Monthly Budget Planner Free Printable Worksheet Savor Savvy

Monthly Budget Planner Free Printable Worksheet Savor Savvy

Monthly Budget Planner Free Printable Worksheet Savor Savvy – It is essential to have a budget in order to keep track of your finances. The printable budget sheets are the best way to keep in the loop. A printable budget sheet can aid you in staying organized.

There are many different ways to come up with budget. An app, a spreadsheet or software program may all be used to construct the budget. If you’re looking for the most straightforward method to make and keep track of your budget, a printed budget sheet is the option to choose.

There are plenty of budget templates online. They can be downloaded online either for free or for a small cost. You can print the form you like and begin tracking your expenses once you’ve located the.

Budgeting doesn’t have have to be difficult. It’s a matter of a few minutes and some planning to ensure your finances are in order.

Why Would You Want To Make Use Of The Budget To Make Choices?

There are many reasons why households and individuals need to establish the benefit of a budget. A budget allows you to record your expenditure and save and can assist you to make informed financial decisions. A budget can also help keep track of your financial goals and targets.

Budgeting is simple and can be done using various methods using pencils and paper, a spreadsheet, or personal financial software. The most important aspect to consider when creating an effective budget is to be honest with yourself regarding the amount of money you earn and what you spend. In order to improve your financial situation adhere to the budget that you’ve established.

Related For Free Printable Monthly Budget Worksheet

How Do You Use Your Budget

Your budget is an important instrument to manage your financial situation. When you track your income and expenditures, you’ll be able to make informed decisions about the best ways to spend your money. While budgeting may seem daunting but with a little planning and effort it is feasible to stick to your budget.

Here are some ideas for budgeting:

- Make sure you know your income and expenditures. To establish a budget, you should first record your earnings. This will allow you to see clearly the amount of money you have.

- Set realistic goals. Once you know the direction your money is heading, you can set achievable goals in terms of saving and spending. You should be sure to account for variables like food and gas, to ensure you don’t spend too much on other purchases.

- Be on the right track.

You Can Track Your Progression

Making a budget is the first step to attaining financial control. But once you have an established budget, you must keep track of your progress to make sure you are sticking to the plan. There are a variety of methods to accomplish this.

A tool that tracks your spending can help you keep track of your budget. These apps are linked to your bank account, and keep track of your spending automatically. They can also assist you in setting the budget and track your progress in time.

You can also monitor your progress with a spreadsheet, pen and paper or notepad and pen. This method takes more manual effort, but it’s just as effective as using an app. Input your expenses and income each month. After that, you can compare the actual amount you spend with your budgeted amount. This will allow you to see where you may need to reduce or adjust your spending.

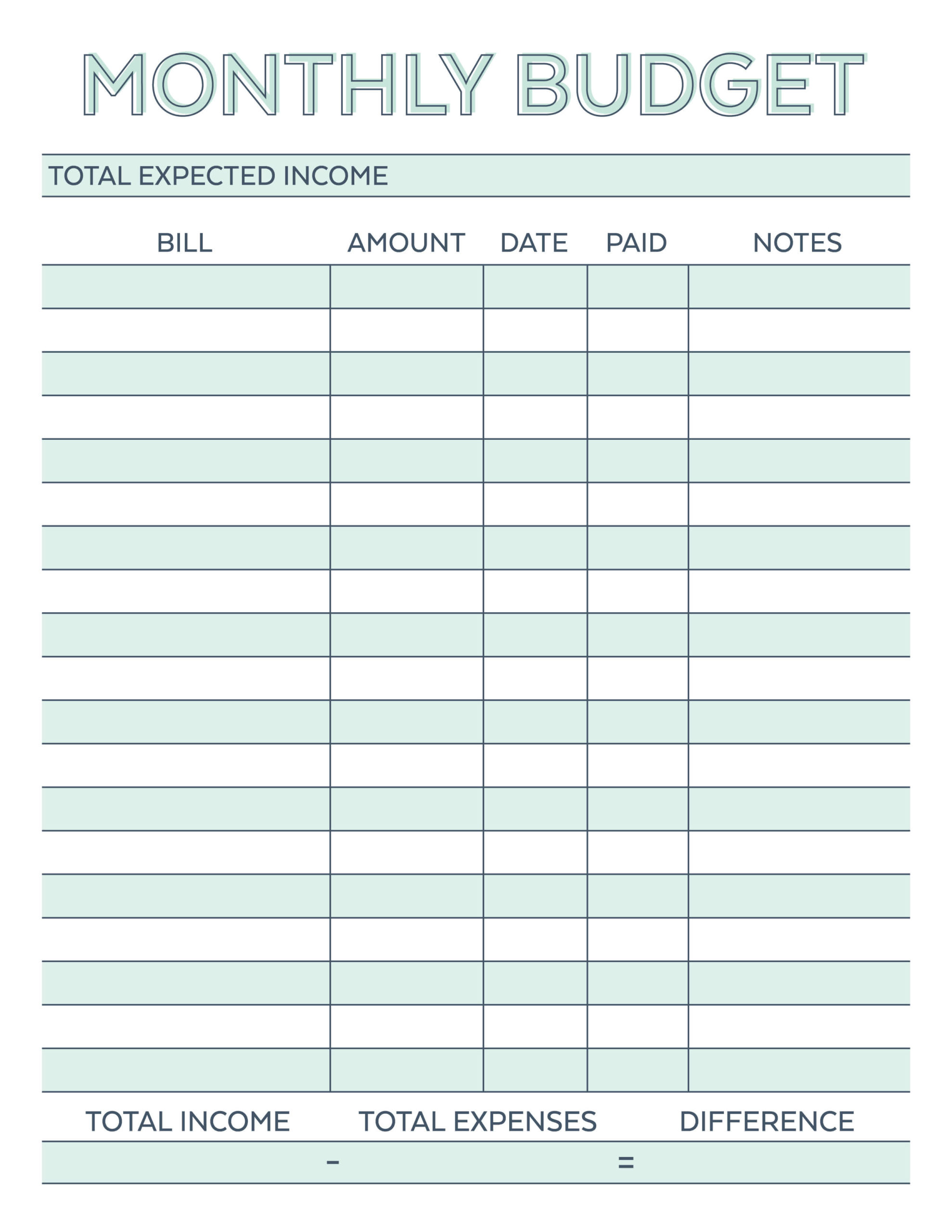

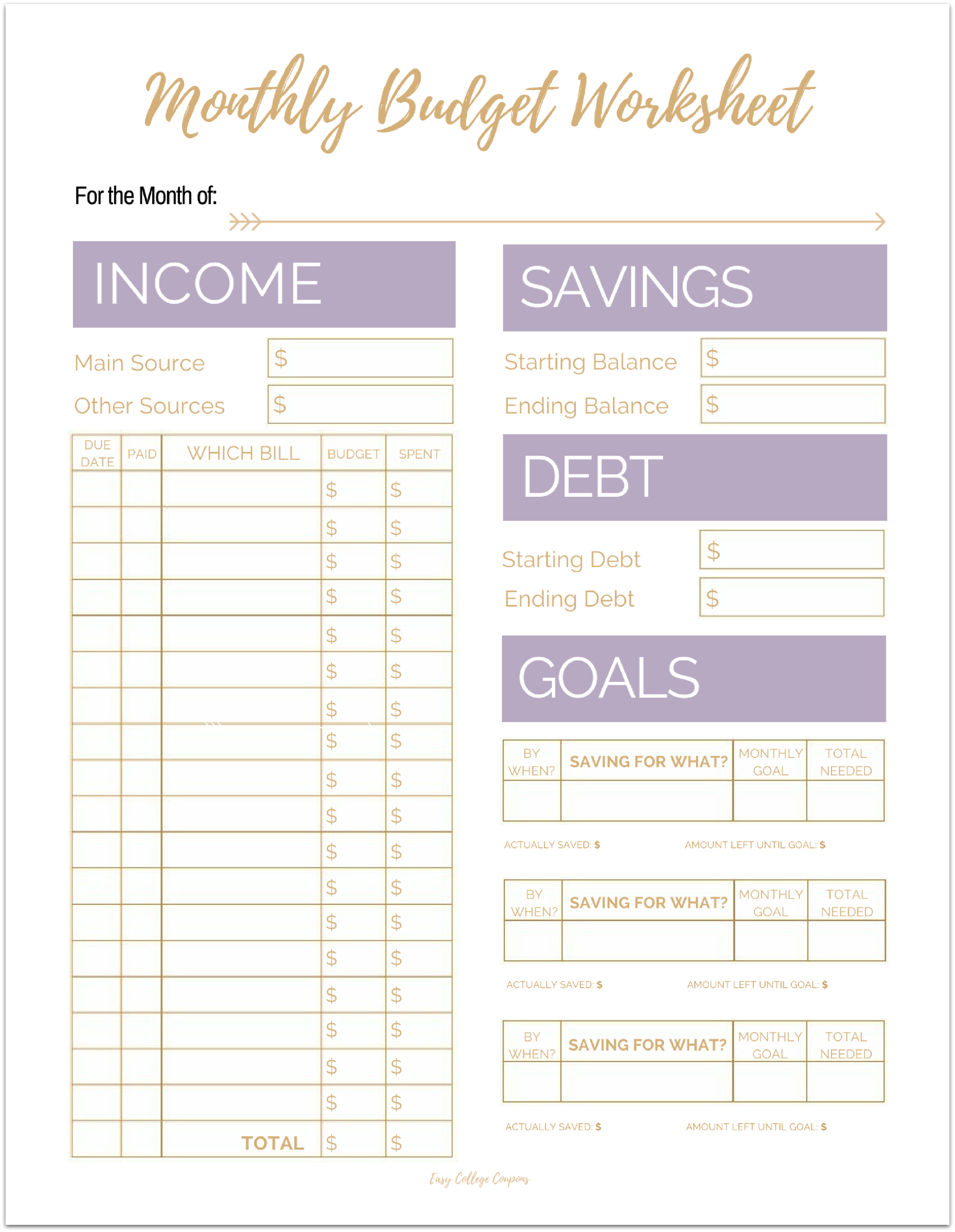

Free Printable Monthly Budget Worksheet

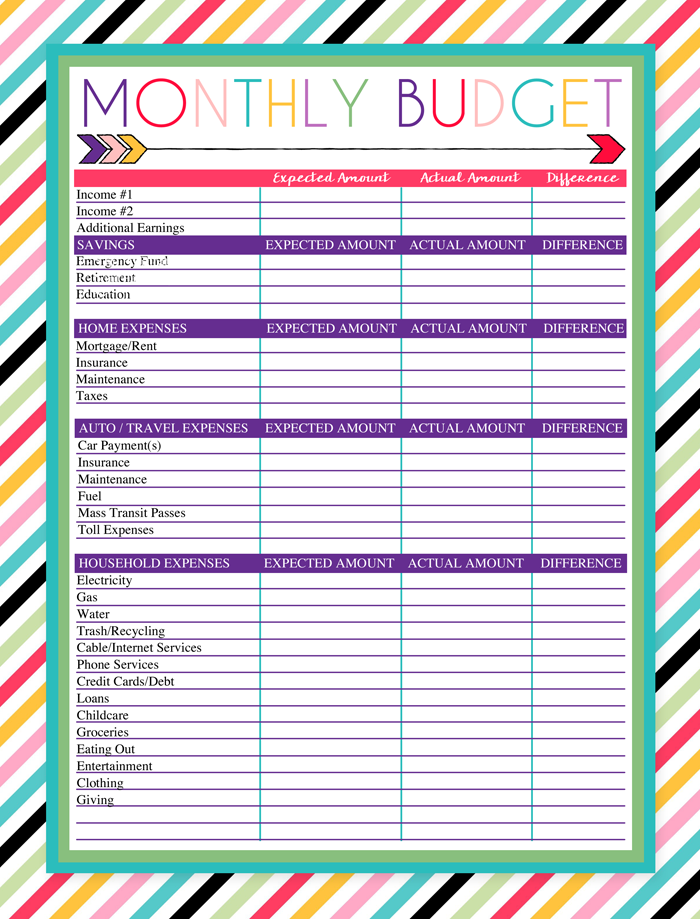

I Should Be Mopping The Floor Free Printable Monthly Budget Worksheet

Free Printable Monthly Budget Template

The Benefits Of Budgeting

Although budgeting may seem like something that is difficult but it’s essential to ensure your financial security. A budget lets you manage your spending, put aside money for savings or emergency funds, and adjust according to the need.

It might take a while for you to feel comfortable with the process of creating and implementing a budget. However, the advantages are well worth the effort. A budget can assist you to reduce debt, save money to fund long-term goals, and avoid financial troubles later on.

If you’re unsure where to begin, there’s a wealth of resources available to assist you in creating an effective budget for you. Success in financial planning is achievable once you begin to budget.