Free Budget Worksheets Single Moms Income Printable Budget

Free Budget Worksheets Single Moms Income Printable Budget

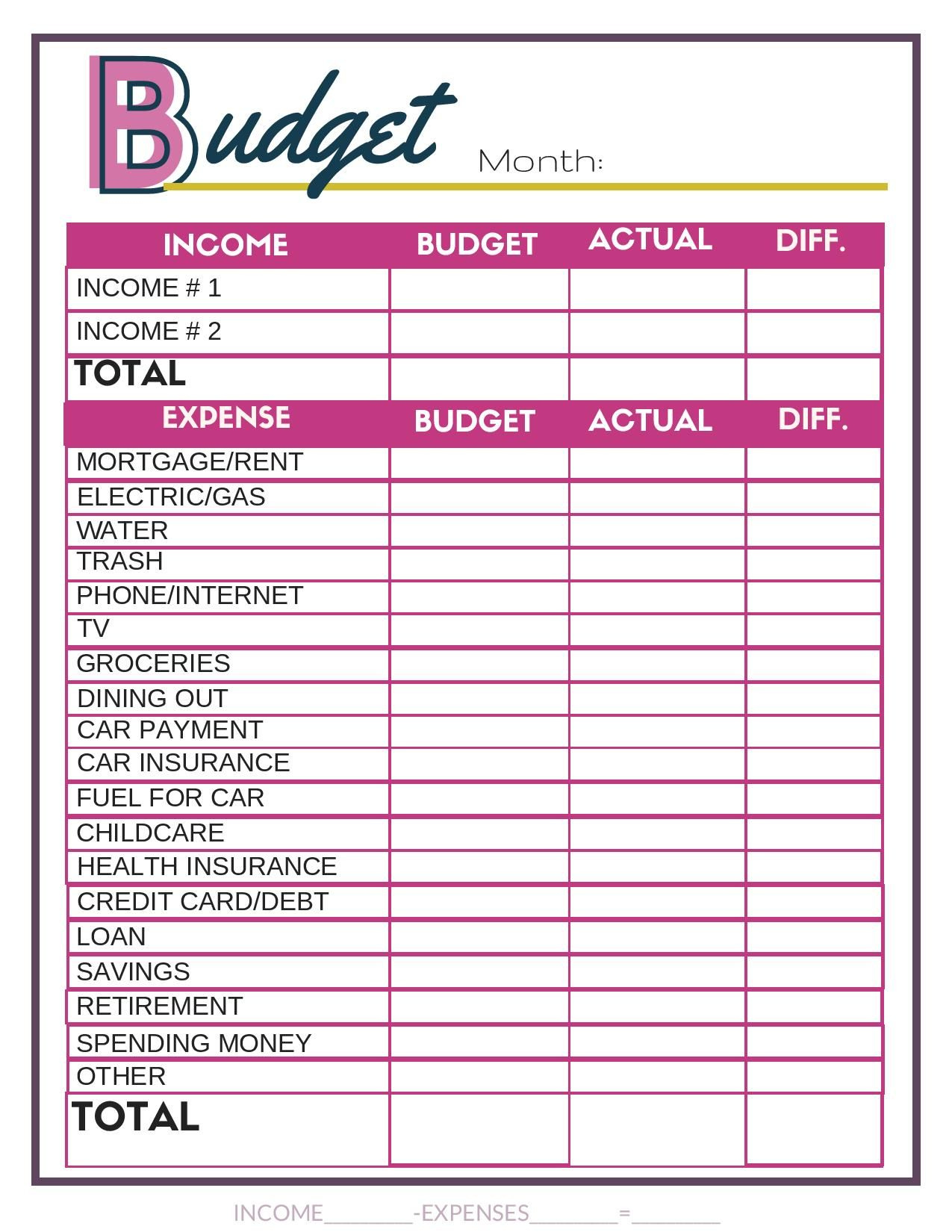

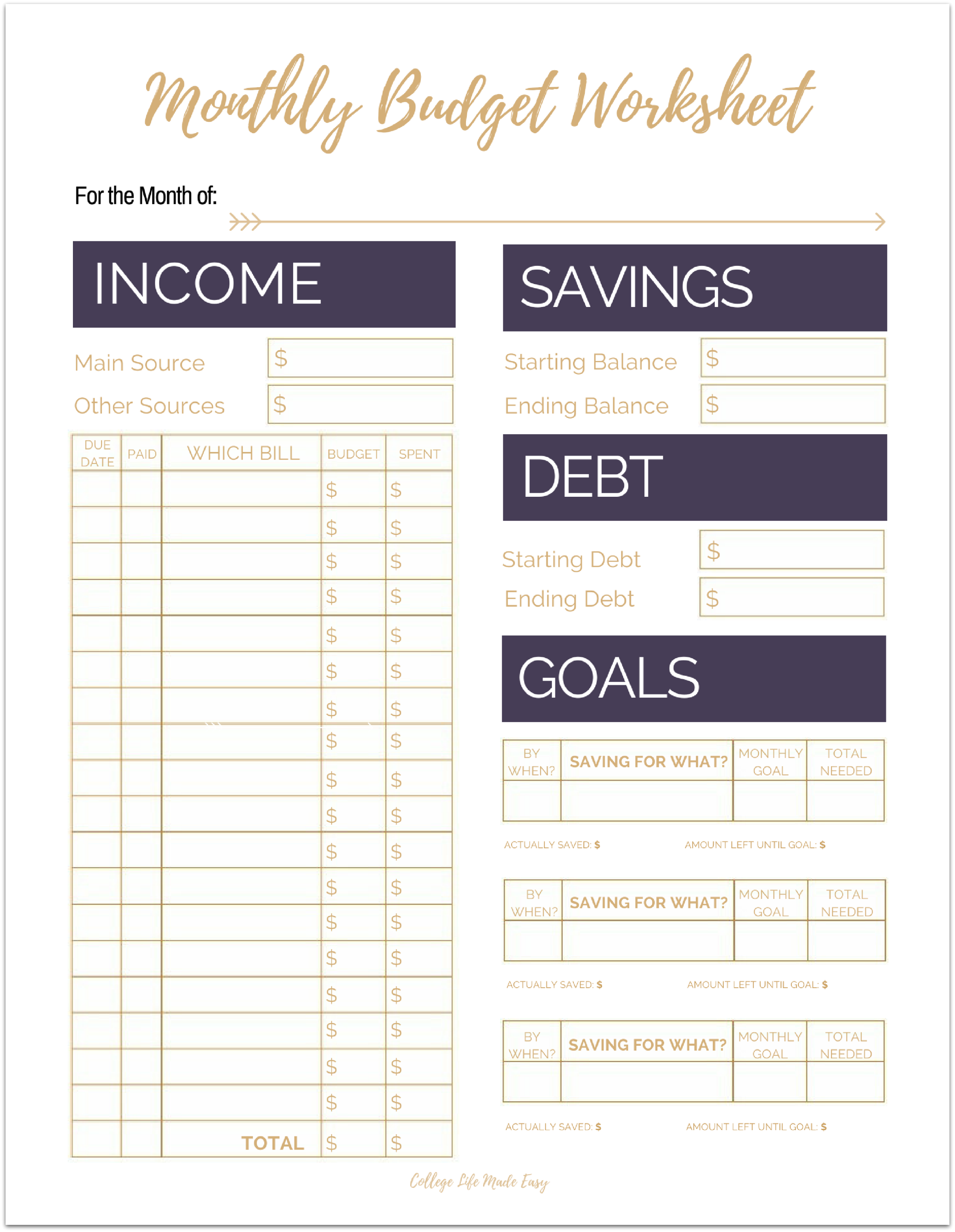

Free Budget Worksheets Single Moms Income Printable Budget – A budget is crucial in order to keep track of your financial affairs. A template for your budget is the most effective way for you to stay on track. Budget sheets that are printable can help you stay organized.

There are many methods to make budget. There are a variety of ways to create your budget. It is possible to use an app, program or a spreadsheet. If you’re looking for the most simple method of creating and keeping track of your budget using a printable budget worksheet is the ideal choice.

It is easy to find printable budget sheets on the internet. They can be downloaded online either without cost or at only a small fee. When you have found the correct sheet, you just need to create it and start tracking your spending.

Budgeting doesn’t have to be a hassle. It’s just a matter of some planning to get your finances in order.

Why Use A Budget?

There are a variety of reasons why households and individuals need to establish a budget. It allows you to monitor your spending and save, which can help you make better financial decisions. You can use a budget to keep track of your financial objectives.

It is easy to create an effective budget. The most important aspect to consider when creating the budget is being honest with yourself about your income and expenses. To increase your financial standing be sure to stick to the budget that you have established.

Related For Printable Budget Sheet

How Do You Use A Budget

The budget is a crucial tool in managing your financial situation. It allows you to track your earnings and expenses in order to make educated choices about how to spend your money. While it may be difficult to plan your budget but with a little planning and effort , it’s possible to stick to your budget.

Here are some suggestions to make use of a budget:

- Make a list of your income and expenses. Tracking your income and expenses is the first step in formulating an budget. This will allow you to get a clear picture about the amount of money you have.

- Set realistic goals. It is possible to set realistic goals when you know the direction of your money. It is important to consider other expenses that aren’t fixed, like grocery and gas so you don’t spend too much on other purchases.

- Keep on the right track.

Tracking Your Progression

A budget is the initial step in controlling your financial situation. In order to ensure that you’re sticking to your budget, it is essential to monitor your progress. There are several ways to do this.

A program that monitors your spending can help you manage your budget. These apps link to your bank account so you can monitor your expenditure. They allow you to create a budget and track your progress over the period of.

A spreadsheet or a pen and piece of paper are another option to track your development. While this requires longer to complete, it’s exactly the same as using an app. Simply enter your income for every month and then check your spending to the budgeted amount. This will help you determine the areas in which you could cut back or make adjustments.

Printable Budget Sheet

Fix Your Finances ASAP With My Free Simple Monthly Budget Template

The Benefits Of Budgeting

While budgeting might seem like an overwhelming task but it is vital to ensure your financial security. Budgeting allows you to track your spending, set aside funds for savings and emergency funds, and make adjustments according to the need.

It might take a while to get comfortable with the process of creating and implementing an established budget. However, the advantages are well worth the effort. Budgets can be utilized to pay off debts, set aside funds for goals that are long-term or to avoid financial difficulties.

If you’re unsure of where to start there are plenty of resources that can help you prepare your budget. Once you get in the habit of spending money, you’ll soon be on your way towards financial success.