10 Sample Monthly Budget Templates Sample Templates

10 Sample Monthly Budget Templates Sample Templates

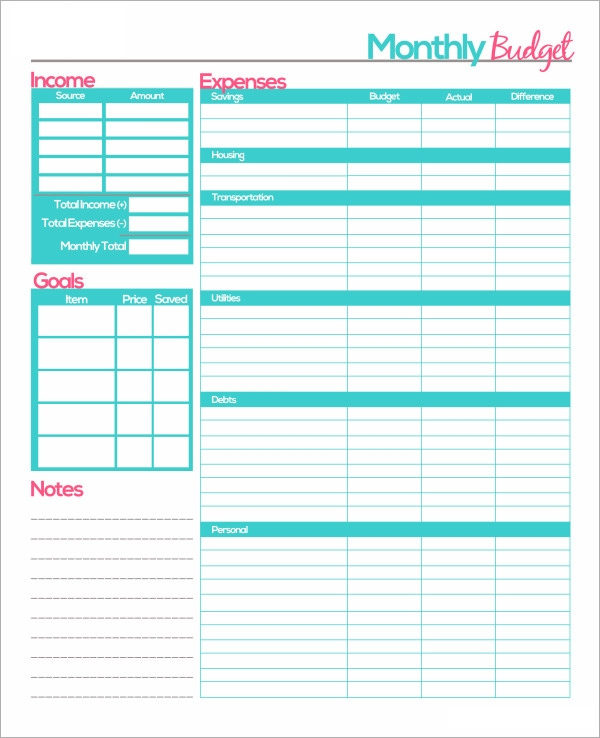

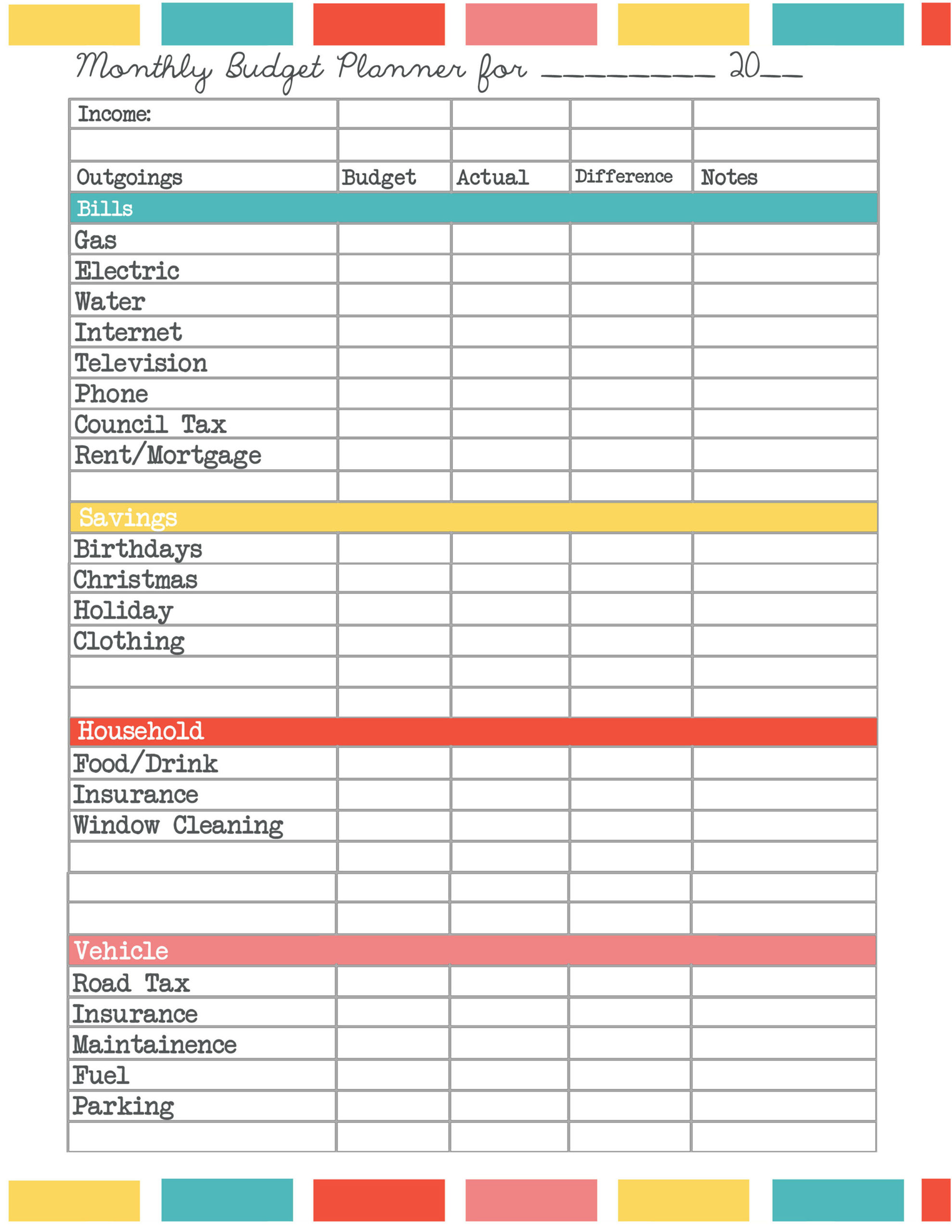

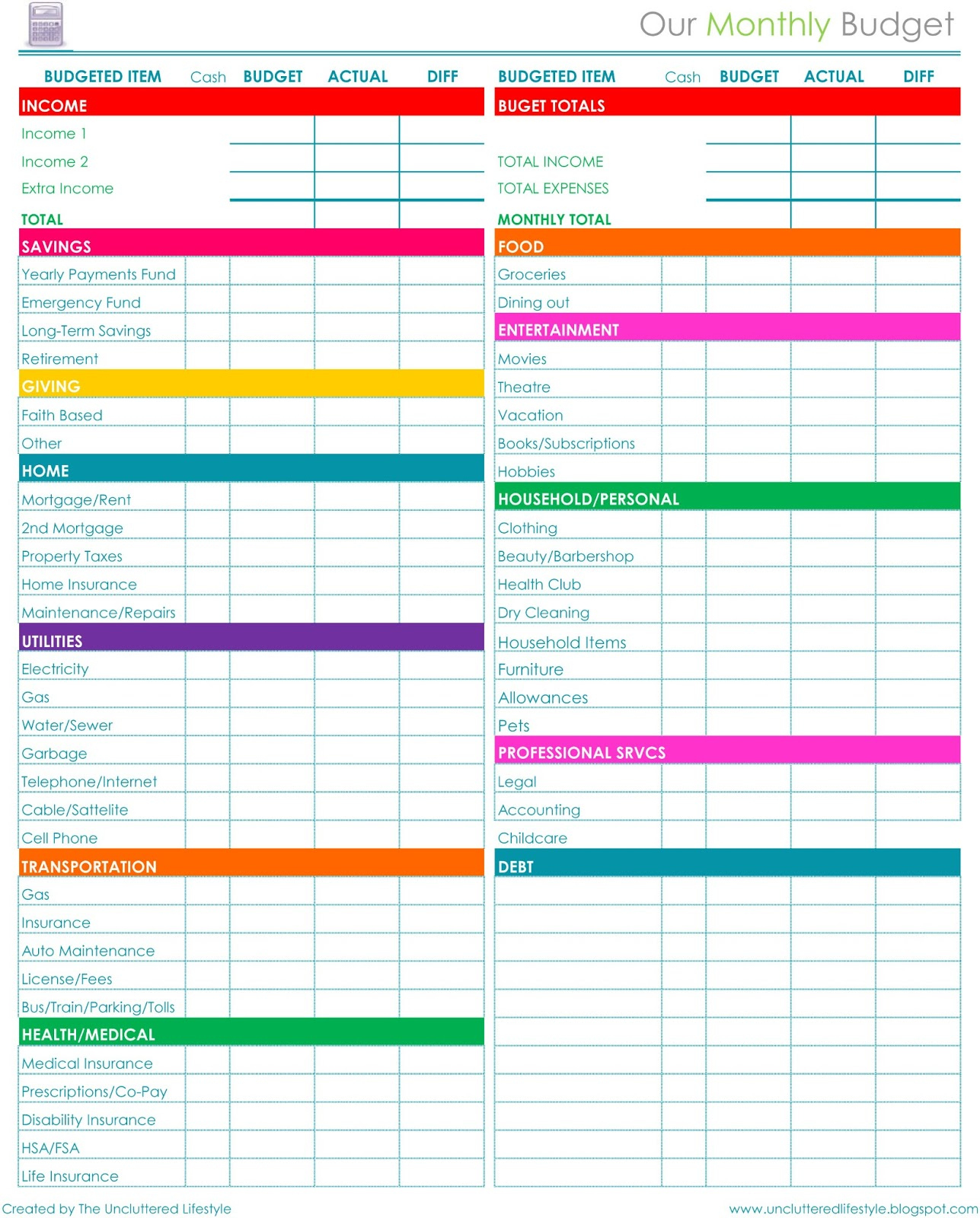

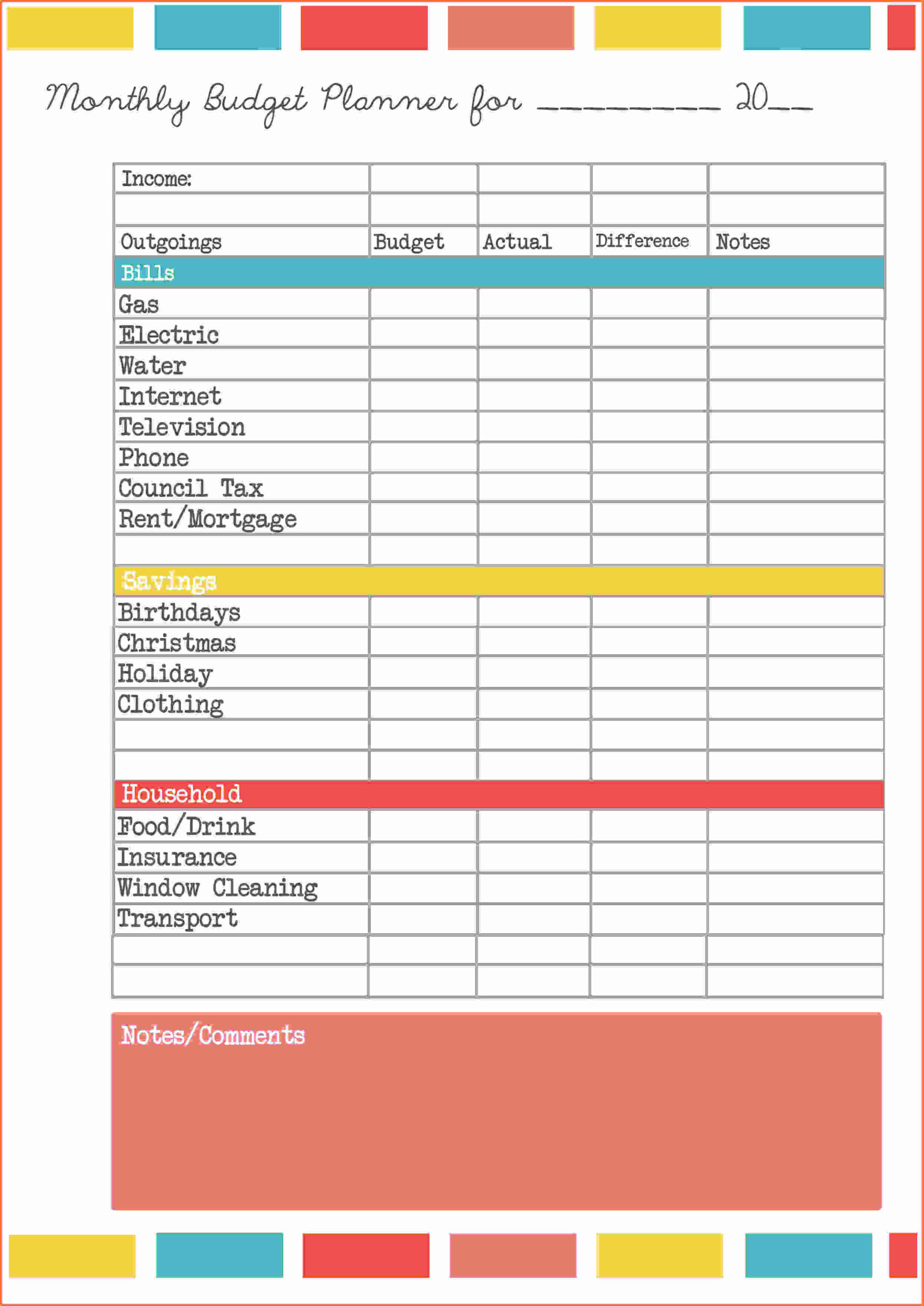

10 Sample Monthly Budget Templates Sample Templates – A budget is crucial for organizing your finances. A budget worksheet that you can print is the most effective way to stay on in the loop. The printable budget sheets can aid you in staying organized.

There are a variety of options available to create an effective budget. You can use a software application, a program, or even an Excel spreadsheet. If you’re searching for the easiest way to make and keep track of your budget using a printable budget worksheet is your perfect solution.

On the web, you can download several budget worksheets that are printable. You can find them for free or for a small fee. After you locate the appropriate document, you simply print it out and begin to track your expenses.

Budgeting shouldn’t be a hassle. You can manage your finances by putting in a bit of planning and effort.

Why Should You Use The Budget To Make Choices?

A budget is essential for a variety of reasons. A budget can be used to track your spending and reduce expenses, which will aid you in making financial choices. A budget can be used to monitor your financial objectives.

Budgets can be made with just a few simple steps. You can make use of a spreadsheet or pencil to draw the budget. It is vital to be upfront about your earnings and expenses when creating budget. You should adhere to your budget in order to improve your financial situation.

Related For Free Budget Spreadsheet Template To Download

How To Use The Budget

The budget is a crucial tool in managing your financial situation. Monitoring your spending and income will help you make informed decisions on how best to allocate your funds. Budgeting can seem daunting however, with a bit of planning and effort, it can be easy to adhere to a budget.

Here are some suggestions for using a budget:

- Find out your income and expenses. To make a budget you first need to track your earnings. This will provide you with an accurate picture of where your cash is going.

- Realistic goals are important. Once you know the exact location of your money You can set realistic goals in terms of saving and spending. To avoid spending too much on other things, be sure to include variable expenses like groceries and gas.

- Keep on the right track.

Monitor Your Development

The first step to financial control is to establish the budget. However, once you’ve got the budget in place, you have be able to monitor your progress to ensure that you are sticking to the plan. This can be accomplished by a variety of methods.

A budget tracking app is available. These apps link to your bank account and track your spending on a regular basis. The apps can also be used to set up an expense plan, track your progress and keep you updated.

A notebook or pen and piece of paper are another way to record your performance. Although this method requires more effort, it is exactly the same as using an app. Record your expenses and your income each month. After that, you can compare your actual spending with the budgeted amount. This will let you know what areas you should cut back or make adjustments.

Free Budget Spreadsheet Template To Download

Sample Family Budget Spreadsheet Pertaining To Sample Household Budget

Free Download Household Budget Spreadsheet Db excel

Free Budget Spreadsheet Intended For Budget Planning Spreadsheet

The Benefits Of Budgeting

Although it might appear like an overwhelming task, it is essential for your financial stability. A budget allows you to track your spending, set aside funds for savings as well as emergency funds, and adjust whenever needed.

Though it takes time to master the art of create and stick to a budget properly but the benefits are worth it. Budgets can be used to reduce debt, set aside funds for goals that are long-term and avoid future financial issues.

If you’re not sure where you should start, there are plenty of resources to help you develop an effective budget for you. Success in financial planning is achievable once you begin to budget.