Monthly Budget Worksheet Free Printable Viva Veltoro

Monthly Budget Worksheet Free Printable Viva Veltoro

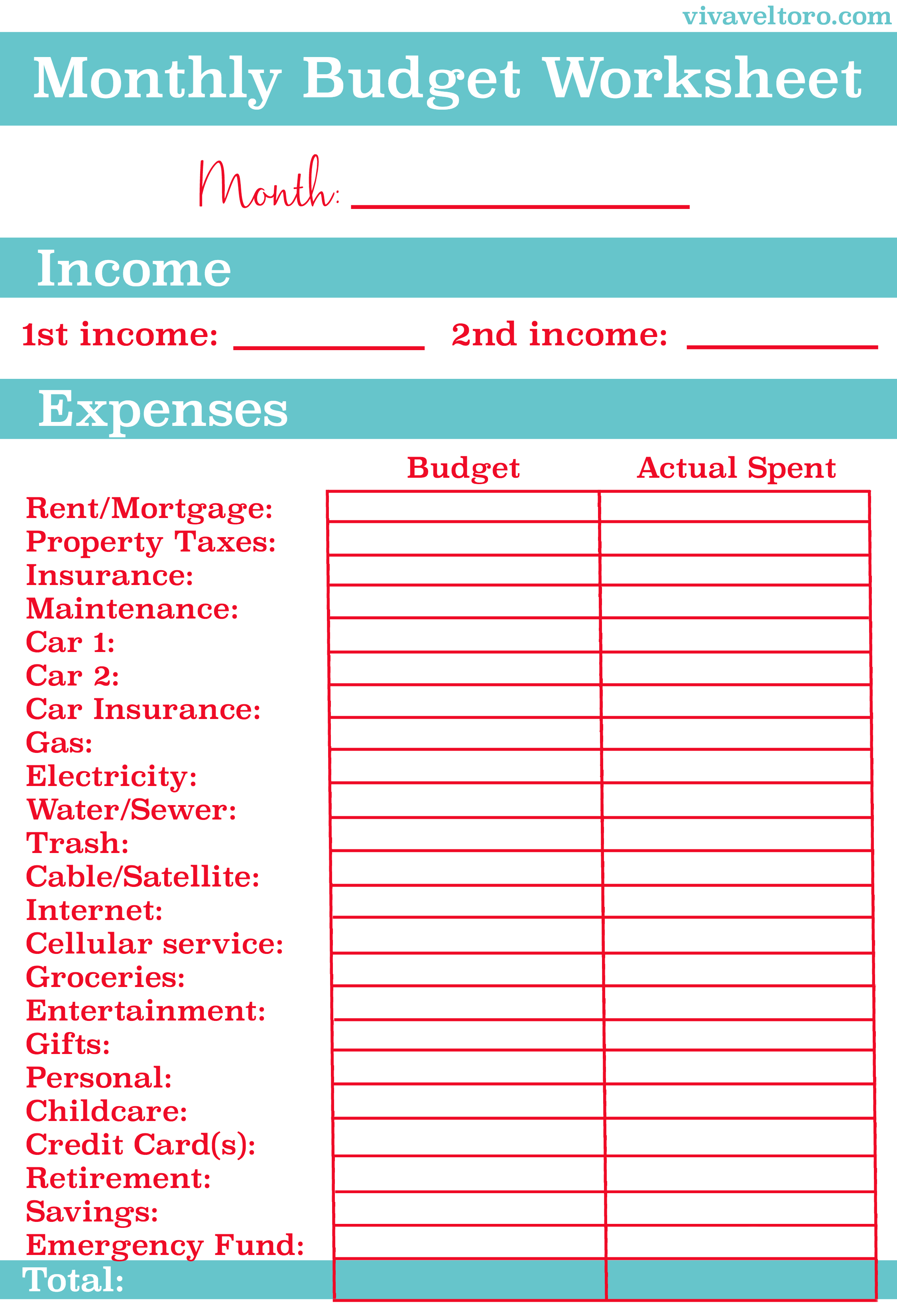

Monthly Budget Worksheet Free Printable Viva Veltoro – If you want to put your finances organized, you’ll require an budget. The most efficient way to track your spending is with the use of a printable. It is possible to use printable budget sheets to help remain on track and organized.

There are a myriad of methods to make budget. It is possible to use a software program, an app or even using a spreadsheet. However, if you’re looking for the most efficient method to design and track your budget, a budget sheet is the method to follow.

Printable budget sheets are widely available online. They are available at no cost or for the cost of a small amount. If you come across a page you find appealing, all you have to do is print it out and begin tracking your expenditure.

Budgeting doesn’t have to be a hassle. It is possible to manage your finances with just a bit of planning effort.

What Is The Reason You Require An Budget?

A budget is essential because of a variety of reasons. It helps you monitor your spending and savings as well as assist you in making informed financial choices. A budget can help you to stay on track with your financial goals.

A budget can be created with just a few simple steps. You can use a spreadsheet or pencil to make it. The most important thing to remember when creating an effective budget is to be honest about your income and expenses. After you’ve created the budget, follow it as strictly as you can in order to enhance your financial situation.

Related For Printable Monthly Budget Worksheets

How Do You Use The Budget

Budgets are an important tool to manage your finances. You can track your income and expenses in order to make well-informed decisions on how to spend your money. It’s not always easy to plan your budget, however it can be done with a bit of planning and work.

Here are some ideas on how to utilize a budget.

- Make a list of your income and expenses. Rectifying your expenses and income is the first step towards making budget. This will give you an accurate picture of where your cash is going.

- Realistic goals are important. Set realistic goals once you’ve figured out where your money is going. You should be sure to account for the cost of variable items, like gas and groceries, so that you don’t go over budget on other expenses.

- Stay on track.

You Can Monitor Your Development

A budget is the initial step in controlling your finances. When you’ve created a budget, you need keep track of your progress to ensure you’re sticking to it. This can be done by a variety of methods.

An app that tracks your spending can help you manage your budget. These apps can be connected with your bank account to monitor your spending, and also automatically connect to your bank account. They can also assist you in setting your budget and monitor your performance in time.

Another method of keeping track of your progress is using the spreadsheet, or pen and paper. Although this takes more manual effort than an app, it could nevertheless be equally effective. Make sure you record your expenses and income every month. Then compare your actual expenses to the budgeted amount. This will help you discern areas where you can cut down or adjust your spending accordingly.

Printable Monthly Budget Worksheets

The Benefits Of Budgeting

Although it can be a bit tedious however, it’s the first step towards financial stability. Budgeting allows you to monitor your spending, make adjustments when necessary, and even set aside money for emergencies and savings.

While it may take some time to understand how to make and adhere to your budget in a proper manner however, the rewards are worth it. A budget can assist you in paying off debts, save money for long-term goals, and help you avoid financial issues in the future.

If you’re unsure where to begin, there’s a wealth of resources that can help you develop a budget that works for you. You’ll soon be able manage your finances effectively and have financial success.