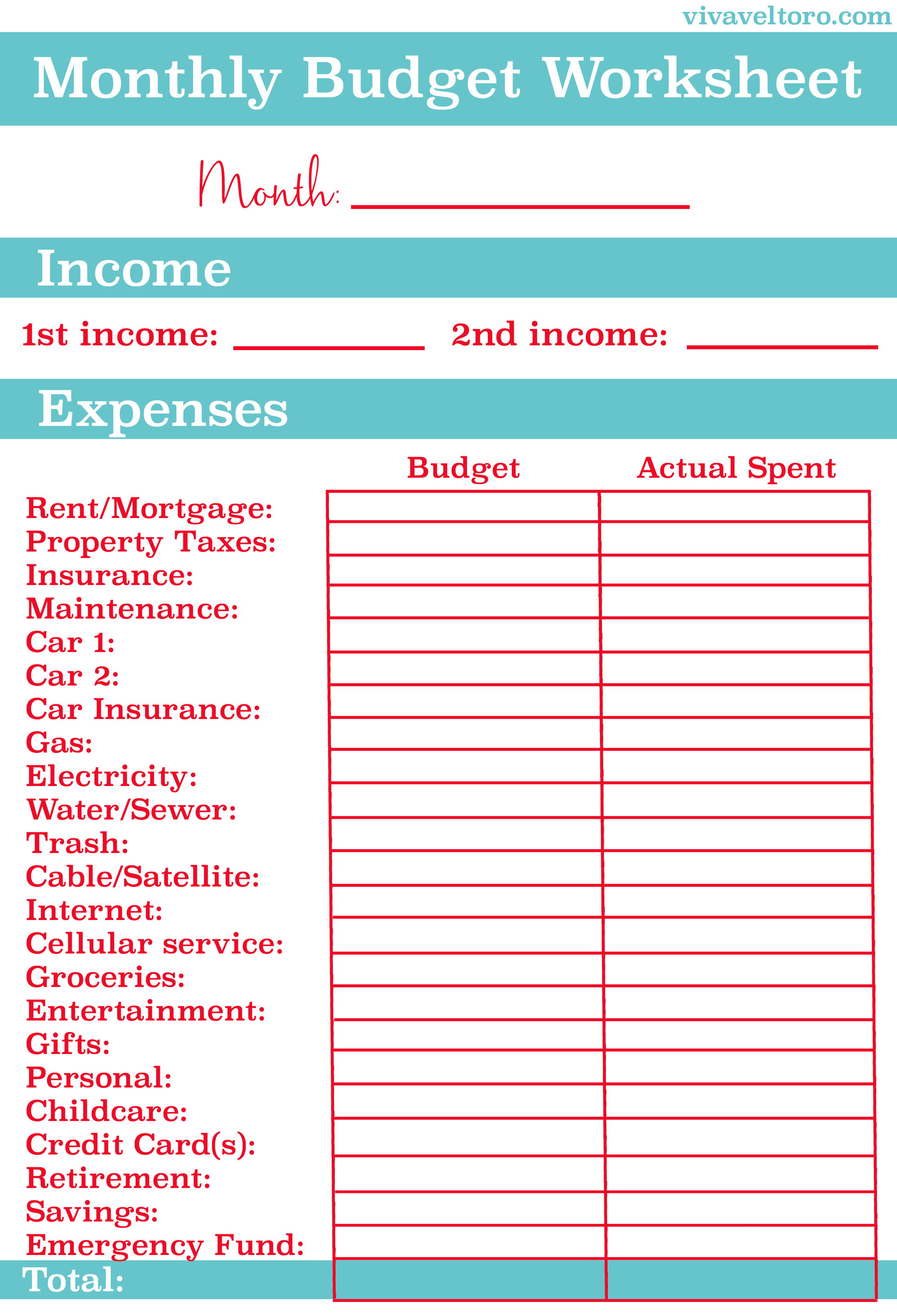

Monthly Budget Worksheet Free

Monthly Budget Worksheet Free Printable Viva Veltoro

The Benefits Of Budgeting

While it may appear to be an overwhelming task but it’s essential to ensure your financial security. A budget allows you to keep track of your expenses, set aside money for savings or emergency money, and make adjustments as needed.

It might take a while for you to feel comfortable with the process of creating and implementing an established budget. However, the advantages are well worth the effort. Budgets can help you reduce your credit card debt, set aside money to meet long-term goals and help you avoid financial problems in the future.

There are numerous resources to help you make a budget that suits your needs. Once you’ve got into the habit of budgeting, you’ll be on the road to financial success.