Budget Template Uk Seven Things You Most Likely Didn t Know About

Budget Template Uk Seven Things You Most Likely Didn T Know About

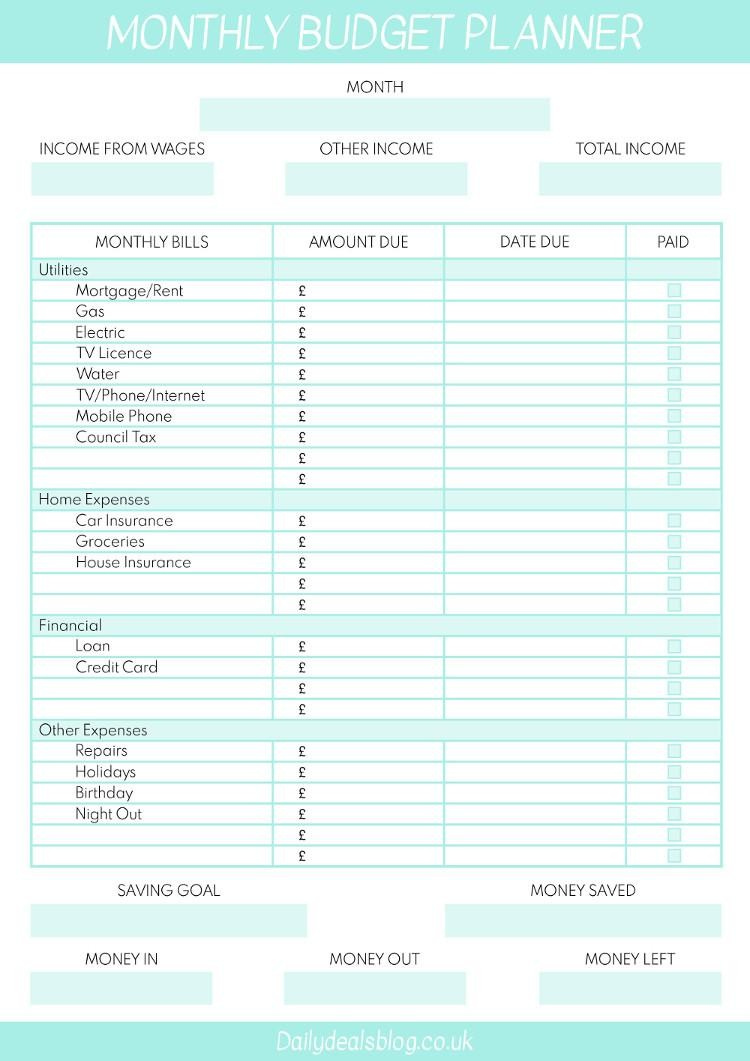

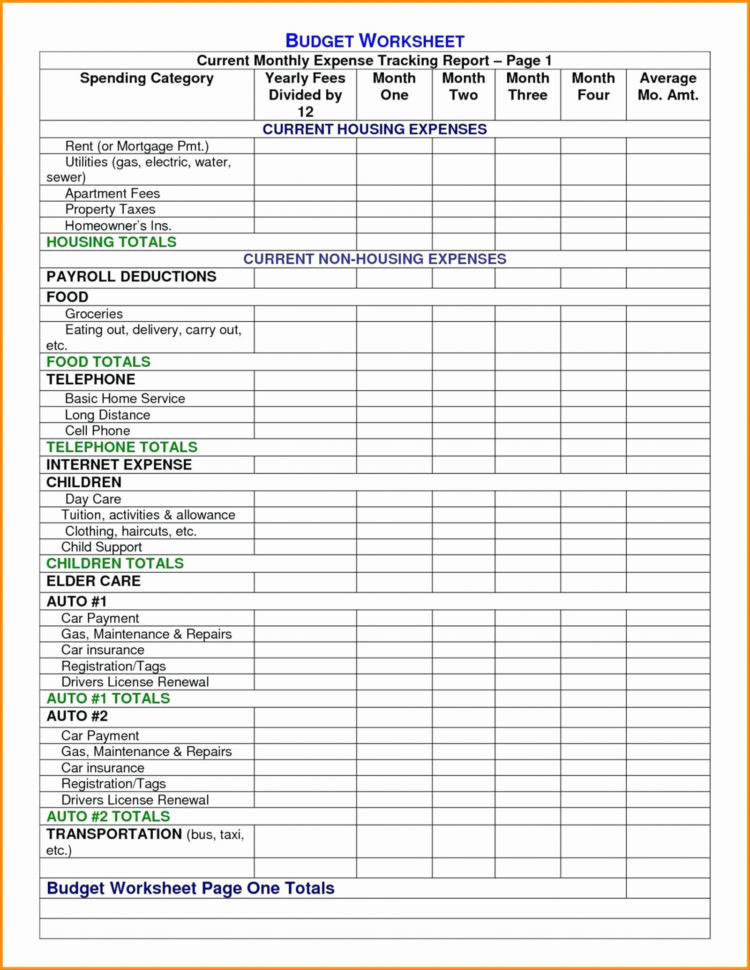

Budget Template Uk Seven Things You Most Likely Didn T Know About – If you’re trying to keep your finances organized, you need a budget. A budget template is the best way to keep in the loop. You can use printable budget sheets to stay on track and organized.

There are a variety of options available for creating your budget. It is possible to use a software program, an app or even spreadsheets. If you’re looking for the easiest way to create and monitor your budget, a printable budget sheet is the option to choose.

Budget worksheets for printing are readily available online. You can find them on a free basis or for some cost. You can print the sheet you like and begin tracking your expenses once you’ve found the.

Budgeting shouldn’t be complicated. With just a bit of work and a bit of planning you can get your finances under control in no time.

Why Would You Want To Make Use Of The Budget To Make Choices?

There are a number of reasons why individuals and households should use budgets. A budget can be utilized to monitor your spending and make savings, which could aid in making financial decisions. A budget can aid you stay on track with your financial goals.

A budget can be designed in just a few steps. You can use an excel spreadsheet or pencil to draw it. The most important thing to remember when making the budget is being honest about your earnings and expenses. Once you’ve made the budget, follow it as closely as possible in order to enhance your financial situation.

Related For Free Budget Spreadsheet Uk

How Do You Use A Budget

A budget is an essential instrument for managing your finances. Monitoring your spending and income will enable you to make informed decisions about the best way to allocate your funds. Budgeting can be daunting however, with a bit of planning and effort, it can be easy for you to stick to a budget.

Here are some suggestions for how you can make use of a budget:

- Determine your income and expenses. To make a budget you should first record your income. This will let you determine where your money is going.

- Setting realistic goals is essential. You can establish realistic goals for savings and spending once you’ve got an accurate picture of how much money you’re spending. To ensure that you don’t spend too much on other purchases, be sure you include any variable costs like groceries and gas.

- Be on the right track.

Tracking Your Performance

The process of creating a budget is the first step in controlling your financial situation. After you’ve established the budget, it’s crucial to keep track of your progress and make sure you adhere to the plan. There are a variety of ways to do this.

You can use an app for budget tracking. These apps are connected to your bank account, so you can monitor your expenditure. These apps allow you to set up a budget and monitor your progress over time.

A spreadsheet or pen and paper is another method to track your development. While this requires more work than an app, it can be just as effective. Record your expenses and your income each month. Then , compare the actual amount you spend with the budgeted amount. This will help you see where you may need to cut back or make adjustments.

Free Budget Spreadsheet Uk

Budget Spreadsheet Uk For Monthly Billseadsheet Free Budget Excel

The Benefits Of Budgeting

The process of budgeting can seem like an intimidating task, however it’s a critical aspect to ensuring financial stability. A budget will allow you to keep track of your expenses, set aside funds for savings as well as emergency funds, and make adjustments according to the need.

It may take some time to get comfortable with creating and following the guidelines of a budget. But, the rewards are well worth the effort. A budget will help you pay off debts, make savings for your long-term goals and avoid financial problems in the future.

There are a myriad of sources that can assist you to prepare a budget that fits your needs. You’ll soon be able to plan your budget efficiently and attain financial success.